Braintree is a technology-forward payment processor headquartered in Chicago. Founded in 2007, Braintree has gone through some significant changes over the years. They purchased Venmo in 2012, and then Braintree was acquired by PayPal just one year later.

Braintree primarily works with online businesses seeking web and mobile payment solutions, and they didn’t launch an in-store payment acceptance solution until 2019. Today, Braintree processes over $50 billion annually and over one billion transactions per quarter.

We have dozens of clients using Braintree and years of experience negotiating directly with this processor. So whether you’re thinking of using Braintree or you’re currently using Braintree to accept payments, this review will help you make an informed decision and determine if you’re getting a good deal.

Insider Insights: Our Quick Take on Braintree

In our opinion, Braintree has the best pricing compared to other payment processors with top-of-the-line technology. Their technology is just as good as the Stripe’s and Adyen’s of the world, but Braintree’s rates are the most competitive.

We also like that Braintree is really easy to work with. Our clients using Braintree are happy with the service, and our team has had pleasant experiences negotiating rates with them over the years.

Other noteworthy highlights include:

- Tons of enterprise-grade features and integrations are available.

- Flat-rate and interchange-plus pricing options are both offered.

- Rates typically depend on volume and how many products you need.

- Braintree is more willing to offer discounts to merchants using multiple products.

- They try to push Venmo and PayPal services, and offer discounts on PayPal and Venmo business pricing.

It’s worth noting that merchants can get optimized Level 2 and Level 3 data rates with Braintree. But one major drawback is that Braintree does NOT have a gateway that handles this automatically for you.

Instead, you’ll need to have a developer set things up for you on the backend to ensure the appropriate data is being captured and submitted properly. Here’s a link to those developer docs with the requirements for Level 2 and Level 3 processing.

Braintree Pricing and Credit Card Processing Rates

Braintree’s pricing depends on a number of different factors. If you’re a new customer or small business, they’ll try to set you up on a standard flat-rate plan.

Interchange-plus pricing is also available, and that’s always going to be the cheapest option for your business.

But regardless of your pricing structure, Braintree is more likely to discount your rates if you:

- Process a high volume of payments

- Add more products and features to your service

- Use PayPal, PayPal Credit, and Venmo to accept payments

Let’s take a closer look at different pricing arrangements so you can see what I mean.

Braintree’s Flat-Rate Pricing

If you sign up for Braintree without any effort to negotiate or attempt to get a better deal, you’ll be offered the following rates:

- Credit and Debit Cards — 2.59% + $0.49 per transaction

- Venmo — 3.49% + $0.49 per transaction

- ACH Direct Debit — 0.75% per transaction

- Foreign-Issued Credit and Debit Cards — 3.59% + $0.49 per transaction

- Non-US Currency Payments — 3.59% + $0.49 per transaction

- Amex Direct Pass-Through Charges — $0.15 per transaction

- Chargebacks — $15 per incident

- 501(c)(3) Charities — 1.99% + $0.49 per transaction

This might be the best advice you hear today: Do NOT accept these rates!

Like most processors, the flat-rate prices advertised online are always going to be high. You can get much better if you reach out and negotiate your terms.

Interchange-plus is always going to be the best option. But if you don’t qualify for that, you can still get lower flat-rate pricing and custom rates based on your business type and processing volume.

Braintree Interchange Plus Pricing

All of Braintree’s interchange-plus contracts are customized for each business, and you won’t find these rates published anywhere online.

But to give you a sense of how drastically different they are from the flat-rate options shown above, I’ll walk you through the rates we negotiated for a client a few years back.

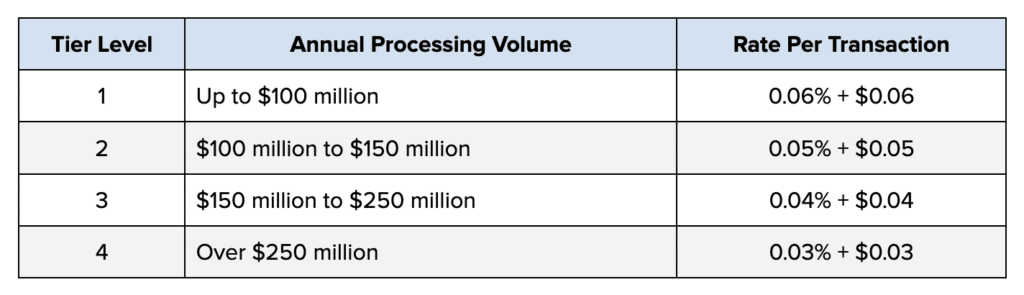

It’s an interchange-plus model that’s tiered based on annual processing volume—with lower rates offered at each level. For additional perspective, the merchant we’re referring to here is an online clothing retailer.

These rates offered by Braintree were based on a three-year commitment by our client. While I’m not always in favor of long-term contracts, a deal like this is good enough to lock in.

And while I realize that most businesses won’t come close to processing $250 million annually, the fact Braintree offers 0.03% + $0.03 per transaction at this tier is incredible. This is one of the best offers you’ll see from any processor on the market, and it’s coming from a provider with such amazing technology.

Even the first tier of 0.06% + $0.06 per transaction is incredibly low compared to what else you’ll see out there.

Again, not every business will qualify for a rate this low. But it just goes to show you how much Braintree is willing to negotiate down from their initial flat-rate prices starting at 2.59% + $0.49 per transaction.

Braintree Features, Capabilities, and Services

As I’ve mentioned several times throughout this review, Braintree has exceptional technology. They offer some of the most powerful features and capabilities on the market. The platform is developer-friendly and highly customizable to fit just about every need you could imagine.

Every merchant has access to basic features, like:

- Payment gateway

- Data migration services

- Basic and advanced fraud tools

- PCI compliance support

- Data encryption via Braintree Vault

But you’ll also have the option to add-on extra features priced separately. Examples include:

- 3D secure authentication

- Advanced fraud protection with custom filters and recommendations

- Fraud risk-analysis

- Account updater (automatically updates cards on file when numbers and expiration dates change)

For those of you seeking even more advanced capabilities, Braintree can handle virtually every scenario and customization that you could ask for.

Without getting too deep into the weeds, I’ll quickly summarize some of the capabilities they offered to one of our enterprise clients. It’s a software company IT solutions for managed services providers.

Braintree sent them a proposal that included:

- Omnichannel payment acceptance (POS, mobile app, web, tablet, QR code)

- Global acquiring services with cross-border payment acceptance

- Platform enhancements with PayPal Checkout, PayPal Marketing, and PayPal Shopping

- Token service provider and acquiring service

- F-PAN Retry for recurring authorization improvements

- Dispute automation services

I’m just barely scratching the service here, but I think I’ve made my point. The capabilities offered are seemingly limitless, which isn’t something you’ll find from every processor on the market.

Our Final Thoughts on Braintree

We really like Braintree. They have top-tier technology that can go head-to-head with the best providers on the market. But what sets them apart from their competitors is that Braintree also offers great rates.

Our team has had great experiences working with Braintree to negotiate lower rates for our clients. They’re highly receptive to negotiations, especially for clients that process a high volume and need extra features.

Are they perfect? Of course not.

They’re not as flexible when it comes to working smaller businesses and new companies. But I still wouldn’t accept the flat-rate pricing advertised on their website. If your rates aren’t as low as the examples we highlighted in this review, contact our team here at MCC for a free audit and analysis. We can negotiate directly with Braintree (or any other processor) on your behalf and identify any cost-saving opportunities for your business.