The world of payment processing and fintech is constantly changing. From upgraded features to new technology, acquisitions, and more, there’s a lot to keep track of.

Our team here at Merchant Cost Consulting always has our ear to the ground when it comes to payment industry news. To keep our readers informed, we want to share some of the most noteworthy headlines from the past month.

Continue below to see what’s happening in the payments world.

Atlantic Merchant Services Acquired by Payroc

In a May 10, 2023 press release, Payroc WorldAccess LLC announced its acquisition of Atlantic Merchant Services.

Founded in 2003, Payroc is a financial services company that offers a wide range of payment solutions. They’re a merchant services provider (MSP), payment facilitator, third-party service provider, and registered encryption support organization (ESO). Payroc processes over $80 billion in transactions per year across 45+ markets.

Atlantic Merchant Services is a full-service merchant processor that’s been in business for 23 years. They work with payment partners across states like Virginia, Maryland, South Carolina, North Carolina, West Virginia, Texas, Michigan, and Tennessee.

Since the acquisition was just announced, it’s currently unclear whether Atlantic Merchant Services will continue to operate under its own brand name within the Payroc umbrella or if its services will be completely rebranded as Payroc. Stay tuned for more updates as we continue to follow this story.

Fiserv Introduces Text Payments and Electronic Debit Cards

Fiserv had two major announcements this month. The first is a text-to-pay solution for its merchants and independent software vendors, and the second is the digital issuance of debit cards for banks.

The text-to-pay software that will be processed through Fiserv’s systems was developed by a California-based tech company, Authvia. It’s a simple concept that allows merchants to send their customers a bill or invoice via text message, and the customer can complete the payment by following the prompt in the text.

Fiserv’s text-to-pay tool initially had a soft launch in Q1 of 2023. But now, that capability has become widely available to the 1,000+ ISVs that work with Fiserv.

In terms of the digital card issuance solution, Fiserv’s technology allows cardholders to request a lost or stolen debit card online and gives those cardholders the ability to start using a digital version of the card immediately.

The technology works by adding the card directly to the user’s digital wallet.

According to Fiserv, 44% of consumers say that instant access to a newly issued card would increase their satisfaction, and 51% say that the ability to easily add a card to a digital wallet is an important feature. Fiserv also says that 70% of newly issued digital cards are used within five days of issuance.

For more information, you can follow Fiserv’s latest rate increases and updates here.

Square Launches Tap to Pay on Android

Most of us are familiar with tap-to-pay technology—as this is widely used on most credit card terminals and POS systems that are EMV compliant.

But Square just brought this technology to Android devices for sellers in the United States, UK, France, Spain, Australia, and Ireland.

For the technology to work, the seller just needs to download the Square app on a compatible Android device. This includes the Square Point of Sale app, Square Invoices app, Square for Restaurants app, and Square Appointments app.

Once the sale has been entered, the compatible Android device can be presented to the buyer, and the payments can be completed using tap-to-pay technology from contactless credit cards, contactless debit cards, and digital wallets.

Additional Reading: How Much Does Square Credit Card Processing Cost?

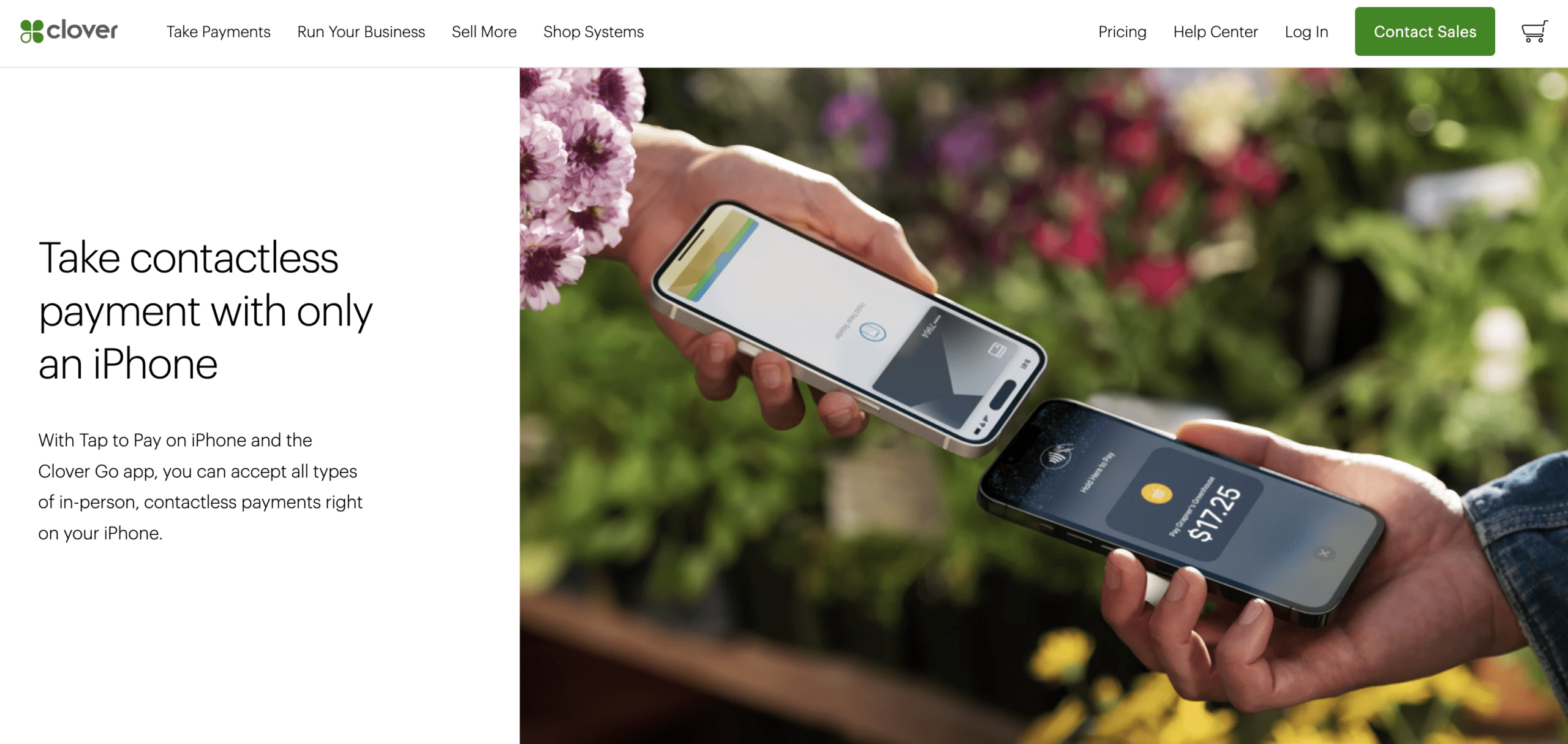

Clover Enables Contactless Payments on iPhone

Similar to the Square headline above, Clover also launched tap-to-pay capabilities this month through the Clover Go app. This announcement is specific to iOS devices.

The Clover Go app is an extension of Clover’s POS systems, and it’s designed to help merchants accept payments while in the field. Common industries that use the app include market vendors, personal trainers, home services, truck operators, and more.

Clover’s contactless payment technology on iPhone supports a wide range of contactless payment options.

Customers can pay using tap-to-pay with their credit cards, debit cards, and virtual wallets.

Uber and Airbnb Both Add Pay by Bank Capabilities For Checkout

Uber and Stripe announced a partnership that will help reduce payment costs and provide customers with more ways to pay for Uber’s services.

Customers will have the option to securely link their bank account information through the app and then use that as an alternative to credit cards, debit cards, and other payment options. For this solution and more, Stripe has become one of Uber’s strategic partners in markets like the US, Canada, France, Brazil, Mexico, Australia, and the UK.

Airbnb announced a similar feature this month—the ability for guests to pay using a connected bank account.

According to Airbnb, pay by bank is only available in the following situations:

- Payer is US resident

- The default payment currency is USD

- Reservation is 28+ nights

- Reservation start date is at least seven business days away

Users can connect their bank account through the Airbnb website, iOS app, mobile app, or mobile web browser.

Stripe Launches New Card Reader and Upgrades Automation Suite

Stripe just announced its release of the new Stripe Reader S700. The tool allows businesses to accept payments through pre-built elements, including email addresses and signatures, directly from the device.

Select custom apps can also be run through the S700 card reader, which will be available in the United States by the summer of 2023. Stripe is expecting the S700 to be available by the end of 2023 in all 23 countries where the Stripe Terminal is currently offered.

In addition to the new hardware, Stripe also announced updates to its Revenue and Finance Automation suite.

The suite includes features for invoicing, billing, revenue recognition, revenue reporting, taxes, and data pipelines. Over 250,000 companies currently use these features, and major upgrades are currently in beta.

Check our complete guide to Stripe interchange rates for more information.

Microsoft Teams Enables In-App Payments Feature

Microsoft Teams is best known for its internal communication, live chat, and video conferencing software. But with the help of Stripe and PayPal, in-app payments are now available via Microsoft Teams.

Known as Teams Payments, the new feature will let businesses accept payments from customers during online meetings, webinars, and virtual events. Merchants can also set up advance payment requirements before a customer joins a session.

All major credit cards, including American Express, Visa, and Mastercard, will be handled by Stripe, while PayPal will handle debit card processing and virtual wallet payments.

Eligible Citi Card Users Can Pay Over Time on Amazon Pay

Consumers using a card issued by Citi bank may now have the option to pay for purchases over time if the card is connected to Amazon Pay. The option will be available from thousands of participating stores.

Through Citi Flex Pay, consumers can select installment plans for three, six, and 12-month terms.

The idea behind the announcement is to make payment options more convenient for customers while simplifying the checkout process.

Paysend Brings Cross-Border Payments to the US

Paysend, a global payment ecosystem founded in 2017, just announced its launch of Paysend Business in the United States.

The platform had previously been used in other countries worldwide but had not yet been established in the US for cross-border payments. This announcement came on the heels of a successful rollout in the UK.

With Paysend Business, SMEs have the option to receive, exchange, and send money in more than 38 currencies without having to deal with complex fees or exchange rates.

This will just be another option to consider for merchants that deal with international payments.

Small Wins in the Fight Against Ecommerce Fraud

Fraud prevention and detection are top priorities for ecommerce brands worldwide. Not only are they costly, but they can damage your company’s reputation.

But recent studies suggest that ecommerce sites are making some gains in this seemingly never-ending fight against fraud.

2.9% of all ecommerce was lost to fraud last year (down from 3.6% the previous year).

It’s also worth noting that 10% of ecommerce revenue is spent fighting payment fraud. So the cost associated with payments fraud might be rising, but at least the efforts seem to be paying off—at least in the short term.

The ability to detect online fraud has been attributed to tools like credit card verification services, identity validation, two-factor authentication, 3D secure authentication, and machine learning.

Shopify and Marqeta Announce Layoffs

While Shopify is best known for its ecommerce platform and website builder, the company does have an integrated payments solution—Shopify Pay. In a recent announcement, Shopify announced that it would cut its workforce by 20%.

Shopify is selling internal logistics to a third-party platform, Flexport, and instead, focusing more on its core product of online commerce.

Marqeta, a card-issuing and payment solution, also announced a 15% reduction of its workforce this month.

Final Thoughts

Keep checking back to our blog for the latest news and updates in payment processing, and we’ll continue to keep you in the loop whenever our team finds a noteworthy headline to share.

Are you overpaying on credit card processing? Schedule your free audit and analysis to find out.

We can help you save money on payment acceptance without the need for you to switch processors.