Like every card network, Discover has its own interchange qualification standards. Each interchange category is based on certain criteria, including the merchant type, transaction type, industry, and unique specifications related to the transaction itself.

To help simplify this complicated framework, we put together four tables that break down the entire Discover Network Interchange Qualification Matrix.

You can use these charts to better understand where your transactions fall within the matrix, which is helpful for anticipating costs and identifying areas for potential savings.

These tables are designed to help you quickly identify the qualification criteria for each Discover interchange category. You can also refer to our Discover interchange rates page for the latest fees that correspond with these categories.

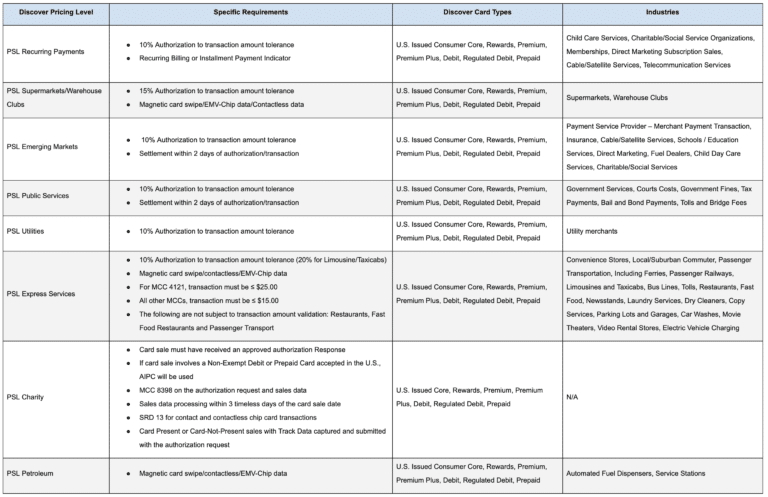

Discover Interchange Qualification Matrix – Table 1

Table 1 Common Requirements:

- U.S. Merchant

- Applicable Electronic Authorization Data must be included within Settlement Record

- NRID

- The applicable Transaction Data Condition Code must be present in the Authorization Request

- Chip Card Transaction Supplemental Data Record (SDR 13) must be submitted for all Chip Card Transactions

- Settlement within 1 day of authorization/transaction (except where otherwise specified)

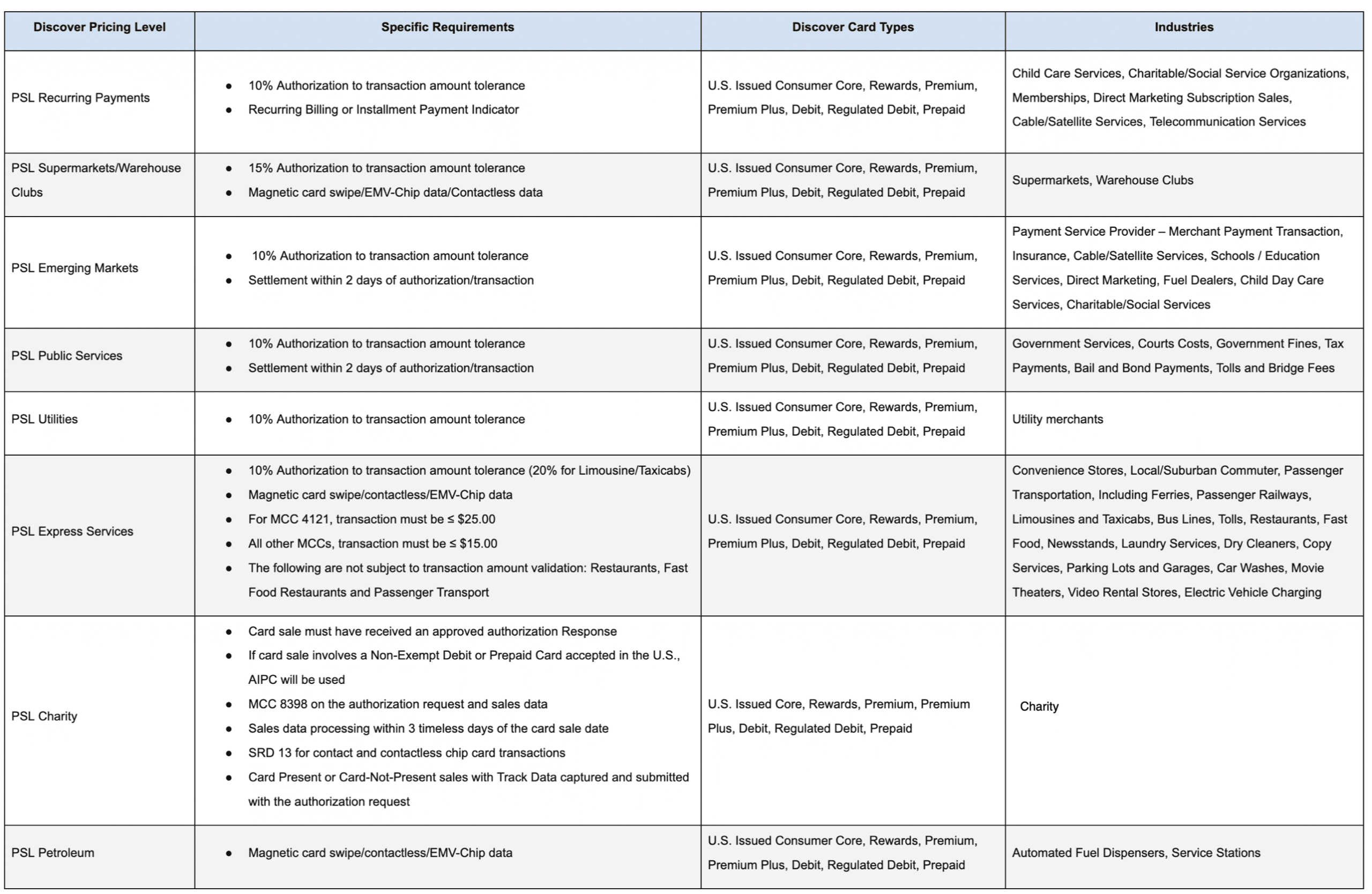

Discover Interchange Qualification Matrix – Table 2

Table 2 Common Requirements:

- U.S. Merchant

- Applicable Electronic Authorization Data must be included within Settlement Record

- NRID

- The applicable Transaction Data Condition Code must be present in the Authorization Request

- Chip Card Transaction Supplemental Data Record (SDR 13) must be submitted for all Chip Card Transactions

- Settlement within 1 day of authorization/transaction (except where otherwise specified)

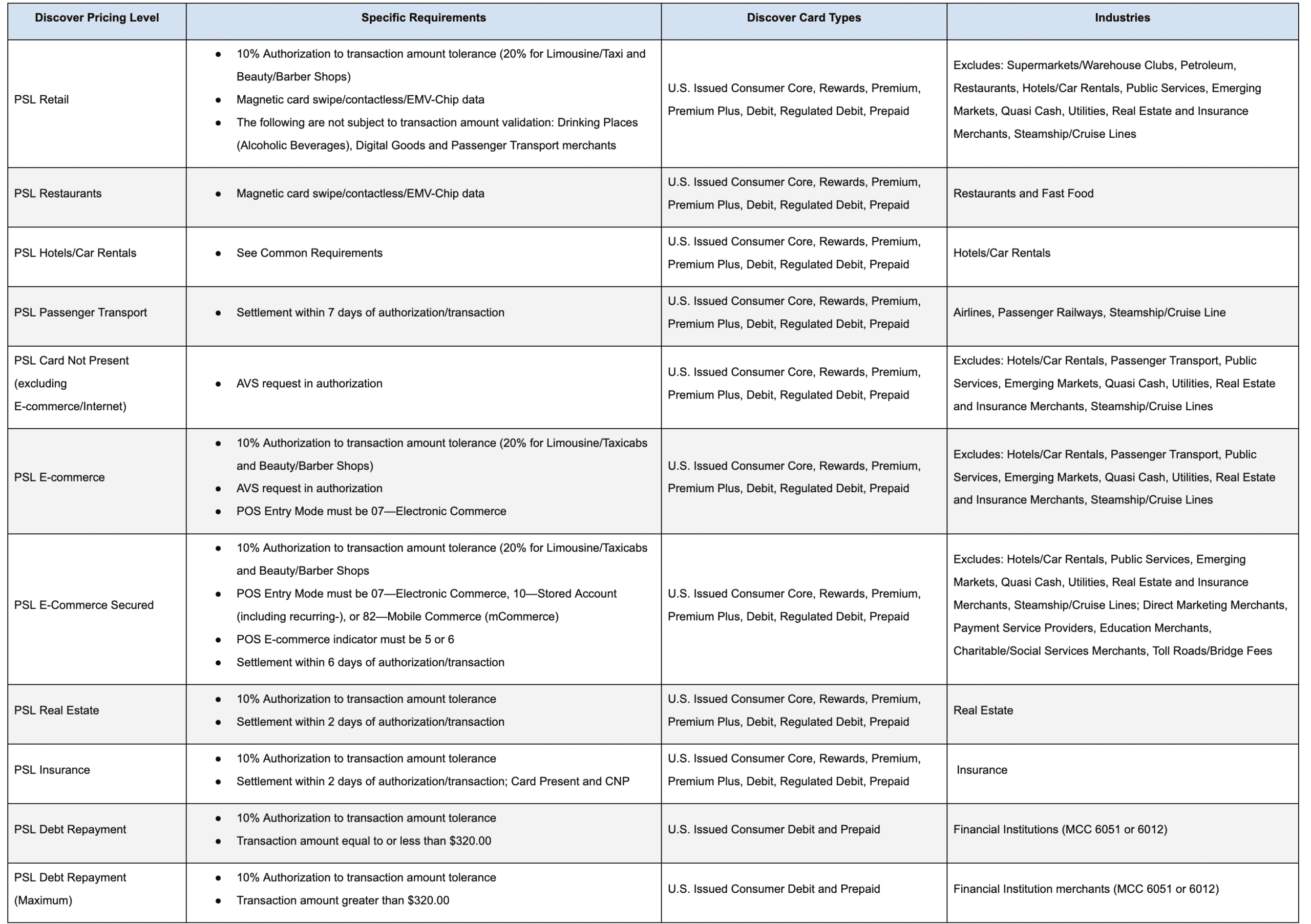

Discover Interchange Qualification Matrix – Table 3

Table 3 Common Requirements:

- U.S. Merchant

- Applicable Electronic Authorization Data must be included within Settlement Record

- NRID

- The applicable Transaction Data Condition Code must be present in the Authorization Request

- Chip Card Transaction Supplemental Data Record (SDR 13) must be submitted for all Chip Card Transactions

- Settlement within 1 day of authorization/transaction (except where otherwise specified)

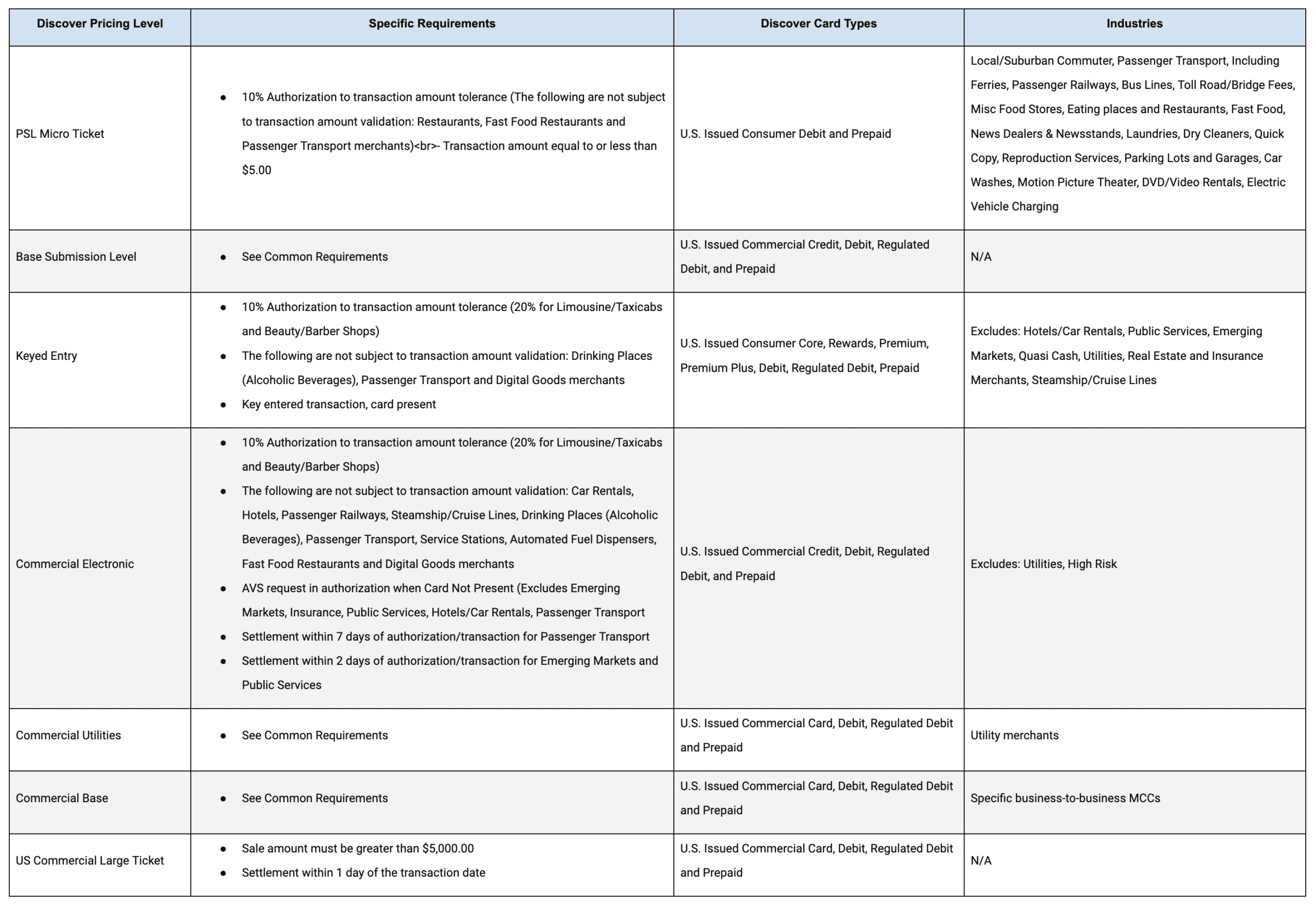

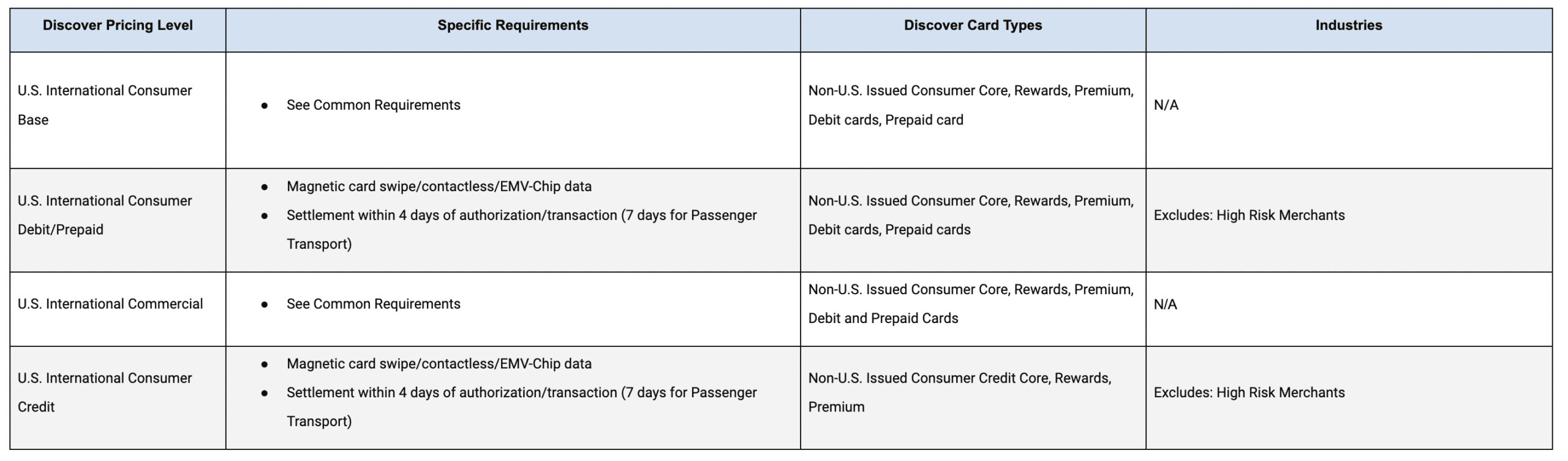

Discover Interchange Qualification Matrix – Table 4

Table 4 Common Requirements:

- U.S. Merchant

- Must be an International card sale

- Applicable Electronic Authorization Data must be included within Settlement Record

- NRID

- The applicable Transaction Data Condition Code must be present in the Authorization Request

- Chip Card Transaction Supplemental Data Record (SDR 13) must be submitted for all Chip Card Transactions

- Settlement within 1 day of authorization/transaction (except where otherwise specified)