Businesses typically need to have a merchant account to accept credit card payments. However, it’s possible to set up a Shopify store and accept card payments without a merchant account.

Shopify users have the option to get a merchant account and accept online payments using a third-party payment processor. Or you can just use Shopify’s integrated payments solution, Shopify Payments—which does not require a merchant account.

That said, getting a merchant account instead of using Shopify payments (or in addition to Shopify Payments) is often the preferred choice of many businesses.

Does Shopify Require a Merchant Account?

Shopify does not require a merchant account. You only need to get a merchant account if you’re planning to use your own third-party payment processor. But if you’re using Shopify Payments to accept credit and debit cards, you won’t be required to get a merchant account.

Technically speaking, Shopify Payments is an aggregated merchant account. This means that millions of businesses are bundled together to share the same merchant ID.

But your individual store won’t be assigned an individual merchant ID number if you’re using Shopify Payments.

Shopify Payments vs. Merchant Account

There are essentially two main ways to accept card payments through Shopify:

- Without a merchant account (using Shopify Payments)

- With a merchant account

One isn’t necessarily better than the other, and I’m not going to review them or try to sway you one way or another. Instead, I’ll just share the facts and compare the key differences between both options so you can decide for yourself.

Shopify Payments is a Faster Setup

When you create a Shopify store and activate Shopify Payments, you can start accepting credit card payments immediately. This means that you can essentially build an online store, launch it, and start getting paid on the same day.

Getting a merchant account takes a bit longer. It often takes at around one to three business days for merchant accounts to be approved, and it could take even longer if the underwriting process requires you to submit additional information. If your merchant account application gets denied, it could be weeks before you’re able to accept card payments.

It’s worth noting that Shopify will still require you to set up your Shopify Payments account completely—including all of your company information and banking details, within 21 days of your first sale. Otherwise, payments you’ve received in that time frame could be automatically refunded to customers.

But overall, using Shopify Payments is definitely faster than getting a merchant account.

Shopify Payments is “Easier”

“Easy” is obviously a subjective term. And I’m not saying that it’s easier based on my opinion. But many people perceive it to be a simpler approach, hence the quotation marks.

Here’s why.

With Shopify and Shopify Payments, you’re getting everything you need under one roof. Everything is managed from a single sign up, subscription, account, and login. There’s no need to work with a third party or set up any integrations. Everything is one place, which some businesses consider “easy.”

Getting a Merchant Account is Typically Cheaper

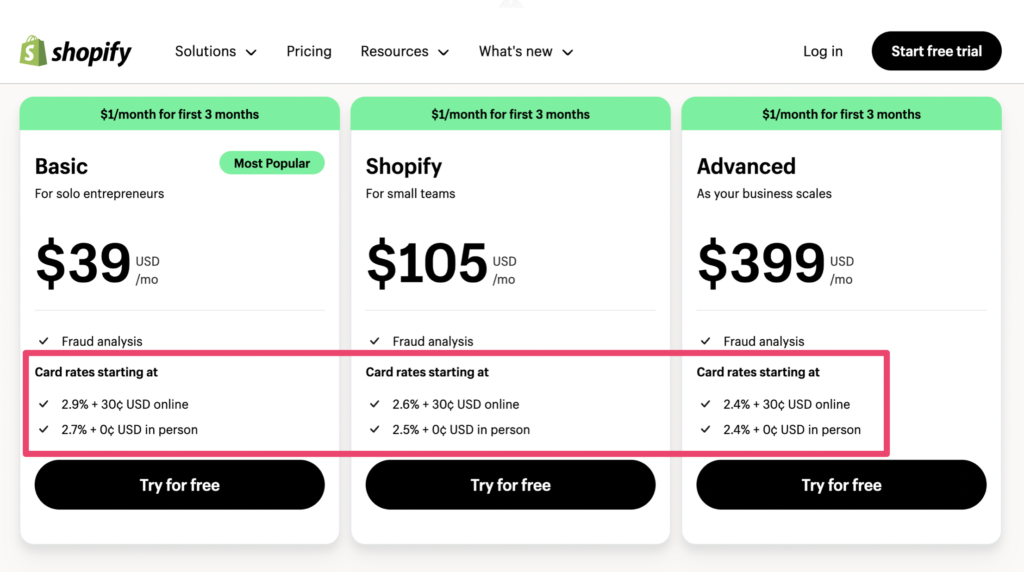

Shopify Payments uses a fixed rate pricing structure, with credit card processing rates starting at 2.9% + $0.30 per transaction. The rate per transaction drops a bit if you sign up for a higher-tiered Shopify subscription, and it varies based on whether the transaction is in person or online.

Here’s a look at those rates for each plan:

While this is straightforward in the sense that you know what you’re going to pay for each transaction, it’s typically not the most cost-effective way to accept credit cards.

Going with an interchange plus pricing structure from another processor under your own merchant account will almost always be cheaper. There are even some subscription-based processors that only charge a monthly membership fee to merchants and don’t markup transactions—meaning you’d only pay the interchange rate imposed at the card network level (also cheaper than Shopify Payments).

For example, let’s say Visa charges 1.43% + $0.10 at the interchange level for a particular transaction. Shopify Payments may charge you up to 2.9% + $0.30 for that transaction—which is more than double the interchange rate.

If you have your own merchant account and you’re on an interchange plus contract, you’d just pay a small amount over the interchange to your processor. Or if you’re on a membership-style plan, you’d just pay the interchange rate and your monthly membership fee.

Merchant Accounts Give You More Flexibility

Shopify Payments is somewhat limiting in the sense that you can’t do everything with it. If you want to sell on third-party platforms beyond your Shopify site, it may not always work.

It does play nice with certain platforms and supports integrations through channels like Facebook and Instagram. You can also use it to accept in-person payments through Shopify’s POS system.

Merchant accounts are often more flexible. You can choose your specific hardware for in-person sales and choose your tech stack for online sales, whether it’s through your website, through a third-party marketplace, via email, or something else entirely.

That’s because you’re not limited by any specific type of technical infrastructure or ecosystem.

Merchant Accounts Leave Room For Negotiation

In our experience, Shopify doesn’t really negotiate credit card processing fees. You may have a bit more luck if you’re a high-volume merchant on a Shopify Plus subscription.

However, Shopify Plus starts at $2,000 per month—which isn’t something that most new Shopify users (like anyone reading this guide) would typically consider.

Alternatively, getting a merchant account and working directly with your own processor leaves you plenty of room for negotiation. You can negotiate your rates during the initial contract and then continue to negotiate them down the road. This is something that we have first-hand experience with and also something that we’ve had tremendous success with.

Negotiation is one of the best ways to lower credit card processing fees.

Shopify Payments Eligibility

While Shopify doesn’t require a merchant account, you need to make sure you’re eligible for Shopify Payments if you want to sell online without a merchant account.

Eligibility requirements include:

- You must be located in one of the 23 countries currently supported

- You must be able to active two-step authentication on your Shopify account

- Your business type and product types cannot be on Shopify’s prohibited list

- You must comply with all of the terms and conditions for Shopify Payments

For example, products related to firearms, explicit adult content, pseudo pharmaceuticals, gambling products, financial products, and counterfeit products can be sold on Shopify, but they cannot be processed through Shopify Payments. You’d need to use a third-party gateway instead.

Do You Need a Payment Gateway and Merchant Account For Shopify?

Payment gateways are required to accept online payments, including payments for Shopify. Unless you’re using Shopify Payments as your integrated gateway and processor, then you will need to get a payment gateway and a merchant account to run a Shopify store.

On the backend, Shopify Payments is powered by Stripe. So it’s a fully integrated processor and gateway paired with an aggregated merchant account.

Many merchant account providers can double as gateway providers. But you could also get a payment gateway from a third party that’s separate from your merchant account provider and processor (as long as they all integrate smoothly).

List of Payment Gateways Compatible With Shopify

If you want to use your own payment gateway instead of Shopify Payments, here’s a list of some potential options:

- JPMorgan Chase

- 2C2P

- 2Checkout Convert Plus (by Verifone)

- Adyen

- Affirm

- Afterpay

- Airwallex

- Aktia (Paytrail)

- Alipay

- Amazon Pay

- Appmax

- Authorize.net

- Bambora

- Bankful

- BillDesk Payment App

- BillEase

- Billplz

- Billwerk+ Payments

- BitPay

- Blik – KOMOJU

- Braintree

- Bread Pay

- Cardinity Online Payments

- Cayan

- CCAvenue

- CCAvenue UAE

- Checkout.com

- Cielo

- Clearpay

- Clip

- Coinbase Commerce

- Comgate

- Conekta

- CRED pay

- PayPal

- Crypto.com Pay

- CyberSource

- Danske Bank (Paytrail)

- DBS PayLah!

- Dragonpay – KOMOJU

- Easebuzz

- eGHL Payment Gateway

- ePay

- FasterPay

- First Data

- Flexiti Payment

- FLOW

- G2A Pay

- Garanti Sanal POS

- GestPay

- Grab Checkout

- HiPay Payment

- HummGroup

- Hyp

- Hyperpay

- IATS Payments

- Ignite Payments

- iPay88

- Katapult

- Klarna

- Klix payments

- KOMOJU

- Konfío Pagos

- LianLian Pay

- MakeCommerce

- Markets Pro

- Mercado Pago

- Merchant e-Solutions

- MIT

- Mollie

- Mondido Payments

- MONEI

- Moneris

- Multibanco – KOMOJU

- MultiSafepay Payments

- MyFatoorah

- Netgíró

- NETOPIA Payments

- Nets Easy Checkout

- NihaoPay

- Nordea (Paytrail)

- Oceanpayment

- OmaSP (Paytrail)

- OnePAY

- OpenNode – Bitcoin Payments

- Opn Payments

- PagarMe

- PagBrasil

- Pago Facil by Bci Pagos

- PayDollar

- Payflex

- PayGate PayWeb

- PayGlocal

- PayJustNow

- Payments via Midtrans

- Paymentwall

- Paymob

- PayNow

- Payoneer Checkout

- PayPal Express Checkout

- PayPal Payflow Pro

- PayPal Website Payments Pro (UK)

- Paysera Payment App

- Paystack

- Paytm Payment Gateway

- Paytrail

- PayU Latam v2

- Payzone Maroc

- Peach Payments

- Pei

- PhonePe PG

- Pin Payments

- PingPong Checkout

- Pivo (Paytrail)

- PixelPay Checkout

- POLi – NZ

- POLi Internet Banking

- POP Pankki (Paytrail)

- PortOne Payments

- Przelewy24

- Przelewy24 – KOMOJU

- Psigate

- QFPay Secure Checkout 2.0

- QuickBooks Payments

- QuickPay (v10 Platform)

- Rapyd Payments

- Razer Merchant Services

- Razorpay Direct – Credit Card

- Realex

- Revolut Pay

- Revolut Payment Gateway

- S-Pankki (Paytrail)

- Safepay

- Sage Payment Solutions

- SagePay

- Satispay

- Secure Payments via PayMongo

- SeQura Payment Gateway

- Sezzle Payments

- ShopBack

- Shopify Payments

- Siirto (Paytrail)

- Skrill – Oceanpayment

- Skrill Official

- Splitit

- Stripe

- Svea Checkout

- Synchrony Financing

- Tap Payments

- TapPay

- Tazapay

- Telr

- Tilopay

- Toss

- TrueMed

- TWINT

- UniPAY Checkout

- Vantiv Integrated Payments

- VentiPay

- Verifone Checkout

- ViaBill Payments

- ViaBill via pensopay

- Vipps/MobilePay Checkout

- Viva Wallet Smart Checkout

- wallee Payments

- Walley (Paytrail)

- Walley B2B (Paytrail)

- Windcave

- Worldline Online Payments

- WorldPay

- Xendit Payment Gateway

- XPay Nexi

- Yoco

- Ziina

- Zip

In total, there are more than 100+ gateways that can be used with Shopify. See the full list here.

Summary

You do not need a merchant account for Shopify, but only if you’re using Shopify Payments as your integrated payment processor and payment gateway. That’s because Shopify Payments is an aggregated merchant account, which means you’ll be bundled with other Shopify merchants and won’t be assigned an individual merchant account number.

Otherwise, you do need a merchant account and payment gateway to use Shopify.

There are pros and cons to both methods, and I can’t make that decision for you. But hopefully the information in this guide helped you better understand the options at your disposal.