Elavon is a credit card processor and service provider for merchants across a wide range of industries. Like other solutions that allow merchants to accept payments, Elavon regularly updates its credit card processing fees.

Here at Merchant Cost Consulting, we keep an eye on those updates to keep our clients and other merchants using Elavon informed.

We use this page to post all the latest Elavon fees. But if you’re looking for a bit more, you can refer our to Elavon review for our insider take and experience working this processor.

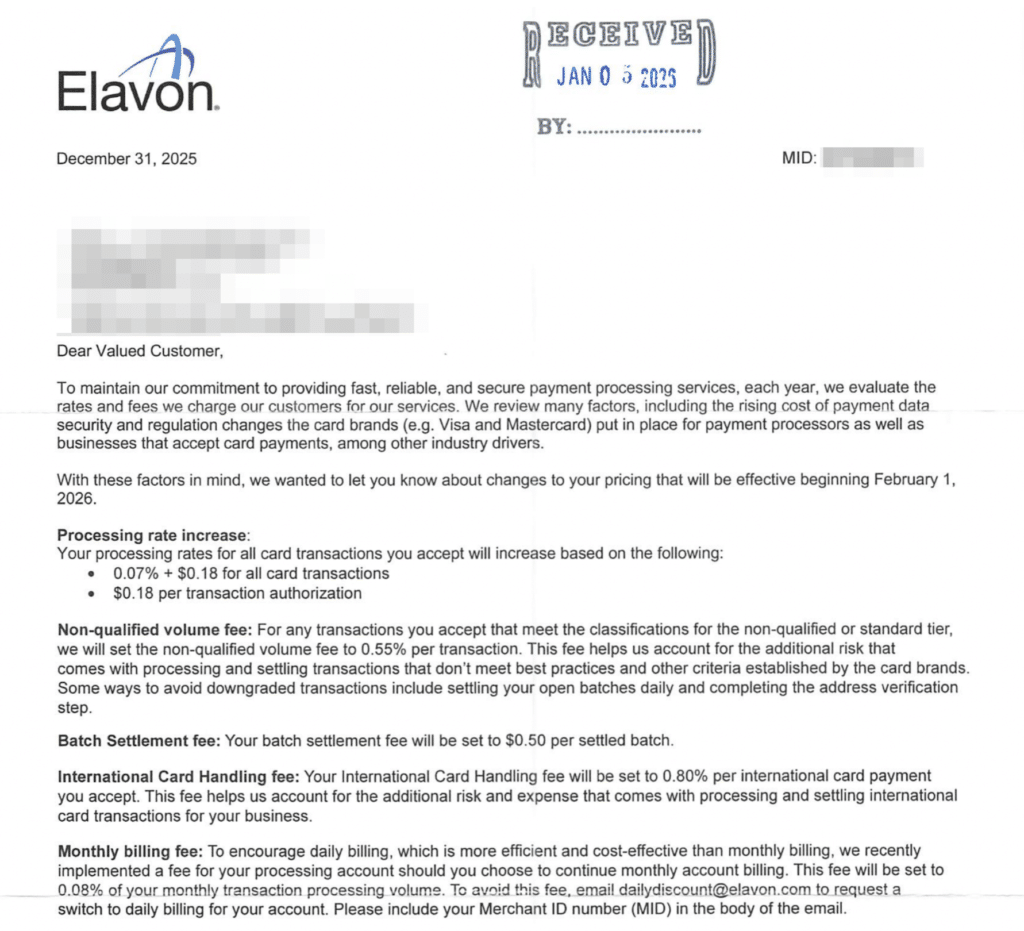

New Elavon Rate Increases Effective February 1, 2026

Exactly one year after their last rate increase, Elavon sent a notice to merchants about another rate hike effective 2/1/2026. Here’s what’s going up:

- 0.07% + $0.18 per transaction on all cards

- $0.18 per authorization

- $0.50 per settled batch

- 0.80% international card handling fee

- 0.08% monthly billing fee

- 0.55% non-qualified volume fee

The monthly billing fee can be eliminated by switching to daily billing. And merchants can email dailydiscount@elavon.com to request the switch.

Though you should be aware that daily billing can add some accounting and reconciliation headaches if you’re used to monthly. So think about this before opting in automatically, and you can always request a consultation with our team here at MCC to explore other options to save money on your Elavon processing rates.

Here’s a copy of that notice we received on behalf of our clients, so you can hear it straight from the source:

New Elavon Rate Increase – February 2025

Effective February 1, 2025, Elavon is increasing its rates by:

- 0.81% + $0.25 per transaction for Visa, Mastercard, and Discover

- $0.25 per authorization

- $0.40 per settled batch

- 0.60% per international card transaction

- 0.40% non-qualified volume fee

We typically see Elavon increase rates about once per year, and this most recent increase is aligned with what we’ve seen in the past.

Elavon Updates for March 2024: Rate Increases, Account Billing Fees, and Commercial Card Optimization

Elavon is making big changes to its rates and fee programs. Effective March 2024, these changes affect Visa, Mastercard, Discover, and American Express transactions. They’re also automatically enrolling merchants into a Commercial Card Optimization solution. We break down all of these changes in greater detail below:

Elavon is Increasing Credit Processing Rates and Account Billing Fees Effective March 1, 2024

In a recent notice to merchants, Elavon is making the following rate changes that go into effect on 3/1/24:

- 0.10% + $0.20 increase for all Visa, Mastercard, and Discover transactions

- 0.20% increase per authorization for Visa, Mastercard, and Discover transactions

- 0.30% increase for all American Express transactions

- 0.06% monthly billing fee based on total monthly processing volume (for merchants who continue to stay on a monthly billing cycle instead of switching to daily billing)

For businesses on monthly billing with Elavon, you can avoid the 0.06% monthly fee by switching to daily billing. You can do this by emailing dailydiscount@elavon.com to ask for a switch. Make sure to include your merchant ID number in the message. You can also call the Elavon customer service team at 800-725-1243 with any additional questions.

Elavon is Auto-Enrolling Merchants into its Commercial Card Optimization Program

Effective March 1, 2024, Elavon merchants will be automatically enrolled into a Commercial Card Optimization solution. This program is designed to offer lower interchange rates for select transactions when additional card data gets captured during the authorization process by collecting Level II and Level III transaction details.

As a result, merchants may notice reduced interchange rates for qualifying commercial credit card transactions.

There are no upfront costs to implement the Commercial Card Optimization program. You can look for these new rates on your “Credit Card” line beginning with your March statement. Merchants will retain 25% of the total interchange savings that are calculated and billed for qualifying and optimized card transactions (which means Elavon is likely keeping the remaining 75% of your savings).

Elavon Processing Fee Increases – March 2023

Effective March 1, 2023, Elavon is increasing the processing rates for all card transactions by 0.07% + $0.25. They’re also increasing per transaction authorization fees by $0.25 and international transaction fees by 0.6%.

All existing chargeback fees will be increased by $35, and monthly minimum fees are increasing to $40 per month.

Elavon is adding a $0.40 batch settlement fee to each settled batch.

Effective 3/1/2023, Elavon will begin charging a monthly billing fee of 0.02% of monthly transaction processing volume for merchants on a monthly billing cycle. Merchants can switch to daily billing to avoid this fee.

Elavon Credit Card Processing Fees and Updates – July 2022

Some merchants using Elavon to process payments were automatically enrolled in a Commercial Card Optimization program earlier this year. The solution systemically adds Level 2 transaction details to help lower interchange rates. Effective July 8, 2022, the service is expanding to include Level 3 transaction details for commercial credit card products.

There are no upfront costs with the service and no changes to how the service is reflected on monthly account statements.

For interchange savings associated with the Commercial Card Optimization service, Elavon will bill 75% of the savings, and you will retain 25% of the savings for optimized transactions.

To opt-out of this service, you can contact L2OptOut@Elavon.com and put “L3 OPT OUT” with your merchant ID number in the subject line.

Elavon Updates and Payment Processing Cost Increases – April 2022

In a letter sent to customers dated March 1, 2022, Elavon updated its customers about upcoming changes for April. The size of your business and your existing rates will dictate your own changes.

But here are some different updates that go into effect as of 4/1/2022:

- The new rate for all card transactions is 0.02% + $0.23.

- $0.023 will be assessed per transaction authorization.

- 0.20% charged for international transactions.

- No charge per settled batches.

Other businesses are seeing these rate changes effective April 2022:

- 0.16% + $0.25 per transaction

- $0.25 per transaction authorization

- 0.60% per international transaction

- $0.40 per settled batch

As you can see, Elavon does not apply the same rates to every merchant. They have different fees for merchants based on the business type and other factors.

If you’re an existing Elavon customer and want to save money on credit card processing, contact our team here at Merchant Cost Consulting. We can negotiate those rates directly with Elevon on your behalf, so you don’t have to change processors.

PCI DSS Monthly Fees Reminder for July 2022

As of July 1, 2022, Elavon will begin charging a standard PCI DSS fee of $84.99 per month. This fee only applies to merchants who have not validated the annual PCI DSS compliance.

To continue receiving the discounted $10 PCI DSS fee, follow the validation steps from your PCI Compliance Manager portal at www.pcicompliancemanager.com.

One way to stay PCI compliant is by using newly updated smart terminals. Just be hardware cost will likely increase if you upgrade your system.

Updated hardware and software crucial for both in person transactions, as well as online payments through a payment gateway.

About Elavon Payment Processing Solutions

Elavon Inc. (formerly NOVA) is a US Bancorp subsidiary that has been providing payment processing services and technologies for 30+ years.

Elavon has more than two million customers across 30+ countries. They process over 6.6 billion transactions globally per year, valued at roughly $450 billion.

This payment processor is known for its industry-specific solutions in categories like:

- Retail

- Restaurants

- Travel and hospitality

- Healthcare

- Government

- Golf

- Automotive

- Supply chain

- Heavy equipment

- Wholesale distribution

- Small Business

- Nonprofit

- Higher education

Elavon offers payment processing for small businesses, mid-size organizations, and enterprises.

If you look at the company’s Better Business Bureau profile, you’ll see they’ve been consistently rated with low scores from merchants. One of the reasons for this rating is due to the constantly changing fees and upcharges.

That’s why it’s so important for you to monitor your statements and keep an eye on your fees. Our team here at Merchant Cost Consulting can help you lower those rates, without switching processors.

Additional Resources: The Complete Guide to Interchange Fees and Rates