Global Payments Integrated regularly sends notices related to fee increases and other important statements to customers. Our team here at Merchant Cost Consulting monitors any major updates to share with our readers and clients.

If you’re looking for more than just the latest updates and rate increases, you can read our Global Payments review for a more in-depth take on our experience working with this processor.

New Global Payments Rate Increase – Effective January 2026

Global Payments just notified merchants that they are starting the new year with a rate increase.

As of January 1, 2026, Global is increasing its merchant discount rate 0.20% per transaction.

It appears as though this being applied to all merchant accounts that were not impacted by the August 2025 rate increase. This is Global’s way of ensuring that all of their merchant accounts are getting rates increased at least once within the last 12 months, and it’s on brand with the way Global Payments approaches account management.

New Global Payments Rate Increase – Effective October 2025

The card networks (Visa, Mastercard, Amex, and Discover) typically change some interchange and assessment classifications in October every year. This year, Global Payments is using that as an opportunity to increase their rates at the same time.

Changes at the interchange level are irrelevant to your processor’s markup. But by announcing a rate increase in the same notice as the network changes, Global is implying that the network changes justify an increase.

Merchants using Global Payments need to keep a close eye on October 2025 statements for increases to discount rates, authorization fees, and per-item fees. The notice also hinted that some new fees could be added as well.

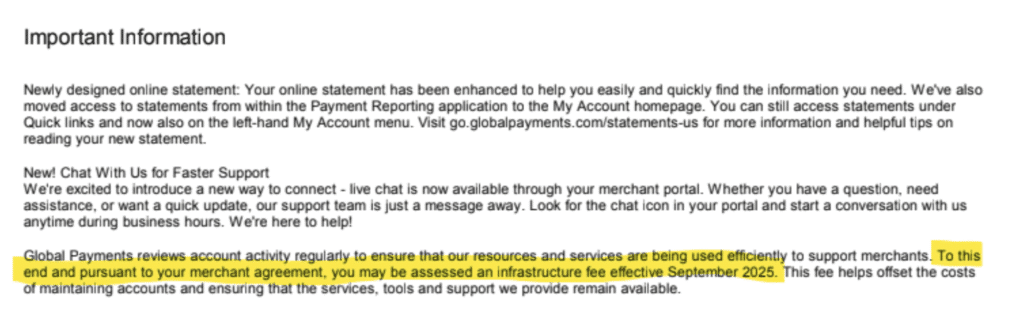

New Global Payments Infrastructure Fee (September 2025)

Merchants using Global Payments can expect a new Infrastructure Fee added to their statements in September 2025.

In true Global fashion, the notice of this new fee didn’t specify the exact amount (which tells me that the charge won’t be equally applied to every business).

But based on how other Global subsidiaries are charging the Infrastructure Upgrade Fee this year, most businesses can expect to be charged around $450.

This fee is completely bogus and you can potentially get it removed from your account. So keep a close eye on your September statements, and let us know if you need help.

New Global Payments Rate Increase – Effective August 2025

Global Payments just sent a notice to businesses saying that they might see new rates and increased existing rates on in August 2025. While the notice did not specify the exact rates changes, it did specify that the following fees could be impacted:

- Discount rates

- Per item fees

- Authorization fees

In our experience, these notices saying that fees might be impacted always means it’s a rate increase from Global.

The fact that they aren’t telling the exact amount of the increase is crazy. So you’re forced to monitor the statements on your own to identify the increase.

We’ve seen instances where Global tripled a merchant’s rates after one of these increase notices, so make sure you keep a close eye on your August 2025 statements to ensure your rate hike isn’t that drastic.

Global Payments Rate Increases and New Rates From Last Year

As usual, Global Payments makes changes fees and updates things on a regular basis throughout the year. Here’s a breakdown by month in 2024:

December 2024

Global Payments is planning to charging an annual fee beginning in December 2024. We’ve received this notification from several of our clients that are currently using Global for payment processing.

One thing I find really annoying about this is that the notice doesn’t actually include the annual fee amount. So it looks like we’ll need to wait until December to see what they’re actually going to charge (and I have a feeling it won’t be consistent for every business).

It’s also interesting that they’re choosing to add an annual fee in the last month of the year. This is Global’s way of ensuring they get this fee in 2024 and 2025.

If you get charged an annual fee from Global Payments this December, please reach out to our team here at MCC let us know how much it was for.

November (Canada Only)

Effective November 1, 2024, there will be new rates for Visa and Mastercard’s Small Business Interchange Program for qualifying small businesses.

It was previously announced that this would go into effect in October for Canadian merchants, but has since been updated to November 1st.

October 2024

Global Payments sent a notice to merchants notifying them of increased pass-through fees from the card networks that go into effect in October 2024. This includes discount rates, assessment fees, per item fees, authorization fees, and more.

Visa is also updating its dispute resolution process on October 19, 2024, which will effect Global merchants going through the dispute process. This update eliminates outdated language for steps that are no longer required, and makes the rules easier to understand.

September 2024

Effective September 25, 2024, 3D Secure Version 2.1.0 will no longer be supported by Global Payments for all card brands.

If you’re currently using this version, you must upgrade to the newest version to continue using 3D Secure. Otherwise, you’ll receive an error code whenever you submit a transaction using the outdated version.

July 2024 (Canada Only)

Effective July 1, 2024, merchants in Canada using Global Payments will see a new or increased Data Security Fee and Risk Assessment Fee listed on the Discount Fees section of monthly statements.

July statements also came with a notice that Global Payments is introducing a new fee for Visa’s Processing Integrity Program in Canada (which went into effect on April 25, 2024). It’s a $0.075 fee on both domestic and international transactions that are not authorized, reversed, or cleared as required by Visa’s terms.

Global is retroactively charging merchants for all fees from April 25 until the most recent statement closing today. Moving forward, they’ll bill merchants monthly for that fee under the “Other Fees” section of the statement.

May 2024

Here’s a list of Global Payments fees that are either new or changed as of May 1, 2024:

- Batch fees

- PCI non-compliance fee

- Network security fee

- Compliance fee

- Risk assessment fee

- Discount rates

- Per item fees

According to Global Payments, Merchants have 30 days of a statement date to dispute a charge that contains any errors. If you need help identifying errors or bogus fees charged to your account, reach our to our team here at MCC for a free audit and analysis.

April 2024

Merchants using Global Payments can expect to see the following rates increased in April 2024:

- Network fees

- Assessment fees

- Switch fees

- Activity fees

- Discount rates

- Per item fees

- Per authorization fees

- Downgraded transaction categories

Global Payments to Retire TXP Gateway July 31, 2023

If you’re using the TXP payment gateway from Global Payments Integrated, you’ll no longer be able to use it as of 7/31/2023. Merchants will automatically be migrated to the TransIt proxy, which includes a new reporting center and Virtual Terminal portal called the Merchant Center.

While Global Payments is not anticipating any interruptions in service, it’s important for merchants to understand what these means for their business. Here’s a summary of what’s happening:

- Global Payments TXP gateway is sunsetting July 31, 2023

- Merchants will automatically be migrated to TransIT gateway

- Merchants must acknowledge the transition to activate their accounts and ensure continuation of services

- 90 days of historical gateway will be migrated

- Following the migration, merchants will have 31 days to access TXP data

- All active customer profiles will be migrated

- Expired wallets will not be migrated

Keep an eye on your inbox for a welcome email following the migration. You must access your new account within five days before the login credentials expire.

Reach out directly to your Global Payments Integrated point of contact, or call 800-543-5327 if you have any questions.

New Global Payments Rate Increases

Merchants will be charged a 0.02% pre-authorization fee on Visa transactions. This is an optional service, that allows merchants to obtain an approval of funds before the actual transaction amount is finalized. As of April 17, 2023, AFDs (MCC Code 5542) will be excluded from this authorization framework.

Effective May 8, 2023, Visa transactions processed through Global Payments will have a rate increase. Specifically, the rate increase applies to consumer credit contactless transactions, which will be charged the same amount as Mastercard’s card-present/non-contactless transactions.

American Express Cross Border Assessment fee is increasing by 0.20% as of May 1, 2023. This applies to inbound fees on purchases using cards issued outside of Canada and excludes JCB cards.

Global Payments Surcharging Rules, Fines, Fees, and Violation Updates

Global Payments recently set a notice to their clients to remind them about card brand rules regarding surcharging and other terms that merchants must follow to stay compliant. Here’s a summary of the key takeaways from this notice:

- Non-compliance fines could range from $1,000 to $25,000 per violation.

- Minimum transactions can NOT be imposed on debit cards or pre-paid cards.

- Minimum transaction requirements for credit cards must not exceed $10.

- For cash discounting, merchants must honor the listed price and then offer a discount for customers paying cash. They cannot charge more than the listed price for customers paying with a card.

- Surcharging rules only apply to Visa, Mastercard, and Discover.

- American Express surcharging is only allowed for merchants on the OptBlue Program.

- Surcharging amounts must not exceed 3%.

- Surcharges cannot be applied to debit cards or prepaid cards.

- There must be a disclosure statement at the entrance and point of purchase regarding minimum transactions, cash discounting, and surcharging.

Merchants must make sure they’ve registered with Global Payments before they can implement certain changes. All payment devices must be properly set up and programmed so that surcharges are properly applied. It’s also the merchant’s responsibility to ensure they’re complying with state and local laws, as surcharging rules vary by location.

About Global Payments

Global Payments is one of the largest payment processors in the world. They process over 73+ billion merchant transactions and 35+ billion issuer transactions every year.

They own and operate other major processing brands, including TSYS, Heartland, OpenEdge, and Cayan.

Get all of the latest interchange rates and updates from our ultimate guide.