Global Payments (formerly OpenEdge) is one of the world’s largest payment processors. They handle over 4.6+ million merchant accounts directly through the Global Payments name and through subsidiaries that they’ve acquired over the years.

Major providers like TSYS, Heartland, and EVO Payments (among others), are all owned by Global Payments.

However, many of these subsidiaries operate independently in the sense that they have their own fee structures and divisions. So for the purposes of this review, we’re going to focus specifically on merchant accounts that are managed directly by Global Payments—which includes OpenEdge.

That’s because most merchant accounts that say Global Payments are actually boarded on the OpenEdge platform (OpenEdge was rebranded as Global Payments Integrated following a merger with TSYS in 2019). So accounts that previously said OpenEdge, or still might say OpenEdge, have many of the same fees and rates as Global Payments. It’s a bit confusing, but it’s the same company.

Read on for a deeper dive into Global Payments, including insider information that you won’t find anywhere else on the web. I’ve even shared some Global Payments statements that highlight rate increases and bogus fees to help you spot the same stuff on your account.

MCC Quick Take on Global Payments

Global Payments is notorious for increasing its rates. These increases aren’t very transparent, and we typically see them come on a quarterly basis—announced in April, June, October, and December.

We’ve also found instances where Global Payments “pads” or inflates assessment fees. This is a deceptive practice because it appears as though those charges are coming directly from the card networks when, in reality, Global is actually making a profit on them.

They also add random monthly fees to statements, with the names changing all of the time. But if you know how to spot these charges and negotiate your rates, you can get those items removed from your statement.

Pros

- Interchange plus pricing

- Rates can be negotiated

- Lower rates when you first sign up

Cons

- Frequent rate increases

- High rate increases

- Inflated assessment fees

- Extra fees added to statements

- Merchants can expect a major increase after 12 months of signing up

- We caught Global Payments ripping off businesses, charging a 20% effective rate to one account

Global Payments Pricing and Credit Card Processing Rates

Merchants typically pay around 2.5% total to process transactions when they first sign up for Global Payments. Global’s markup starts around 0.15% to 0.20% per transaction.

But we’ve also seen these rates upwards of 3.5% with markups around 0.45% + $0.45 per transaction or higher. So there’s quite a big range here, and Global is known for increasing rates.

It’s worth noting Global Payments doesn’t publish or publicly disclose its processing fees. That’s because they don’t charge the same rates to every business.

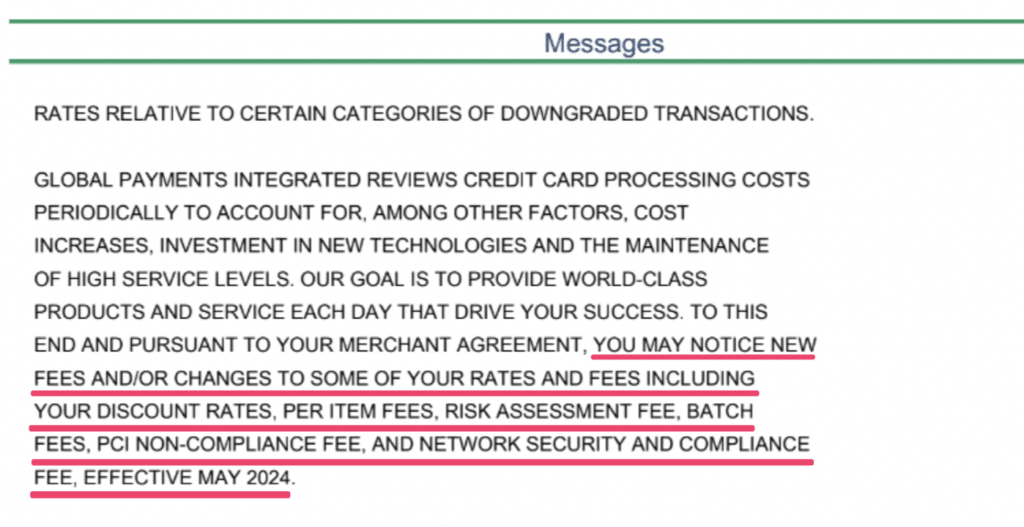

In fact, when Global Payments increased its rates in April and May of 2024, they didn’t actually specify the exact changes. Instead, Global sent a blanket message to merchants saying that they “may notice new fees and/or changes” along with a list of items that could be impacted.

When auditing statements for our clients using Global Payments, we found that these fees and increases were applied somewhat arbitrarily. Some merchants had new fees, others had rate hikes, and some had a combination of both—but there was rarely consistency applied across the board.

Global Payments Fees to Look Out For

Global Payments is one of the industry’s biggest offenders for adding extra fees to merchant statements. While this is something we see from providers, the range of different fees that Global sneaks in is probably the longest.

Here are some examples to watch out for and what you can do about them.

- Risk Assessment Fee — Try to get rid of this.

- Settlement Funding Fee — Try to get rid of this.

- Bank Deposit Service Fee — Try to get rid of this.

- OpenEdge Check Fees — You can usually cut this fee in half.

- Analytics Reputation Management — $45 monthly fee that you can typically get rid of.

- Auto Enrollment Fee — This is just one example of a random fee that we’ve seen added to statements. The name changes all the time, and you should ask to get it removed.

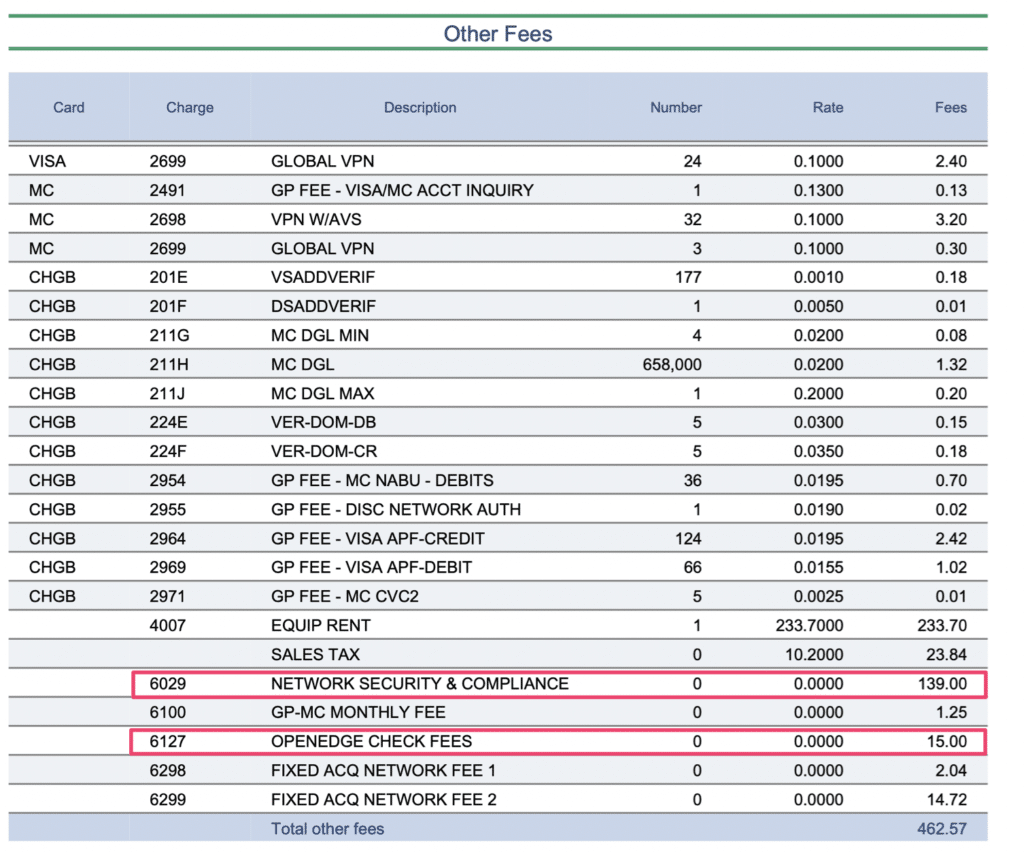

- Network and Compliance Fee — Monthly fee of $139 that you should try to get rid of.

- CE Suite Fee — $45 charge that can be negotiated.

- Global VPN Fee — Rate varies and is sometimes disguised as a fee from the card network.

This is honestly just the tip of the iceberg. While these are the most common fees we see when we’re auditing statements for our clients, Global Payments still surprises us with some new ones from time to time.

Most of these can be successfully removed from your bill if you apply the right negotiation tactics.

For example, our team here at MCC helped an orthodontics practice identify hidden fees from Global Payments and ultimately negotiated a 34% total cost reduction on their behalf. We even got Global Payments to refund some of those extra fees back to the merchant.

Keep an Eye Out For Inflated Assessment Fees

In addition to the random monthly and one-off fees charged by Global Payments, you should also keep a close eye on your assessment fees.

Similar to interchange rates, assessment fees are imposed at the card network level and then passed through to merchants from the processor. These rates are non-negotiable, and they go directly to Visa, Mastercard, American Express, and Discover.

You can refer to our guide on assessment fees to see some of the most common charges from each of these four card networks.

But Global Payments is known for “padding” assessments, which means they inflate the charges imposed by the card networks and pocket the difference. This is a deceptive practice and it’s extremely difficult to catch if you don’t know what you’re looking for.

Some of the assessments that we’ve seen inflated from Global include:

- Mastercard Assessment Fee

- Visa Assessment Fee CR

- Visa Assessment Fee DB

- Discover Assessment Fee

- Amex CNP

- Amex Network

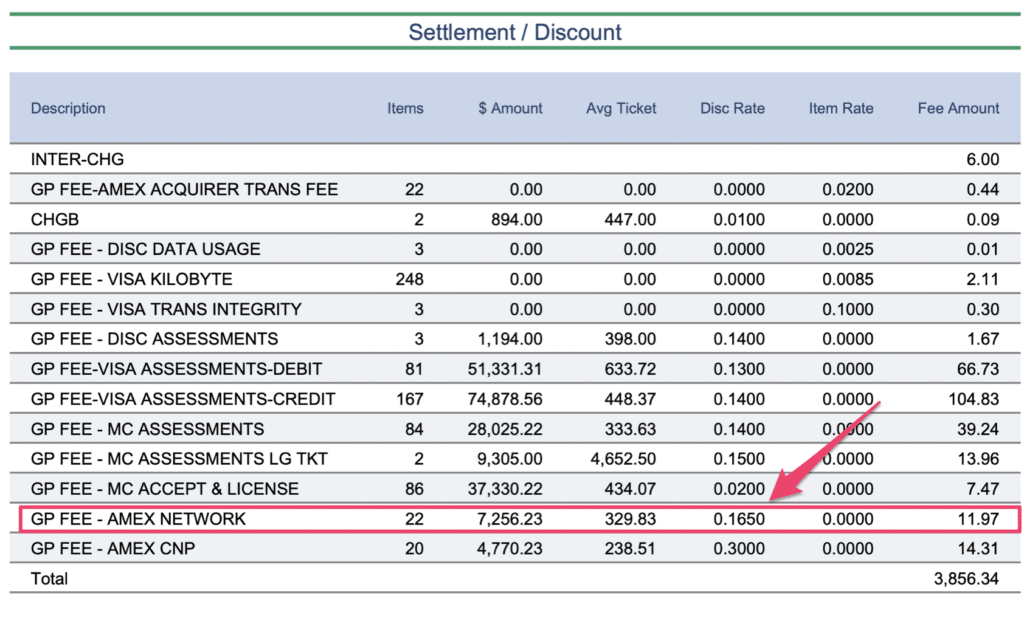

Here’s a recent example of a padded assessment that we found on a Global Payments statement:

The Amex Network Assessment Fee is supposed to be 0.15%. But as you can see from the statement above, Global is charging 0.165%.

At the end of the day, the dollar amount here is minimal. But these charges add up quickly, and if your processor is doing this, then there’s a good chance they’re inflating other charges on your bill as well—and that’s exactly what we see from Global Payments.

Again, this is super difficult to spot if you aren’t familiar with the rates. This is just one line that’s 0.015% higher than it should be—buried within a statement that has nearly 100 different line items to review. Most businesses don’t have time to review these statements so closely, which is why Global thinks they can get away with it.

You can always get a free audit from our experts to see whether or not Global Payment is padding your assessments.

How to Audit a Global Payments Merchant Account Statement (With Real-World Examples)

To highlight some of the fees massive rate hikes we’ve discussed so far, I want to share some monthly statements from one of our clients that uses Global Payments.

When they first signed up, the merchant was paying a 2.5% effective rate to process payments. After just 12 months of using Global’s service, that rate jumped to 3.3%.

Here are some of the particulars:

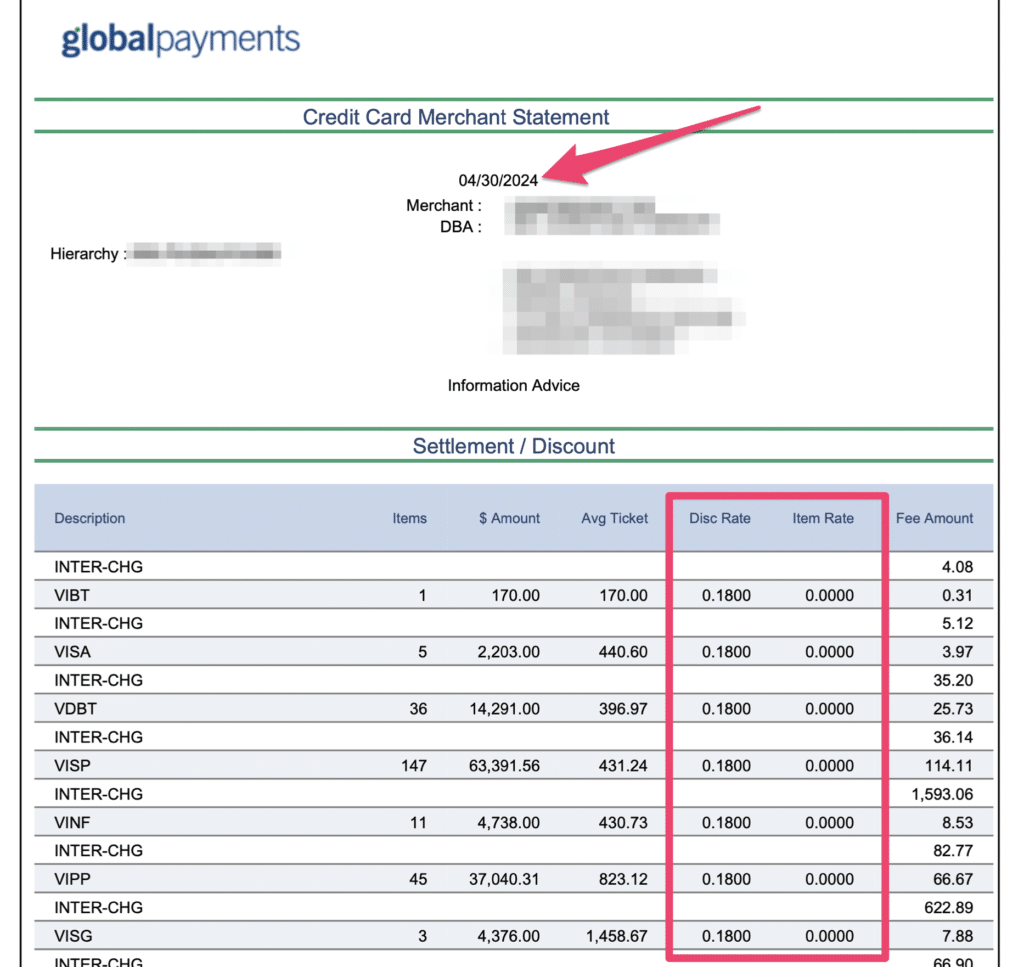

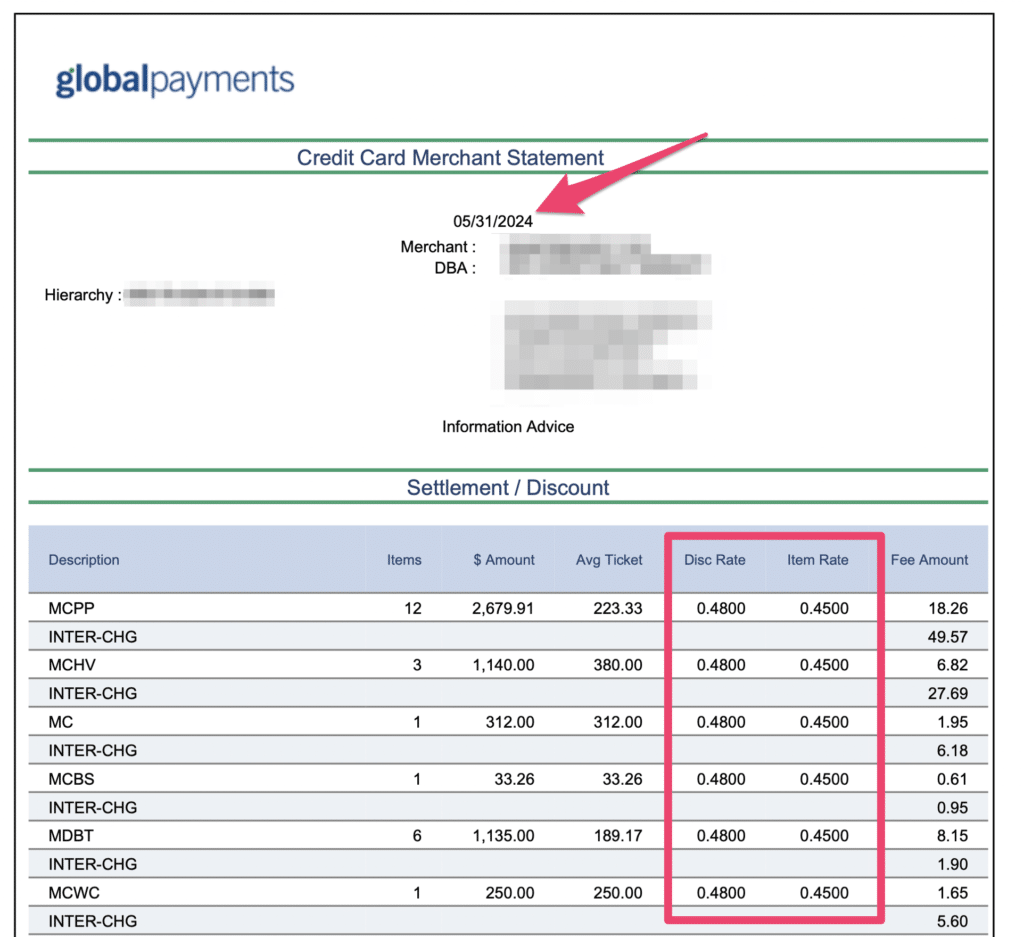

- Discount rate increased from 0.18% to 0.48%

- Per transaction rate increased from $0.00 to $0.45

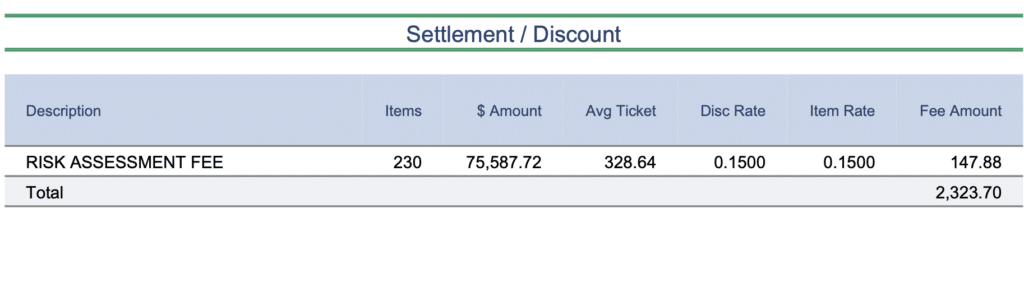

- Risk Assessment Fee of 0.15% + $0.15 per transaction fee was added

- Network and Compliance Fee of $139.99 per month was also added

Let’s look at the statements so you can see for yourself:

In April, the merchant was paying 0.18% + $0 per transaction.

That’s a pretty good deal, and they were getting this rate for the previous 12 months.

But the following month, Global Payments increased those rates to 0.48% + $0.45 per transaction. Here’s the May statement:

Take a moment to think about how crazy that is.

In April, Global Payments was taking $0.18 from this merchant to process a $100 transaction. Then in May, they took $0.93 to process the exact same transactions. That’s more than quadruple the cost from one month to the next—and it doesn’t even account for the other fees that they started charging.

Here’s the Risk Assessment Fee of 0.15% + $0.15 applied to 230 transactions:

And here’s a laundry list of “Other Fees” that Global charged this merchant in May—including some of the bogus ones that we mentioned earlier.

To the untrained eye, it’s easy to overlook these.

That’s because they’re just listed with some legit fees, like network assessments and chargebacks.

This is one of the many reasons why it’s so important to work with a merchant consultant who can audit your statements and identify those increases on your behalf.

Most processors, including Global Payments, seem to make statements almost intentionally deceptive so they’re difficult to understand. They use terms like “discount rate” to show the percentage you’re paying them per transaction and “item rate” to show the flat fee you’re paying for each transaction—but without a percentage sign or a dollar sign.

At first glance, you could look at this statement and think you’re actually getting a discount—and potentially that your discount increased from month to month. But in the world of payment processing, when your discount rate increases it actually means you’re paying more (there is no discount).

Our Final Thoughts on Global Payments

We don’t recommend switching to Global Payments to get a lower rate. A global sales rep may quote you at a rate that’s lower than what you’re currently paying, but that will likely be short lived—and you can expect a significant price increase about a year into the service.

Plus, Global is constantly adding new fees, and we’ve also caught them padding assessments. These are all red flags.

Instead, you’re better off negotiating your rates directly with your current processor. They won’t want to lose your business, and you’ll have much more leverage.

The same holds true for merchants that are currently using Global Payments. After reading this review, you might be tempted to cancel your merchant account agreement. But you’ll have better luck negotiating your rates with Global and getting those bogus fees removed from your statements.

If you need some help identifying those fees and inflated rates, we can provide you with a free audit that includes an estimate of how much you can save—all without having to switch processors. We’ll even negotiate those rates on your behalf so you can focus on running your business and let us handle the cost savings for you. Find out how much you can save today.