Credit Card Networks Explained: How Credit Card Networks Work in 2024

Credit card networks help power the global economy. Millions of credit card transactions are processed every day—all of which would be impossible without the card networks.

From small businesses to ecommerce giants and everything in between, credit card networks help funnel sales into organizations of all different shapes and sizes.

As a merchant, it’s important to understand credit card networks and their function—which is precisely why we created this guide.

What is a Credit Card Network?

Credit card networks operate the communication infrastructure that’s required for banks and businesses to process credit card transactions. Card networks authorize transactions, establish transaction terms, and move payments between cardholders, banks, and businesses.

Visa, Mastercard, Discover, and American Express are the four major credit card networks that most people are familiar with.

What do Credit Card Networks Do?

Card networks create and maintain the technology that powers payment processing and credit card authorization.

Each time a card is swiped, dipped, tapped, or entered, it’s the card network’s job to verify the approval or denial from the issuing bank. This is one of the many elements that takes place in the few seconds while the transaction gets processed.

Credit card networks must verify the account is active, the transaction is authorized, and that there’s enough available credit to cover the purchase amount.

In addition to issuing cards and assisting with approving or denying transactions, the card networks perform other card-related roles that aren’t directly tied to a sale.

Card networks might extend product warranties to cardholders. They can also protect consumers with car rental insurance, travel insurance, and other benefits. If you have a credit card in your wallet, I’m sure you’re familiar with some of these perks.

How Credit Card Networks Work

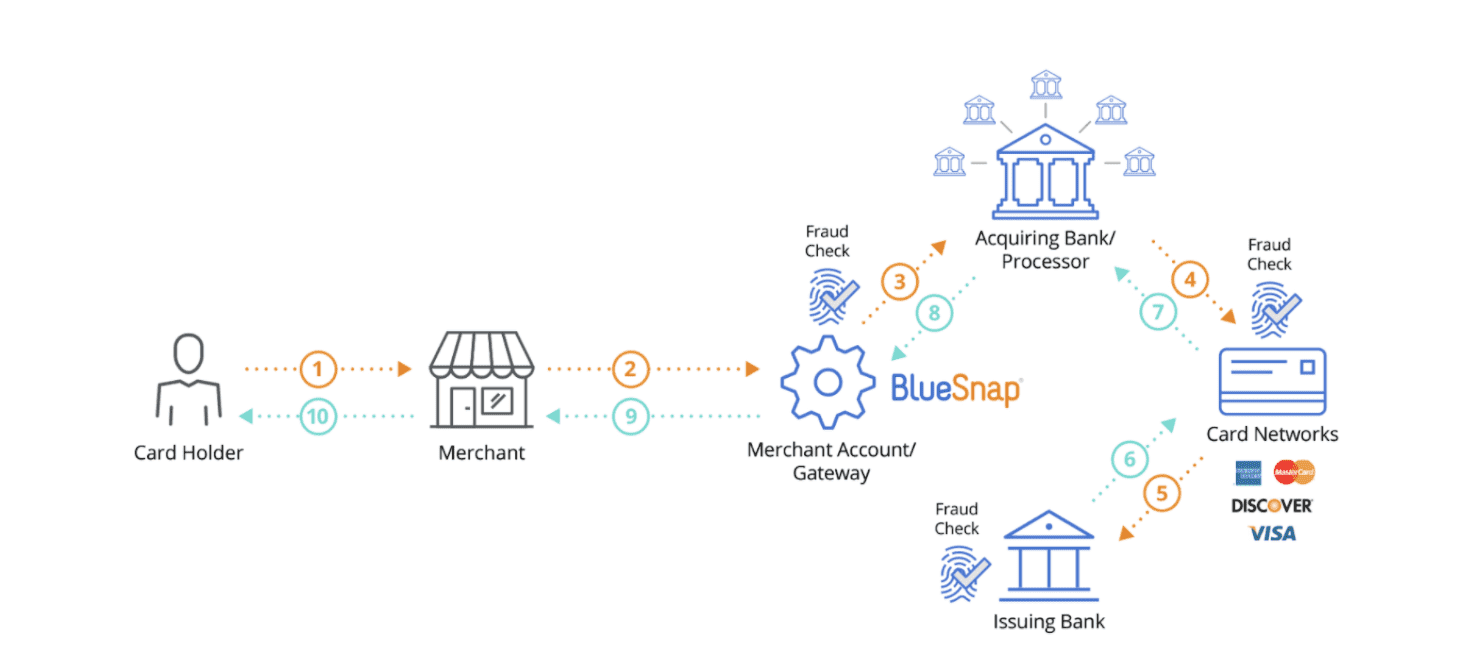

While a credit card transaction might seem like a simple exchange between two parties (the consumer and the merchant), there are actually lots of other players involved in this process.

- Cardholder — The consumer

- Merchant — Business/store/vendor etc.

- Acquiring Bank — The merchant’s bank

- Payment Processor — The company that processes the payment

- ISOs and MSPs — Third-party companies that processing is outsourced to

- Issuing Bank — The cardholder’s bank

- Card Networks — Associations issuing cards

When a card transaction gets initiated by a cardholder at a particular business, the cardholder data is read by the terminal and gets passed to the acquiring bank. From there, the acquiring bank requests authorization from the credit card network.

Then the credit card network passes the approval or denial to the issuing bank so that the final authorization and approval can be handled.

Assuming the transaction is approved, the sale gets finalized, and the merchant exchanges goods or services with the consumer.

Here’s a visual representation that shows the path of a credit card transaction, which explains exactly how credit card networks work.

Like everyone else involved, the card networks take a fee as a percentage of each transaction for their role in the sale.

Credit card networks have their own rules and policies. Merchants must follow those network regulations and understand the liability exposure for various circumstances.

Credit Card Network vs. Credit Card Issuers: What’s the Difference?

Card networks and credit card issuers both play a significant role in credit card processing. Before the card network can approve or deny a sale, it needs to verify the transaction with the credit card issuer, also known as the issuing bank.

However, some credit card networks double as the issuing bank. They don’t have to take that extra step in the process to approve or deny a transaction—they handle everything under one roof.

American Express and Discover both function as a credit card network and issuing bank. Visa and Mastercard don’t issue cards directly to consumers. So they operate as an intermediary between the merchant and issuing banks, even though the cards are branded with the Visa or Mastercard name. Here’s an example with Mastercard as the card network, and Citibank as the issuing bank:

In this case, card issuer and credit card network are two different financial institutions. The card network (Mastercard) sets the interchange fees that are imposed by payment processors to merchants accepting credit card payments. But the card issuer (Citi) still plays a crucial role when it’s time to process transactions. Both the network and card issuer work together to assist cardholders and approve purchase requests initiated by merchants.

Other common functions of a card-issuing bank include:

- Setting credit card interest rates

- Determine foreign transaction fees

- Charging cardholders penalties for going over limit

- Cardholder communication

- Cardholder rewards programs

If an Amex cardholder wanted to dispute a charge or had a question about traveling internationally, they’d contact American Express directly. But a Visa cardholder with the same inquiries wouldn’t contact Visa; they would contact the issuing bank.

Who Pays Credit Card Network Fees?

Merchants pay credit card network fees in the form of interchange rates and assessments. These are imposed on every credit card transaction processed by the business and facilitated through the issuing bank.

While some credit cards have annual fees that are paid by the cardholder, these are completely separate from the per-transaction fees paid by the merchant.

Technically, annual fees (paid by the cardholder) and network fees (paid by the merchant) are totally unrelated. But it’s common for certain cards, especially those with the best perks and rewards, to have higher interchange rates. Cardholders may pay a higher annual fee to get better cash-back rewards, travel perks, or other bonuses. In turn, the interchange rates on those particular cards could be slightly more expensive for the merchant—as the card network needs to compensate for the benefits on the cardholder side.

4 Major Credit Card Networks

There are four major credit card networks that dominate the global market share—Visa, Mastercard, American Express, and Discover. I’m sure most of you are familiar with these names, but I’ll give you a brief description of each one below.

Visa

Visa is essentially the gold standard in credit card processing. These cards are accepted basically anywhere that accepts credit cards. According to a recent study, Visa controls 60% of the entire credit and debit card market share.

- Read more: Visa Interchange Rates

Mastercard

In terms of market share and popularity, Mastercard is second in line behind Visa—controlling 30% (according to the same study). Visa and Mastercard typically go hand in hand for merchants. Businesses that accept Visa cards almost always accept Mastercards as well.

- Read more: Mastercard Interchange Rates

American Express

As previously discussed, American Express is both a card network and an issuing bank. Amex controls less than 10% of the market share, but it’s known for providing exceptional customer service to cardholders.

Some merchants don’t accept Amex because of the higher processing fees. Amex is also known to back up its customers in disputes, which can be frustrating for merchants.

- Read more: American Express Interchange Rates

Discover

Like Amex, Discover is also a card network and issuing bank. This credit card company isn’t quite as popular as American Express amongst consumers, but merchants favor Discover over Amex. That’s because Discover’s fees aren’t nearly as high, despite their dual-functionality.

- Read more: Discover Interchange Rates

Other Credit Card Networks

Alongside the four major card networks, there are additional networks that have a niche market in certain regions.

JCB

Formally the Japanese Credit Bureau, JCB is a card network accepted in 20 different countries. As you might have guessed, the card network is popular in Japan. With that said, a recent partnership with Santander is allowing JCB to expand and become more prevalent in Spanish markets.

STAR

STAR is an industry leader in PIN debit card transactions. They became the first network to facilitate ATM deposits without envelopes. The STAR network was acquired by First Data in 2003.

Interac

Interac dominates the debit card market share in Canada. This network has 59,000+ ATMs and is accepted at 450,000+ different merchants in the region.

Accel

The Accel network has over 400,000 ATMs worldwide, including coverage throughout the United States. Lots of US Air Force bases across the globe have Accel ATMs on-site.

Credit Card Issuer List

Beyond the card networks, here are some major credit card issuers:

- Chase Bank

- Capital One

- Bank of America

- American Express Bank

- Wells Fargo

- Discover

- Citibank

- US Bank

- Barclays

These are just the big names. But in the US alone, there are more than 85 different card issuers.

Open vs. Closed Credit Card Network

Credit card networks can be segmented into two main categories—open and closed networks. Let’s take a closer look at each one:

- Open Network: Open credit card networks allow third-party financial institutions to issue cards within that network to customers. For example, banks like Chase, Wells Fargo, or Bank of America can distribute Mastercard or Visa-branded cards to their customers.

- Closed Network: In a closed network, the credit card company doubles as the card issuer and typically doesn’t allow third-party financial institutions to issue their cards. American Express and Discover are both closed networks.

It’s also worth mentioning that even closed networks can have co-branded cards. For example, American Express partners with Delta to issue Delta-branded cards on the Amex network.

Understanding whether a card is issued on an open or closed network helps make it easier to determine what’s happening behind the scenes of a transaction.

Final Thoughts on Card Payment Networks

Card networks are the backbone of credit and debit card transactions. Credit card networks work with every financial institution in the transaction process.

As a merchant, it’s important to understand the role that these networks play in credit card processing.

In this day and age, you should be accepting all four major credit cards, at a minimum. Just understand that they each function differently, and the fees vary from network to network.

0 Comments