Setting up recurring payments has become a popular and profitable way for businesses across multiple industries to generate ongoing revenue.

Recurring payments are often seen as a win-win for merchants and customers alike, as they eliminate the need for the customer to provide payment details every month.

Despite the benefits, recurring payments aren’t always priced the same as other credit card transactions, and it’s common for recurring payment processing to incur higher interchange rates.

This in-depth guide explains everything you need to know about recurring payments and how they affect credit card processing rates.

What Are Recurring Payments?

Recurring payments are automatic charges that occur when a consumer agrees to repeated purchases from a merchant on a set schedule. A recurring payment typically occurs weekly or monthly, but it can also be set up for any interval, including quarterly and annual payments.

There are two different types of recurring payments:

- Fixed Recurring Payments — The payment is for the same amount every time (like a gym membership or streaming subscription).

- Variable Recurring Payment — The charge varies with each payment cycle (like an electric bill with usage-based pricing).

It’s important to note that recurring payment processing refers to a fixed and automatic billing schedule. So while the actual price might vary, the billing frequency is the same for it to be considered a recurring transaction.

How Do Recurring Payments Work?

There’s a lot happening behind the scenes to process a recurring payment. Here are the steps involved in recurring payment processing:

- The consumer provides payment details and authorizes the merchant to save their card on file for ongoing payments.

- An automatic online request is sent to the payment gateway based on the billing frequency.

- The gateway forwards that request to the payment processor.

- The payment service provider sends the request to the card network.

- The card network verifies funds with the issuing bank.

- The issuing bank approves or denies the translation.

- The approval or denial is sent back down the line through the processor.

- The transaction is processed, the merchant gets paid, and the consumer will see the transaction on their monthly statement.

This entire process occurs in seconds. It’s essentially the same steps involved in any other credit card transaction, except card details are already stored on file.

Difference Between Recurring Charges and One-Time Transactions

The biggest difference between recurring charges and one-time transactions is the frequency. Even if a customer buys something on a regular basis from the same business, it’s not necessarily a recurring transaction.

One-time transactions are unique purchases. There’s no subscription or ongoing agreement between the buyer and seller for repeat charges. A payment service hasn’t been authorized to continue billing the customer, and the business hasn’t agreed to provide an ongoing product or service to the consumer.

With a one-time transaction, the cardholder’s payment information is not automatically saved on file. For some ecommerce purchases, customers may have the option to save their card details on file for future purchases. But the card being saved doesn’t necessarily make it a recurring transaction either.

Here are two examples to help you better understand the difference.

Let’s say you have a restaurant. Every day, the same customer comes in for lunch and buys a sandwich and a coffee. Even though they’re charged the exact same amount every day, each individual transaction is still considered a one-time payment.

Now let’s say your restaurant also offers a meal prep delivery service. For $145 per month, three pre-made meals will be delivered to the customer’s home every week. This is considered a recurring payment.

Difference Between Recurring Transactions and Recurring Billing

The terms “recurring transaction” and “recurring billing” are often used interchangeably—but the two are not the same.

A recurring transaction refers to a card on file being processed. But a recurring bill doesn’t actually mean that money has changed hands.

For example, it’s common in the B2B space to send an invoice to a business customer for services. Maybe it’s a contractor that sends a bill every month for services or an accountant that sends a quarterly invoice for services rendered.

Recurring bills don’t have card information saved on file, and the person or business receiving the bill often has multiple payment options to choose from, including a check, ACH payment, e-check, credit card, or debit card.

How Much Do Recurring Transactions Cost?

The cost of recurring transactions varies based on the card type, processor, and merchant agreement. But generally speaking, recurring transactions typically cost around 2.9% + $0.30 per transaction.

This is slightly higher than an in-person transaction, which might start around $2.6% + $0.10 from the same processor.

Like other interchange rates, the reason why recurring transactions cost more than other transactions is because they’re a higher risk.

Card networks and processors alike view in-person transactions as the least risky because the card is present—making it harder for a fraudulent transaction to occur. But recurring payments are processed online, which means the card is not present, and there’s a higher chance of the cardholder disputing the charge.

To compensate for potential chargebacks and fraud, recurring transactions are priced higher—typically at the same rate as an online transaction.

But recurring transitions may incur other extra charges. For example, Stripe charges an additional $0.25 per update to automatically update the payment information for cards on file.

Types of Businesses That Need Recurring Payment Acceptance

Recurring payment acceptance really only works for certain types of businesses and industries. Here are some common examples:

- Subscription Services — It’s common for subscription services to charge customers a fixed monthly or annual rate for access to a particular product or service. Examples include video and audio streaming (like Netflix or Spotify) and magazine subscriptions. There are even subscription box services, like Dollar Shave Club, that automatically deliver products to a customer’s door each month.

- Memberships — Businesses that operate on a membership model usually set up recurring payments. This is common for gyms, yoga studios, co-working spaces, and social clubs. Country club memberships would also fall into this category.

- SaaS Businesses — SaaS (Software as a Service) has become a popular business model, especially in the B2B space. While many SaaS products can be purchased month-to-month, it’s common for these platforms to offer discounted billing for long-term subscriptions, like annual payments. Examples here might include project management software, CRM software, and video conferencing software.

- 1:1 Services — Any one-to-one service agreement between two parties can be set up for recurring payments if the billing frequency remains the same. For example, personal training, legal services, and daycare would all be considered a 1:1 service. Even dog walking could fall into this category.

- Services Offering Payment Plans — High-priced products or services offering payment installments can be set up for recurring payments. For example, a wedding photography and videography service may let customers split a $10,000 payment into four $2,500 transactions spread between the contract start date and the week of the wedding.

Pros and Cons of Recurring Payments Credit Card Processing

Recurring payments are generally positive for businesses. But they aren’t always perfect. We’ll take a closer look at the advantages and pitfalls of recurring payment processing below.

Benefits of Recurring Payments

- Increased Customer Convenience — Your customers don’t have to call, go online, or visit a store to pay for something every month.

- Reduced Manual Effort — Merchants also don’t have to chase down customers to get their credit card details.

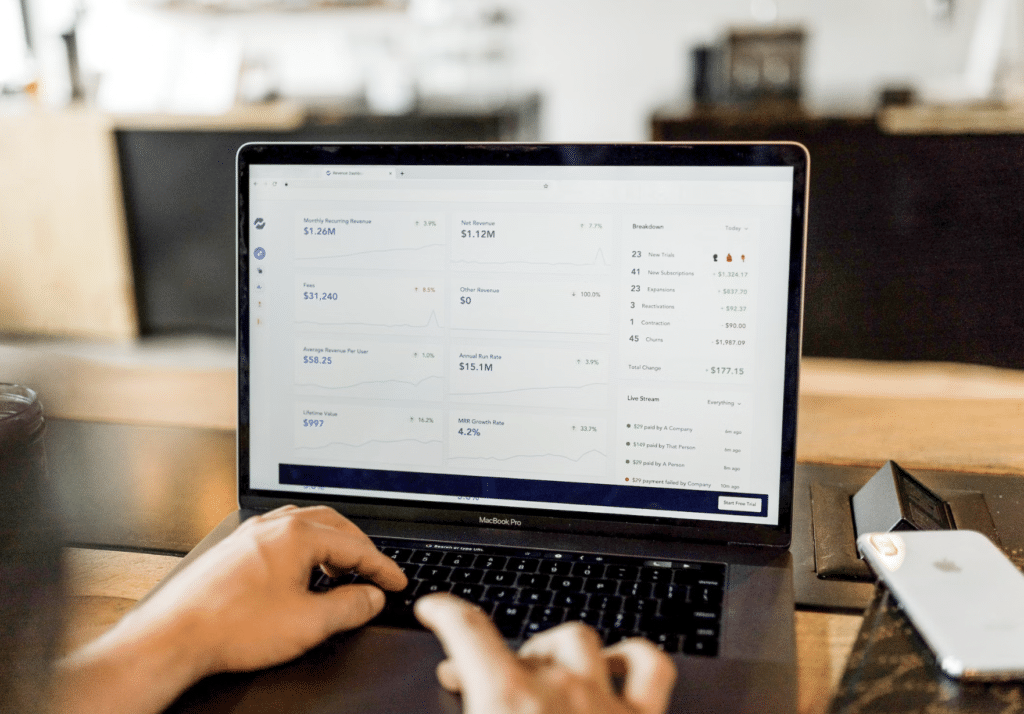

- Accurate Cash Flow Estimate — It’s easier for merchants to predict how much revenue they’re getting each year or month based on memberships or subscriptions.

- Automated Processing — Everything is stored on file and billed automatically.

- Flexible Payment Options — Merchants can offer different pricing structures based on billing frequency, such as monthly, quarterly, or annual payments.

Drawbacks of Accepting Recurring Payments

- Higher Processing Costs — Recurring payments typically cost more than in-person or card-present transactions.

- Higher Risk of Chargebacks — Since the card isn’t present, there’s a higher chance of fraud or the possibility that the cardholder disputes the transaction.

- Extra Fees — Some processors may impose extra costs for processing recurring transactions, like a fixed fee to automatically update card details.

Final Thoughts on Recurring Payment Credit Card Processing Rates

Recurring payments are ideal for subscriptions and membership-based businesses. But they can also be used by any business that provides an ongoing product or service to customers.

Rather than sending a monthly bill, you can simply save those card details on file and bill the customer at a predetermined frequency—with their prior authorization, of course.

While recurring payments typically cost more than other types of credit card payments, the pros generally outweigh the cons.

Rather than eliminating recurring payments from your business model, you can look for other ways to save money on credit card processing. Our team here at Merchant Cost Consulting can help lower your cost of accepting recurring payments without forcing you to switch processors.

We’ll negotiate the rates on your behalf to lower your total cost of payment acceptance. Find out how much money you can save today.