Every dollar matters when you’re running a nonprofit organization. With limited funds and resources, you need to come up with some creative ways to save money.

With cash becoming nearly obsolete, the majority of people use credit cards and debit cards to pay for everything, including nonprofit donations. Plus, your nonprofit might sell merchandise like shirts or hats online as an additional way to raise funding.

Have you ever stopped to consider how much money you’re paying for credit card processing?

Imagine if that number could be cut in half, or even completely eliminated. As a nonprofit organization, there’s a good chance that you qualify for reduced credit card processing rates.

Nonprofit Discounts For Credit Card Processing

The majority of payment processors offer discounted credit card processing fees for nonprofits.

In most cases, you’ll just need to provide proof of your 501(c)(s) status. This is something that should have been discussed when you first opened up a merchant account. If it wasn’t, you need to call your processor to see what kind of deals they can offer. Or better yet, have a professional merchant consultant negotiate the rate for you.

It’s rarely in your best interest to switch credit card processors. So even if your provider doesn’t offer a nonprofit discount, a consultant can still help you negotiate those fees.

Types of Credit Card Processing For Nonprofits

Before you can get discounted payment processing for your nonprofit, you need to understand the pricing models used by providers in the payment processing industry. The pricing model of your plan dictates where your discount will come from.

Nonprofit credit card processing can be segmented into two categories:

- Merchant accounts

- Third-party processing

I’ll cover each model in greater depth below.

Traditional Merchant Accounts

With a traditional merchant account, your provider will offer a dedicated account for your nonprofit organization.

People pay using their cards, and the payment processor draws its fees before sending the rest to your bank account. The fees will vary based on the pricing structure of your processing plan.

- Tiered pricing — In most cases, fees are broken down into three different tiers (qualified, mid-qualified, and non-qualified). Qualified transactions have the lowest fees, while non-qualified transactions have the highest. Since it’s not always clear which category a payment will fall under, your nonprofit can end up paying more than needed.

- Interchange plus — This pricing structure is much more transparent. All payments come with an interchange fee, which is the fee paid to respective credit card associations and banks on the card network. The “interchange” fee is non-negotiable, but the “plus” part is the markup charged by the processor. Markups are usually a percentage of the transaction plus a flat rate, or in some instances, just a flat rate.

As a non-profit organization, you can potentially get lower interchange costs for specific credit cards. To qualify for those discounts, you need to make sure that your merchant account has you set up with the right merchant category code (MCC).

For Visa and Mastercard, the MCC 8398 is used for charitable and social service organizations.

Then you can get additional discounts from your provider if they reduce the markup fees.

Third-Party Processors

A third-party processor groups multiple businesses into one large merchant account. The processor will have an MCC for the large account, but it will not be MCC 8398. That’s because the processing company is not a nonprofit organization.

Due to this, a third-party processing account cannot get the special interchange rates offered to nonprofits.

However, the majority of third-party credit card processing providers do offer some type of discount for nonprofit organizations. Although these rates and monthly fees will vary based on your provider. Again, it’s best to have a professional negotiate your discount with your processing company to get the lowest possible rate.

Free Credit Card Processing For Nonprofits

As a nonprofit organization, it’s possible to get free credit card processing. Although the definition of the word “free” here is a bit loose.

The credit card processor and credit card companies will still charge you a processing fee for their role in the transaction. But you can pass those costs along to your donors.

This is typically handled one of two ways:

- Surcharging

- Convenience fee

In both cases, the card user pays for the processing costs. The only difference is that you must offer a “primary” payment method for donors that don’t want to pay a convenience fee.

It’s tough to properly implement a surcharge or convenience fee to credit card payments. Some states do not allow surcharging at all.

In my professional opinion, the best way to implement this is by giving your donors the option to pay extra to cover your processing charges, as opposed to making it a mandatory part of the transaction.

How to Choose a Nonprofit Credit Card Processor

Choosing the best credit card processor for your nonprofit can be tough. For those of you who haven’t done this yet, these are the features that you should keep in mind during your search.

Processing Rates

You’re obviously trying to find the best price for nonprofit credit card processing. Compare the discount offered to the standard rate for other merchants to see how much of a deal you’re getting. You can also shop around pricing between multiple providers.

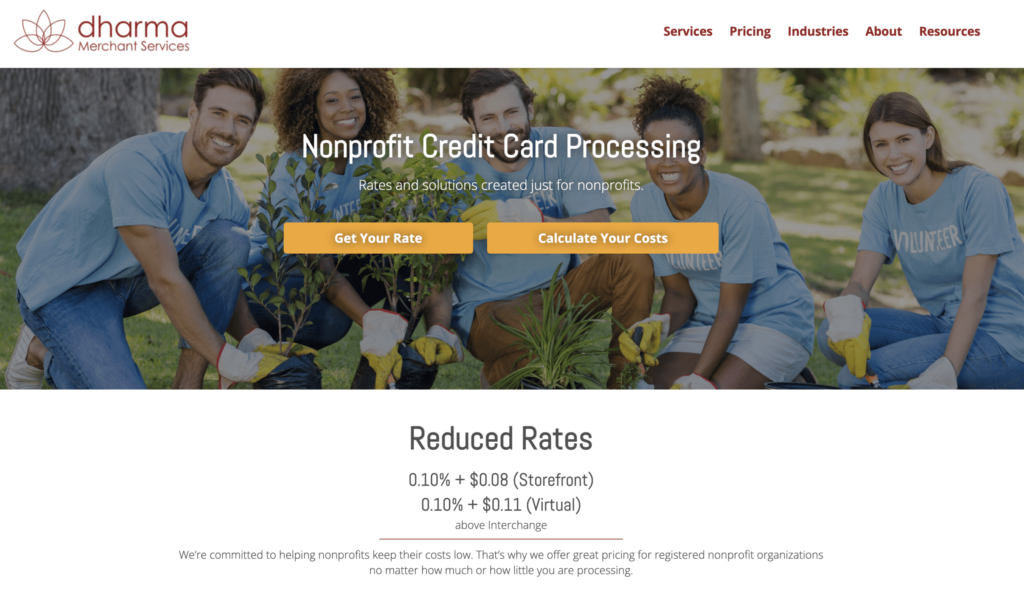

Dharma Merchant Services has payment processing services designed specifically for nonprofit credit card donations. Here’s a look at their reduced rates and processing fees for nonprofits:

If you compare this to the average credit card processing fees from other credit card processors, you’ll see that they’re definitely on the lower end to accommodate non-profit organizations.

Customer Support

Choose a credit card processor that will be available if and when you need assistance. In my experience, that day will come eventually. Whether it’s in two months or two years, having a provider that can help you on nights, weekends, or holidays is crucial.

Payment Gateway

If you’re taking donations or selling products online, you need to have a payment gateway. Most third-party processors will set you up with a free payment gateway if you’re using their software. Not every traditional merchant account offers this for free, so make sure you ask ahead of time.

Transaction Types

How will you plan to accept donations for your nonprofit? You need to make sure that your processor gives you the tools you need to accept a wide range of transactions. If you take donations over the phone, you’ll need a virtual terminal. If you take donations on the go, you’ll need a mobile card reader. From online donations to in-person auctions and permanent physical locations, you need a processor that offers it all.

Recurring Payments

It’s common for donors to make regular contributions to a nonprofit organization on a recurring basis. Choose a processor that will let you set up automated billing on a monthly or annual basis for recurring donations. This allows you to maximize donations with significantly fewer manual tasks. No more playing phone tag or forcing donors to visit your website every month.

CRM and Integrations

The best payment processors for nonprofits have CRM (customer relationship management) software. It’s a bonus if your processor has software that’s compatible with third-party integrations for things like accounting software or other tools that you’re using to run your nonprofit.

Final Thoughts

There’s a high probability that your nonprofit organization is eligible for discounted payment processing.

You don’t need to switch providers to benefit from these discounts. Try contacting your processor directly to see what they can offer you. Otherwise, ask a merchant consultant to negotiate the rates on your behalf.

Here at Merchant Cost Consulting, our team of experts has years of experience working with a wide range of businesses, including nonprofit organizations.