What is Interchange Plus Pricing?

Interchange plus pricing is commonly used by credit card processors to determine the per-transaction rates paid by merchants. But it’s just one of several different contract structures that businesses might be presented with when they’re signing up for credit card processing—and it’s one of the most complex.

Complexity aside, interchange plus pricing is typically the most affordable option for credit card processing. Yet so few businesses understand how this pricing structure works.

Whether you’re currently on an interchange plus pricing plan, thinking of changing to an interchange plus model, or shopping and comparing processing fees around for the first time, this guide is for you.

I’ll explain everything you need to know about interchange plus pricing, including what it is, how it works, and how it compares to other credit card processing models. You’ll also learn more about the pros and cons of interchange plus pricing to determine if this fee structure is right for you and your business.

What is Interchange Plus?

Interchange plus pricing is a credit card processing model where a processor markup is applied on top of the interchange rate set by the card networks.

As the name implies, there are two main components to interchange plus pricing—the “interchange” and the “plus.”

For each credit or debit card transaction, there’s an interchange rate imposed at the card network level (Visa, Mastercard, American Express, Discover). Then the processor marks up that fee for its role in processing the merchant’s transaction, which is where the “plus” comes from.

How Does Interchange Plus Pricing Work For Credit Card Processing?

To better understand how interchange plus pricing works, you must first learn how interchange works. We have an in-depth guide on interchange fees and rates that explains this in greater detail, but here’s a quick summary that covers the basics.

Every credit card and debit card transaction has an interchange rate. The interchange rates are determined by the card networks and vary based on things like card type, transaction environment, merchant category code (MCC), annual transaction volume, industry, and other unique factors.

There are literally thousands of different interchange rates when you look at all of the fees published by the major card networks.

For example, a Visa transaction will have different interchange rates than an American Express transaction. Ecommerce transactions will have different interchange rates than in-person transactions. Even two in-person transactions can have different interchange rates if one customer is using a Visa rewards credit card and another is using a Visa Signature card or debit card.

But for merchants to accept these credit cards, they need help from a credit card processor. Payment processors and merchant account providers must be compensated for their role in the transaction. With the interchange plus model, they’re compensated by adding a per-transaction fee on top of the interchange rate.

Merchants end up paying the interchange rate set by the card network plus a processor markup. That’s where the term “interchange plus” comes from.

What is an Example of Interchange Plus Pricing?

Let’s say you own a restaurant, and you’re on an interchange plus contract with your merchant account provider.

A customer pays for their bill using a Mastercard World Elite credit card. You could look at the latest Mastercard interchange fees to see that the interchange rate for this type of transaction is 2.00% + $0.10.

In addition to the interchange rate, your credit card processor charges 0.30% + $0.15 for all transactions. Using this example and assuming the bill is $100, your total cost to process this card with the interchange plus pricing model would be $2.55.

The $2.55 is broken down into two parts—$2.10 goes straight to Mastercard (interchange) and $0.45 to the processor (plus).

These fees are automatically deducted from the transaction, and $97.45 is left for the restaurant. This gets held in the restaurant’s merchant account before it gets deposited into its business checking account.

Interchange Plus Pricing Compared to Other Merchant Account Plans

There are several different types of credit card processing models on the market today. We’ll compare interchange plus to these alternatives in greater detail below.

Interchange Plus vs. Tiered Pricing

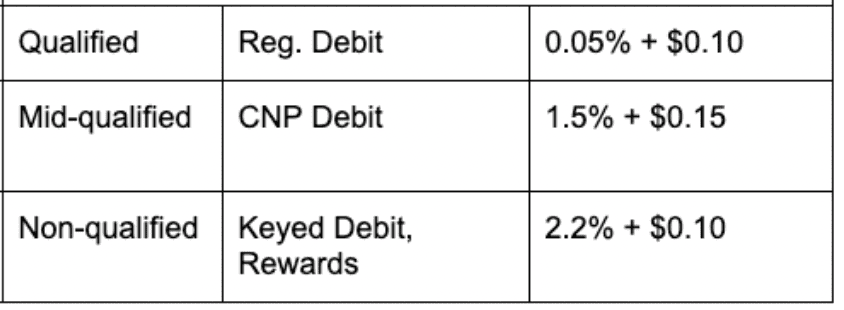

Tiered pricing for credit card processing segments all transactions into one of three buckets—qualified, mid-qualified, and non-qualified. Qualified transactions are the least expensive, and non-qualified are the most expensive.

The problem with the tiered pricing model is that the processor determines which bucket each transaction will fall in. This often leads to them choosing mid-qualified or non-qualified rates for the vast majority of transactions.

Here’s a hypothetical example of debit tiers that shows how the rates can significantly jump at each level:

Many merchants feel misled when they sign up for a tiered contract because the sales rep only shows them the qualified rates. But the business rarely, if ever, actually gets transactions at those rates. So your actual cost of accepting credit card payments becomes much higher than you anticipated.

Interchange plus pricing is much more transparent and typically less expensive when compared side-by-side to tiered credit card processing.

Interchange Plus vs. Flat-Rate Credit Card Processing

As the name implies, flat-rate credit card processing charges the same rate for every type of card. So the interchange rates set by, Visa, Mastercard Amex, and Discover, are essentially thrown out of the window—at least from the merchant’s perspective.

Credit card associations still impose interchange rates for each transaction, but the merchant only pays the flat fee that’s set by their processor.

The only time where your transaction will change if you’re using flat-rate processing is if the transaction environment changes. For example, you’ll typically see cheaper rates for in-person dip or tap transactions compared to in-person swiped or manually keyed transactions. Card not present transactions will have a higher interchange fee than card present transactions.

Compared to interchange plus pricing, flat-rate processing is ultra-transparent, and it’s easy for merchants to know exactly what they’re paying for every translation. However, flat-rate pricing is usually more expensive than interchange plus pricing. Processors still need to turn a profit, so the flat rates are often inflated and sometimes a full percentage point higher than the interchange rates set by the card networks.

Interchange Plus vs. Subscription Plans

Subscription pricing, also known as membership pricing, is a variation of the interchange plus model. Merchants still pay the interchange rates imposed at the card network level, but the markup fee is dictated by the subscription.

For example, a $199 monthly subscription can give merchants access to lower markup rates compared to a $79 monthly subscription. Simply put, the more you pay each month, the lower the markup rate becomes.

Similar to interchange plus pricing, subscription plans are very transparent—since you’re still paying the interchange fees imposed by the card networks, like Visa and Mastercard. However, you need to do some math to determine your monthly and annual processing volume to see which membership tier is right for your business. Some processors also force merchants to higher membership levels when they reach an annual processing threshold, such as $250,000 or $1 million per year.

Interchange Plus vs. Interchange Plus Plus Pricing

Interchange plus plus, or interchange++, is another variation of interchange plus.

The additional “plus” adds a third component to the total transactional fees—acquiring bank scheme fees. The acquiring bank also passes on the scheme fees from networks, which are determined by multiple factors like the transaction type and card used.

This model isn’t quite as popular as interchange plus pricing, but it adds even more transparency to the statements. Merchants can see exactly what they’re paying and how the additional acquirer fees are factored into the equation.

Pros and Cons of Interchange Plus Pricing

Interchange plus pricing is typically the best type of contract and fee structure for most businesses. There are several advantages to using interchange plus, which we’ll cover in greater detail below. We’ll also highlight some potential flaws or drawbacks with interchange plus pricing.

Interchange Plus Pros

Some of the top benefits of interchange plus pricing for credit card processing include:

- Transparency — Unlike other types of credit card processing, interchange plus tells you exactly what the card brand, issuing banks, and processors are charging for each payment. This structure helps prevent merchant account providers from adding extra fees to each transaction.

- Low Cost — Interchange plus pricing is usually the least expensive way to process credit cards and debit cards.

- Easier to Negotiate — While the interchange rates imposed at the card network level are non-negotiable, the “plus” component of interchange plus pricing can be negotiated. Compared to other pricing models, interchange plus gives merchants the most room for negotiation and securing the lowest possible rates.

Interchange Plus Cons

While the pros tend to outweigh the cons, there are still a few considerations that you should keep in mind as you’re evaluating interchange plus pricing:

- Complexity — There are so many different interchange rates out there, which makes it difficult for merchants to accurately predict their fees each month.

- Some Cards Are More Expensive — Accepting certain types of credit cards, like American Express cards or elite membership rewards cards, increases the interchange rate set by the card network. So one transaction can be more expensive than another, even if the ticket value is exactly the same.

- Interchange Rates Change — The card networks are constantly making changes to their interchange fees. This will likely cause your rate per transaction to increase over time.

Final Thoughts on Interchange Fees

Despite the few drawbacks, interchange plus is almost always the best credit card pricing model for merchants. It’s transparent and usually cheaper compared to every other plan type.

So if you’re on the fence between interchange plus and another option, interchange plus is the clear winner.

If you’re already on an interchange plus plan and you want to save money on credit card processing, then you’re in luck. Interchange plus is the best model for negotiating your rates. So you can lower your cost to accept credit cards without having to change plans or switch processors.

To be clear, the interchange rates set by card networks are a non-negotiable part of payment processing. But the “plus” component set by your processor is completely arbitrary.

Our team here at Merchant Cost Consulting can audit your statements and let you know how much you’re overpaying for credit card processing. Then we’ll negotiate the markup costs directly with your processor to help lower your rates.

0 Comments