Within credit card processing, there are 6 different pricing structures out there, most of which are deceptive pricing traps and what we call teaser rates. More about the different pricing structures here.

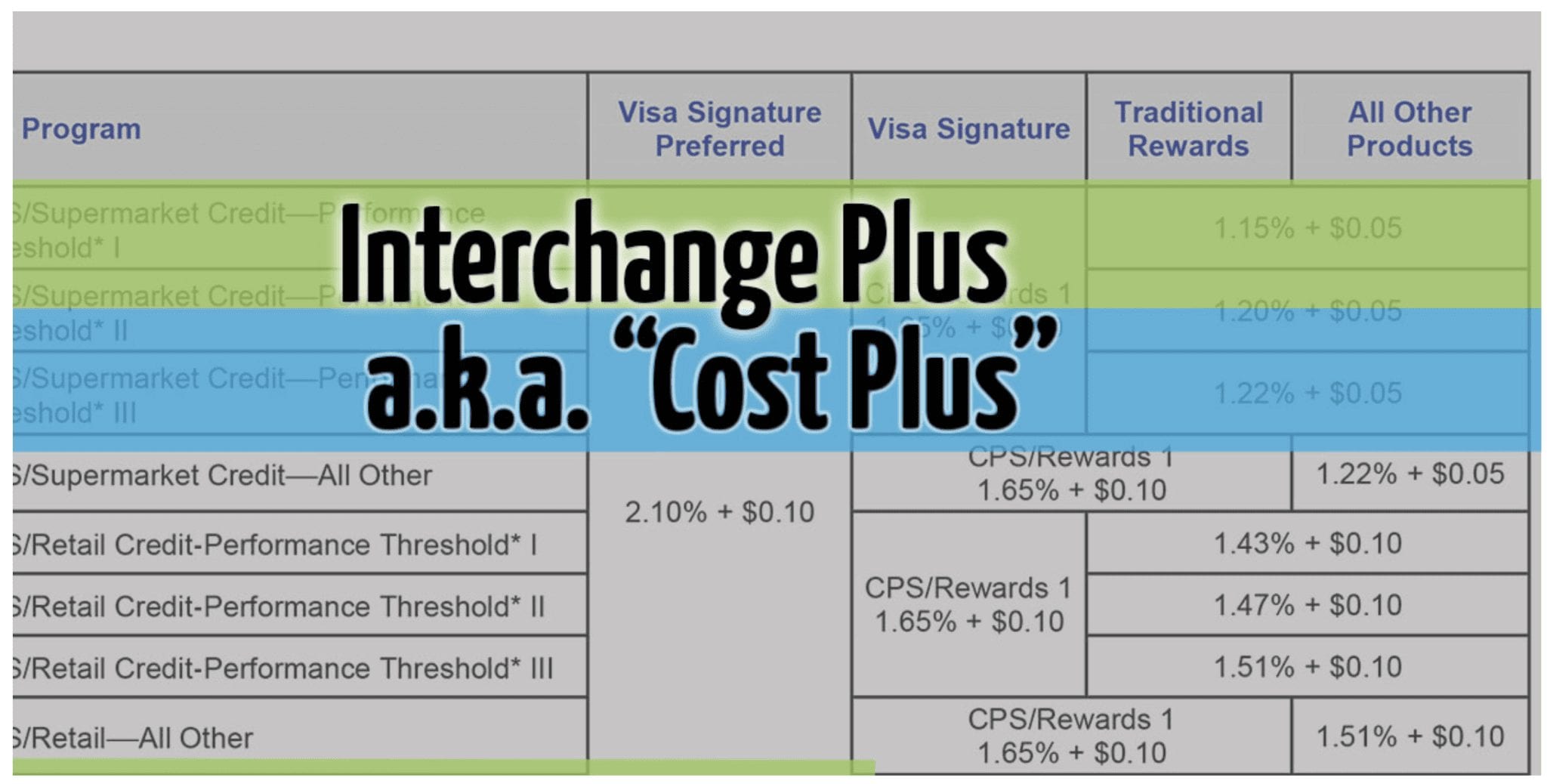

There is one credit card processing pricing structure I do want to talk about, one that alleviates the deception and keeps all credit card merchant fees as transparent as possible, and that is Interchange Plus Pricing.

Interchange Plus Pricing:

The reason this credit card processing pricing structure is head and shoulders better than anything else out there is because of its transparency. It gets rid of all the confusion and alleviates those “Keyed” or “Swiped” credit card merchant fees that you see advertised on the internet. With Interchange Plus Pricing, your business is passed along the interchange fees established by the card networks (there are thousands of interchange fees) and then you are charged a service markup by the credit card processor. Interchange Plus Pricing quotes usually resemble this:

Interchange Plus + 0.30% + $0/10/transaction.

Lets break the above example down into 3 easy sections to help you understand how credit card merchant fees work.

First Section: “Interchange Plus”

This is the section of credit card merchant fees that no one has control over other than the card networks (Visa, MasterCard, Discover, etc). These credit card merchant fees change twice a year (April & October) and can range anywhere from 0.05% – 2.95% pending the credit or debit card your business accepts.

Debit cards and standard credit cards are by far the lesser expensive credit cards to accept if you are trying to get the lowest interchange fees. The issue is it’s nearly impossible to know what kind of card your customer is using at the time of sale and what the true interchange rate of that credit card is. No one has time to analyze each card, the interchange rate associated with it, and track all this data, especially as a business owner or a financial professional.

When it comes to accepting business credit cards, this is where things can get interesting. All businesses nowadays want to use their shiny new rewards card because they get their rewards points, frequent flyer miles, cash back, and all the other bells and whistles that come with it. The problem here is that the interchange rates on these types of credit cards are far more expensive than credit cards that do not have the rewards (Not rocket science). If you are a B2B firm accepting credit cards, understand your interchange rates are going to be more expensive.

HOWEVER…. (IMPORTANT FOR B2B FIRMS)….

This does not have to be the case. In credit card processing, for B2B firms there is such thing called Level 2 & 3 Interchange Optimization. On a high level overview, if you accept the same rewards cards from your customers, but you have Level 2 &3 Interchange Optimization, the true interchange rates are significantly less expensive, ultimately lowering your credit card merchant fees. The average reduction of the interchange credit card merchant fees when obtaining Level 2 & 3 Interchange is ~0.80% on the majority of your B2B credit cards that qualify. More on this later.

Second Section: “0.30%”

This section of interchange plus pricing is the service markup percentage that your credit card processing company profits every time you accept a credit or debit card. It is also referred to as the “Discount Markup.” These percentages can vary greatly pending on the credit card processor you decide to go with and the metrics of your business.

Keep in mind, credit card merchant companies are in business to make money and to make a profit, just like everyone else, so credit card processing will never be free. However, there is no need for these credit card merchant providers to overcharge or make their merchants over pay in service markup credit card merchant fees. You can get a free audit here to see if you are being over charged on the discount markup costs of your processing statement.

Third Section: “$0.10/transaction”

The last section in the interchange plus pricing model is the per transaction service markup your credit card processing company profits every time you accept a credit or debit card. Regardless if you are processing a refund, or accepting the card for the first time, you are going to be charged a per transaction fee. Similar to the discount markup, this fee can vary pending on the credit card processing company and the metrics of your business.

Be aware, per transaction fees can be confused with “authorization” fees which ultimately are the same thing but different (confusing I know). There are such credit card merchant fees called “unauthorized transactions” and “authorized transactions” that have a fee associated to them. These fees can be different than your per transaction fee but because all of these per item fees are so similar, credit card processing sales reps use this to their advantage to not fully disclose all the per item fees your business would be charged.

As long as your business is on Interchange Plus Pricing, you are half way there to conquering the credit card processing industry. It would be naive to believe that just because your business is getting interchange plus pricing that you are in the clear. There are still multiple ways a credit card processing company can overcharge you or add hidden costs, but you should at least have piece of mind that it could be far worse. Always ask for interchange pricing, always get your statements audited quarterly in order to lower your credit card merchant fees.