ModMed is a cloud-based electronic health records (EHR) system. They work with specialty healthcare practices in categories like urology, podiatry, surgery centers, outpatient clinics, and more.

In addition to providing typical EHR features for healthcare organizations, ModMed Pay offers payment processing services directly within the platform.

This review will focus on ModMed Pay and ModMed’s payment processing solutions rather than covering its entire suite of tools for managing electronic health records.

Whether you’re currently using ModMed for EHR and considering them as your payment processor or you’re completely new to ModMed Pay, this review will explain everything you need to know about their payment processing system—including fees and real statements you won’t find anywhere else on the web.

Quick Take on ModMed Pay

You should only consider ModMed Pay if you’re already using the EHR software and you don’t mind paying a premium to accept payments within the same platform.

Like all PayFacs, ModMed Pay charges higher rates than you’d get directly from a processor. But since the payment acceptance capabilities are being offered within a system that’s tough to get an integrated payment solution elsewhere, the costs are even higher.

Pros

- Fast onboarding and easy setup (without traditional underwriting requirements).

- Ability to accept payments directly within your EHR software.

- Discounts can be negotiated.

Cons

- Flat-rate pricing only (we haven’t seen interchange-plus offered at all).

- Very high rates for both card-present and card-not-present transactions.

- Pricing is not competitive.

ModMed Pay Pricing and Credit Card Processing Rates

ModMed Pay only offers flat-rate pricing for payment acceptance. While this is the easiest to understand, it’s among the most expensive ways to accept card payments.

Here’s an overview of ModMed Pay’s standard pricing:

- Card Present Transactions (excluding Amex) — 2.99% + $0.15

- Amex Card Present Transactions — 3.49% + $0.15

- Card-Not-Present Transactions — 3.49% + $0.15

- Text-to-Pay Transactions — 3.54% + $0.15

- ACH Transactions — $0.39

- ACH Return Fee — $15

- Chargeback Fee — $24.99

As you can see, these rates are incredibly high—and you likely won’t find any processors on the market charging more than this (even for integrated processing within a specialty software).

How ModMed Pay Pricing Works (and Why It’s Important)

ModMed is a PayFac, meaning they don’t actually process anything internally, and they outsource the backend processing to another provider.

When a payment gets accepted, the backend processor charges the interchange rates directly to ModMed.

Instead of passing those wholesale costs directly to the healthcare provider with a markup, ModMed just charges a flat rate that’s more than enough to cover the processing costs (plus plenty of margin to profit from).

As a result, healthcare providers using ModMed Pay end up paying significantly more for every payment they accept. ModMed is likely profiting anywhere from 100 to 200 basis points per transaction, whereas a direct processor offering interchange-plus pricing may only markup these transactions by 25 basis points (on the high end).

Healthcare organizations using ModMed Pay don’t need a traditional merchant account to accept payments either, which is another reason why ModMed can leverage higher rates.

The backend processor just uses ModMed’s master account to handle the transactions. But the actual merchants processing the transactions are just sub accounts—provided by ModMed and not held to the same underwriting requirements or stipulations of a merchant account issuer.

Read More: How Flat-Rate Processing Eats Into Your Profits

A Closer Look at ModMed Pay’s Merchant Statements

I always stress the importance of understanding how to read your monthly merchant statements. The information you’ll find here is invaluable and can save you a ton of money once you learn how to identify overages and inaccuracies.

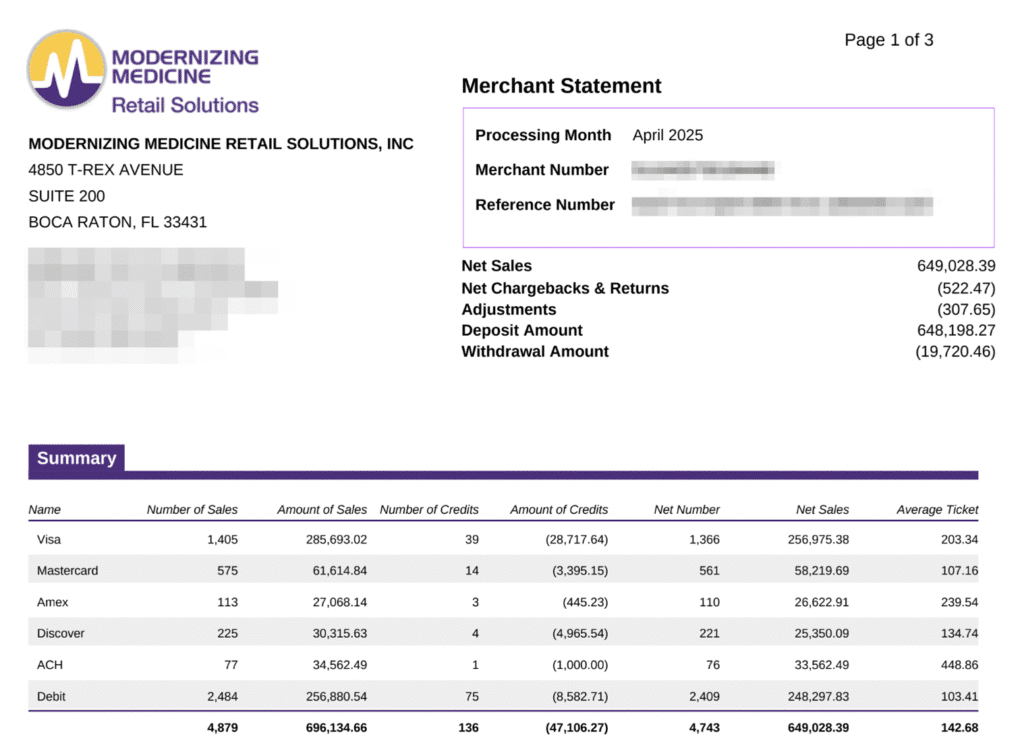

Here’s a recent statement that we audited for one of our clients using ModMed Pay:

You get a summary of highlights on page one—including net sales, total deposits, and the withdrawal amount (which is the fees paid directly to ModMed).

In this case, the merchant is paying about a 3% effective rate on 649k in sales.

At first glance, this may not seem too bad for an integrated payment solution within an EHR system. But that effective rate includes ACH transactions, which drastically brings down the average.

Remember, ModMed charges just $0.39 per transaction for ACH debits. Those transactions only cost the merchant about $30 in total fees on over $34,500 in sales.

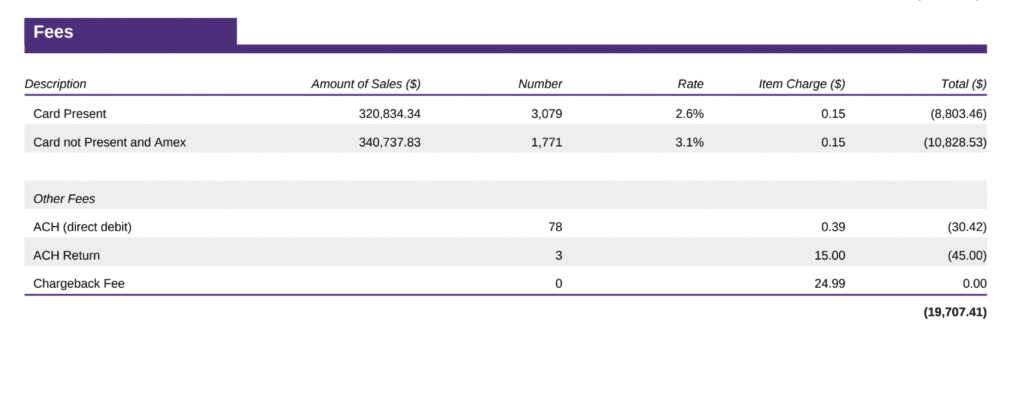

If we jump to the last page of this statement, we can see a breakdown of all these fees by transaction type:

We were able to negotiate a lower rate for this merchant compared to ModMed’s standard pricing covered earlier. Instead of paying 2.99% for card-present transactions and 3.49% for CNP, we got them down to 2.6% and 3.1%, respectively.

This negotiation saved about $2,580 for this billing period—resulting in over $30k in annual savings.

So while ModMed’s rates are high compared to market alternatives, there are still savings to be found if you know how to negotiate.

Should You Switch to ModMed Pay?

No. There’s really no reason to use ModMed Pay as your payment processor if you already have payment acceptance set up elsewhere.

The convenience of being able to get paid within your EHR system is nice. But I don’t think ModMed Pay’s rates justify the cost.

Stick with your current processor and save yourself from overpaying.

Should You Cancel Your ModMed Pay Contract?

Despite ModMed Pay’s high rates, canceling your contract is an extreme measure if you’re already set up.

You actually have a bit more leverage here than you might realize. ModMed Pay’s structure is designed so they generate high profits every time you accept a payment. They don’t want to lose your business.

Use this information to your advantage to negotiate a lower rate. While you won’t get rock-bottom interchange-plus rates like you could elsewhere, there’s still plenty of savings to be had.

Our Final Thoughts on ModMed Pay

ModMed Pay is a niche-specific payment solution that is only a viable solution for healthcare organizations already using ModMed’s EHR software. That said, even if you are using ModMed for electronic health records, it doesn’t mean that using ModMed Pay for payment acceptance is a no-brainer decision.

ModMed Pay’s rates just aren’t competitive.

As you saw from the statement example earlier, one practice processing about $650k per month saved over $30k annually by negotiating a lower rate—and even that reduced rate is still high compared to other processors.

So depending on your processing volume, you could easily be overpaying by $50k to $100k in unnecessary processing fees every year by using ModMedPay as your processor.

Whether you’re currently using ModMed or another provider, chat with our team here at MCC to discuss your options. As a merchant consultant, we’ll work on your behalf to ensure you get the best possible rate on credit card processing (without switching processors).