Pass-through fees are a significant part of payment processing, and the majority of your merchant processing costs come directly from pass-through fees.

But so many businesses that we consult with don’t understand the basics of pass-through fees, which is a big problem if you’re trying to truly get a clear picture of your costs.

To make matters worse, Google’s search results for pass-through fees will steer you toward tons of inaccurate definitions. Processors have started to tweak the language associated with pass-through fees to include their own costs (incorrectly). It’s a subtle trick that confuses merchants, but it really matters when you’re trying to figure out what you’re actually paying for.

Let’s clear this up.

What Are Pass Through Fees?

Pass through fees are payment processing costs charged by the card networks and issuing banks that payment processors pass along to merchants at cost. They consist of two main categories:

- Interchange Fees: Set by the card networks (Visa, Mastercard, Discover, Amex) but paid to the issuing bank. They are the biggest component of pass-through fees, typically 1.3% to 3%, with the exact rate depending on the card type, network, and how the transaction is processed.

- Assessment Fees: These are charged directly by the card networks themselves for the cost of maintaining their payment infrastructure. Assessments are much smaller than interchange (usually 0.13% to 0.15% of volume).

The defining characteristic of a pass-through fee is that your processor has zero control over the rate. They’re coming from a third-party, and being passed from the processor to the merchant (hence the name).

It’s also worth noting that pass-through fees are non-negotiable.

You can’t call up Visa and ask for a discount on interchange. Every merchant is subject to the same standards for interchange qualification. These are standard network costs that are completely separate from your processor’s services.

What Are NOT Pass Through Fees

Any fee that’s paid directly to your payment processor is NOT a pass-through fee. This includes:

- Per-Transaction Markups: That $0.10 or $0.20 per transaction authorization fee on your statement is part of the processor’s markup, not a pass-through fee.

- Basis Point Markups: If you’re on an interchange-plus plan and paying “interchange + 0.30% + $0.10,” that 0.30% and $0.10 go straight to your processor.

- Monthly Fees: Account fees, statement fees, PCI compliance fees, monthly minimum fees, etc. are all processor charges.

- Batch Fees and Gateway Fees: Processor services = processor revenue.

- Mystery Service Fees: Aka ambiguous named charges that look and sound official but aren’t tied to actual network costs.

Essentially, any charge on a merchant processing statement that isn’t an interchange fee or assessment is not a pass-through fee.

Why the Industry is Trying to Redefine Pass Through Fees

Here’s where things get messy. I’ve noticed that processors have started to manipulate the language when defining pass-through fees.

If you run a Google search for pass-through fees right now, you’ll find that the majority of results all include “processor markups” as part of the total pass-through fee umbrella.

Why? Because calling something a pass-through fee makes it sound like the processor has no control over it. It sounds like a legitimate, unavoidable cost rather than a negotiable processor revenue.

One particular blog post from a provider includes interchange, assessments, and payment processor fees in their pass-through fee definition. And then in the very next section, they state that pass-through fees are non-negotiable.

Only half of this statement is true, and it’s dangerously misleading information.

Yes, pass-through fees (interchange and assessments) are non-negotiable. But processor markups are 100% negotiable.

An unsuspecting merchant might come across information like this and think that they don’t have control over their processor’s rates. That’s exactly what processors want when they publish this type of misinformation.

How Pass Through Fees Actually Work

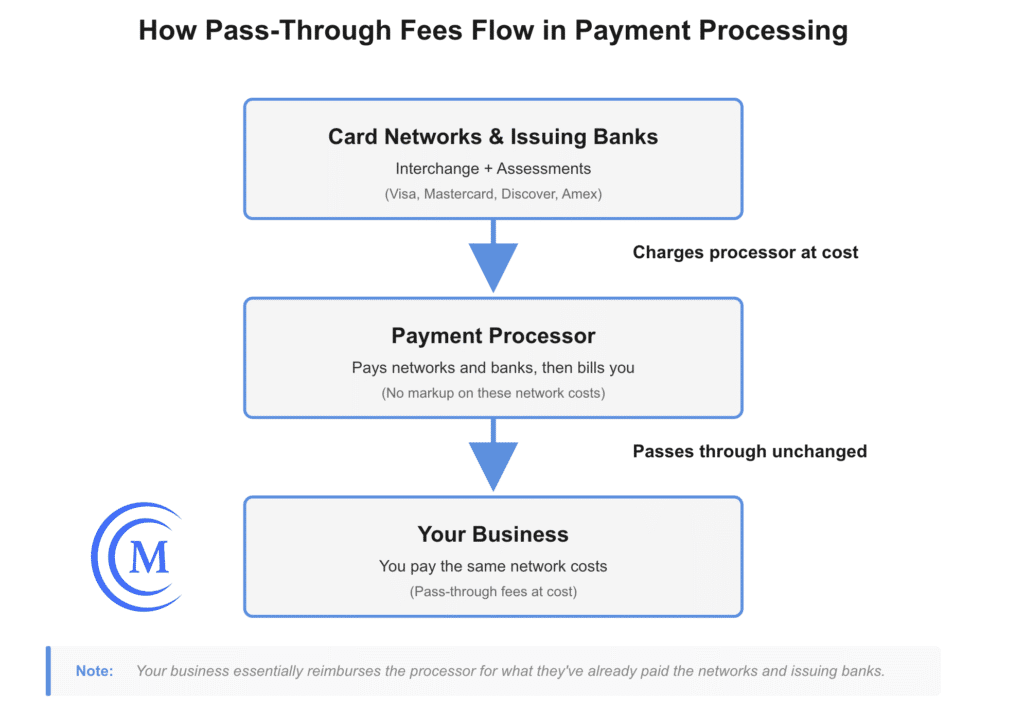

The whole point of a pass-through fee is that it originates elsewhere and the processor passes it along without markup. The moment your payment processor adds a margin or creates the fee themselves it stops being a pass-through fee and becomes a markup.

Here’s how this works:

- Card networks and issuing banks set the fees — Visa and Mastercard publicly publish interchange rates twice per year (April and October).

- The processor gets billed — When a merchant processes a transaction, they don’t get a bill from the card networks and issuing banks. Instead, they bill the acquiring bank (processor) for the interchange and assessments.

- The processor decides what to do — This is the key point. The processor chooses whether to pass those fees along to you transparently or bundle them into their pricing.

True pass-through fees are effectively reimbursements from the merchant made to the processor to cover costs they’ve already been billed for.

Most processors pass through interchange and assessments to merchants because it’s more transparent and easier to justify their pricing. But the processor is still making a choice about how to structure your costs.

This is really important to understand because it means that pass-through fees aren’t automatic. Your processor has to decide how to show them to you separately on your statement. Some don’t, and it all depends on your pricing model.

Pass Through Fees and Pricing Models

To be clear, the card networks and issuing banks charge processors interchange fees and assessments no matter what. There’s some type of interchange and assessment associated with every single transaction.

But whether you see pass through fees on your statement depends on your processing model.

Interchange-Plus Pricing

This is the only pricing model where pass-through fees are truly transparent. Your statement will show:

- Actual interchange costs itemized by transaction type

- Actual assessment fees

- Your processor’s markup as a separate line item

This is the gold standard for transparency because you can verify the pass through fees against the actual interchange schedules and network fee tables.

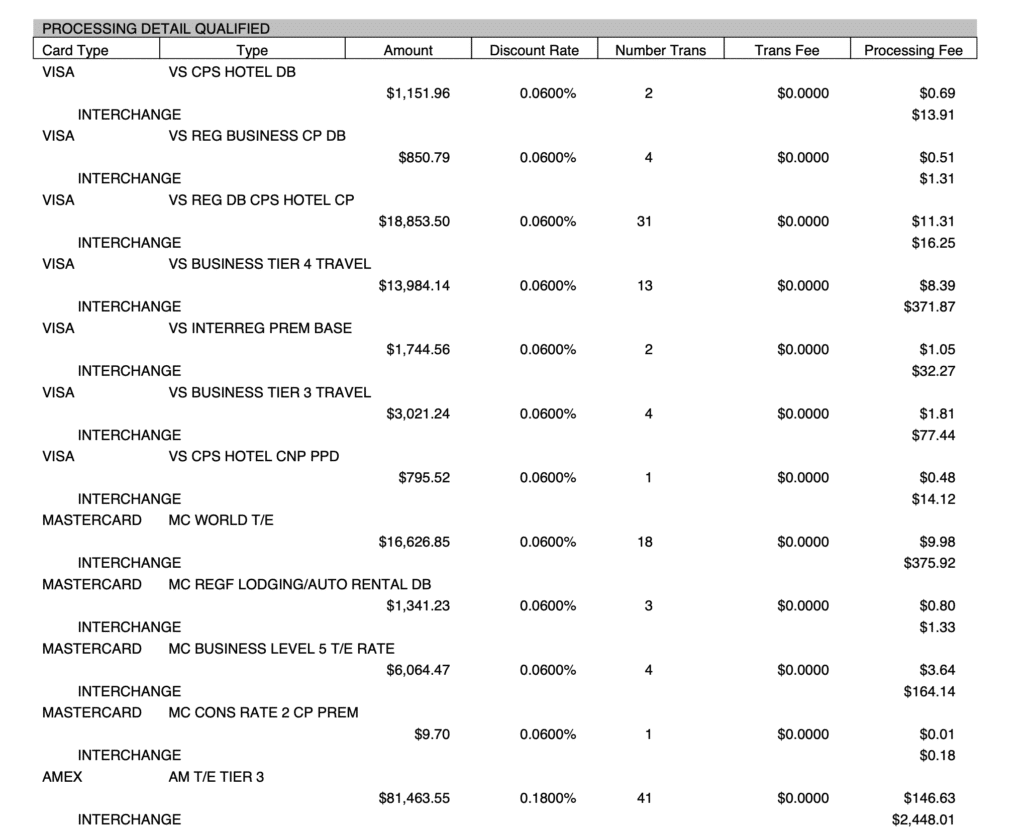

Here’s a good example of an interchange-plus statement:

This has the level of detail that you want to see because it clearly shows the interchange rate and processor markup as separate line items associated with each transaction category.

If you look to the far right “Processing Fee” column, you’ll see two lines for each transaction type.

The top line is the processor’s discount rate (in this case, a 0.06% markup for Visa and Mastercard, and 0.18% markup for Amex), and the bottom line is the interchange rate that’s been passed-through the processor to the merchant.

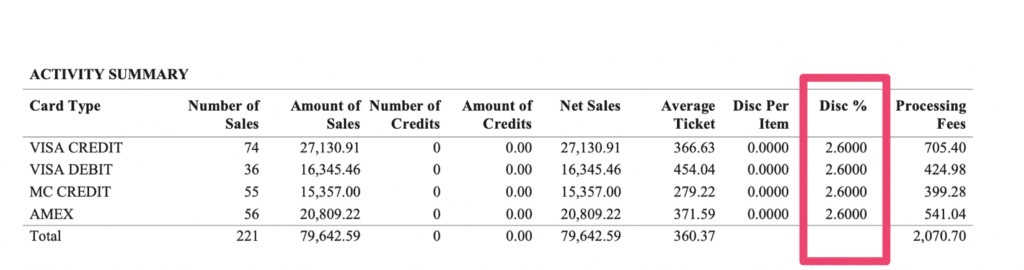

Flat-Rate Pricing

With flat-rate pricing, you won’t actually see any pass-through fees itemized on your statements. It’s the least transparent pricing model because you have no idea what you’re actually paying in interchange fees and assessments.

Instead of passing through network fees at cost, your processor just charges a fixed fee for every transaction. Here’s an example:

This is literally the entire statement.

The card networks and issuing banks still charge the processor interchange and assessment fees. But instead of passing them through to the merchant, those costs are just bundled into the flat rate.

It sounds easier to understand but it’s often the most expensive way for merchants to accept credit cards. Since interchange fees vary so significantly, the processor essentially has to account for the most expensive possible interchange categories when setting your rate.

So there’s a ton of extra margin baked into the rate you pay for transactions to cover their costs and include enough to turn a profit for their services.

Tiered Pricing

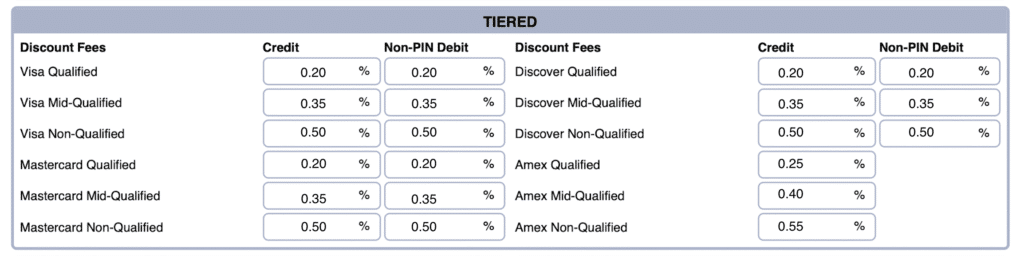

Tiered pricing gets a bit more complicated because it can be structured in different ways. But typically, the processor gives you three different rates that your transactions can fall into:

- Qualified (cheapest rate)

- Mid-Qualified (middle)

- Non-Qualified (most expensive)

Your tiered pricing agreement will look something like this:

In this particular case, the processor will still charge you the interchange rate plus their markup, but the markup is determined by their own qualification standards (and most of your transactions will likely be categorized as mid or non-qualified).

So you’d see the pass-through fees on your statement.

Other processors have bundled tiers, which include everything into a standard price (similar to flat-rate processing).

The qualified rate might be 2.29% per transaction, mid-qualified at 2.99%, and non-qualified something like 3.49%. With this setup, you wouldn’t see any pass-through fees on your statement (even though your processor is still being charged).

When “Pass Through” Isn’t Really Pass Through

Some processors claim they’re passing through fees at cost, but they actually “pad” them with inflated margins. This isn’t a standard practice in payment processing, but unfortunately, it happens more than you think.

It can happen a few different ways:

- Padded Assessments: The processor charges you 0.28% for an assessment fee that’s supposed to be 0.13%.

- Inflated Interchange: Your processor adds a few basis points on top of the interchange rate and still charges you their own markup as a separate line item.

- Fake Assessment Fees: Processors can create an official-sounding fee that looks like a network assessment, sounds like a network assessment, and gets itemized alongside other network assessments, but it’s not actually part of the network fee schedules. The Transaction Network Access Fee is a classic example of this.

This is completely unethical and one of the worst things a processor can do to a merchant because it’s so difficult to spot.

Read More: How to Spot Padded Assessment Fees

How to Verify Your Pass Through Fees

There’s really only one way to check if your pass through fees are accurate to ensure your processor isn’t doing anything shady:

- Get the actual interchange schedules from Visa, Mastercard, Discover, and Amex (they’re public, just hard to read).

- Cross-reference your statement to match transaction types to the actual interchange rates.

- Check the network fee schedules to verify that your assessment fees match what the networks actually charge.

If your processor is legitimately passing through fees at cost, they won’t have anything to hide. Every rate will legitimately match up against the published rates from the card networks.

The problem with this method is that it’s extremely time consuming. Each month, your statement can have close to a hundred line items across dozens of pages.

Double-checking each and every one against the card network source can take hours. And spot checking isn’t good enough because many processors apply shady tactics to some fees but not all (to make it even harder for you to find).

That’s where working with a merchant consultant can help.

Here at MCC, we can audit your statements to identify any inaccuracies in your pass-through fees and get them corrected on your behalf. Part of our service includes ongoing monitoring of your monthly statements to ensure your processor doesn’t try this again down the road.

Examples of Pass Through Fees vs. Processor Fees

To help further illustrate what a pass-through fee is and what it isn’t, let’s look at some examples so you can see the clear difference.

Examples of Legitimate Pass Through Fees:

- Visa FANF Fee

- Mastercard Digital Enablement Fee

- Visa Digital Commerce Service Fee

- Visa Transaction Integrity Fee

- Mastercard Kilobyte Access Fee

- American Express Assessment Fees

- Visa ISA Fee

- Visa Never Approve Fee

- Visa Account Name Inquiry Fee

- Visa Credit Voucher Fee

- Mastercard Acquirer License Fee

- Visa Acquirer Processing Fee

- Visa Non Qualified Consumer Credit Fee

- Mastercard NABU Fee

- Mastercard Safety Net Acquirer Fee

All of these charges come directly from the card networks, and they’re associated with a particular interchange category or assessment that’s publicly available and charged consistently for every business.

Charges That Are NOT Pass Through Fees:

- Settlement Funding Fee

- Risk Assessment Fee

- Infrastructure Upgrade Fee

- Analytics Reputation Management Fee

- Amex Support Fee

- Global VPN Fee

- Transaction Network Access Fee

Despite sounding very official and sometimes even including a card network in the name, all of these fees come directly from your processor.

These fees are 100% negotiable, along with the markup you pay per transaction.

Final Thoughts

Understanding the difference between pass through fees and processor markups is crucial because it’s one of the first ways you can figure out if you’re being charged a fair rate.

Complaining about interchange rates is pointless because you can’t change them. But your processor markups? Those are absolutely negotiable.

When processors publish blog posts and other information online claiming that their markups are pass-through fees, it’s a sneaky way for them to misinform merchants. And I’m honestly shocked by how many of these posts I’ve come across from industry players that I wouldn’t expect it from.

Pass through fees are totally out of your control. They’re interchange rates and assessments coming from the card networks and issuing banks.

Everything else is negotiable processor markup (regardless of what they call it).