Payjunction is a California-based merchant services provider that was founded in 2000. With a wide range of technology capabilities and over 25 years of experience, Payjunction is a reputable processor that supports businesses of all shapes and sizes.

Whether you’re thinking of using Payjunction for credit card processing or you’re a current Payjunction customer wondering if you’re getting a good deal, this in-depth review covers everything you need to know.

Our Quick Take on Payjunction

We’ve been working with Payjunction for years, as we have several clients using Payjunction’s payment processing services. This gives us a unique perspective on how they handle accounts of different sizes in terms of pricing, contract structure, and negotiations.

- Overall, Payjunction is a solid processor.

- But they can be a bit stingy with their pricing.

- They try to push flat rate and tiered pricing models (as these are more profitable Payjunction).

- They’re more willing to offer interchange-plus pricing and make concessions for high-volume accounts.

- We like that they don’t lock you into a long-term contract, and there are no cancellation fees.

- Reporting is straightforward, and it’s refreshing to see statements that aren’t packed with bogus hidden fees (unlike many of their competitors).

Payjunction has its own in-house processing services. But they also have partnerships with other acquirers, and they’re a registered ISO of Wells Fargo Bank.

Many of our clients using Payjunction are either in the medical space or veterinary industry. But we also have some retail clients using Payjunction, and I know this provider also supports auto dealers, ecommerce sites, and multi-location businesses.

Payjunction Pricing and Credit Card Processing Rates

Payjunction’s standard flat-rate pricing option starts at 1.49% + $0.15 per transaction for credit and debit cards. ACH processing starts at 0.75% per transaction.

That said, your exact rate is going to depend on what type of contract structure you’re on and your monthly sales volume.

Interchange-plus pricing is always going to be the best option for businesses looking to optimize their processing rates. But 50 bps (0.50%) seems to be Payjunction’s floor for interchange markup unless you’re doing a ton of sales.

Payjunction Cost Comparison

As mentioned above, Payjunction’s rates can vary significantly from business to business. To show you what I mean, I have some real statements from our clients using Payjunction that we can go through to compare costs.

Merchant A — Flat-Rate Contract

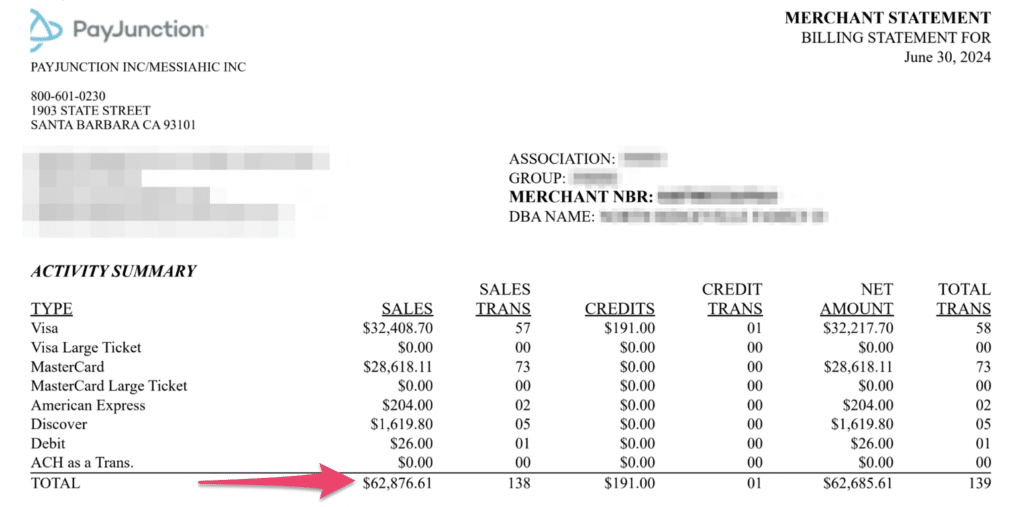

First, here’s a dentist on a flat-rate plan with Payjunction that processed $62,867 during this statement period.

The quick activity summary shows that they processed only credit and debit transactions—and there’s a mix between all four of the major card networks (Visa, MC, Amex, Discover).

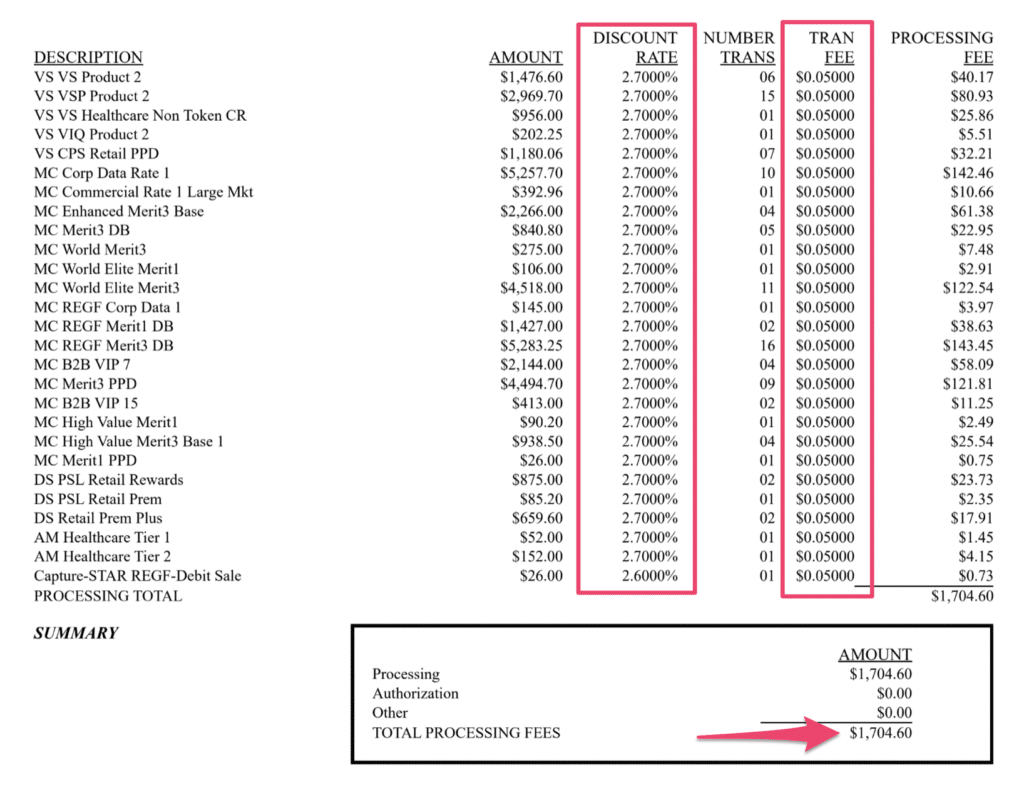

If we scroll down a bit on the statement, we’ll see there’s a flat discount rate of 2.70% + $0.05 applied to all of these transactions.

Businesses like this because it’s straightforward, simple to understand, and you can easily predict your costs. But this is not the best deal on credit card processing.

All of these different card types have an interchange rate that’s significantly lower than 2.70% + $0.05 per transaction.

Payjunction sets this rate at a point that’s high enough to cover all of its costs plus a hefty profit.

For example, if we look at the very top line item, we can see the merchant processed several Visa Product 2 transactions. But if we check this against Visa’s interchange rates, we can see that VS Product 2 cards are charged 1.43% + $0.10 at the interchange level.

While a flat rate of 2.70% may sound simple, it’s a whopping 1.27% higher than the actual interchange rate. That’s all profit for Payjunction.

Merchant B — Interchange-Plus Contract

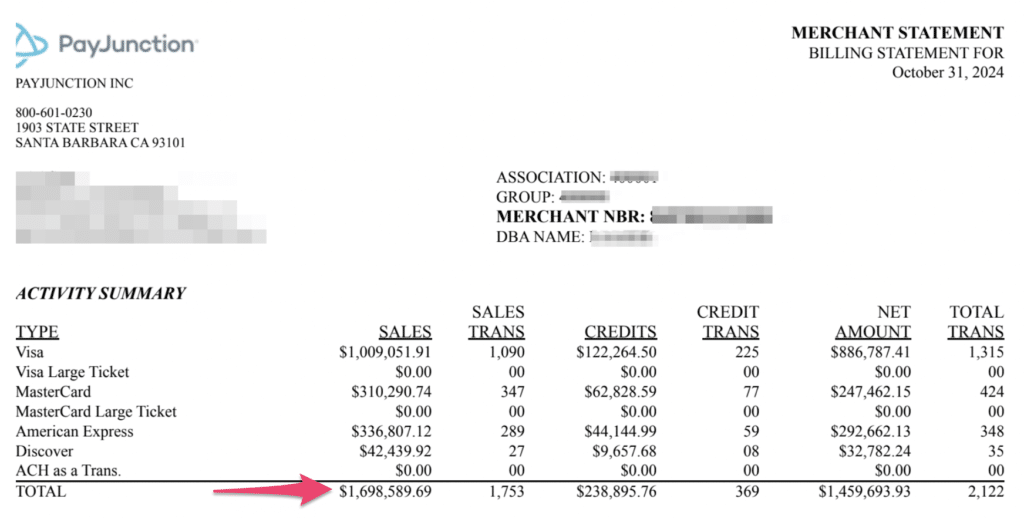

Now let’s look at a merchant on the other end of the spectrum. This a veterinary clinic on an interchange-plus plan that processed nearly $1.7 million during the statement period.

This statement is a bit more complex, as we have 1,753 transactions to look at compared to just 138 for the previous example.

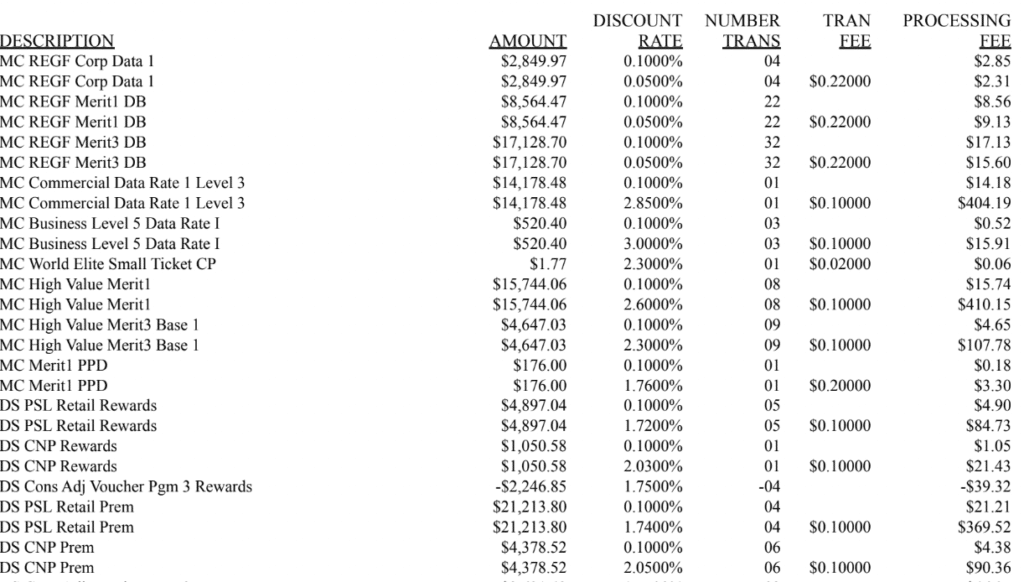

I’m obviously not going to bore you with over one thousand transactions, but here’s a quick snippet to show you how the discount rate varies for each one:

This is a good thing.

It means the merchant is paying the interchange rate imposed by the card networks plus a small markup to Payjunction, which is much more transparent and much cheaper than a flat rate. I see some on here as low as 0.05% + $0.22.

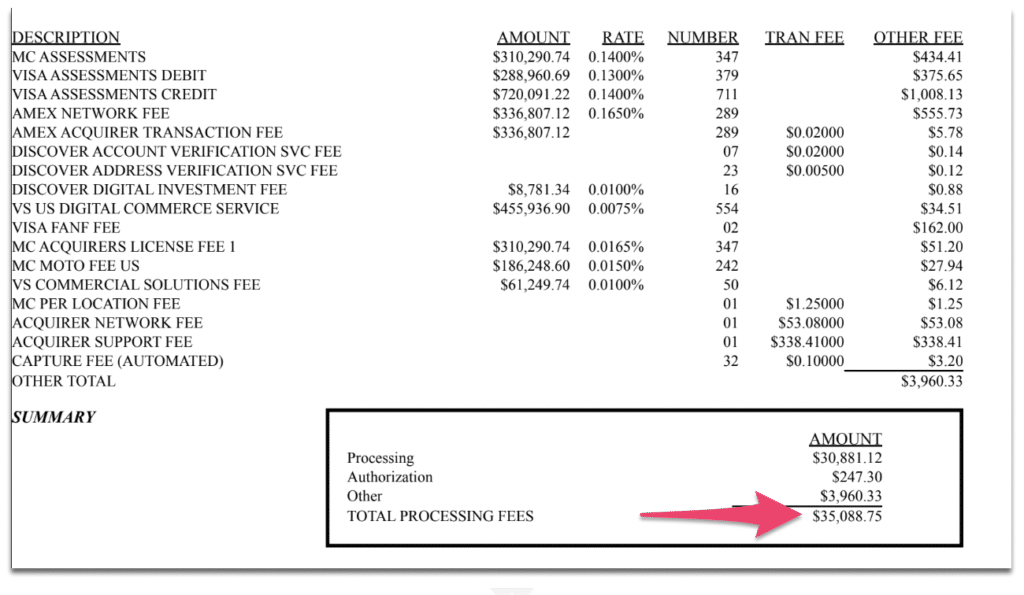

Now if we scroll to the bottom of the statement and account for all card network assessment fees, authorization fees, and other fees paid by the merchant, we can see they paid a total of $35,088 for the statement period.

Now we just do some quick math, dividing this number by the total transaction volume for the month—and we can calculate the merchant’s effective rate at 2.06%.

If they were billed at the same rate as the first example we looked at, they’d be paying nearly $11,000 more in processing fees just in this month. That’s over $130,000 throughout the course of a year.

This is just one example showing how much money you can save with Payjunction on an interchange-plus plan compared to a flat-rate plan.

Payjunction Features and Services

Here’s a quick rundown of some of Payjunction’s top features and noteworthy offerings. I won’t spend too much time going through this stuff, as it’s all publicly available on Payjunction’s website.

No-Code Payments Integration

Payjunction is really proud of its no-code payment integration that’s just a browser extension for Chrome and Microsoft Edge. It works well if you’re using another cloud-based tool, like a CRM or ERP, which interacts with that software in real time—allowing you to automate data entry and customer information.

It’s definitely not the most complex or impressive technology we’ve ever seen. But it’s solid, and it works well with lots of industry-specific tools in the healthcare and veterinary space.

AdvancedMD, Chiro Cat, DrChrono, Hippo Manager, DaySmart Vet, and ProVet are just a handful of the dozens of examples.

Terminal Hardware

Like many processors, Payjunction also provides terminals for businesses that accept payments in person. They promote their “ZeroTouch Terminal” the most, which is just a contactless payment system (that everyone seems to have nowadays).

I find it strange that their marketing materials around this are saying that it’s helpful in reducing the risk of transmitting COVID-19. And while I’m not dismissing the importance of avoiding germs, it just feels like an outdated marketing ploy for an otherwise basic machine.

Rapid Refunds

The Rapid Refund feature from Payjunction is pretty cool for merchants processing card-on-file transactions. From your web-based dashboard, you can quickly search for a transaction by date, amount, customer name, or the invoice number, and then issue a fund with just a single click.

It supports partial refunds as well, in addition to full refunds, and you don’t have to contact the customer to get their card information.

Integrations and API

For businesses seeking custom integrations, you can use Payjunction’s developer API to build something unique. So you can embed payment capabilities into any SaaS application.

Like most of what Payjunction offers, it’s pretty solid.

But it’s not ground-breaking technology. And I don’t think it’s on pace with the technology we’re seeing from providers like Braintree.

Multi-Location Support

For businesses with multiple locations, I like how Payjunction simplifies receipts and daily reconciliations into a single source of truth.

You can view big-picture insights, but also get granular by location and even by terminal.

Should You Switch to Payjunction?

It’s rarely a good idea to switch payment processors. So in short, no, I probably wouldn’t switch to Payjunciton.

You have more leverage negotiating a better rate with your existing provider as opposed to switching. Plus, it’s not like Payjunciton offers the lowest or most competitive rates on the market.

That said, if you’re just getting started or need an integration that a basic processor can’t handle, Payjunction can work—particularly if you’re in the medical, dentistry, or veterinary spaces.

Our Final Thoughts on Payjunction

Payjunction is a solid processor.

In terms of negotiating the best rate, they can be a bit stingy with their prices, especially if you don’t have a ton of volume. But businesses processing millions of dollars can get better rates, and Payjunction is much more willing to make concessions to get your account.

Their technology is definitely above average and has the capabilities you need to succeed. But it’s nothing earth-shattering, and the same features are available from competitors on the market.

If you need help negotiating your rates with Payjunction or another processor, just contact our team here at Merchant Cost Consulting for assistance. We can audit your statements and provide cost-saving opportunities to optimize your payments without having to switch processors.