We’re just a few weeks into the new year, but payment processing headlines are already making a big splash. This month, we’ve highlighted new rate increases, new laws, and other noteworthy updates worth your attention.

Here’s a summary of the biggest stories from January:

EVO Payments Increases Discount Rates Up to 1%

EVO Payments recently sent a notice to merchants with expiring contracts. The notice stated that discount rates are being increased by up to 1% for all Visa, Mastercard, Discover, and American Express transactions—effective January 1, 2024.

New York Enacts New Surcharging Laws

New York’s Governor, Kathy Hochul, signed a new law that prohibits merchants in the state from imposing credit card surcharges that are more than what’s charged by the credit card company for each transaction.

The law also requires merchants to “clearly and conspicuously” disclose the total price for using a credit card—which would include the surcharge amount.

Merchants can face a $500 penalty per violation for non-compliance.

Visa Increases Efforts to Enforce Surcharge Rules

In the same breath, Visa is also cracking down on surcharging violations.

Visa has its own surcharge rules for merchants accepting Visa-branded cards. Merchants found in non-compliance with these rules can face fines ranging from $50,000 to $1 million.

Read more about Visa fees and surcharge rules here.

FedNow Eclipses 400 Participants

FedNow entered the new year with 400 participants—up from just 35 institutions when the program first launched last year.

This is a significant accomplishment for the program, which aims to compete with other real-time payment solutions.

Read more about FedNow here to learn more about its fees and how it works.

Fiserv Applies to Obtain a Merchant Acquirer Limited Purpose Bank Charter

Historically, Fiserv has relied on a banking partner to handle daily transaction settlements for merchants.

But Fiserv just applied to obtain a merchant acquirer limited purpose bank charter. The application would enable Fiserv to authorize, settle, and clear payment transactions for merchants without relying on a third-party banking partner.

The application was submitted in Georgia, and the approval status and timeline of the rollout is still unclear. Stay tuned for future updates on this.

Read more about Fiserv and Fiserv fees here.

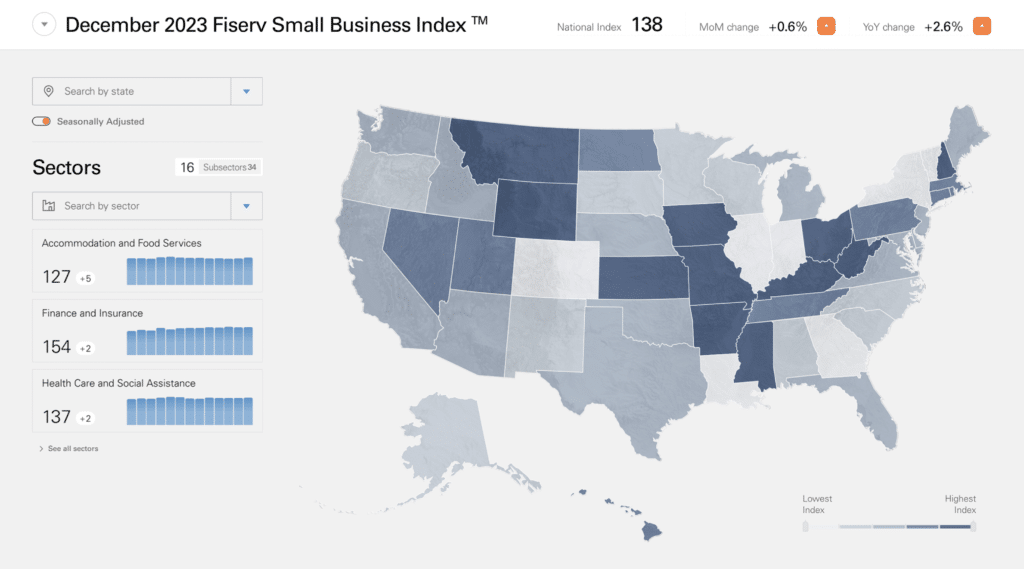

Fiserv Launches First-of-its-Kind Small Business Index

More Fiserv news—the payment processor just launched the Fiserv Small Business Index.

The index will be released in the first week of every month, and it’s designed to deliver deep insights and assessments on how small businesses are performing across the US.

Insights can be viewed at a national level, state level, or industry-specific level.

The data comes from POS transaction data from roughly two million small businesses across the US. It encompasses card payments, cash, and check payments—both in-person and online.

Record Spending During Holiday Season, With BNPL Reaching an All-Time High

Looking back on how we ended last year, research shows that consumers spent $221.1 billion in online shopping between November 1 and December 31—up 4.9% YoY.

Furthermore, $16.6 billion of that spending came from Buy Now Pay Later (BNPL) services. This is a 14% increase from the previous year.

Zooming out and looking at 2023 as a whole, consumers spent a whopping $75 billion through BNPL services. That’s also a 14.3% increase from 2022.

Acquisitions and Strategic Partnerships

As always, we like to highlight some noteworthy partnerships and acquisitions in the payments and finance world. Here’s a quick summary from the past month:

- Adyen collaborates with Straumur to expand its global reach in Iceland.

- Global Payments announces a joint venture with Commerzbank in Germany.

- Tulip announces a new product, Tulips Pay—powered by Stripe.

- Accel-KKR acquires Accertify from American Express.

- Worldline announces strategic partnership with Google

- Evolve, a vacation hospitality company, partners with Affirm for BNPL bookings.

Like what you see on this page? Subscribe to our newsletter to get these headlines delivered straight to your inbox every month. In case you missed it, click here for a recap of last month’s biggest stories.