Our team at Merchant Cost Consulting always keeps a close eye on the latest news and updates in the world of payment processing. We want to keep you informed as well, so we summarized the most noteworthy news and announcements from last month in this article.

Amazon and Stripe Expand Global Partnership

Amazon and Stripe are two of the most well-recognized names in ecommerce and payment processing. The two companies initially partnered back in 2017 as a way to accelerate growth throughout Asia and Europe. Stripe also helped Amazon support millions of transactions globally on Cyber Monday, Black Friday, and Prime Day.

But according to a January 2023 press release from Stripe, Amazon and Stripe have signed an “expanded global agreement.”

Stripe will become a strategic payment partner for Amazon throughout the US, Canada, and Europe. This partnership will include a significant role in processing payments for Amazon Pay, Prime, Audible, Buy With Prime, Kindle, and more.

In addition to Amazon relying more heavily on Stripe for payments, Stripe will also rely more heavily on Amazon Web Services for crucial infrastructure needs.

For more information, check out the latest Stripe interchange fees.

Visa Explores Blockchain Automation

Blockchain has become one of the hottest buzzwords in the world of fintech over the past several years.

Now Visa is looking for new ways to leverage blockchain for automatic recurring payments. This news comes directly from a technical paper published on Visa’s website.

The blockchain usage for Visa focuses on “account abstraction.” This is a blockchain paradigm that’s used to hold assets by smart contracts. Visa is looking to take this concept and apply it to a real-world application for automatic payments.

Rather than requiring the user to actively participate in pushing payments on the blockchain, the account abstraction process could automatically pull funds by writing smart contracts for self-custodial wallets.

Most of us are familiar with how automatic payments work associated with traditional bank accounts and credit cards. But this isn’t as straightforward on a blockchain. That’s because accounts on the Ethereum blockchain require smart contracts to be initiated manually. These must come directly from a user account and be signed by the user.

Visa’s potential solution would involve a new type of account contract for account abstraction—delegable accounts.

This would allow users to approve auto payments through a list of allowed contracts on their delegable accounts, and the smart contract rules would be written to ensure payments can only be executed in a specific way. For example, the account could only be charged once per month and could have a maximum amount associated with the charge.

Additional Reading: Visa Interchange Rates

Nuvei to Acquire Paya

According to a press release issued on January 9, 2023, Nuvei Corporation has entered into a definitive agreement to acquire Paya. The acquisition will be an all-cash purchase at $9.75 per share, valued at roughly $1.3 billion.

So far, the Board of Directors at each organization has already approved the transactions. Assuming all conditions are met, the transaction is expected to officially close by the end of Q1 2023.

Nuvei is a Canadian fintech company. They provide organizations with technology to support card issuing, banking, risk management, fraud management, and more.

The company helps connect businesses with consumers in over 200 markets. The platform supports 150 currencies and over 585+ alternative payment methods.

Paya is an integrated payment solution that processes over $40 billion in payments per year, serving 100,000+ clients throughout industries like healthcare, B2B, education, government, non-profit, and more. You can read more about Paya here.

Update on Credit Card Completion Act Bill in Congress

Congress failed to pass the Credit Card Completion Act in December. But Senator Dick Durbin of Illinois plans to continue pushing the bill in 2023.

The bill would mandate that merchants would have access to card networks beyond Visa and Mastercard to route credit card transactions.

Durbin has successfully won similar proposals, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act which imposed similar requirements for debit transactions.

Amazon’s “Buy With Prime” Increases Conversions by 25%

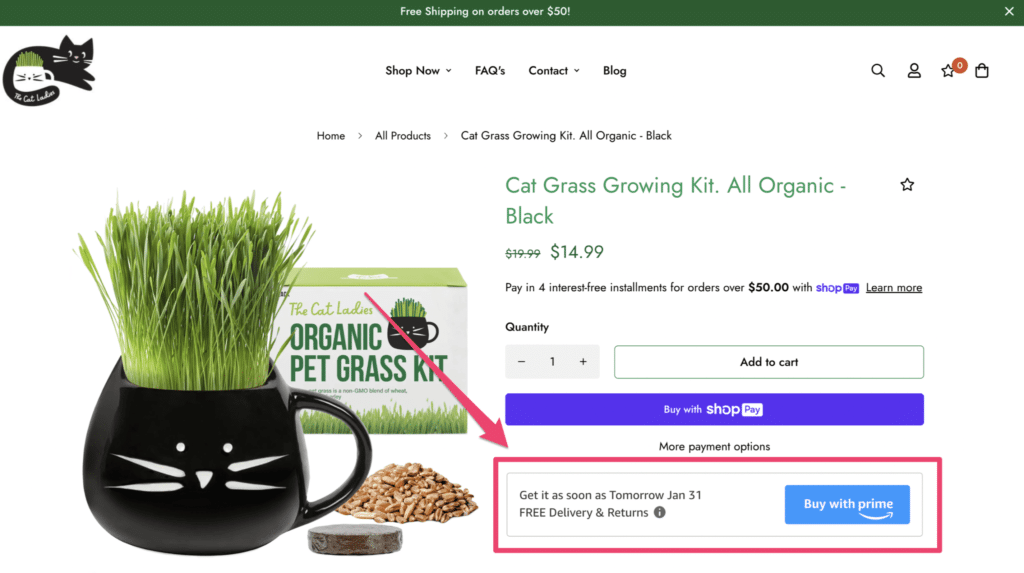

Buy with Prime makes it possible for US-based Amazon Prime members to shop directly from select online stores with the same experience they get from Amazon. This includes free delivery, fast delivery, simple checkouts, and free returns on eligible purchases.

The initial rollout of Buy With Prime was only available to a limited number of merchants on an invite-only basis. But as of January 31, 2023, the option will become widely available to online stores.

According to a recent report, the Buy With Prime option on ecommerce sites increased conversions by an average of 25%. The data compares consumer behavior when the option was available compared to when it wasn’t in the same period.

Buy With Prime also allows merchants to display customer reviews from Amazon on their own ecommerce sites.

Here’s an example of what this looks like directly on a third-party site:

BigCommerce also announced its simple integration with Buy With Prime. This will allow ecommerce retailers using BigCommerce to easily add the option to checkouts without any coding required.

Afterpay Revokes Buy Now Pay Later in New Mexico

Due to new regulatory changes in New Mexico, Afterpay pulled its “buy now, pay later” option in the state. This change went into effect on January 1, 2023.

Customers that were previously using BNPL from Afterpay received an email regarding this update.

According to reports, the regulation that Afterpay is referring to is House Bill 132, Interest Rates for Certain Loans, which is an amendment to New Mexico’s Small Loan Act and Bank Installment Act.

The bill’s sponsors say that the amendment does not prohibit BNPL services but is intended to prevent predatory lending practices in the state. It’s supposed to force lenders to set reasonable lending rates for consumers.

House Bill 132 caps small loan interest rates at 36%, down from the previous 175% cap. It also limits fees on late payments within ten days to $0.05 per $1 on the total installment price.

Afterpay lets customers purchase items in four interest-fee equal installments. But they do impose late fees.

Fraud Continues to Decline in the Card Payments Industry

All players in the card payments industry have been taking steps forward to prevent fraud in recent years. From EMV compliance to 3D checkout and more, we’ve seen fraud prevention tactics imposed at every level, from the card networks to banks and processors.

Recent reports confirm that these practices are working.

The total amount of fraud in dollars is growing, but that’s only because the overall volume of card transitions is increasing.

However, gross card fraud is a more accurate depiction of the progress. This metric looks at fraud as a share of every $100, and gross card fraud is continuing to drop. Globally, gross card fraud peaked at $0.072 in 2016 but has since dropped to $0.066.

A recent projection of global card fraud for merchants, issues, and acquiesce is estimated to reach $397.4 billion in the next ten years. But this is down from the $408.5 billion projection last year for the same period.

Worldline and Splitit Agree to Partnership

Splitit is a white label buy now pay later (BNPL) service. It enables businesses to offer BNPL solutions to consumers.

A recent press release announced that Splitit agreed to a North American partnership agreement with Worldline—a multinational payment and transaction service.

The agreement terms allow Worldline to integrate Splitit into its North American processing platform. It will also enable the Splitit API to work on the front end for merchants.

This will make it easier for merchants using Worldline to offer BNPL options for their customers.

Worldline Announces Buy Now Pay Later for Travel

Worldline announced a new partnership with Fly Now Pay Later as a way to offer BNPL services to merchants in the travel industry.

This service will be available to organizations using Worldline’s TravelHub solution for payment processing.

Payment Processors and Fintech Companies Slash Jobs

Like many organizations in the tech world, fintech companies and payment processors slashed jobs at the end of last year.

These job cuts were tied to inflation that adversely affected consumer behavior.

Some examples of the job include Stripe, which cut roughly 1,140 employees (14% of its workforce) in November. Plaid is another example, cutting 260 employees (20% of its workforce) in December.

Klarna cut 700 employees back in May (10% of its workforce), and made additional cuts in September. Brex cut 136 employees (roughly 11% of the workforce) in October, and Bolt cut about 250 jobs (30% of the workforce) earlier last year.

Fast, a checkout startup with about 400 employees, shut down completely last year as well.

Many of these companies are forced to focus more on profitability over growth to battle rising interest rates and inflation. We could see more job cuts into 2023 if interest rates and inflation continue to rise.