Debit Card Processing (Fees Explained)

The best merchants offer as many different payment options as possible, including debit cards.

If your company is processing millions of dollars in debit card transactions each year, those fees can add up fairly quickly. That’s why understanding how much you’re being charged to accept debit cards is critical.

Not every debit transaction is the same. You can save thousands of dollars in debit card processing fees if you accept those cards in a certain way.

I’ll cover all of these details and more, and we continue through this guide.

Average Debit Card Fees (2024)

The average cost to process a debit card transaction is 0.74% per transaction or $0.34. This data comes from the Federal Reserve, and includes all types of debit transactions, including exempt and covered transactions from all networks.

The average interchange rate of an exempt debit transaction is 1.19% per transaction or $0.52. The average debit card interchange of a covered transaction is lower, at 0.48% or $0.23.

All of these rates are significantly lower than the average credit card processing fees.

Types of Debit Card Transactions

Debit card transactions can be segmented into two main categories:

- PIN Debit

- Signature Debit

Most merchants don’t realize this, but one of these methods is more expensive than the other. I wish that I could give you a general answer on which one is the most cost-effective for your organization, but it varies from business to business.

Additional Reading: PIN vs. Signature Debit (Interchange Rates Compared)

PIN Debit Card Transaction Fees

PIN debit transactions get routed through a PIN debit network.

As the name implies, a PIN debit transaction gets processed when a customer provides their personal identification number (PIN) to complete the sale. After the card has been dipped or swiped, the customer enters their secret digits into a PIN pad.

This is how customers verify their identity. Once a PIN has been entered, the customer won’t need to sign the sales receipt.

Information from a PIN debit transaction is routed to the customer’s bank from the merchant through a PIN debit network. These transactions are subject to fees imposed by the PIN debit networks. This means that the debit network fee can vary based on what the debit network charges. I know, the credit card processing industry doesn’t always make things easy for merchants to understand.

PIN debit transactions are commonly known as online debit transactions. That’s because the debit network handles the transaction’s routing data, as opposed to Visa or Mastercard.

The PIN network that handles the data assesses its own fees, and the interchange fees charged by credit card associations do not apply here.

In many cases, merchants won’t have any idea which PIN network the transaction is getting processed through. However, the fees between the various PIN networks are typically similar.

PIN debit transactions typically have low percentage fees, but the fixed fee per transaction can be high.

Due to this pricing structure, small-ticket transactions are typically more expensive to process. But large-ticket PIN debit transactions are usually more cost-effective for merchants, even though you won’t always know which PIN debit network fees are being assessed prior to the transaction.

Signature Debit Processing Fees

Signature debit transactions are processed without a personal identification number (PIN).

Customers verify their identity of a signature debit transaction by, you guessed it—providing a signature. After the card has been dipped or swiped, the customer will sign the sales receipt. The signature is used the same way it would be for a credit card transaction.

Signature debit transactions get routed to the bank through Visa or Mastercard’s network, as opposed to the PIN debit network. Since the PIN network doesn’t have a role in processing these transactions, a signature debit sale is often called an offline debit transaction.

If customers are signing debit receipts as opposed to providing PINs, the sales are being processed similarly to a credit card transaction.

Signature debits are routed through the credit card network branded on the card, and interchange fees are applied.

With that said, credit card associations have different interchange fees that apply to debit card transactions. Those fees are typically less than the interchange fee associated with a traditional credit card transaction.

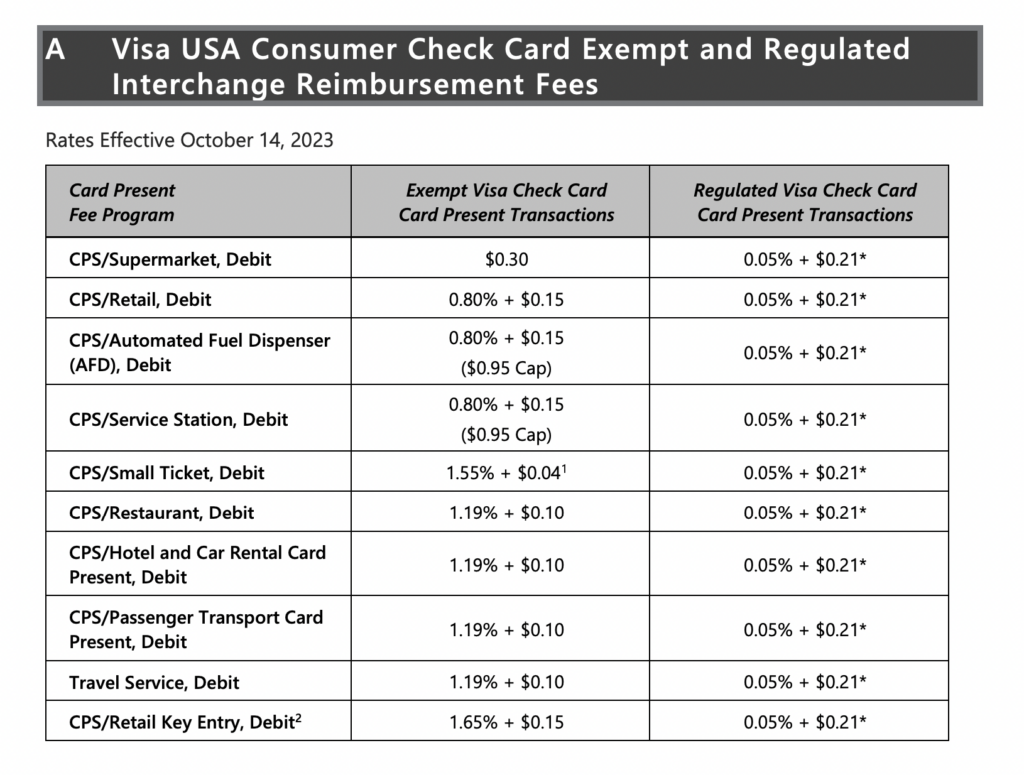

Here’s an excerpt from Visa’s interchange fees table.

As you can see, the interchange fee varies based on the card type as well as the merchant’s fee program.

But that’s not all. If you read our complete guide to Visa interchange rates, you’ll see that the fees in the table above are significantly lower than comparable credit card transactions.

For example, the lowest possible credit card interchange rates for a Visa supermarket merchant are 1.18% + $0.05 per transaction. These go as high as 2.00% + $0.07 per transaction.

If you compare those credit card rates to the debit card table above, the credit card interchange fees are significantly higher than the debit fees.

Take a $100 transaction at a supermarket. This could result in a $2.07 interchange fee for a Visa credit card, but as low as $0.30 or $0.26 for a Visa debit-branded debit card. The credit card fee is nearly seven times higher than the debit card rate.

Why is there such a drastic difference here?

This is largely due to the risk associated with the transaction. The issuing bank is not extending credit to the customer for a debit transaction. Instead, the funds are deducted straight from the customer’s bank account.

Additional Reading: What’s the Difference Between Credit and Debit Transactions?

How To Calculate Debit Card Merchant Fees

How can you calculate the cost of a debit card transaction?

The rates will vary from merchant to merchant. But these are the main factors that need to be taken into consideration when you’re calculating these costs.

Debit Method

A debit card transaction can take one of two routes when it gets processed—PIN or signature. The difference between PIN debit and signature debit card transactions holds the most significant weight in determining your debit card processing costs.

PIN transactions have lower percentage fees and higher fixed fees. Signature debit transactions are subject to card network interchange fees.

Card Network

PIN transactions are routed through debit networks. There are at least one dozen debit card networks that operate in the US. Each one has different fees.

If the debit card is processed as a signature transaction, the signature debit fees are subject to Visa or Mastercard rates.

Issuing Bank

In October 2011, the Durbin Amendment went into effect.

This new law restricted the amount that banks could charge for a debit card transaction. However, the cap only applies to financial institutions with more than $10 billion in assets.

Large national banks like Wells Fargo or Bank of America can only charge 0.05% + $0.21 per transaction. Small local banks don’t have these restrictions.

Processor Fees

In addition to the fees imposed by card networks and banks, you’re also subject to the processor’s markup, just as you are with credit card transactions.

These rates will vary depending on the type of processing plan you have. In some cases, you’ll pay a flat transaction fee. Other times, the merchant fees will vary. But the average interchange fee will be lower on debit payments compared to credit transactions.

Unregulated vs. Regulated Debit Cards

It’s also worth noting that the size of the debit card issuing bank can impact how debit card fees work. If the bank or credit union has more than $10 billion in assets, there’s a maximum fee of $0.21 + 0,05%.

These regulated per transaction fees are due to the Durbin Amendment, which was passed back in 2010.

Beyond the Durbin Amendment, things are a bit more complicated for exempt transactions. That’s because there’s no cap on the rate, and the fees vary depending on the credit card network. Payment processors can impose higher fees here as well.

Fortunately, most debit cards are issued by major banks. So you typically won’t have to worry about this, as you can expect customers to pay with regulated debit cards.

Final Thoughts on Debit Card Transactions

Every business should accept debit cards. But the way you process those debit card transactions has a significant impact on your credit card processing fees.

Organizations with higher average sales tickets can usually benefit from PIN debit transactions. That’s because the fees as a percentage of the transaction are much lower.

Businesses with smaller sales tickets might be better off using signature debit transactions.

Again, the optimal method varies from business to business, and there are lots of other factors at play. Overall, debit cards cost merchants less than credit card payments.

To find out how much money you can save on debit card transactions, request a consultation with our team here at Merchant Cost Consulting. We can help you save money without changing your credit card processor.

0 Comments