Priority Payments provides merchant services to 75,000+ businesses in over 70 countries worldwide. Founded in 1986, Priority has really advanced its technology over the years and evolved into a truly modern, cloud-based payment processing system.

They work with businesses across a wide range of industries, providing end-to-end payment processing solutions that can be customized to fit the needs of their customers.

Our team here at MCC is very familiar with Priority Payments. We’ve been auditing Priority statements for years and negotiating directly with them on behalf of our clients.

This review is based on our first-hand experience dealing with priority—and it’s an honest take on what we like, what we don’t, and a closer look at Priority’s fees that aren’t available anywhere else on the web.

MCC Quick Take on Priority Payments

Priority Payments is actually a pretty decent processor. They support tons of integrations and have an extensive network of technology partners, which allows them to offer integrated payment solutions for businesses in nearly every industry.

Overall, our experience working with Priority Payments over the years has been pleasant. Their rates are fairly competitive, and they’re receptive to negotiations when we push back against certain fees.

In terms of the integrations and technology supported, they seem to follow the same models as Worldpay and Global Payments. But Priority’s prices are much better than the Stripes of the world, and you’re still getting top-tier technology.

What We Like About Priority Payments

- Competitive pricing and open to negotiations.

- Robust technology and integrated payments solutions.

- Interchange-plus contracts are available.

Where Priority Payments Falls Short

- Occasional rate increases.

- Reporting can be somewhat deceptive as certain fees are hidden.

- You need to request your statements in a different format to get a full breakdown of your rates and fees.

Priority Payments Pricing and Credit Card Processing Rates

Priority Payments offers custom pricing to each merchant. Rates vary quite a bit, and your exact cost will vary based on factors like MCC code, volume, and integrations you need.

They do offer interchange-plus pricing, which is a positive. So you’ll have the card network fees passed through at cost and then pay a processor markup directly to Priority Payments.

We know merchants paying 0.12% + $0.10 per transaction, which isn’t the cheapest rate on the market, but it’s definitely not terrible.

For additional context, these companies have a pretty high processing volume—upwards of $300,000 per month. But if your volume is lower or you need complex integrations, you can expect your markup to be a bit higher.

I’ve also seen quotes and statements on the higher end 0.40% + $0.02 per transaction.

In some cases, Priority Payments charges higher rates for American Express—which I’ve seen as high as 0.60% + $0.02 per transaction.

Other Priority Payments Fees to Look Out For

In addition to the markup you pay per transaction, there are some other one-off and miscellaneous fees that are commonly found on Priority Payments statements.

Examples include:

- Annual Fee — $39.95

- Monthly Service Fee — $8

- Refund Fee — $0.10

- Batch Fee — $0.10

- PIN Debit Authorization — $0.02

- PCI Non-Compliance Fee — $39.95

- AVS Fee — $0.05

Keep a close eye on your statements for any fees that don’t quite look right. And you can always contact our team here at MCC to verify if the fee is legit or should be removed.

A Closer Look at Your Priority Payments Merchant Statement

One major problem with Priority Payments is its default reporting system. They aren’t transparent about the fees you pay unless you ask for more information.

Let’s look at some real examples so you can see exactly what I mean.

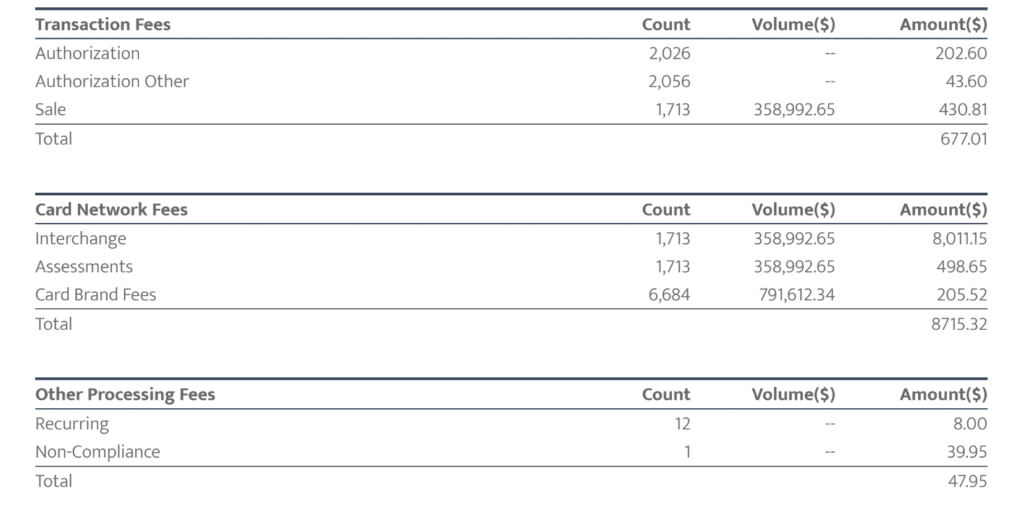

Here’s a standard summary of fees that you’d find a regular statement from Priority Payments:

As you can see, there are three categories—transaction fees, card network fees, and other processing fees.

But there are only a few line items within each category. Meanwhile, if you look at the “Count” column, you’ll see literally thousands of different charges.

There’s over 2,000 authorization charges, over 1,700 interchange fees and assessments, and over 6,600 card brand fees.

But without seeing the line-by-line breakdown, it’s impossible to know if Priority Payments is ripping you off and passing through the true interchange amount. They could be padding your assessments, and you’d have no idea because you aren’t seeing the actual charges—just a summarized total.

That’s not good enough.

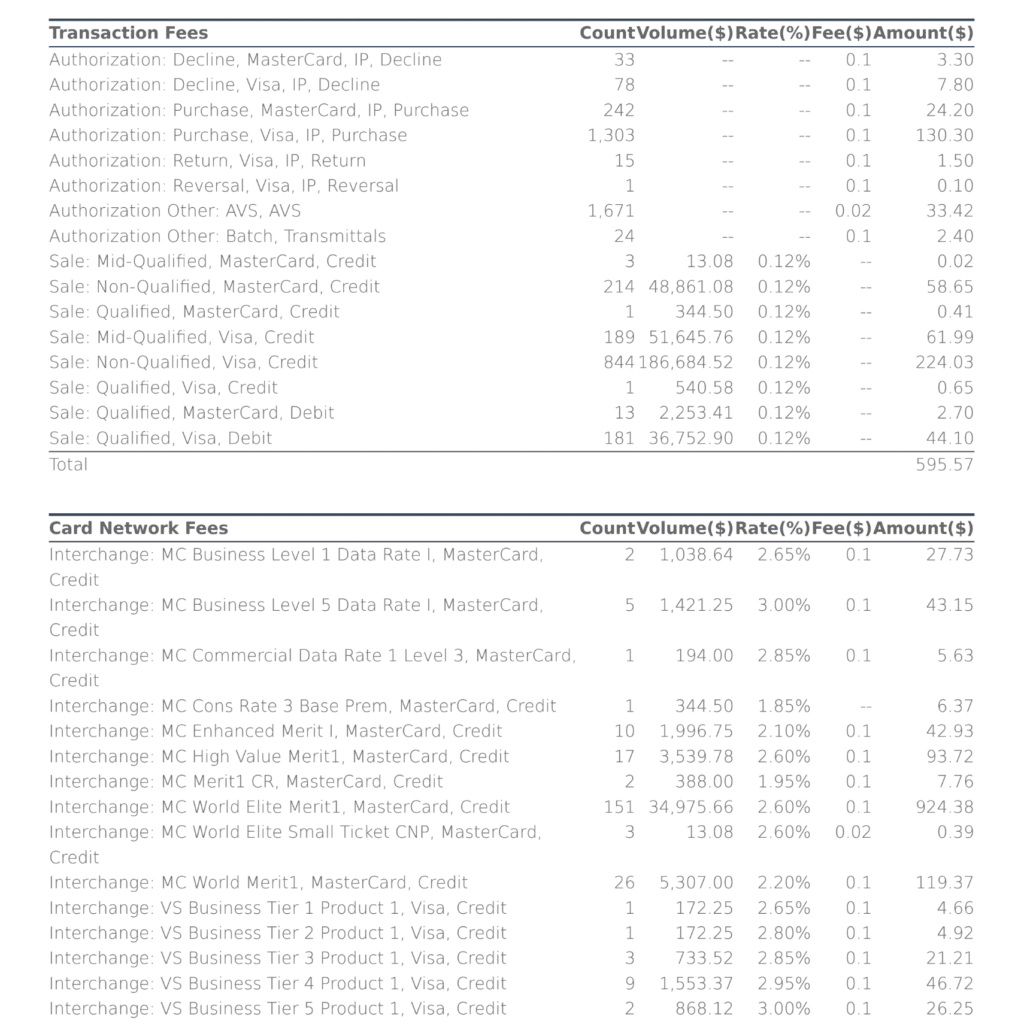

So the following month, we asked Priority Payments to send us a more detailed breakdown of these charges. Here’s a snippet of the following month’s statement from the exact same client:

This is what you want to see.

Now you can really read your merchant statement—line-by-line and fully audit every fee.

In this particular case, we didn’t find any padded rates or hidden fees. But it’s generally a red flag when processors don’t give the full breakdown by default.

So if you’re currently using Priority Payments and your statements don’t look like the second example, make sure you reach out ASAP and ask them for a fully itemized breakdown of your charges.

Other Priority Payments Products

Priority has tons of different solutions for different types of businesses—including retail management tools, ERP software, hospitality management, and software for educational institutions. You’ll see everything from CRMs to project management and equipment rental tracking offered on the Priority website.

I’m not going to cover all of those here. Instead, we’ll focus on the other payment-specific solutions that are typically offered to merchants using Priority Payments.

Priority Capital

Priority Capital offers instant loans to businesses using Priority Payments. It gives you access to capital based on your receivables, and you can request funding directly from the MX Merchant platform.

Offers are based on your company’s performance. So you don’t need to offer up collateral or submit a credit check for approval.

Loans are paid back in flat-rate installments, and everything is managed from a simple dashboard.

Passport

Priority’s Passport solution is built for SMB merchants.

It’s essentially a banking service that gives you faster access to your funds, alongside other perks—like corporate debit cards for employees, vendor payments, interest-bearing savings accounts, money market accounts, and more.

Plastiq

Plastiq is Priority’s version of a corporate charge card that’s specifically designed for paying vendors. Once enrolled, you can use your Plastiq card to pay for inventory, advertising, rent, equipment, telecom services, shipping, and more—then Plastiq pays vendors on your behalf.

It’s built to help merchants keep cash on hand and better manage payables, particularly if your vendors don’t accept card payments.

You can use Plastiq to get credit card perks without having to pay extra fees or deal with ACH transfers, checks, and wires to vendors.

Should You Switch to Priority Payments?

If you’re looking for a new credit card processor, Priority Payments should definitely be on your radar. But it’s better for new businesses as opposed to well-established brands that want to switch processors.

Switching credit card processors is rarely a good idea. Even if your current rates are a bit high, sticking with your existing processor is the best option for 90% of businesses.

Working with your current processor to negotiate better terms is typically more cost-effective in the long run than switching. So while we definitely like Priority Payments and don’t have a problem recommending them, you should think long and hard before you switch to Priority (or any other processor for that matter).

Our Final Thoughts on Priority Payments

Priority Payments is definitely an above-average processor. They have great technology and tons of options for merchants in different industries looking for an integrated payments solution.

Just be forewarned that Priority leverages a network of third-party providers for different tools. This means the support and quality of the systems you need can vary, and the payment acceptance functionality may not always get Priority’s full attention.

Fortunately, rates are fairly competitive. And while I hate the fact that Priority doesn’t give you a detailed breakdown of the interchange fees and card network fees on standard statements, you can request those full reports, and they’ll provide them.