Refunds and reversals sound similar, but they aren’t quite the same thing. While both actions effectively cancel a sale, there are several key differences that can impact your business and processing costs.

A refund occurs after a transaction has already been completed and settled. The customer has paid, the funds have been deposited into the merchant’s account, and now the money gets sent back to the customer.

Reversals happen before the transaction settles. In simple terms, a reversal cancels a pending authorization before the funds actually change hands.

That’s the quick answer—read on for an in-depth explanation and differences between refunds and reversals.

What’s the Difference Between a Refund and a Reversal?

The biggest difference between refunds and reversals is that they occur at different points of the payment lifecycle.

Refunds happen after the transaction has already been processed. The payment has already gone through, money has moved between accounts, and now it’s being sent back. This means that the merchant has to pay the full interchange fees and processor fees, even though the sale didn’t stick.

Reversals cancel transactions before the settlement, which typically prevents merchants from incurring additional processing costs.

Authorization reversals typically happen immediately, whereas a refund can happen days, weeks, or potentially months later.

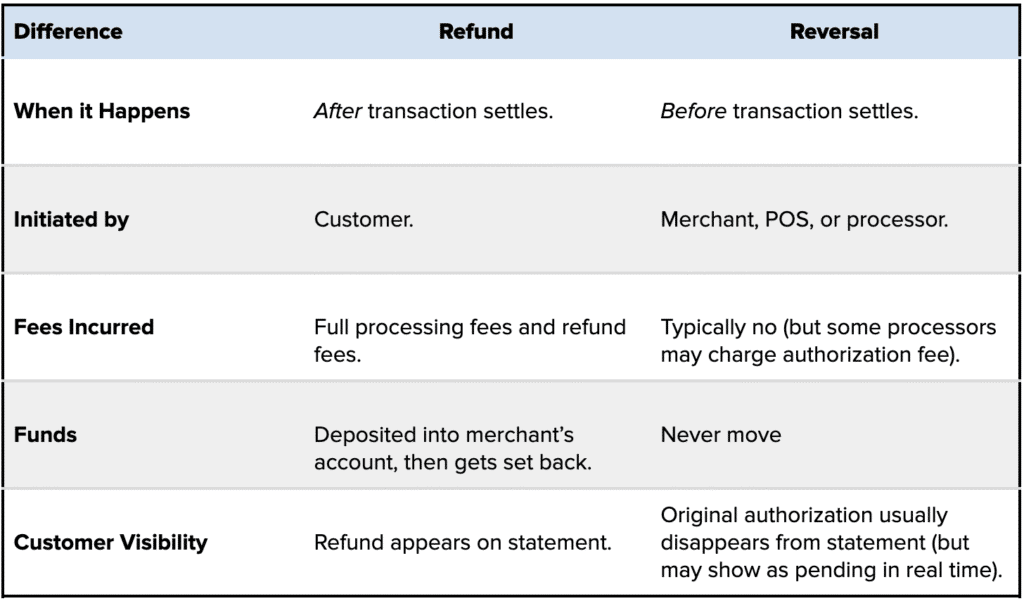

Refunds vs. Reversals: Quick Side-by-Side Comparison

Key Differences Between Refunds and Reversals in Payment Processing

Let’s dive a bit deeper into the most important aspects that merchants need to understand about reversals and refunds.

Timing

Reversals happen before the settlement process occurs, which is typically between 1-3 days of the transaction.

Authorization is the first thing that happens when a card is swiped, tapped, or entered. The reversal process just cancels the authorization prior to settlement. If you’re set up for same-day or next-day funding with your processor, then the settlement will occur faster (limiting your time to initiate a reversal).

But anytime you send money back to the customer after the funds have been settled, it’s considered a refund. With a reversal, there’s nothing to refund (because you haven’t actually received anything yet).

Process

Refunds require you to initiate a new transaction altogether. You’ll do this manually through your POS system or online dashboard.

Payment reversals can be triggered automatically if your POS system or gateway identifies a problem. They can also be voided manually if someone on your team realizes a mistake. But they don’t require you to run a new transaction—just cancel the original one.

Reason for Initiation

Refund requests typically come from customers for several reasons, including:

- Returns

- Not satisfied with product or service

- Order errors (wrong size, wrong item, etc.)

- Late deliveries or failed service fulfilment

- Order cancellations that occur after the transaction has settled

If you sell a pair of pants to a customer and they want to return the item a week later, it’s too late to cancel the transaction. The funds are already in your account, so you have to send them back in the form of a refund.

Reversals are more commonly used in scenarios like:

- Customer cancels order immediately after placing it

- An item is out of stock or unavailable

- Duplicate transaction is detected

- There’s a pricing error or technical issue at checkout

Let’s say you’re running a coffee shop and accidentally charge a customer $45 instead of $4.50. If you immediately catch that error, you don’t need to issue a refund. You can simply reverse the transaction to cancel it, like it never happened.

Fees and Costs

Refunds are more expensive for merchants compared to reversals.

With a refund, you’re still on the hook for all the processing costs of the initial transaction. Then you’ll pay an additional fee to process the refund.

Since reversals don’t settle, you typically avoid processing fees altogether. In some cases, you might be charged a pre-authorization fee, depending on the type of transaction. But these are typically marginal, and not as high as the full interchange costs.

Read More: How Refunds Impact Processing Fees

Funding and Cash Flow Impact

When you issue a refund, you’re giving money back that you’ve already counted as revenue. This can add some complexity to your cash flow reporting and accounting, but it’s just part of doing business.

Reversals don’t impact your cash flow at all because there’s no incoming money to begin with. Your books are clear, and there’s no reversal line item to reconcile.

Why it Matters to Merchants

So, what’s the big deal? What does it matter if you have a refund, reversal, or both? Both of these are common parts of doing business, it does matter a bit more than you might realize.

First, refunds eat into your profits. You’re paying fees twice (first the original processing fees, then a refund fee), without actually getting to keep your sales revenue.

And while reversals aren’t as costly fee-wise, an excessive number of reversals can be a big-picture problem for your business. A consistently high volume of authorization reversals can be a red flag for your processor and card network.

Card networks can even penalize you in the form of additional charges—like Visa’s authorization misuse fee.

It’s also worth noting that, even though refunds have extra fees, you should still have a customer-friendly refund policy to avoid chargebacks. Getting a chargeback is even worse because you’re out the full amount of the transaction, plus processing costs, chargeback fees, and you likely won’t receive any inventory back.

Practical Scenarios and Use Cases

To help you better understand when it makes sense to issue a refund vs. running a reversal, here are some common real-world scenarios your business might encounter:

- If a customer cancels their order five minutes after checkout, run a reversal (if possible).

- If a customer receives damaged items, send them a refund.

- If a duplicate transaction is detected, automatically initiate a reversal.

- If a customer returns a product after two weeks, issue a refund.

- If an inventory error is caught before a product ships, reverse the authorization.

- If an incorrect price was entered into the credit card terminal, initiate a reversal.

Obviously, these are just a handful of potential reasons why you might do one or the other. But I’m hoping this demonstrates the most appropriate actions for whatever scenario you’re in.

Final Thoughts

Costs associated with refunds and reversals shouldn’t be so high that you’re stressed or losing sleep over.

If you’re worried about these extra charges, it’s likely a sign that your other processing costs are eating into your bottom line—which is a problem.

This is a good opportunity for you to audit your statements and assess your total costs. Look beyond your cost per transaction, and calculate your effective rate. This takes all of your costs into consideration (including refund fees, chargeback fees, assessments, and other miscellaneous charges imposed by your processor).

When all of this is factored in, you could be paying a full percentage point higher (or more) than you initially realized to accept credit cards. That’s a ton of money.

For every million in sales, that’s an extra $10,000 down the drain.

Here at MCC, we can find cost-saving opportunities on your statements without you having to switch processors or change any equipment. All of your processes can stay the same, you’ll just pay less and profit more. Contact our team for a free audit to find out how much you can save.