Stripe is one of the largest players in the eCommerce and subscription payment space. Big companies like Facebook, Lyft, Target, and Under Amour use Stripe to power their payments.

Stripe focuses on delivering developer-friendly solutions with extensive options for customization which is a developers dream.

Are you wondering if Stripe has competitive credit card processing fees compared to processors like Square, Braintree and PayPal?

If so, you’ve come to the right place. We’ll explore Stripe’s pricing relative to some other options on the market, share a few tricks on how to get lower processing fees from Stripe.

Stripe Payment Processing Costs (2026)

Stripe’s processing fees start at 2.9% + $0.30 per transaction. But the exact cost varies based on the transaction environment, payment acceptance method, and technology used. Here’s a closer look at some specific Stripe fees:

- Online Cards and Digital Wallets – 2.9% + $0.30 per transactions

- Manually Entered Cards – 3.4% + $0.30 per transaction

- International Cards – 4.4% + $0.30 per transaction

- ACH Direct Debit – 0.8% ($5 max) per transaction

- Stripe Terminal (In-Person Cards and Wallets) – 2.7% + $0.05 per transaction

- Tap to Pay – $0.10 per authorization

- Currency Conversion – 1% per transaction

All credit cards and debit cards processed through Stripe are charged the exact same rates. There are no setup fees or recurring monthly fees for Stripe’s integrated payments solutions.

Other Stripe Fees

In addition to interchange fees, Stripe offers several other services and add-ons for merchants. Fees for those services include:

- Auto Update Card Info For Customers On File – $0.25 per update

- Network Tokens – $0.15 per token

- Instant Payouts – 1% ($0.50 minimum)

- Post-Payment Invoices – 0.4% ($2 max)

- Recurring Invoices and Subscriptions – 0.5%

- Online Invoicing – 0.4%

- Auto Tax Calculation – 0.5%

- Chargeback Protection – 0.4%

- Instant Bank Account Verification – $1.50 per verification

Stripe also has solutions for creating and managing your virtual or physical cards. They even provide services for forming an LLC and more.

Additional Reading: Stripe Review: Pros, Cons, and Pricing Comparison (Our Insider Take)

Stripe Currency Conversion Refund Fees

Effective October 15, 2023, Stripe is no longer refunding the currency conversion fee to merchants on refunded transactions.

When a merchant accepts a payment from a non-primary currency, Stripe automatically converts the purchase into the merchant’s primary currency and charges a currency conversion fee.

Historically, if the transaction was refunded, Stripe would also refund the currency conversion fee to the merchant. But that will no longer be the case as of 10/15/23. Even if a transaction gets refunded, the merchant will still have to pay the initial currency conversion fee.

How Stripe Works

Stripe’s setup a bit different than standard credit card processing services. Stripe is similar to PayPal in the sense that it’s a third-party processor. But the major difference here is that a standard credit card processing company approves each merchant.

For traditional credit card processors, every merchant that signs up with the processing company has to go through the underwriting processing which creates a single account for that specific business. This process can take anywhere from two to ten business days.

Third-party processors, like Stripe, make it much easier for a business to quickly accept payment processing. They simply combine many business accounts together into one giant account.

With a third-party vendor, merchants can sign up and accept payments immediately. So if you’re looking for a fast and easy way to process credit card payments for your business, Stripe may have the edge compared to traditional credit card processor.

That being said, there are some downsides for certain merchants when it comes to easy approval and acceptance.

If Stripe or other third-party vendors see even one transaction that may looks fishy, they’re much more likely to shut down the account or freeze funds without any type of warning. The bulk of bad reviews for these types of vendors tend to be from merchants being shut down or funds being held without any noticed.

Of course, funds being held hostage it is a very sensitive topic. But Stripe doesn’t just randomly hold funds—there has to be a certain red flag that sticks out.

For example, if a business sells unapproved products like CBD or hemp etc, the account could get flagged. Other businesses can have funds frozen if they have a huge spike in chargebacks or high return ratio.

The majority of merchants who use Stripe will never have to worry about a freeze or hold. So, if you are currently using them and worried, as long as you are following their guidelines this should never happen.

Stripe Features

- Customizable Options for Developers

- Transparent Pricing

- No termination fee

- Versioned API changes

- 24/7 support

- Multiple currency options and currency conversion

- Supports international payments

- Easy to setup recurring billing

- Can offer discounts and coupon codes

- No refund fees

- No monthly fees

- Seamless checkout meaning increased conversions

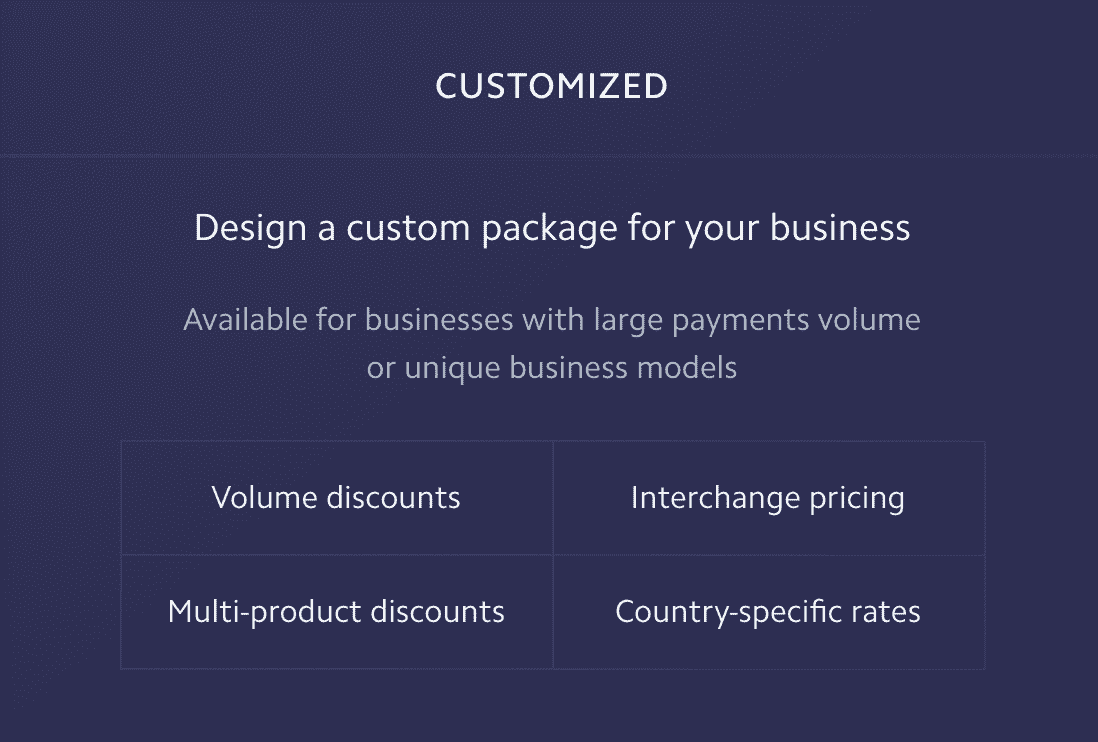

Does Stripe Negotiate or Offer custom Pricing?

A question we receive here almost daily is “does Stripe negotiate pricing?”

Of course, companies like Stripe, Square and PayPal can be very expensive for a business doing a lot of monthly volume on 2.90% + $0.30 per successful transaction.

This typically brings that all in effective rate (total fees / total volume) above 3% which is not competitive pricing by any means.

Fortunately, the answer to that question is yes they do offer different pricing options and structures pending on the volume.

Below is a list of factors that Stripe looks at when evaluating a pricing reduction:

- Monthly processing volume

- Types of cards the business is taking (Business cards, Rewards cards etc)

- Chargeback and return ratio

- International transactions or all domestic

- Business type

- Projected 1 – 3 year growth for the business

- Past growth trajectory with Stripe

- Funding the business has received from investors

The monthly volume that a business typically needs to be running in order to speak with Stripe about a reduction is around $100,000 in monthly sales volume via Stripe.

It is important to note, if you are running a non profit you can typically start off with a reduction rather than waiting to hit $100,000 in monthly volume.

Steps to Negotiate With With Stripe to Get Lower Stripe Fees

If you’re processing over $100,000 per month and it feels like you are paying too much, it’s time to negotiate. But fair warning—negotiating with Stripe is not an easy task.

Stripe considers themselves a premium service and relies on its business model its software and technology to justify its pricing.

Additionally, if your business has been using Stripe for a long time, Stripe understands it’s not easy for you to just switch vendors.This tends to give them the hand up in the negotiation.

That being said, there are multiple tactics you can use to reduce your processing costs to a fair rate and bring the effective rate down significantly.

Step 1 – Do Your Homework

Understand what card types you’re processing look up the actual interchange rates charged at the card network level. This will give you a good idea of how much money Stripe is making on your account, which allows you to have an educated conversation. If you currently are on a flat-rate pricing you’ll have to request this information from Stripe.

Step 2 – Reach Out to Stripe

If you have a dedicated account representative, start there. Otherwise, you can reach out to Stripe through the online portal and request a pricing review. From there, an account rep will contact you to chat about pricing and learn more about your business. Be aware, 95% of the time the rep will tell you that there’s no room to lower your fees.

Step 3 – Push Back

Just because the account rep tells you the pricing can’t be changed, it doesn’t mean you should give up. Push back with your knowledge. Now you understand how much Stripe is making off your account it is important to continue to push back. It usually takes at least three phone conversations until Stripe will look into a reduction.

Step 4 – Inquire About Other Pricing Options

Ask about different pricing options, and inquire about switching from flat-rate pricing to interchange-plus pricing. That being said, before looking into interchange plus option you 100% need to be fully aware of what your true interchange fees from the card brands are. A lot of times Stripe will offer someone an interchange pricing but the effective ends up being higher. And oddly enough, once you commit to this new pricing option they will not revert you back to the old one.

Step 5 – Get a Guarantee in Writing

If a Stripe account manager offers you a pricing adjustment or switches you to to an interchange-plus pricing model, make sure you get a deal in writing. I cannot reiterate enough how important it is to receive this guarantee from Stripe. Otherwise, you’ll have no recourse if they try to revert back or increases your rates in the future.

Step 6 – Validate Your Savings

Once the change goes into effect, you need to make sure that you’re actually saving money. This is an extremely important step. Start by comparing your newest statement against the months prior to your switch. Calculate your new effective rate compared to the old one to ensure you’re actually saving money.

Example Stripe Negotiation With Reduced Interchange Fees

Let’s say Stripe switched you to a reduced flat-rate plan or switch you to an interchange-plus model. You can look back to see your history and find how much you’re saving.

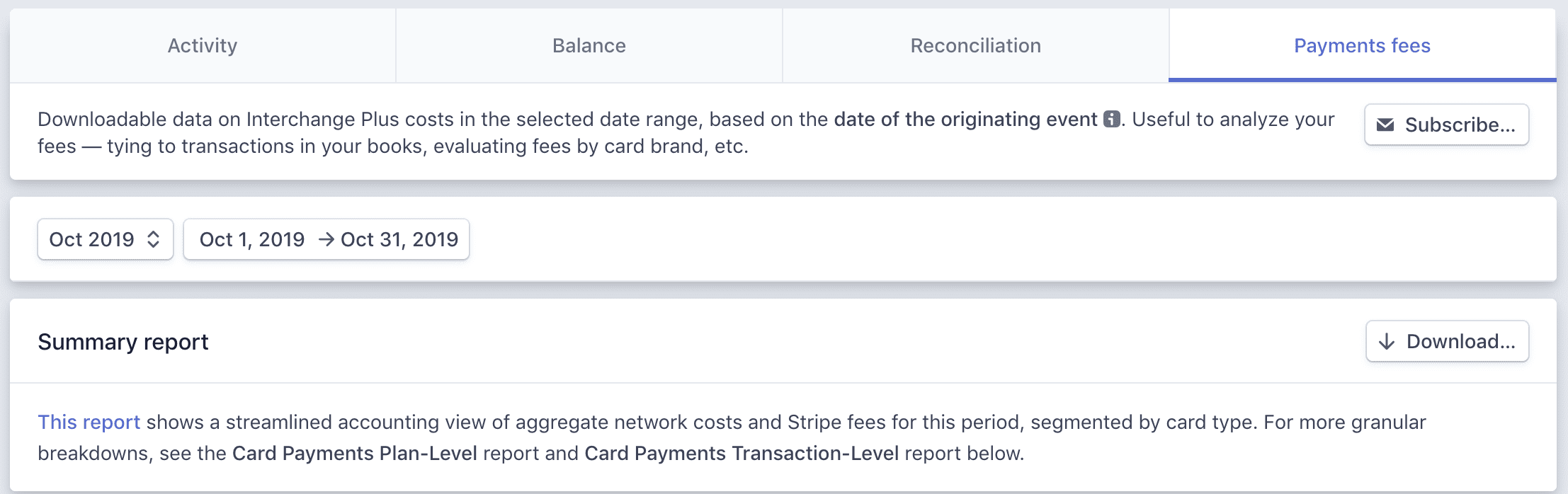

Look at the example screenshots and steps below to calculate this updated pricing using Stripe’s online portal.

Once in the Stripe portal click on Reports > Payments Fees > then download the Summary Report. Once this report is downloaded scroll to the bottom right cell and that will give your total fees for the month.

From there, divide the total fees by the monthly volume and that will give you updated effective cost on the new pricing.

Now, it is very important to understand that the bulk of people reading this article are most likely on a flat rate type of pricing structure with Stripe.

Example 1

Let’s say all the you’re accepting cost 2.90% + $0.30 per transaction. This includes radar, so it is very easy to keep track of what your monthly costs are going to be.

A lot of CFOs, controllers, and business owners tend to like this method for accounting and transparency reasons.

Above we mentioned a different pricing option that Stripe offers to high volume businesses which is interchange plus pricing. This is less transparent, but it’s often much cheaper than flat-rate processing.

Interchange rates are dictated from the actual card brands and card types your business is seeing, which fluctuates monthly.

If you are looking to keep things as simple as possible and remain on a flat rate structure Stripe does offer reduced pricing in that aspect as well. They usually are willing to give a reduction on the flat rate structure much sooner than offering the interchange plus pricing.

Example 2

Now let’s say you are seeing half debit and half credit cards, and you total costs from cards brands is around 1.90%.

Stripe currently has you setup on 2.90% + $.30 per transaction this means they are profiting about 1% on all your volume which is extremely high.

A fair margin for Stripe to be making is about 0.30% – in this example Stripe should realistically have you setup on 2.20% + $.30 per successful transaction.

This is for the soul reason that on any type of flat rate the margins for Stripe and other third-party vendors are typically higher than switching you over to the interchange plus structure. When negotiating a flat rate type of pricing it is obviously very important to understand what your average interchange and card type are.

Should You Stay With Stripe?

That is a good question and it depends on numerous factors. I do believe that Stripe offers a fantastic service for marketplace and subscription based businesses.

The real benefits of Stripe is its great developer tools that give you the power to customize everything about the payment experience.

Stripe also providers deep insights and analytical data that you will most likely lose when making a switch.

Businesses that want a fully branded solution, as well as subscription based businesses, marketplace and tech-focused companies will find all the tools they need within the Stripe platform.

For these types of businesses it does make sense to overpay a bit more relative to a standard credit card processing company (but not by as much as they want you to think).

However, for the eCommerce business that just needs a payment processor, Stripe may be overkill. If you don’t have the developers on staff, you may never tap into Stripe’s potential. It’s also worth noting that it may take some time for the funds to reach your bank account.

Final Thoughts on Stripe Fees

The key take way to note in all of this is that Stripe does negotiate and it is possible to obtain extremely competitive pricing.

I would suggest to reach out to Stripe as soon as your business hits the $100,000 in monthly sales.

Here are Merchant Cost Consulting, it is our job to educate, inform, and assist our audience about the murky waters of the credit card processing industry and help our clients lower credit card merchant fees without making a change to their current processor, bank, equipment, or gateway provider.

If you are wondering how much your Stripe fees can be reduced by simply reach out and we will run a full analysis on the margins Stripe is currently making.