TSYS is a merchant services provider and credit card processing solution that facilitates over 32 billion transactions annually on its platform. Short for Total Systems Services, the company still operates under the TSYS branding, even though it’s owned by Global Payments.

This in-depth review can be helpful for merchants currently using TSYS or any business that’s evaluating TSYS services for payment processing.

MCC Quick Take on TSYS

Overall, TSYS is a well recognized name and one of the most established players in the payment processing space. But they are notorious for adding extra fees to monthly statements, and we spend a ton of time negotiating to get those unnecessary fees removed for our clients.

TSYS also charges other fees on top of its regular service markups for merchants relying on software integrations. We’ve seen these as high as 3.5% over the interchange rates, assessments, and standard markups.

Since so many ISOs and third-party MSPs contract TSYS to handle payment processing, there’s an inconsistent experience for merchants and pricing can fluctuate significantly for each business.

What We Like About TSYS

- Interchange-plus pricing is available

- Rates can be negotiated

- Large and reputable organization

- Safe and secure transactions

- Robust technology for payment processing

Where TSYS Falls Short

- Lots of extra fees are added to monthly statements

- Surcharging transactions facilitated via software integrations

- Sales reps push tiered pricing to most merchants

- 3-year contract requirement and auto-renewal

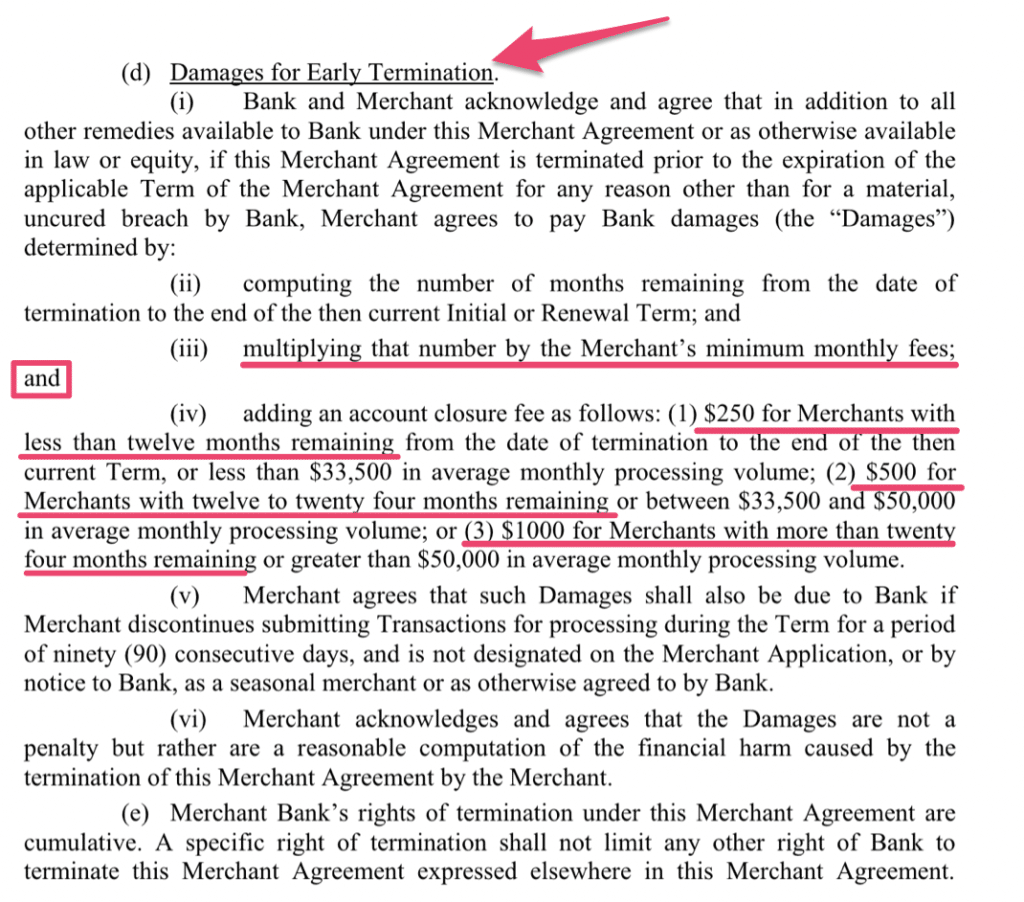

- Early termination fees over $1,000+

- Lacks pricing transparency

- Massive rate hikes

For more information on standard contract terms, you can refer to this TSYS Merchant Processing Agreement.

TSYS Pricing and Credit Card Processing Rates

TSYS does not publish its rates online. That’s mostly because they don’t offer the same rates or even the same contract structure to every business that relies on them for payment processing.

If you’re getting a quote from an ISO or third party that’s using TSYS to process your payments, that rate might be different from another ISO using TSYS and will also be different from going directly to TSYS.

TSYS reps and ISOs often try to steer businesses into a tiered or bundled pricing structure. That’s because the qualified rate offered here is typically the lowest available, but it’s the rate for any of your transactions to actually fall into this category. So it’s definitely in your best interest to go with an interchange plus pricing model from TSYS to get the lowest possible rates.

On statements, TSYS uses a basis points system to convey how much they’re charging over interchange (which is their processor markup). This number used is actually ten times the fee that they are charging. So if you see the number “10” listed, then you’re actually paying 100 basis points (which equals 1%).

TSYS looks for other ways to inflate your charges, even if you’re on an interchange plus plan.

For example, TSYS typically does a downgrade surcharge on interchange rates for businesses using software integrations. In our experience, this surcharge affects between 60% and 80% of transactions—and it ranges anywhere from 10 basis points to 3.5% over the interchange rate and normal service markups (which means it’s separate from the base rate and per transaction fee).

Other TSYS Fees to Look Out For

Aside from the regular per-transaction processor markups imposed by TSYS, we often see a wide range of other hidden fees added to monthly statements. Examples include:

- Non-EMV Risk Assessment Fee

- Non-EMV Program Fee

- Breach Coverage Monthly Fee

- Transaction Network Access Fee

- Fees For Access to Card Brands

- Analytics Reputation Management

- Non Receipt of PCI Validation

- Infrastructure Upgrade Fee

- Global VPN Fee

- Settlement Funding Fee

- Annual Fee (sometimes itemized as Annual Administrative Fee)

If you’ve seen any of these fees on your statement, it’s definitely possible to get them removed. You can try to do this yourself by picking up the phone, sending emails, and giving them a hard time. Or you can work with a merchant consultant to do the negotiating on your behalf.

Our team here at MCC has had great success over the years getting bogus fees removed from TSYS statements. We can also help determine if the basis points on your statement are inflated and if there’s room to save money there as well.

Watch Out For Massive Rate Increases From TSYS

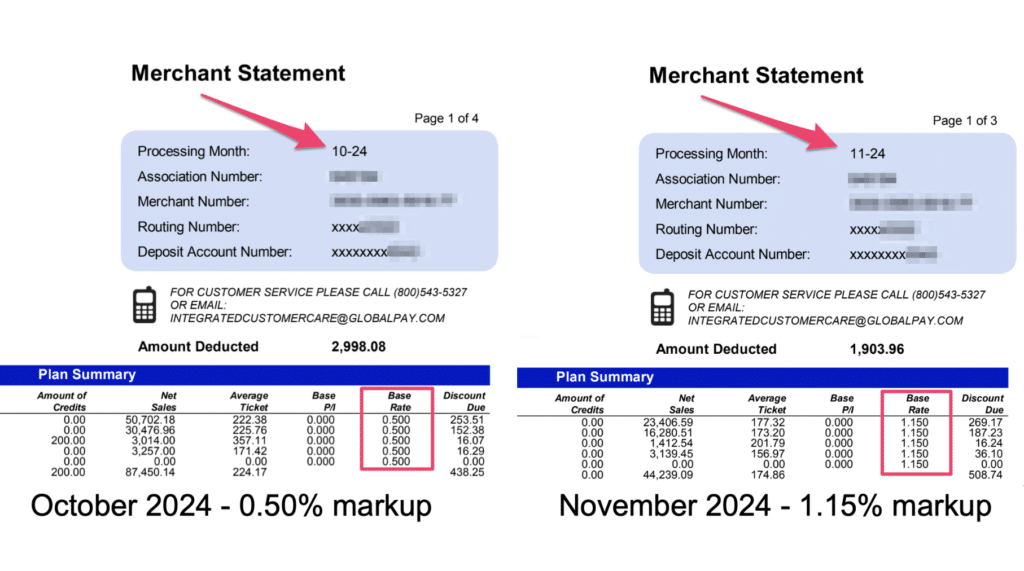

TSYS is notorious for drastically increasing rates for merchants. Let’s look at a real example so you can see what I mean.

Here’s a side-by-side comparison of two statements from the same merchant, one from October 2024 and the other from November 2024:

TSYS hiked this merchant’s base rate by 0.65%, which is a huge increase. This new 1.15% rate is more than double what the merchant paid previously (0.50%).

You will see notices of rate hikes prior to the jump (and this notice was included on the October statement).

But this still doesn’t justify such a drastic price increase.

Latest TSYS Updates and Noteworthy News

TSYS started 2025 with rate increases that went into effect immediately. Effective January 1, 2025:

- 0.90% increase to the qualified base discount rate

- 0.40% increase to settlement funding fees

- $0.20 increase to the transaction network access fee

Last year, in 2024, TSYS updated rates in May, July, August, and November. Those changes include:

- 0.65% increase to qualified base discount rates

- 0.75% increase to non-qualified surcharge processing fees

- 0.45% increase to settlement funding fee

- $0.20 increase to transaction network access fee

This information is not publicly available. But we’re able to obtain these increase notices from our clients.

In 2023, TSYS increased its PCI non-compliance fee to $94.95 per month. For a full history of TSYS rate changes and increases, refer to this guide.

Should You Switch to TSYS For Credit Card Processing?

With a few exceptions, we typically don’t recommend switching to TSYS if you have an existing merchant agreement in place elsewhere. Here’s why.

First, the TSYS rep or ISO agent will always undercut your existing rate. They know what you’re paying elsewhere, and they know that quoting you at a lower rate can get your business.

But this often leads to a bait and switch. As you’ve seen above, rates can increase at any time. So before you know it, you’ll likely end up paying more with TSYS than you are right now—especially if they get you to sign up for a tiered pricing plan.

Instead, it’s much easier to negotiate directly with your current processor if you want to lower your credit card processing rates. You’ll have much more leverage there as a current customer.

The only time you might want to consider switching to TSYS is if you’re using a fixed-rate PayFac and you want to get an interchange-plus plan directly from TSYS.

Should You Terminate Your TSYS Merchant Agreement?

Probably not. Similar to what we said above, you’ll have a better chance negotiating with TSYS directly.

Can you get a better rate elsewhere? It’s possible.

Another payment processor will definitely advertise a lower rate. But whether you actually get those rates and continue to get those rates for the long term isn’t guaranteed.

If you’re still within the first three years of your TSYS contract, you could have to pay hefty damages for terminating early.

If you think you’re overpaying to process payments with TSYS (and there’s a good chance you are), you can reach out to our team here at Merchant Cost Consulting for assistance.

We’ll audit your statements to estimate how much you can save and negotiate directly with TSYS on your behalf. There’s no risk to you, and you can lower your rates without having to switch processors.

Our TSYS Review Process (and Why You Should Trust MCC)

Our TSYS review is based strictly on the facts, our interactions with TSYS, and clients’ experiences with TSYS. We work with dozens of merchants using TSYS for payment processing, which gives us privileged access to monthly statements and information that would otherwise be unavailable to the general public.

Beyond TSYS, we also analyze thousands of monthly statements and merchant agreements from other providers. So it’s easy for us to tell if TSYS’s fees are fair or if they’re overcharging.

The majority of other TSYS reviews you’ll find online were written for affiliate marketing purposes. Publishers either have an agreement with TSYS to incentivize signups or agreements with other payment processors to incentivize signups elsewhere. It’s fairly easy to spot those “reviews” because they’re constantly pushing other processors throughout the post or encouraging you to sign up for TSYS.

We’re not doing any of those things here. Our TSYS review is completely unbiased, and we’re not being compensated by TSYS or any other processor for the facts and opinions shared in this post.

TSYS Integrations

Some businesses forced to use TSYS because they’re the only integrated processor (or one of the limited processing options) for a particular software they’re using. Processors like TSYS often leverage this to their advantage, inflating rates even more because they know you can’t do much if you want to integrated payments.

We commonly see TSYS as the integrated processor for tools like:

- Carestream Dental

- OrthoTrac

- WaveOrtho

- DaySmart Vet (powered by Vetter)

- DRV Technologies

- ServiceTitan

- MindBody

So if you’re using any of these systems and have integrated processing set up, then you’re likely using TSYS on the backend (whether you realize it or not).

Other TSYS Products and Services

The vast majority of our review focuses on TSYS as a payment processor. But it’s worth noting that they do offer a handful of other services.

Third-Party Card Issuing

TSYS helps businesses issue private-label and co-branded cards. So if you’re in the retail space and want to offer a branded credit card to your customers for purchases that can only be made through your business, TSYS can help manage everything you need to facilitate this initiative.

Fraud and Risk Management

They also provide a range of end-to-end fraud services, including fraud scoring, authentication services, account decisioning, and account acquisition. You can use TSYS to configure your own fraud rules and leverage their machine learning and risk models.

CRM API

Businesses can use TSYS for customer relationship management. It helps organize things like disputes, case management, and a holistic view of customer journeys.

Commercial Card Issuing

TSYS facilitates commercial card issuing for things like travel and entertainment programs. They can also issue fleet cards, corporate purchasing cards, enjoyables, combo cards, and commercial cards for small business spending.

Healthcare Technology Services

TSYS offers a wide range of solutions specifically for healthcare service providers, third-party administrators, and healthcare technology companies. They can help you set up the technology needed for HSAs, HRAs, FSAs, transit and commuter programs, wellness incentives, direct spending, and more.

Our Final Thoughts on TSYS

TSYS is undoubtedly a leader in the payment processing space. Their merger with Global Payments has made them even more powerful, and it has allowed them to expand and spend more time focusing on technology and other value-added services that go beyond payment processing.

If you’re thinking about switching to TSYS as your merchant account provider, you should try to negotiate with your existing processor first. Even though TSYS might seem cheaper, you probably won’t save much over the long term—and it could even be more expensive than your current provider.

For those of you currently using TSYS to process payments, there’s a good chance you have extra fees on your monthly statement that you shouldn’t be paying. If you’re on a tiered plan, switching to an interchange-plus structure can definitely help save you money with TSYS. Just make sure to keep an eye on your basis points and other fees they might be adding.

Need help identifying hidden fees on your TSYS statement? We can help.

Reach out today for a free audit and analysis. We’ll help negotiate your rates so you can save money without switching processors.