Tyler Technologies provides integrated software and services to organizations in the public sector. From federal agencies to schools and municipalities of all sizes, they offer everything from ERP software to integrated payment processing.

If you’re currently using Tyler Technologies or considering them as your integrated payments provider, this review is for you.

You’ll get our insider take on how Tyler Tech handles payments to ensure you get the best possible deal.

MCC Quick Take on Tyler Technologies

We have several clients in the public sector who are currently using Tyler Technologies for various purposes. To simplify operations, our clients also leverage the platform’s integrated payments capabilities, allowing them to process payments without complex third-party setups.

Here’s what you need to know:

- TylerTech has two options for integrated processing: TylerPay and Global Payments.

- With either option, your rates are 100% negotiable.

- There’s a good chance you’re overpaying to accept payments.

- We’ve found cost-saving opportunities on every TylerTech processing statement we’ve audited.

- The software supports native billing and cashiering systems.

- Tyler is Level 1 PCI-DSS compliant.

Tyler Technologies definitely has powerful software. But since your options are limited for payment acceptance, they use this to their advantage and overcharge accounts.

Tyler Technologies Overview

Tyler Technologies is one of the largest software providers for the public sector in the US. While initially founded in 1966, they’ve been exclusively serving the public sector since 1998.

Over 45,000+ installations of TylerTech software are currently installed across 13,000+ locations nationwide.

As a payment provider, TylerTech processes $91 billion per year for 9,000 clients. The payment solutions are specifically designed for government institutions for use cases like:

- Tax collections

- Utilities payments

- Police tickets

- DMV fees

- Business licenses and permits

- Hunting licenses and permits

For all of these use cases (and more), Tyler supports a range of payment acceptance options online, in-person, and over the phone. People can make payments with credit cards, debit cards, eChecks, and digital wallets—and everything is integrated within the TylerTech software you’re using.

Tyler Technologies Integrated Payment Processing Options

If you’re using one of TylerTech’s software solutions and want to start accepting payments through the same platform, you have two choices—TylerPay or Global Payments.

The truth is, it doesn’t really matter which one you’re using, as the end result will effectively be the same. There’s just a slight variation as to what’s happening behind the scenes and who you’ll be dealing with to negotiate a better rate.

In either case, your sales rep is always going to try to get you to pay the highest possible rate. At a minimum, they’re aiming for 100 basis points over interchange. But we’ve seen some really egregious stuff, including a recent instance of a client being charged a 10% effective rate.

TylerPay

TylerPay is Tyler’s in-house processing solution. They operate as a PayFac (payment facilitator), which means your organization can start accepting payments without having to apply for a traditional merchant account.

The initial setup is a bit easier but the rates will always be more expensive because TylerPay is utilizing a third-party processor to actually handle the transactions behind the scenes.

And since Tyler knows your options are limited here, it’s much easier for them to charge a premium because (they think) there’s not a whole lot you can do about it.

Global Payments

Alternatively, Global Payments also integrates with Tyler Technologies.

Theoretically, going directly to the processor instead of using a PayFac should result in lower rates. But Global Payments is one of the most unethical processors on the market.

Read More: Global Payments Outrageous Fees Exposed

Global will most likely have to pay a commission to Tyler Technologies for the referral, so they’ll factor this into your rate to ensure they’re still getting a hefty profit after that kickback is paid.

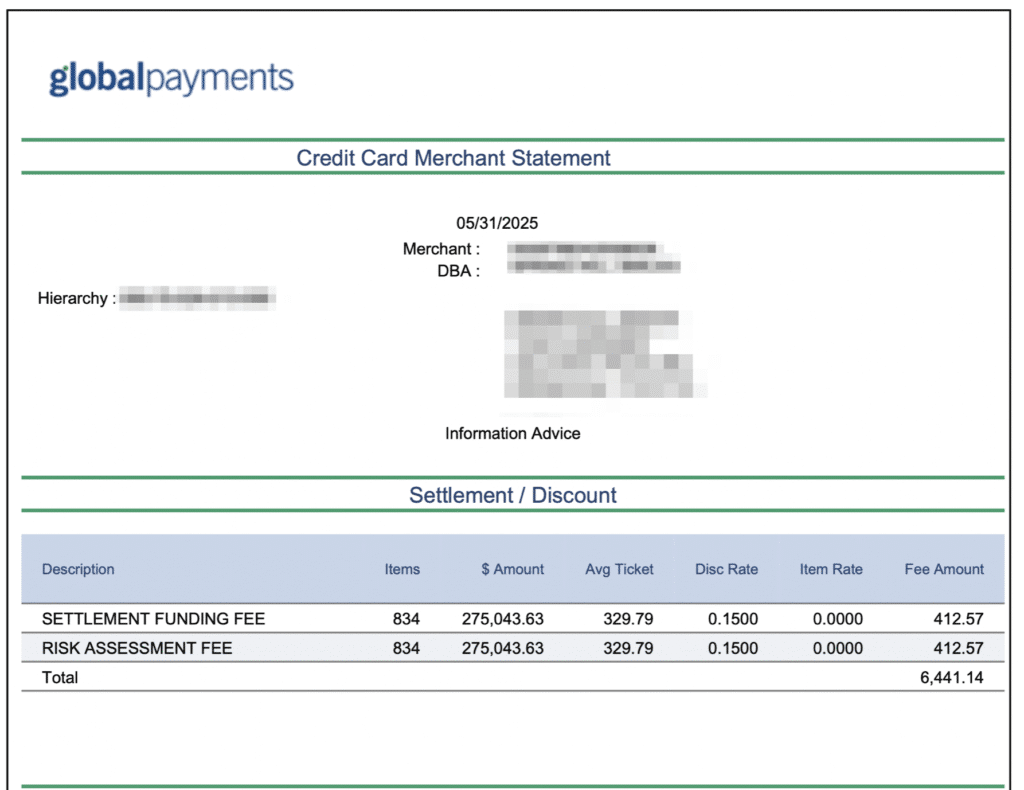

Here’s an example of what a Global Payments statement looks like:

I included this page because it shows over $6,000 in two bogus fees—Global’s Settlement Funding Fee and Risk Assessment Fee. So if your statement is in this format and you see these fees, then Global is processing your payments for Tyler Technologies.

Check out our Global Payments Review for additional insights and fees to watch out for, including which ones can be removed from your account.

Government Entities Should Qualify For Lower Interchange Rates

Whether you’re using TylerPay or Global as your integrated processing solution in TylerTech, you need to make sure that you’re on an interchange-plus pricing structure.

With this model, you pay the wholesale rate set by the card networks (Visa, Mastercard, Amex, and Discover), plus a markup to your processor (TylerPay or Global).

If you haven’t gone through any cost-reduction efforts, I’m willing to bet that you’re paying at least 100 basis points (1%) over the interchange rate right now—if not more.

That’s far too high, even for an integrated solution. Getting a 50 basis point markup is somewhat reasonable for integrated processing, but we’ve seen it as low as 10 or 20 points.

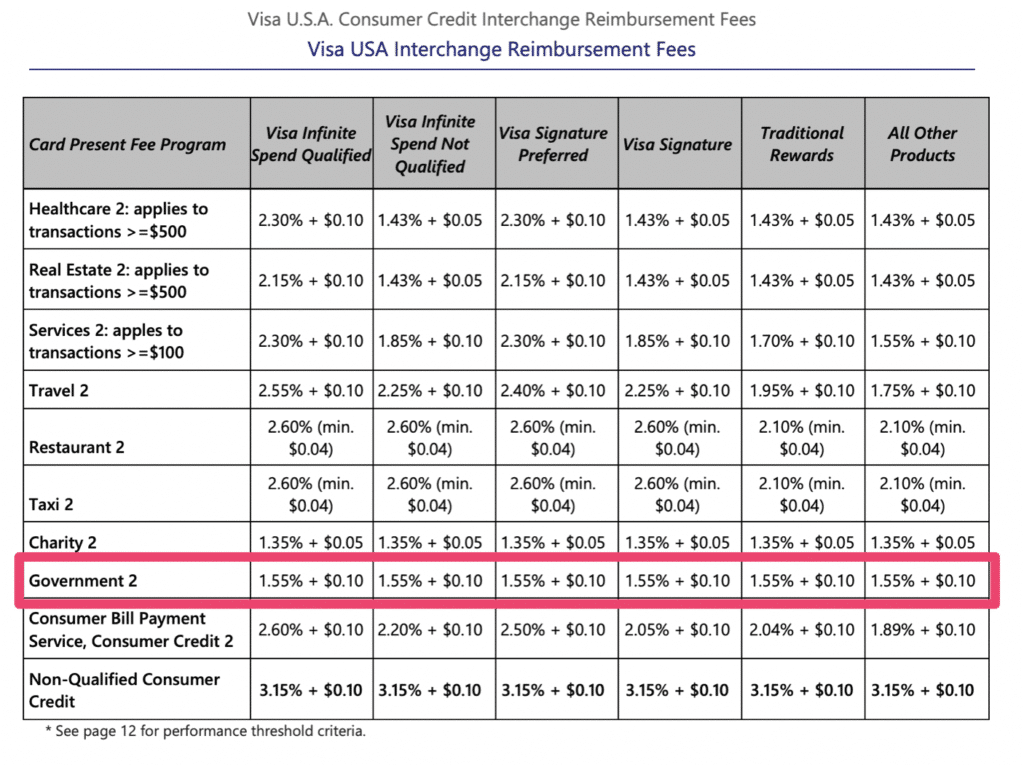

As a government organization, you should be qualifying for some of the lowest interchange rates available. Here’s an example of some Visa interchange categories so you can see what I mean:

In this table, all government transactions are charged 1.55% + $0.10 at the interchange level.

Other non-government categories are around 2.30% to 2.60%, so nearly a full percentage point higher—and that’s before the processor markup. Visa debit card transactions are even lower for government MCC codes, as low as 0.65% + $0.15 or 0.05% + $0.21 per transaction.

Amex interchange rates for government transactions (tax payments, tolls, and bail) also start at 1.55% + $0.10.

This is all my long-winded way of saying: if your processing rates are much higher than these numbers, then you’re getting ripped off.

Government entities shouldn’t have an effective rate much higher than 2%, even through an integrated processing solution. So if your processing costs exceed 2%, then there’s definitely room to save money.

How to Get Lower Payment Processing Rates With Tyler Technologies

Even if your payment acceptance solution is already set up and integrated in TylerTech, you can still get lower rates without having to change your software or switch providers.

Step 1 – Figure out who is actually processing your payments: It’s either going to be TylerPay or Global Payments. This answer is ultimately going to dictate who you’re negotiating with and how you’re going to approach the negotiation process.

Step 2 – Audit your statements. Calculate your effective rate to get a better sense of your total processing costs. Look for miscellaneous fees, increases, and anything that doesn’t look right as you’re comparing fees each month. We have a guide on how to read your monthly processing statements that’s extremely useful for this step.

Step 3 – Negotiate. Pick up the phone and contact your processor. Let them know you want a rate reduction and won’t take no for an answer. You have a lot more leverage than you realize, especially if you’re processing a high volume of transactions. Many of our government clients process millions per month, so the provider doesn’t want to lose their business.

If you need help with this process, our team at MCC can do it all on your behalf.

We’ll audit your statements to identify any cost-saving opportunities and then negotiate directly with Global or TylerPay on your behalf. Once we’ve lowered your rates, we’ll continue monitoring your statements every month to check for hidden charges and increases.

Our team has saved clients using Tyler Technologies upwards of $50,000 per month on processing fees. So get a free audit to find out how much you can save.

Final Thoughts on Tyler Technologies

Overall, Tyler Technologies provides robust software and really dominates the public sector space.

However, their payment processing—while equally powerful—is often more expensive than it should be.

Integrated processing generally commands a premium. But that doesn’t mean you should just blindly accept high rates and assume there’s nothing you can do about it.