According to the Amex website, American Express is accepted by 99% of places in the US that accept credit cards. This might seem hard to believe — considering the fact that you’ve probably walked into at least one business that says “No Amex” or something similar by the credit card terminal.

I’m not here to dispute that claim but rather to shed light on why certain businesses choose not to accept American Express.

This information can be really valuable for consumers and merchants alike. If you’re an American Express cardholder, you can use this to determine where your Amex card will be accepted. And if you’re a business, this guide can help you decide whether or not you should be accepting Amex cards for your customers.

Why Some Businesses Don’t Accept American Express

American Express is more expensive to process than other credit cards, which is why some businesses choose not to accept Amex cards.

It’s worth noting that the Amex OptBlue program—for merchants processing less than $1 million in Amex transactions annually—offers more competitive pricing for small businesses. That said, even when you compare these rates to Visa and Mastercard’s interchange rates, Amex OptBlue is still slightly higher across most categories.

Something else that’s interesting about Amex is that they often charge more for higher ticket transactions. For example, a $1,000 transaction will likely have a higher fee than a $100 sale, which is the opposite of what we’ve come to expect for other cards.

So if you have lots of high-ticket sales and you process more than $1 million in Amex cards per year, you’ll likely be paying higher rates than smaller businesses.

Some businesses DO accept American Express (even though they say otherwise)

If you’ve seen a sign that says “no Amex” or you’ve gone to pay with your Amex card and the cashier asks if you have another card, there’s a good chance that business has the capability to accept American Express payments but chooses not to.

This is a direct violation of Amex’s rules for card acceptance.

If we look at the Amex US Merchant Regulation Reference Guide, we can see this violation in Section 3.2 – Treatment of the American Express Brand. Unless permitted by law, American Express strictly prohibits any of the following:

- Indicate that they prefer other payment products over Amex

- Try to dissuade customers from using their Amex card

- Criticize the card, service, or program

- Encourage customers to use another type of payment product (like a check)

- Impose fees or restrictions on Amex cards that aren’t equally applied to other cards

- Require customers to waive their right to dispute a transaction

As a consumer, I’ve personally seen several businesses violate these card brand rules. They actually accept Amex, but try to encourage customers to use other cards to avoid paying higher fees.

This is why it may seem like Amex isn’t as widely accepted—even though those businesses technically do accept American Express cards.

Why is American Express More Expensive?

Ok, so we’ve established that it’s more expensive to accept Amex cards—but why?

American Express is a closed network. This means that they operate as the card network and issuing bank, handling everything in-house. As a result, they have more control over their fee structure and they also incur additional costs for providing multiple services under one roof.

This is very different from how other card brands (like Visa and Mastercard) operate.

Visa and Mastercard are both card networks. But they rely on third-party issuing banks to distribute cards and provide services to cardholders.

If a cardholder wants to increase their line of credit, ask a question, or dispute a transaction, they don’t call Visa directly. They get support from the bank or financial institution that issued the card—like Chase or Wells Fargo.

Furthermore, if a merchant wants to accept Visa and Mastercard, they don’t go directly to these card networks. Instead, they go through an acquiring bank. This third-party processor acts as the middleman between the business and the card network, passing through fees and providing services that the card networks don’t offer.

But American Express does merchant acquiring services. Businesses can contact Amex directly to accept their cards without having to go through a third party.

They control all aspects of each component of the card issuing and acceptance in their closed network, which gives them the ability to markup their processing fees accordingly.

Businesses That Don’t Take American Express

Costco is the most notable business that does not accept Amex cards. There aren’t many other national stores or chains that fall into this category.

Some small businesses don’t accept American Express. We also see some government entities that don’t accept Amex cards for things like tax collections or similar fees.

Amex also prohibits merchants in certain categories from participating in the Amex OptBlue program. Examples include:

- Airlines and charters

- Bankruptcy services

- Car retinal agencies

- Check cashing and cash at POS

- Collections agencies

- Commercial leasing

- Credit financing

- Credit restoration services

- Gambling services

- Marijuana-related companies

- Multi-level marketing

- Online adult entertainment

- Payday loans

- Travel-related telemarketing

- Timeshares

- Postal services

That doesn’t necessarily mean that these businesses can’t accept Amex, but it means that they’d need to set up an Amex Direct agreement. This isn’t as easy as getting set up with the Amex OptBlue program, so there’s a greater chance that you’ll find businesses in these categories that aren’t accepting American Express.

Which Countries Do Not Accept American Express?

There are some countries where Amex is not accepted anywhere, including:

- North Korea

- Cuba

- Syria

- Sudan

- South Sudan

- Iran

Historically, American Express wasn’t accepted throughout most of Africa. But that’s changed as of late. Most recently, Amex partnered with Ecobank to add 12 new countries to its acceptance list in Africa.

That said, just because Amex can be accepted in a particular country or region, it doesn’t mean that it will be widely accepted by every merchant.

Is American Express Accepted in Europe?

American Express is accepted throughout Europe, it’s not as widely as accepted as other card brands.

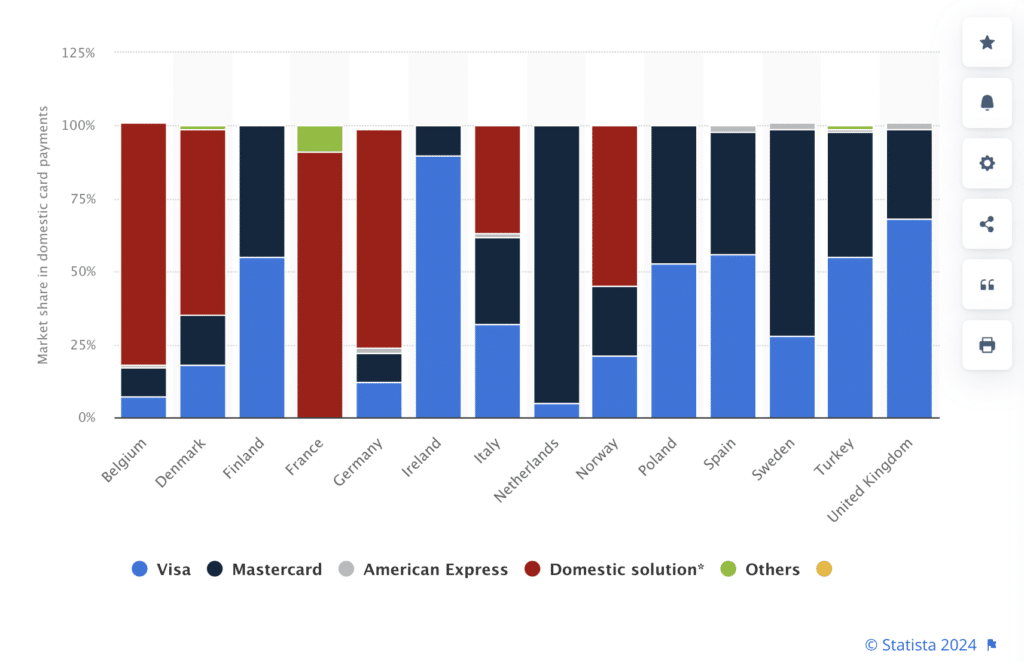

This data from Statista shows Amex’s market share in 14 European countries:

American Express is barely visible on this chart.

Its highest market share sits at just 2% in the UK, Sweden, Spain, and Germany. Otherwise, it’s 1% or less.

Is American Express Accepted in Japan?

Thanks to a partnership with JCB, American Express is accepted in Japan. But it’s not as widely accepted as other payment options—especially at smaller businesses.

Small markets and street food vendors in Japan likely will not accept Amex cards.

Final Thoughts

American Express is accepted at most businesses in the US. While it’s not as widely accepted as other cards globally, Amex is taking steps to expand its footprint internationally.

The reason why some US businesses don’t accept Amex is simply because of the cost.

But that said, I don’t think Amex’s higher costs should be a reason for you to not offer as many payment options as possible to your customers. At a minimum, every merchant in the US accepting credit cards needs to be accepting payments from all major card networks—Visa, Mastercard, Discover, and yes—Amex, too.