Point of sale (POS) software facilitates transactions for your small business. Modern POS systems have replaced clunky cash registers and hand-written receipts.

Choosing the right POS solution for your business will dramatically improve the customer experience while boosting your efficiency on the back-end.

The capabilities of POS software today are impressive. You can find POS solutions with built-in payment processors, inventory tracking, sales metrics, and employee productivity tools.

Whether you’re launching a startup or need to upgrade your existing POS system, this guide will steer you in the right direction.

Commonly Used Point of Sale (POS) Systems For Small Business

There is an overwhelming amount of POS systems on the market. Finding the best one can be challenging if you don’t know where to look.

As an expert in this space, I’ve narrowed down the list to five choices for small business owners to consider. I’ll cover the top features, benefits, and prices for each one below.

Square — Best Overall POS Software For Small Business.

Square has quickly become one of the most popular POS solutions in the country. I probably see a Square terminal at least once during my daily routine.

One of the reasons why Square is so popular is because the hardware options are so versatile. You can turn your iOS device into a Square terminal using the Square Reader for magstripe to collect payments on the go.

Alternatively, you can use the Square Register or Square Terminal for a more traditional behind-the-counter POS solution.

Square Pros:

- Free software

- Lots of hardware options

- Built-in payment processing

- Inventory management

- Fully customizable

Square Cons:

- Accounts might be placed on hold if you scale too quickly

- Customer support could be better

Square Pricing

Square POS software is 100% free to download and use. For payment processing, Square costs at 2.6% + $0.10 per transaction. Custom rates are available for businesses processing over $250k.

Whether you need one terminal at a single location or ten terminals across five locations, Square is a top choice to consider for any small business owner.

Vend — POS For Small Retail Locations.

More than 25,000 retailers across the world trust Vend as their POS software provider. While the company does offer enterprise solutions, I’d recommend it to those of you with a small, single-location retail shop.

Vend’s POS system is entirely cloud-based. The Vend POS software works on iOS, Android, and Windows devices.

The software remains consistent across all screens and devices, no matter what type of hardware you’re using.

Vend is exclusively software. Unlike other POS solutions on the market, Vend does not process payments or sell hardware.

This makes Vend a top choice for small retailers that want to continue using their own hardware without switching payment processors.

Vend Pros:

- Cloud-based POS software

- Integration with third-party payment processors

- Easy to use

- Cross-platform consistency

- 14 day free trial

Vend Cons:

- No built-in payment processing

- Limited capabilities for larger organizations

Vend Pricing

Vend Lite starts at $99 per month with an annual contract. It’s for businesses that process less than $20,000 per month. For companies that process more volume, the Vend Pro plan starts at $129 per month when you sign up for a year. You can opt-in for month-to-month contracts, but you’ll pay $119 or $159, respectively.

Vend charges extra for each additional register with the software, which is another reason why it’s best for smaller retailers.

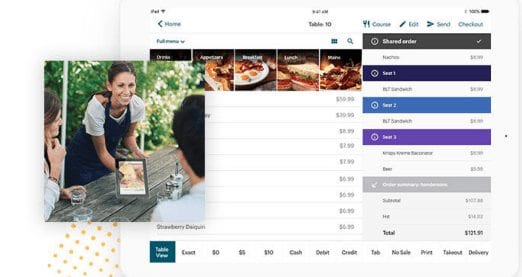

TouchBistro — POS Software For Restaurants.

TouchBistro is a niche-specific POS solution. The software is designed specifically for restaurants, food trucks, bars, and other small businesses in the food service industry.

They offer flexible solutions to meet the needs of any small business in this space. With full-service restaurant POS and self-ordering kiosks, to tableside ordering back-end kitchen displays, TouchBistro has it all.

The food service industry typically has high employee turnover. From new hires to part-time staff, TouchBistro is easy for anyone to use.

Another notable standout of TouchBistro POS is its exceptional customer service. They are available 24/7/365 if you ever have any questions or run into problems.

TouchBistro Pros:

- Integrated payment processing options

- Pay-at-table functionality

- Restaurant inventory management

- Detailed reports and analytics

- Staff management and scheduling capabilities

TouchBistro Cons:

- Hardware requirements (iOS only)

- Pricey add-ons and accessories

TouchBistro Pricing

The pricing for TouchBistro starts at $69 per month for a software-only single license. The software and hardware bundle starts at $105 per month.

Price is based on the number of licences required. For example, the software only package for five licenses is $249 per month, and the hardware bundle for that same plan starts at $359 per month.

All TouchBistro plans are based on annual contracts. Month-to-month rates are not available.

ShopKeep — Personalized POS Setups.

ShopKeep offers a wide range of POS solutions for various business types. They specialize in POS software for retail, quick-service, bars, and restaurants.

If you’re in the food service industry, TouchBistro will be a better option for you. But ShopKeep is still a viable option for quick-service coffee shops, ice cream parlors, or wine bars.

ShopKeep is an all-in-one solution for POS software, hardware, and credit card processing.

They offer custom solutions and personalized POS setups to meet the specific needs of your small business.

One unique feature of ShopKeep is its business funding solutions. You can get a small business loan directly from ShopKeep, and pay back your balance with a percentage of your credit card sales.

ShopKeep Pros:

- Personalized and custom POS setups

- Built-in payment processing

- Business capital solutions

- Analytics and reporting

- Inventory management

ShopKeep Cons:

- Payment processing rates are not transparent on the website

- Add-ons cost extra

ShopKeep Pricing

ShopKeep’s prices are 100% customized for each business. You need to contact their sales team to request a quote based on your needs.

Shopify — POS Software For Ecommerce Integration.

Shopify is an industry leader in ecommerce. But the company also offers POS software for free with your Shopify plan.

Shopify POS is the ultimate way to integrate your physical retail locations with your online store.

Whether you’re a brick-and-mortar retailer looking to expand online, or an ecommerce store opening a physical location for the first time, Shopify POS is for you.

All of your inventory can be managed in real-time between your retail shop and online store. For those of you with multiple locations, you can decide where inventory will ship from when a customer orders from your website.

Shopify POS Pros:

- Built-in payment processing

- Free POS software

- Ecommerce integration

- Customer loyalty solutions

- Inventory management

Shopify POS Cons:

- Limited to 8 store locations

- Only worth it if you have an ecommerce site

Shopify POS Pricing

Shopify POS software comes free with your Shopify plan. There are three different pricing tiers costing $29, $79, and $299 per month, respectively.

The entry-level plan is only good for small pop-up shops or markets. If you have at least one store location, you’ll need to upgrade. Payment processing rates for in-store purchases vary based on your plan.

Final Thoughts

What’s the best POS software for small businesses? It depends on what you’re looking for.

Factors like built-in payment processing, hardware options, store locations, and your industry will impact your decision.

Contact us here at Merchant Cost Consulting if you need help negotiating your credit card processing rates with your POS provider.

0 Comments