ACH vs. Wire Transfer: What’s the Difference?

In addition to credit card processing, cash, and checks, there are other ways of getting paid. Two alternative methods include ACH payments and wire transfers.

If your business sells large ticket items, such as machinery, equipment, or inventory, these alternative payment collections might be for you.

Generally speaking, ACH payments and wire transfers are used for B2B merchants. If you’re selling sandwiches, t-shirts, or cups of coffee to general consumers, getting paid via wire doesn’t make a ton of sense.

But that’s not always the case. Insurance companies use ACH transfers to collect monthly premiums. Utilities companies leverage this payment method as well. Some real estate companies even allow people to pay rent with an ACH transfer or wire.

The point I’m trying to make is this—both ACH and wire transfers can be used for a wide range of use cases. With that said, these payment collection methods aren’t for everyone.

Use this guide to see if ACH and wire transfers are right for your business.

What is an ACH Transfer?

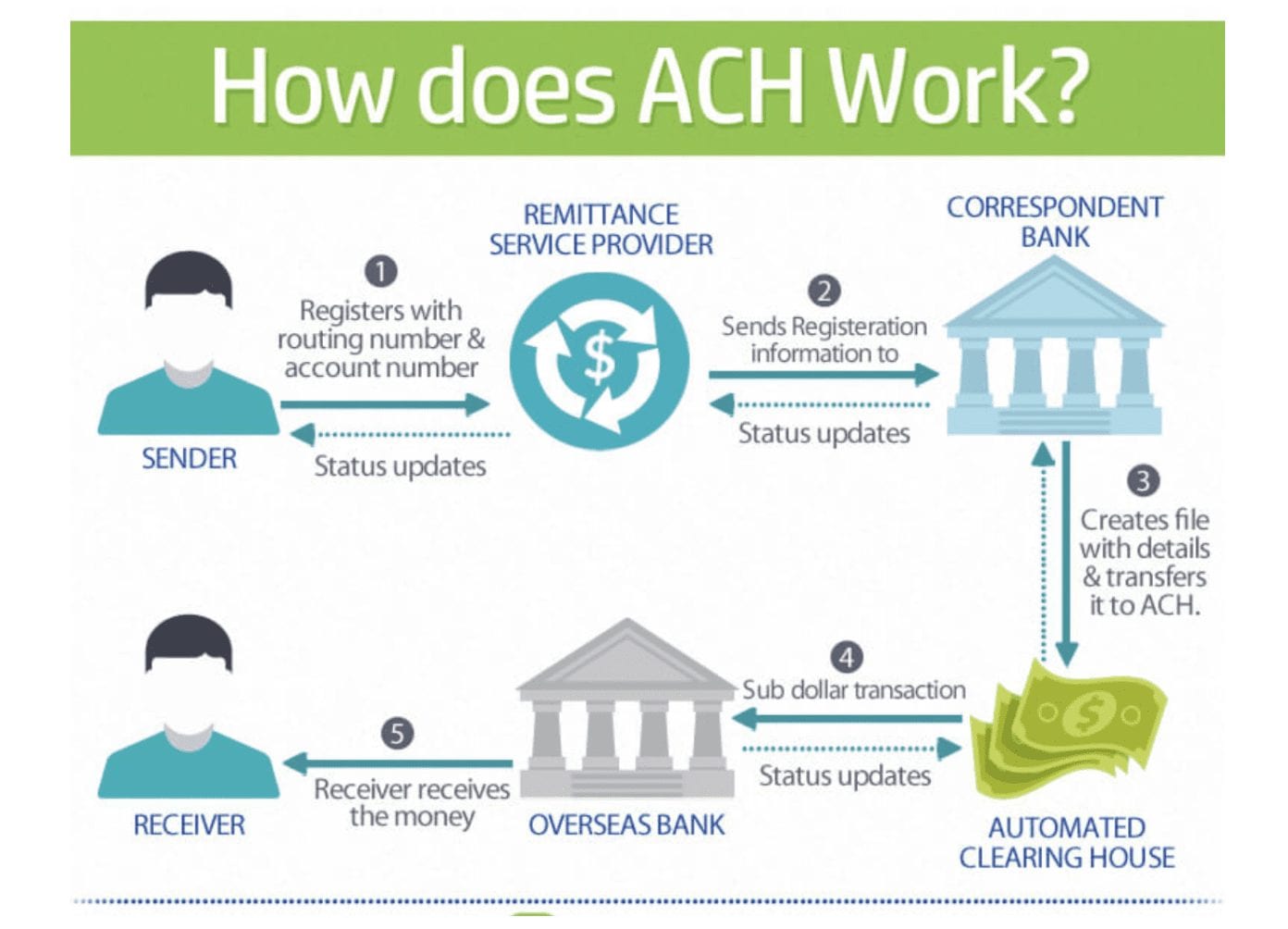

An ACH payment is an electronic transfer between two banks that’s processed through the Automated Clearing House Network, which is where the acronym “ACH” comes from. ACH transfers are made using a specific type of code, which are governed by Nacha (National Automated Clearing House Association).

With domestic ACH transfers in the United States, codes get transmitted with the Federal Reserve operating as the central bank. For international money transfers, banks typically use the SWIFT network to facilitate the transaction. The international bank can act as a central bank or receive the money directly, depending on the transaction and banks involved.

Here’s a visual representation that explains how ACH transfers work.

There are two types of ACH payments—ACH credit payments and ACH debit payments.

With an ACH credit, the party sending the money needs to authorize the payment before any money gets transferred. The recipient has to provide the sender with their bank account number, routing number, and other instructions. This method is a better option for non-recurring payments where you want to control exactly how much is paid and when you want to pay (or get paid).

An ACH debit involves money drawn from an account based on a specific schedule. This is what’s commonly used for recurring bills, such as utility payments. The person paying must provide the recipient with their account number, routing number, and the authorization to pay on the specific date of each month.

What is a Wire Transfer?

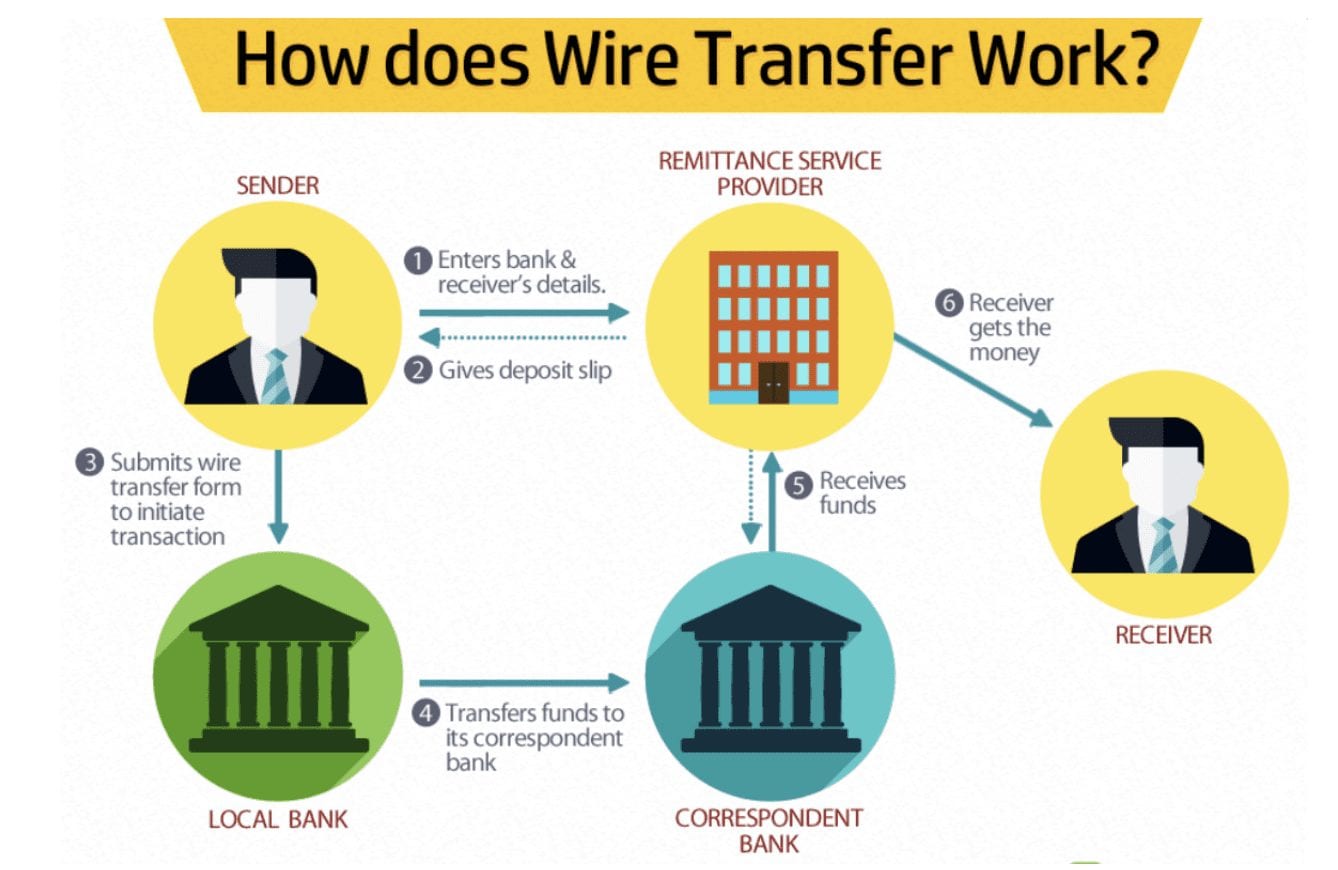

A wire transfer is a one-time payment between two banks that can be ordered and completed whenever the sending bank, receiving bank, and central bank are open during business hours. With wire transfers, banks transfer the funds from one bank account to another, right away, without batching. The Federal Reserve usually acts as the central bank for domestic transfers within the United States.

Wire transfer payments use a more traditional method of moving funds between financial institutions. That’s because wire transfers existed long before computer networks.

Back in the day, banks transferred money using messages via telegraph lines. Today, domestic wire transfers in the US are transmitted through the CHIPS network or Fedwire network. International wires are typically transmitted via SWIFT (just like international ACH).

Check out this visual depiction explaining how wire transfers work:

While wire transfers are safe and secure, the sender almost always needs to be physically present at their bank to initiate the transfer. Not all banks allow for wire transfers to be processed online or over the phone.

ACH vs. Wire Transfers: Key Differences Compared

Now that you have a better understanding of how ACH transfers and wire transfers work, let’s take a look at these two payment collections head to head.

Processing Costs

It costs money to accept ACH and wire transfers.

Similar to credit card processing, the banks and networks involved in the transaction must be compensated for their role in the transaction. ACH transfers are generally much cheaper than wire transfers. Actually, ACH transfers are even cheaper than credit card processing fees.

Flat fees typically range from $0.20 to $1.50 per transaction. If you’re charged based on a percentage, the percentage is usually in the 0.5% to 1.5% range. In some cases, the cost will be capped at a maximum charge per transaction, such as $10.

Wire transfers have outgoing and incoming costs. As a merchant, incoming wires typically cost anywhere from $15 to $45, depending on your bank and where the money is coming from (international transfers cost more).

Transfer Speed

Wire transfers move funds faster than ACH payments. For domestic wires, transfers can happen in minutes. But most wires process in less than 24 hours, at most.

ACH payments can take 1-3 days to move money between accounts. Some banks and processors offer same-day ACH. However, these services aren’t universal and they almost always require an additional fee on the transaction.

Security

Generally speaking, wires and ACH transfers are secure. But the data transmitted could be hijacked by fraudsters or criminals.

For example, the SWIFT network has been hacked multiple times. However, money stolen during an attack like that is the bank’s responsibility. Merchants usually won’t have to worry about this.

With that said, merchants still need to be careful about how they’re protecting sensitive bank account information associated with ACH and wire transfers. If that information gets into the wrong person’s hands, a criminal could pose as an employee or a vendor trying to re-route money to an unauthorized account.

Wire transfers are final. Funds cannot be reversed.

For ACH transfers, there are only three unique circumstances that allow for a reversal:

- An unauthorized transaction was revoked.

- Transaction date was earlier than the date authorized.

- Transaction amount did not match the authorization amount.

Any ACH transfer dispute needs to be filed within 90 days of the transaction and within 60 days of the statement being sent.

Convenience

For the most part, wire transfers are not convenient for customers.

As a merchant, you could potentially allow clients to pay for something using a wire transfer, but that usually means they have to visit their local bank in person. In today’s day and age of digital banking, that’s not going to speed up your collections process.

International Payments

The ACH network is designed for direct payments between bank accounts using the national Automated Clearing House in the United States. But it doesn’t support cross-border payments. This means that you’ll need to use international wire transfers if you’re collecting payments from other countries.

An international wire transfer costs more money than a domestic wire transfer. It’s also worth noting that international wires can take a few days to process, whereas domestic transfers are processed in the same business day.

Either way, wire payments have the edge over ACH payments if you need to transfer money between countries (even though the processing fees are higher).

Remittance Transfers

A remittance transfer applies to electronic transfers of $15 or more from someone in the United States to a recipient in a foreign country through a remittance transfer provider. While this is technically an international payment, it’s different because the payment initiated in the US. Whereas a payment that originated in another country and gets sent to the US is not a remittance transfer.

US federal law has certain regulations on remittance transfers and remittance transfer providers to protect people who want to send money abroad.

For example, people must have the right to know certain information about the transfer, including fees, taxes, exchange rates, amount expected to be delivered, and any applicable foreign tax fees.

People also have the right to cancel a remittance transfer within 30 minutes, as long as the money has not been deposited into the recipient’s bank account. This cancelation can be done at no charge.

Is it Better to Use ACH or Wire Transfers?

ACH transfers are typically more convenient and less expensive than wire transfers—making it a better option for most businesses. With that said, it can take up to three business days for an ACH transfer to process. So if funds need to be transferred immediately, wire transfers are the better choice.

ACH transfers are definitely more common than wire transfers for payment collection. They’re also more easier for your customers ad cheaper for merchants.

If your business needs to collect bank payments from international customers, then you’ll need to accept wires. But the vast majority of your payments are coming from domestic payers, you’ll be fine with ACH.

Final Verdict

There are pros and cons to both ACH payments and wire transfers.

But I’d only recommend these payment collection methods to B2Bs or merchants with high-ticket invoices. Furthermore, If you’re a high-risk merchant and struggling to get approved for credit card processing, ACH and wire transfers are both suitable alternatives to consider, at least for the short term.

It’s also worth noting that it’s typically in your best interested to provide your customers with as many different payment options as possible. So it’s a good idea to accept both ACH and wire options.

While the fees will vary between these to payment methods, there are other ways to offset these costs by lowering your credit card processing rates. To better understand this at a higher level, we have a guide on how to calculate processing rates. This will explain how to calculate your effective rate, which is your total cost to process payments.

Once you’ve determined this number, you can reach out to our team here at Merchant Cost Consulting for a complete audit and analysis of your statements. We’ll help lower your total cost of processing, without having to switch providers.

So if you end up accepting a wire that’s more expensive than an ACH transfer, it won’t matter in the grand scheme of things. Your processing rates will already be lower.

0 Comments