OpenEdge Review (2024)

While OpenEdge offers some positives, like interchange-plus pricing and negotiable rates, our experience has shown they’re one of the most expensive processors in the market, with some questionable billing tactics.

This review dives deep into OpenEdge’s fee structure—highlighting common charges and revealing how they inflate assessment fees. We’ll also share some real examples from client statements, including one shocking case where a merchant was paying over 10% in processing fees.

Whether you’re considering OpenEdge or already using their services, this insider take will help you understand what to expect and how to potentially save thousands on your payment processing costs.

MCC Insider Insights: Key Takeaways From Our Experience With OpenEdge

At Merchant Cost Consulting, we have dozens of clients using OpenEdge for payment processing. We’ve been auditing OpenEdge statements and negotiating with them on an ongoing basis for nearly a decade.

Truthfully, they’re not great. While there are a few things we like, they’re one of the most expensive processors on the market and some of their billing practices are unethical.

- OpenEdge offers interchange-plus pricing, which is our favorite type of contract structure.

- You can negotiate your rates with OpenEdge (assuming you know what to look for).

- They inflate assessment fees, which is a deceptive tactic that’s totally unethical.

- We’ve seen them charge merchants upwards of 10% for payment processing—more than triple what they should be paying.

- OpenEdge frequently increases processing rates and adds tons of bogus fees to statements.

Since we’ve audited and negotiated with virtually every major payment processor in the industry, we have a unique perspective on the market. This allows us to confidently assess how OpenEdge compares to its competitors and alternatives—and you won’t find this type of insider knowledge anywhere else on the web.

OpenEdge Fees to Look Out For

If you’re using OpenEdge to process payments, you need to be extremely diligent when reviewing your monthly statements. They’re notorious for adding bogus and unnecessary fees—and they’re constantly changing the names of these fees to make them sound more legit.

Here are some of the most common ones we see when we’re auditing statements.

Again, these are just the ones we see on a regular basis.

When we negotiate with OpenEdge on behalf of our clients, we’ve had success either eliminating them altogether or at least getting them reduced.

Here’s a screenshot from a recent OpenEdge statement we audited that includes a couple of these charges:

What’s even crazier about this example is that OpenEdge is charging a PCI Non Compliance Fee and a PCI Program Fee to this merchant.

It’s so easy to become PCI compliant that processors should be assisting merchants with this process. So that fee shouldn’t be there to begin with. But even if the merchant isn’t PCI compliant, then why would they be charged a PCI Program Fee?

It doesn’t make any sense.

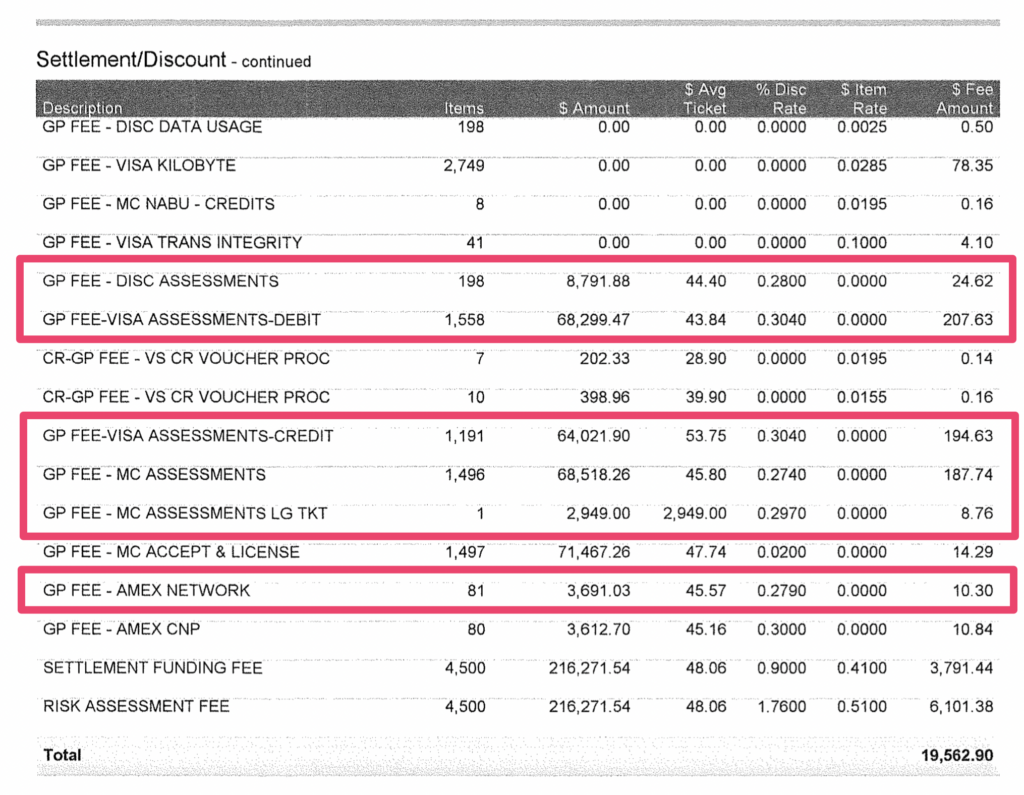

Here’s another example of unreasonable high Settlement Funding Fees and Risk Assessment Fees, showing on back-to-back line items of a recent statement:

For this particular merchant, these two fees alone cost them nearly $9,900 in a single month.

You can always try to negotiate and push back against OpenEdge by yourself. But if you need some help, just reach out to our team here at MCC for assistance. We know what to say and which buttons to push to ensure things go in your favor.

Watch Out For “Padded” Assessments On Your OpenEdge Statements

In addition to the one-off monthly fees mentioned above, you also need to be really careful about padded or inflated assessment fees from OpenEdge.

Similar to interchange fees, assessments are imposed at the card network level by Visa, Mastercard, Discover, and American Express. They’re non-negotiable and passed through to the merchant from the processor.

However, some payment processors “pad” these fees by charging higher rates than the card network. The reason why this is so deceptive and unethical is because the charges are presented on statements like they’re coming directly from the card networks.

But since most merchants don’t know what these assessment rates are actually supposed to be, then OpenEdge gets away with charging extra and simply pocketing the difference.

Let’s look at a real example from one of our clients using OpenEdge so you can see what I mean.

This is one of the most egregious examples of inflated assessments that I’ve ever seen.

Let’s start at the top with the Discover assessments. As you can see from the example, the discount rate listed on this statement is 0.28% on the total transaction volume of all 198 Discover transactions in this billing cycle.

Here’s the crazy part. The Discover assessment fee is only 0.13% of the total transaction volume. OpenEdge charged this merchant more than double what they were supposed to—and they disguised it as a legitimate charge from the card network. But in reality, that extra 0.15% is all profit for OpenEdge.

I put together this table that looks at each of the six assessments highlighted above. So you can see what OpenEdge is charging compared to the actual rates imposed by the card networks.

OpenEdge is basically doubling the assessment rate in each of these categories.

Had we not audited these statements on behalf of our client, the merchant would have no idea that OpenEdge is ripping them off.

OpenEdge Pricing and Credit Card Processing Rates

OpenEdge offers interchange plus pricing, but they don’t publish rates online. They offer customized pricing at different rates for every business.

Typically, we see rates lower when a merchant first signs up—and then those rates steadily increase over time.

Most businesses should be paying around 3% to process payments with OpenEdge. However, we’ve seen some examples where OpenEdge charges over 10%, which is outrageous.

We actually just had a new client come to us to audit their statements from June 2024. What we uncovered was jaw-dropping.

The merchant has six locations plus online transactions, representing 7 total accounts with OpenEdge. Here’s a closer look at each of the accounts for June:

This is one of the great injustices in the world of payment processing.

It’s an example of a major processor just taking advantage of a merchant. These fees should all be closer to 3%.

We’re just beginning our negotiations with OpenEdge on behalf of our new client. But we should be able to save them over $20,000 per month.

Is OpenEdge the Same as Global Payments?

OpenEdge has been rebranded as Global Payments Integrated. Global began phasing out the OpenEdge branding following its 2019 merger with TSYS. However, OpenEdge’s payment processing software is still being used today by merchants worldwide.

So you’ll notice a lot of similarities between this OpenEdge review and our review of Global Payments.

While the two companies are essentially one and the same, the fees and services are actually a bit different. Even though a merchant’s statements may say OpenEdge, they could still be boarded and process payments through OpenEdge’s systems.

Is OpenEdge Legit?

Yes, OpenEdge is a legitimate company.

Global Payments (formerly OpenEdge) handles over 4.6 million merchant accounts worldwide—covering over 100+ unique industries.

Although they’re legitimate, we find OpenEdge to be untrustworthy and totally unethical.

Our Final Thoughts on OpenEdge

If you’re seeking a new payment processing solution, we don’t recommend OpenEdge. The fees are outrageously high and you should avoid any processor that uses unethical billing practices, like padding assessments.

If you’re currently using OpenEdge, there’s a strong chance you’re overpaying.

But you’re actually better off sticking with them as opposed to looking for a new provider.Since they offer interchange plus pricing, the rates are 100% negotiable. So you can actually save a ton of money if you know how to approach this.

Want to find out how much you can save? Reach out to our team here at MCC for a free audit. We’ll help identify any overages or bogus fees on your OpenEdge statements and give you an estimate of how much you can save—all without having to switch providers.

We’ll even negotiate directly with OpenEdge on your behalf.

0 Comments