Seeing any “non-qualified” charge on your processing statement usually indicates you’re paying more than you should for those transactions.

The problem is that “non-qualified” can actually refer to two completely different types of charges, each requiring a different solution.

So if you see this on your statement, particularly Visa’s Non-Qualified Consumer Credit Fee, use this guide to understand exactly what you’re dealing with.

What is the Visa Non-Qualified Consumer Credit Fee?

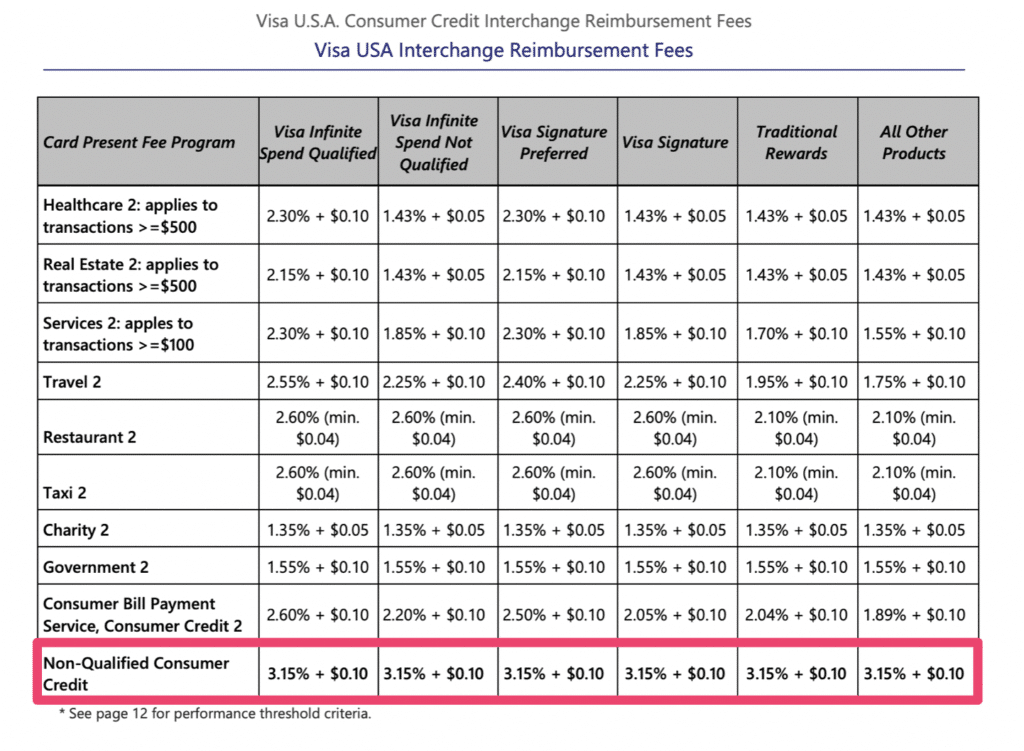

Visa’s Non-Qualified Consumer Credit Fee is a specific interchange category set by Visa. It’s 3.15% + $0.10 per transaction, and it applies to consumer credit cards that don’t meet the qualification criteria for lower-cost interchange rates.

This interchange category is applied to transactions that carry a higher risk, and Visa believes they warrant higher costs.

Compared to other Visa interchange rates, 3.15% + $0.10 is extremely high and among the highest rates you’ll see set at the card network level.

Why Transactions Downgrade to Visa Non-Qualified

There are several different processing issues that can cause transactions to “downgrade” to Visa’s non-qualified interchange category. Examples include:

- Using magnetic stripe readers instead of EMV chip-enabled terminals

- Missing security validation (like AVS or CVV)

- Settlement delays

- Authorization issues

- Forced transactions

- Incorrect MCC codes

- Mismatched processing methods

Essentially, any scenario that Visa deems to add risk to the transaction could trigger the non-qualified category designation.

Learn more: Most Common Interchange Downgrade Scenarios (and How to Avoid Them)

Situations When Visa’s Non-Qualified Rate Isn’t Actually a Downgrade

There are a handful of instances when the Visa Non-Qualified Interchange category is actually the best possible rate for a particular transaction. This typically will only apply to high-risk merchants or businesses processing non-secure online transactions.

While Visa doesn’t explicitly define a non-secure transaction, we typically see this applied to online transactions that have address mismatches or gateways failing to use 3D secure payments.

High-risk merchants often pay significantly more above standard interchange rates. So 3.15% + $0.10 isn’t the worst rate you could see on your statement.

2 Types of Non-Qualified Charges

When you see the term “non-qualified” in your statement, it’s crucial that you quickly identify which type of fee you’re dealing with because the solutions and costs are completely different.

1. Visa’s Non-Qualified Interchange Rate

This is a legitimate interchange rate set by Visa. Like all interchange fees, they’re non-negotiable and charged for any transactions fitting the qualification criteria.

It’s important to understand that the Visa Non-Qualified Consumer Credit Fee doesn’t include your processor’s markup. This is just what’s being passed through your processor from Visa and represents the wholesale rate for the transaction.

So in reality, you’ll actually end up paying more than 3.15% + $0.10 per transaction once you factor in the processor’s markup (which varies based on your contract).

2. Processor’s Non-Qualified Fees

This is where we see many merchants get taken advantage of. If you’re on a tiered processing model, your processor creates their own “non-qualified” category that has absolutely nothing to do with Visa’s actual interchange rates.

These processor-defined qualification terms are often ambiguous and much higher than Visa’s non-qualified fees (which are already high).

With tiered pricing, there are typically three different buckets where every transaction is categorized—qualified rate (lowest cost), mid-qualified (medium cost), and non-qualified (most expensive).

We tend to see processors use the qualified rate as a marketing ploy to convince merchants to sign these contracts. But few, if any, transactions actually fall into the qualified bucket. Most end up being charged the non-qualified rate, which could be upwards of 3.49% + $0.30 per transaction or higher.

How to Tell Which Non-Qualified Fees You’re Being Charged

You should be able to figure out fairly quickly whether you’re being charged Visa’s legitimate Non-Qualified Consumer Credit interchange fee or if your processor is ripping you off.

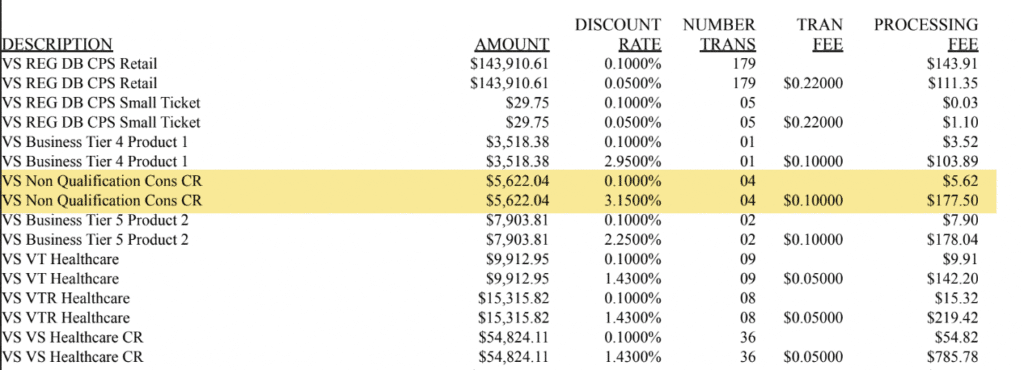

The first thing you should do is check the math. If you’re being charged 3.15% + $0.10 for non-qualified Visa transactions, it’s likely the Visa interchange rate. Here’s an example I pulled from one of our clients’ statements:

As you can see, the VS Non Qualification Cons CR has a 3.15% discount rate and $0.10 transaction fee, which matches the rate set by Visa at the interchange level.

This is clearly an interchange-plus pricing structure, where other interchange categories are shown in detail on every line item, and the processor is marking up 0.10% (10 basis points) on the total amount.

If you don’t see a breakdown of interchange rates, but see your fees listed in categories like:

- Qualified

- Qualified Rewards

- Mid-Qualified

- Mid-Qualified Rewards

- Non-Qualified

Then you’re on a tiered pricing contract, and the non-qualified category is being assessed solely at your processor’s discretion. It has nothing to do with Visa’s qualification terms.

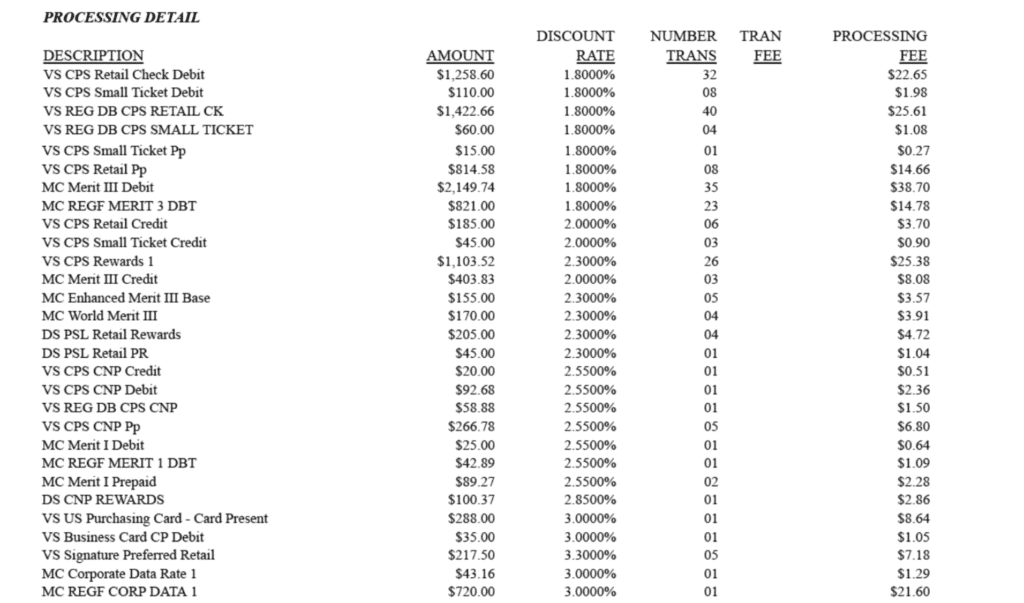

Here’s another statement example from the same processor (PayJunction), except this time, it’s tiered pricing:

Even though we don’t actually see “qualified” or “non-qualified” in the description, we clearly see the tiered discount rates:

- 1.80%

- 2.00%

- 2.30%

- 2.55%

- 3.00%

If you were to actually look up the interchange fees at the card network for each of these categories, they would not match the rates above.

We can use the very first line item as an example—VS CPS Retail Check Debit.

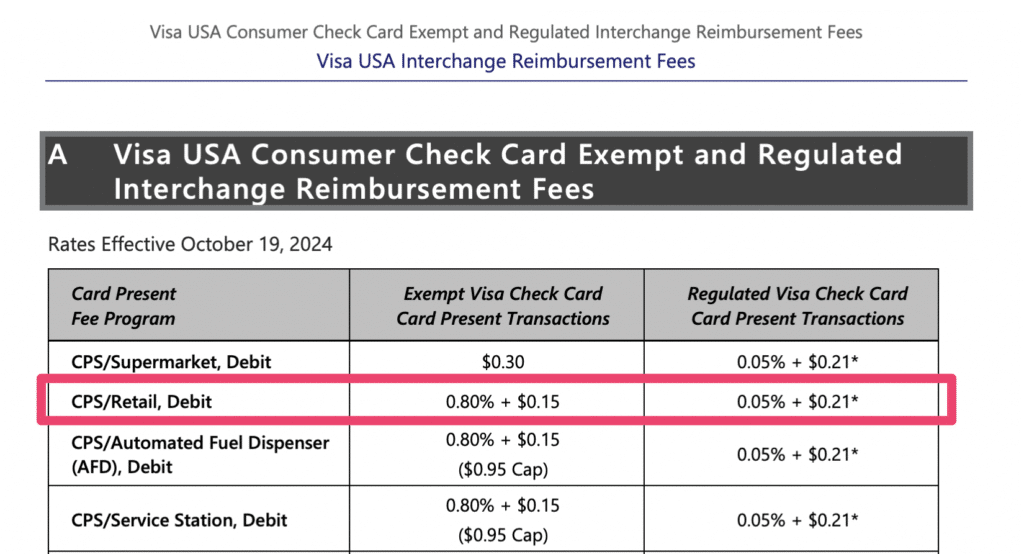

PayJunction is charging 1.80%, which is its lowest qualified rate. But Visa’s actual interchange rate here is 0.80% + $0.15 or $0.05 + $0.21 per transaction.

PayJunction added over 100 basis points over interchange as the markup for its lowest possible qualification category. This just goes to show you how much of a rip off tiered pricing is.

What Merchants Can Do About Non-Qualified Fees

Regardless of what’s causing them, non-qualified fees are not good. So if you’re seeing them on your statements, then I can guarantee those transactions are more expensive than they should be—and you could be taking steps to avoid them.

If it’s a Visa Non-Qualified Consumer Credit Fee, you need to identify exactly what’s causing your transactions to downgrade. Whether it’s outdated tech, human error, problems with your terminals, you should consult with your processor ASAP to sort this out.

If you’re paying non-qualified fees because you’re on a tiered pricing structure, you need to get yourself out of this contract ASAP.

Non-qualified transactions will always haunt you if you’re on a tiered plan, regardless of what your processor says. It’s the worst possible pricing structure for merchants (even worse than flat-rate processing), and you’ll always pay a huge markup over the actual interchange rate.

You don’t necessarily need to switch processors, but you do need them to restructure your contract and put you on an interchange-plus model.

If you need help with this process, our team here at MCC can negotiate everything on your behalf to ensure your processor gives you the best possible deal.

Final Thoughts

Visa’s Non-Qualified Consumer Credit interchange category is expensive. So don’t ignore this fee when you see it on your monthly statements.

Paying an extra 1% or more on these transactions can add up quickly—costing you tens of thousands of dollars in unnecessary fees throughout the year.You should also double-check that the non-qualified charge is a legitimate interchange fee set by Visa, and not a deceptive pricing scheme set up by your processor. Learn how to read your monthly statements to ensure you’re not being ripped off, and you can always get a free audit from our team if you still have questions.