Chase Paymentech is one of the oldest and largest merchant acquirers on the market. With roughly four decades of providing payment solutions, this subsidiary of JPMorgan Chase handles over $1 trillion in processing volume per year.

Whether you’re currently using Chase Paymentech or you’re thinking of switching, you can use this review to learn more about how Chase stacks up against the crowd. We’ll dive into its pros, cons, fees, and other insider tips to help you stay informed.

Our Quick Take on Chase Paymentech

In a nutshell, Chase Paymentech is solid in the sense that they’re a highly reputable merchant acquiring service backed by one of the largest banks on the planet. But Chase’s pricing isn’t as competitive as other providers, and they’re a bit behind the eight-ball in terms of their technology—which we classify as legacy systems.

Pros

- Dynamic currency conversion.

- Level 2 and Level 3 rate optimization for commercial cards.

- Discounted pricing when merchants accept credit cards issued by Chase Bank.

Cons

- Outdated technology.

- Pricing is never the cheapest.

- Limited software integrations (and pricey for the available options).

Chase Payment Solutions Pricing and Credit Card Processing Rates

Chase offers custom pricing to each merchant, with interchange-plus pricing available for larger businesses. That said, Chase tries to get smaller businesses on a flat-rate plan with rates starting at:

- 2.6% + $0.10 per transaction for taps, dips, and swipes

- 2.9% + $0.25 per transaction for online purchases

- 3.5% + $0.10 per transaction for manually keyed cards

These rates are high, and we don’t recommend settling for these default options. You can definitely negotiate a better deal, particularly if your business processes a higher volume.

For example, we recently negotiated a deal for one of our clients who processes about $1.1 million annually. And we got their rates down to 0.05% + $0.02 per transaction for Visa, Mastercard, and Discover.

Chase Offers Cheaper Rates For Transactions Processed Through ChaseNet

One thing that’s really unique about Chase is that they’re a card issuer and acquirer bank. So they’re willing to give merchants a better deal whenever they accept a Chase-issued credit or debit card.

It’s still a win-win for Chase because they’re processing everything in-house directly instead of having to go through Visa. They’re essentially double-dipping because they get processing fees from the merchant and the interchange rates that they set on each type of Chase card.

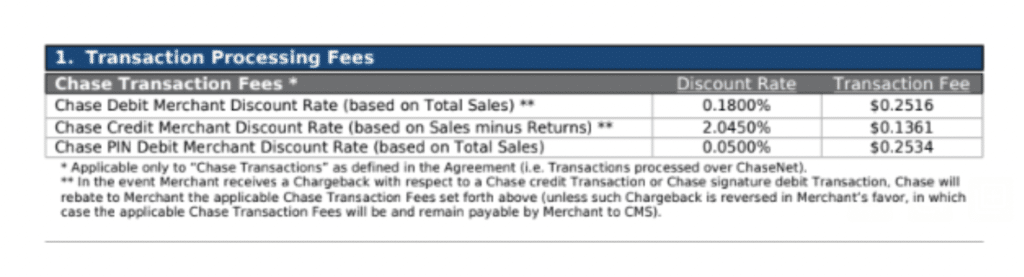

Here’s an example that we pulled from a merchant agreement:

As you can see, 2.045% + $0.1316 per transaction for Chase-branded credit cards is cheaper than the standard rates ranging from 2.6% + $0.10 to 2.9% + $0.25.

In my opinion, these rates could be even lower. It’s a closed-loop system (meaning there’s no separate communication between the acquirer, issuer, and payment network) so Chase can still be profitable at lower rates. So try and get this as low as possible when negotiating your contract.

Keep in mind that this won’t apply to all of your transactions. But Chase has over 149 million cards in circulation globally, which is the most of any issuer in the world.

Other Chase Fees

In addition to transaction fees, Chase has a plethora of other charges you may find on your statement—many of which are billed per item or incident.

Examples that we commonly see include:

- Voice Authorization — $0.90

- Voice AVS Authorization — $1.75

- Chargeback or Dispute Fee — $10

- Re-presentment Dispute Response Fee — $10

- Pre-Arbitration and Compliance Dispute Denial — $15

- Rejected Transaction Fee — $0.02

- POS Terminal Authorization — $0.02

- Safetech Page Encryption Fee — $0.025

- Safetech Tokenization Per Item Fee — $0.005

We’ve also seen Chase charge a monthly maintenance fee to its clients, which varies based on the account. We’ve seen it as low as $4 per month but honestly this is something that should be eliminated from your statements altogether—regardless of how marginal it is.

Chase Offers Dynamic Currency Conversion

Chase’s Dynamic Currency Conversion (DCC) service allows cardholders to pay in their local currency when buying from international merchants. This is also known as CPC (cardholder-preferred currency).

Everyone knows exactly what they’re paying upfront, and the rate is guaranteed at the time of purchase.

In terms of transparency, it’s convenient for cardholders to compare pricing. However, the exchange rates may be less favorable than the standard bank rate you’d get for currency conversion.

This isn’t something that you’ll find from every provider (although Fiserv also offers it).

We Have Mixed Feelings About Chase’s Tax Augmentation Service

Chase recently started a Tax Augmentation Service, which (theoretically) should save money for merchants. But upon further inspection, you’re not saving as much as you should be.

Let’s break this down.

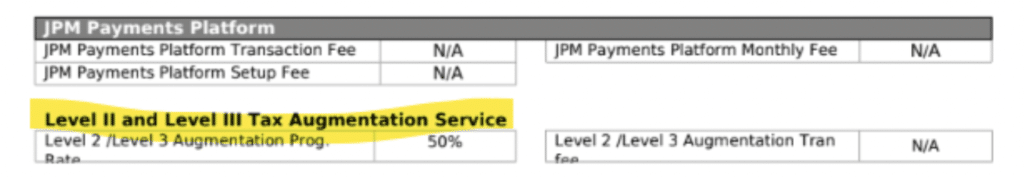

Chase claims that this program optimizes Level 2 and Level 3 enhanced data rates—reducing the rates you’d be paying at the interchange level. However, Chase is actually taking a percentage of this savings from you.

Here’s an example I pulled from a Chase Schedule A to Merchant Agreement that shows Chase is taking 50% of the savings from the merchant on this program.

It’s essentially the exact same thing we’ve seen with Fiserv’s commercial card optimization program, which I just covered in my Fiserv review.

Chase is already getting the processing fees associated with this transaction. You’re collecting extra card data to make the transaction more secure and less risky for the card networks, and you’re being rewarded with a lower interchange rate.

So why is Chase taking 50% of those savings and pocketing them for themselves? They shouldn’t be.

While I like the idea of this, those rates aren’t truly optimized in my opinion if you’re not actually getting all of the savings.

Chase is a Legacy Technology Provider With Limited (and Expensive) Integrations

Despite its size, one major drawback of Chase Paymentech is its technology. They’re really behind other players in this space.

Beyond their payment gateway with Level 2 and Level 3 enhanced data capabilities, Chase is basically a legacy provider technology-wise.

They don’t have many integration options with different software. And when they do, the pricing for these integrations isn’t very competitive.

Final Thoughts on Chase Paymentech

Chase is obviously a giant in the payments space. They’re solid, but definitely not the cheapest option on the market.

If you’re a bigger company, you have a better chance of getting lower rates. But we find that Chase typically gets its biggest clients through their banking relationships, not through channel relationships that you’d normally see with other processors.

Maybe that’s why they’re not really incentivized to improve their technology or offer lower rates? They figure that if a merchant is already banking with them and processing payments, they’d rather keep everything under one roof regardless of the cost.

Just know that if you’re currently using Chase Paymentech, these drawbacks aren’t really a reason to cancel your contract or switch providers. They’re still room for cost-saving opportunities if you know how to negotiate a better deal—something that our team at MCC can handle on your behalf.

So if you think you’re overpaying for Chase Payment Solutions and want to get an expert opinion, reach out to us for a free audit.