Surcharging has been a hot topic lately for consumers and merchants alike. Some small business owners implement a surcharge to save money on credit card processing.

What is a surcharge?

In short, it’s an extra fee added to a credit card transaction to cover the costs of accepting the customer’s card. If a consumer wants to pay via credit card, the merchant can pass their processing costs to the customer with a surcharge.

If you’re considering adding a surcharge to your goods or services, make sure you read this guide first. We’ll explain why businesses are implementing this strategy and give you some alternative solutions to increase your profit margins.

How Credit Card Surcharges Work

For simplicity’s sake, let’s assume your processor charges you 3% for credit card transactions. To make it easy, we’ll say the total value of a hypothetical sale is $20.

- Without a surcharge: The customer pays $20, and the merchant is charged $0.60.

- With a surcharge: The customer pays $20.60.

In both scenarios, the credit card processor still gets their fee. A surcharge just determines if it’s coming from the merchant or from the customer.

Are Credit Card Surcharges Legal?

Credit card surcharge laws vary from state to state. Rules are continually changing with new laws being passed. But as of now, credit card surcharges are illegal in Colorado, Connecticut, Kansas, and Massachusetts.

- Under federal law, surcharge fees are illegal on debit card transactions in all 50 states.

- 4% is the maximum amount allowed for a surcharge. This is a national regulation.

Consult with a lawyer or your state’s Attorney General to verify if surcharging is allowed under local legislation. Even if it’s legal, there might be specific stipulations that you need to follow.

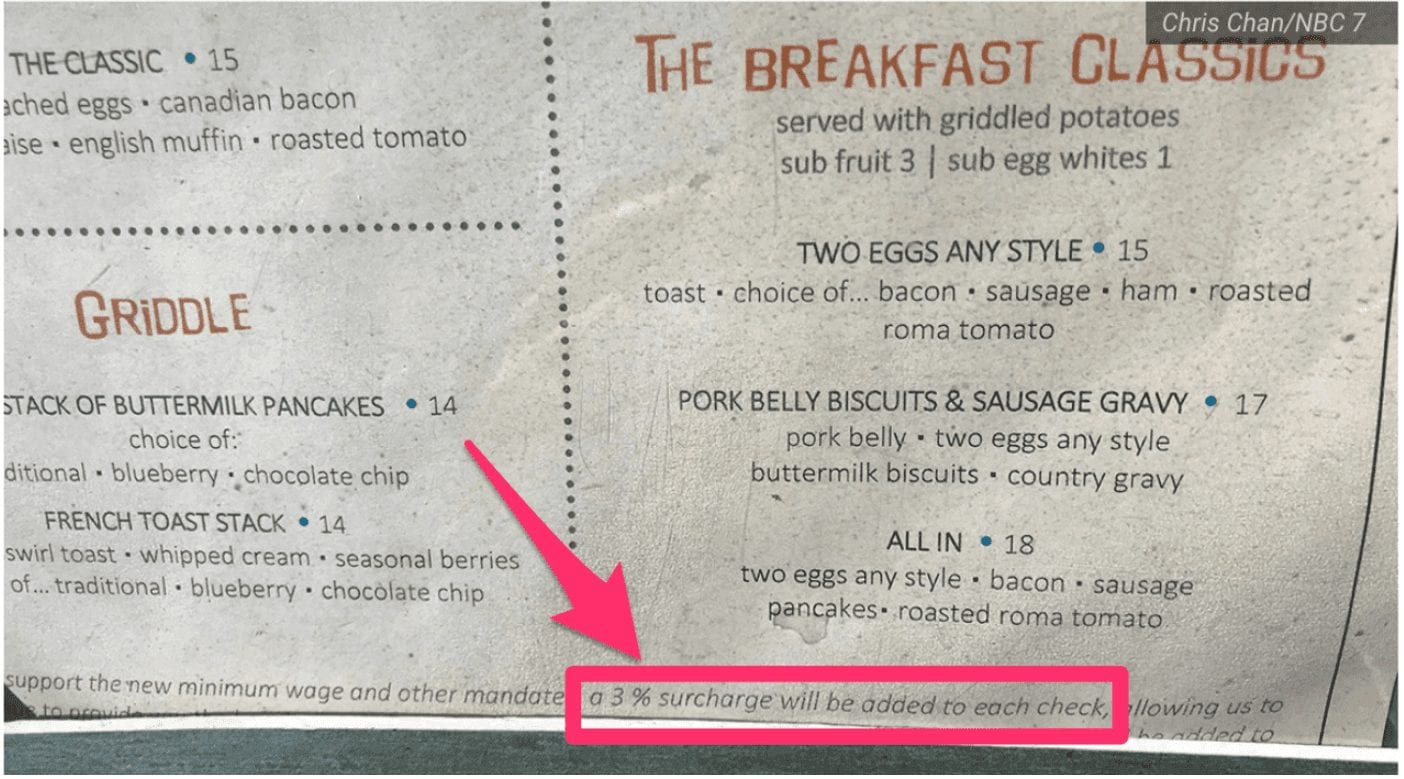

For example, according to a recent story from NBC, a southern California restaurant was forced to pay a $34,500 fine for adding a 3% hidden surcharge to patrons’ bills.

The Attorney General said the business violated the Business and Professions Code of California’s False Advertising and Unfair Competition Law.

Even though the surcharge was disclosed on the menu, the Attorney General’s office says that it needs to be clear, distinct, and as big as the other prices.

Card Association Rules For Surcharging

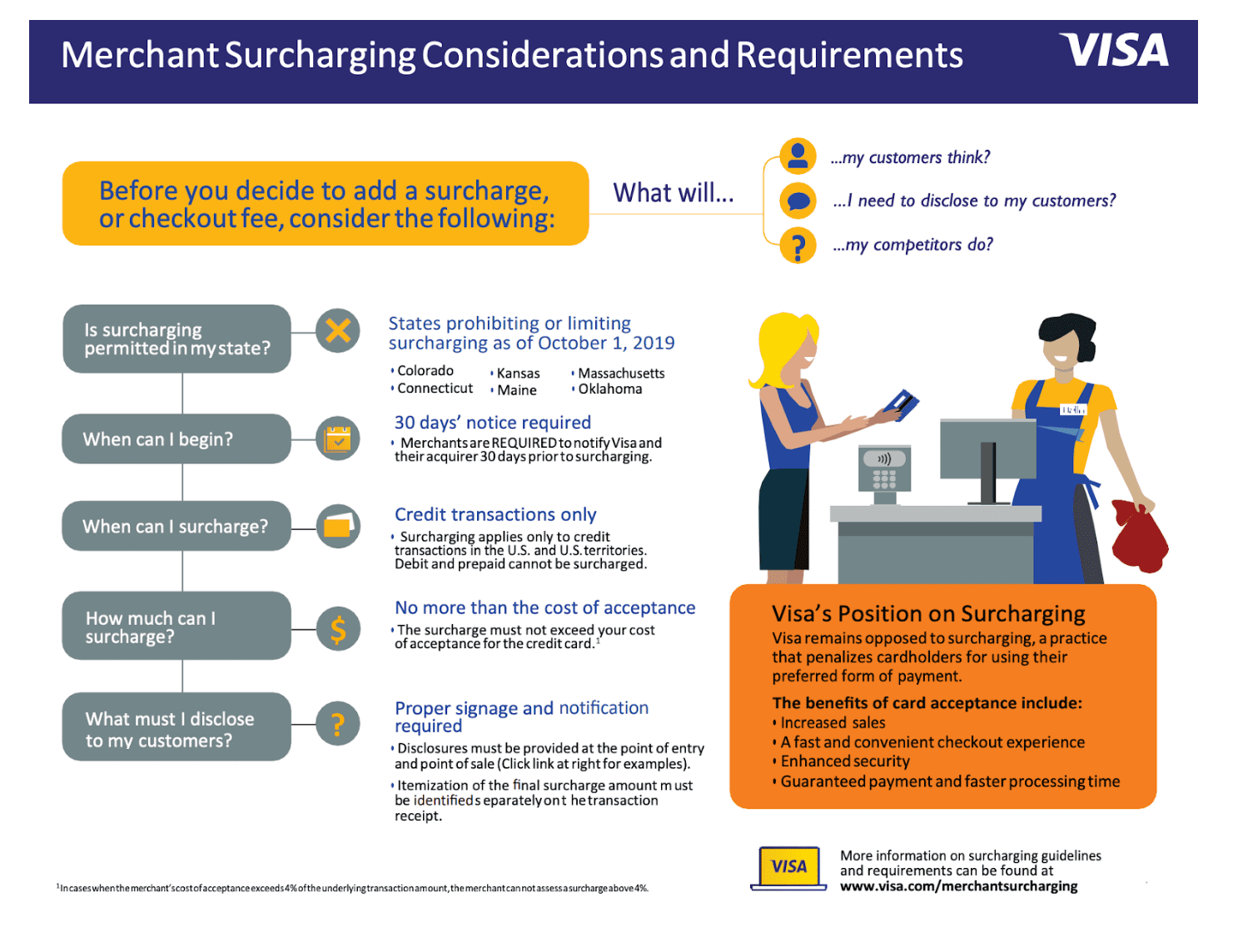

Assuming it’s legal to surcharge credit card transactions in your state, you’ll also need to abide by card association requirements.

These rules will vary slightly depending on the credit cards that your business accepts. Visa and Mastercard have different regulations than American Express. Discover has its own policies as well.

If you accept all of these cards, you’ll need to review all of their requirements before you consider implementing a surcharge program.

Credit card associations want to make sure the merchant isn’t discouraging customers from using one card brand over another (Example: discouraging American Express transactions by making it cheaper for customers to pay with a Visa card).

In most cases, you’ll need to notify your credit card processor and credit card associations before you start surcharging credit card transactions.

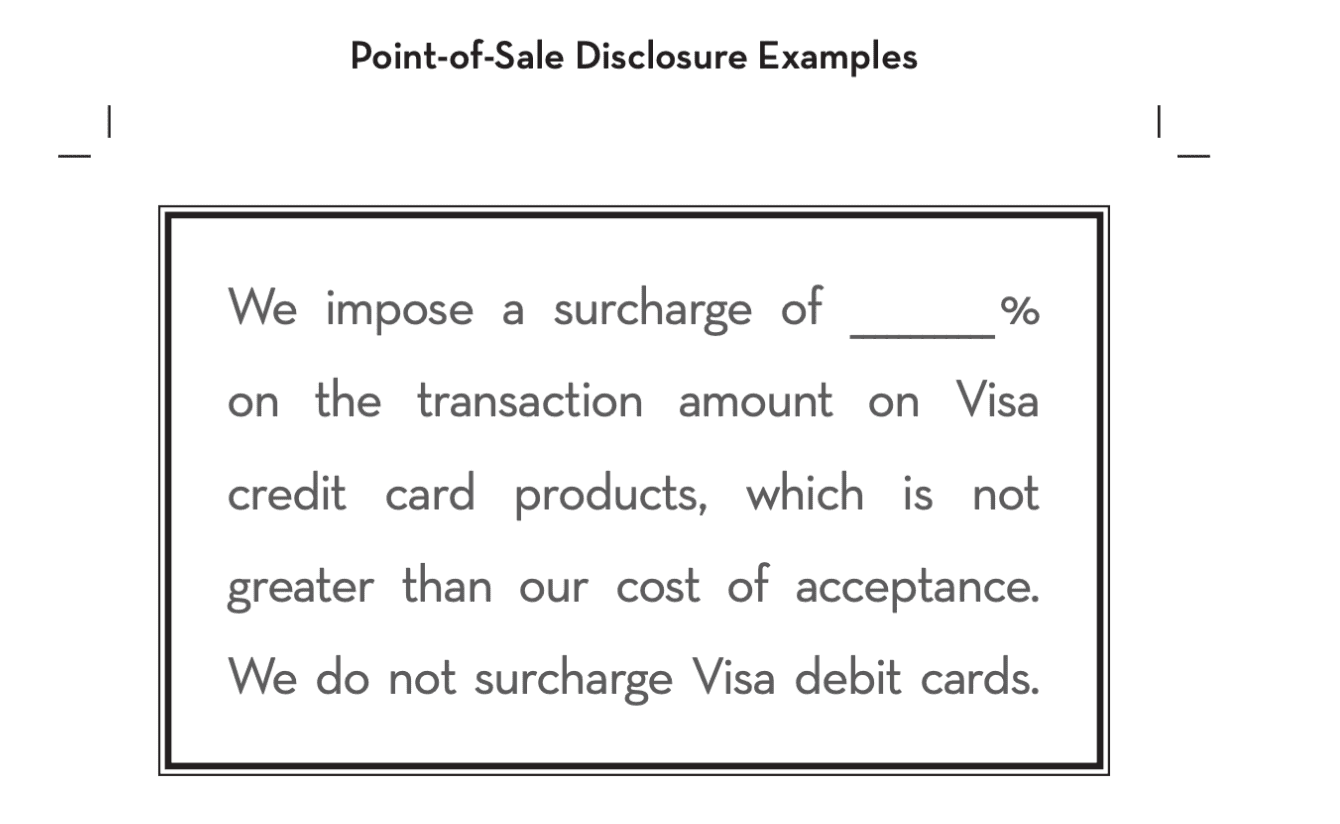

Disclosure is arguably the most important part of credit card surcharging. The surcharge cannot come as a surprise to the customer. Here’s an example of a surcharge disclosure template from Visa:

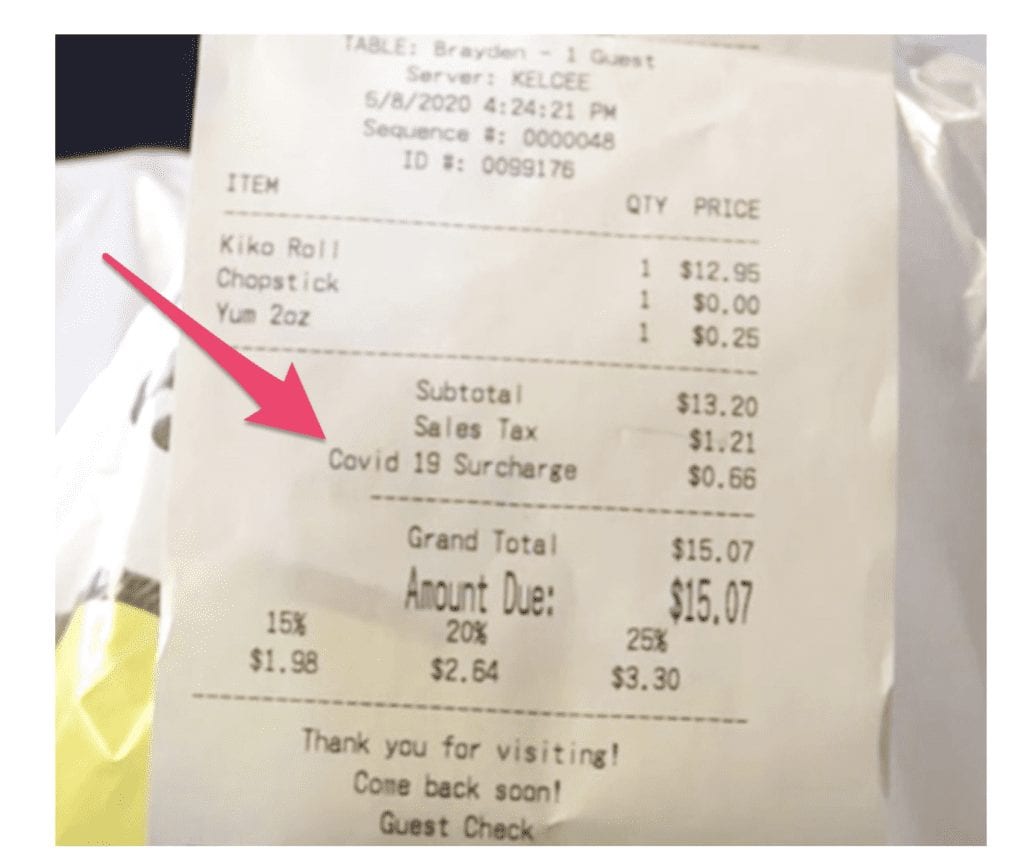

Surcharges must appear as a separate line item on the customer’s receipt as well. These same rules apply for businesses with an eCommerce website.

Again, rules will vary slightly for each card association. So read through all of your agreements to ensure that you’re complying with each card brand.

How to Add a Surcharge to Credit Card Transactions

If you want to implement credit card surcharging at your business, these are the steps that you need to take.

- Verify that surcharging is legal in your state. Check with your local Attorney General’s office to ensure full compliance.

- Notify your credit card processor and card associations. In many cases, you’ll need to submit your intentions in writing, at least 30 days in advance to surcharging transactions.

- Review the rules and requirements for each credit card association.

- Make sure that your credit card processor supports surcharging. Figure out what type of documentation and reporting steps need to be followed.

- Post appropriate disclosure signs at the point of sale. Do not deceive your customers.

Here’s another helpful visual representation from Visa for merchants who are considering credit card surcharges.

Should Your Business Add a Credit Card Surcharge to Transactions?

In short, no—you should not be adding a surcharge to transactions.

There are some circumstances where a handful of businesses have been able to do this successfully. But this really only works in certain locations where customers haven’t been impacted financially by the pandemic. If you’re in an area where your clientele is employed and has plenty of spending power, they’ll be happy to support their favorite businesses, even if it means spending a few extra dollars.

But who are financially burdened by don’t want to see extra costs added to their bills, receipts, and invoices.

Never add a surcharge fee to debit cards. This is illegal, and not allowed anywhere.

Alternative Methods to Surcharging

So how can you make more money without surcharging your customers? Try these five tips as a way to offset your credit card processing costs.

Modify Your Product and Service Offerings

Consider eliminating low-margin products or services. If you’re in an industry where inventory goes bad or spoils quickly, you want to make sure that you eliminate waste whenever possible.

The restaurant industry is a perfect example of this. You might want to reduce the size of your menu. Focus on your most popular items and the food where you can overlap fresh ingredients from dish to dish.

Do you own a barbershop, nail salon, or business in the beauty and personal care industry? In some states, these businesses have been forced to close their doors. You might have to get creative and start selling t-shirts, gift cards, or other merchandise to increase your cash flow.

Offer Cash Discounts

To avoid credit card processing fees altogether, you might want to consider offering customers discounts for paying cash. This can be a win-win for both parties since customers are looking for ways to save money as well.

Related Reading:

Increase Your Prices

Instead of surcharging, you’d be better off just increasing your prices. Businesses need to update their pricing annually or every other year to keep up with inflation. So you can use this as an excuse to bump up your prices as well.

Customers would rather see a higher price that’s transparent, as opposed to being blindsided by a surcharge or convenience fee.

Some businesses disguise surcharges as convenience fees or a processing fee. But it’s all the same thing. If you’re adding an additional fee for credit card purchases, it’s a surcharge.

Accept Tips

Obviously, some companies already accept tips for their employees. This is the norm for foodservice businesses.

But consider adding a tip jar or tip line item on credit card receipts in other industries as well.

For example, maybe you have a dry cleaning business. Do people normally tip the counter staff at a dry cleaner? Probably not. But if you give them the option, they might be willing to do so. This puts the ball in your customers’ hands. If they want to give a little extra to support your staff, they’ll have the opportunity to do so. If not, no problem.

Lower Your Credit Card Processing Fees

In a time when businesses are trying to save costs in as many ways as possible, you should be evaluating your payment processing fees.

Believe it or not, the credit card fees you’re currently paying aren’t necessarily set in stone. How much do you pay each year in credit card processing? Some merchants pay tens of thousands or even upwards of $100k in processing fees.

I’m sure you could use an extra $10k or $20k right now. Who couldn’t?

Consult with our team at Merchant Cost Consulting to find out how much money you can save on credit card processing—without switching processors.

How to Save Money on Credit Card Processing Fees

Merchants turn to credit card surcharging as a way to save money on credit card processing. This is especially true for small business owners with slim profit margins.

However, credit card surcharging is not that simple. As you’ve learned in this guide, there are several different rules and regulations that you need to follow in order to comply with local and federal laws. You’ll also have to abide by card association requirements.

Failure to comply could lead to fines or other penalties imposed by various parties.

Furthermore, credit card surcharging is not convenient for the customer. Making them pay extra to use their credit cards can damage your company’s reputation.

Fortunately, there are other ways to save money on credit card processing fees that don’t involve surcharging. Did you know that your credit card processing rates can be negotiated?

Here at Merchant Cost Consulting, we can negotiate those rates with your credit card processor. You’ll benefit from the cost savings without passing additional charges to your customers. You won’t have to worry about breaking any card association rules or local laws either.

Final Thoughts on Surcharging Credit Card Purchases

While credit card surcharging might seem like an appealing way to recoup costs associated with accepting credit card payments, that’s rarely the case. If you impose surcharges or charge convenience fees, you’ll likely upset your customers and you could even find yourself in legal trouble.

In most instances, credit card surcharging is more of a hassle than anything else.

If you’d still like to move forward and implement credit card surcharges, we recommend that consult with a lawyer and your local Attorney General’s office before you do anything. You’ll need to notify your processor and credit card associations as well.

For an easier way to save money on credit card processing, contact us here at Merchant Cost Consulting for a free audit and analysis.