American Express processes eight billion transactions per year. If you have a business that accepts Amex credit cards (which you should), then you’re paying a fee each time a customer pays for something using an American Express card.

But here’s something you might not know. Not every merchant pays the same fees for Amex transactions.

In fact, you can even negotiate your Amex merchant fees with your processor to save money on credit card processing.

Does this sound like something you’d be interested in? You’ve come to the right place.

This guide will show you how to save money on Amex merchant fees and keep your credit card processing rates as low as possible.

Tips to Reduce Amex Processing Rates

Our team here at Merchant Cost Consulting is always finding new ways to save our clients money on credit card processing. Based on our industry experience, we’ve narrowed down the best tips and strategies that you can use to reduce Amex processing rates on your own:

Understand Why American Express is Different For Merchant Fees

American Express has a reputation amongst business owners and CFOs for having higher processing rates compared to other card networks.

These high rates have historically prevented some merchants from accepting Amex cards altogether. I still walk into some businesses that flat out do not accept Amex.

This is not something that we recommend. Turning away a major credit card brand can cause problems for your business. Instead, you can simply take the time to understand why Amex is so different.

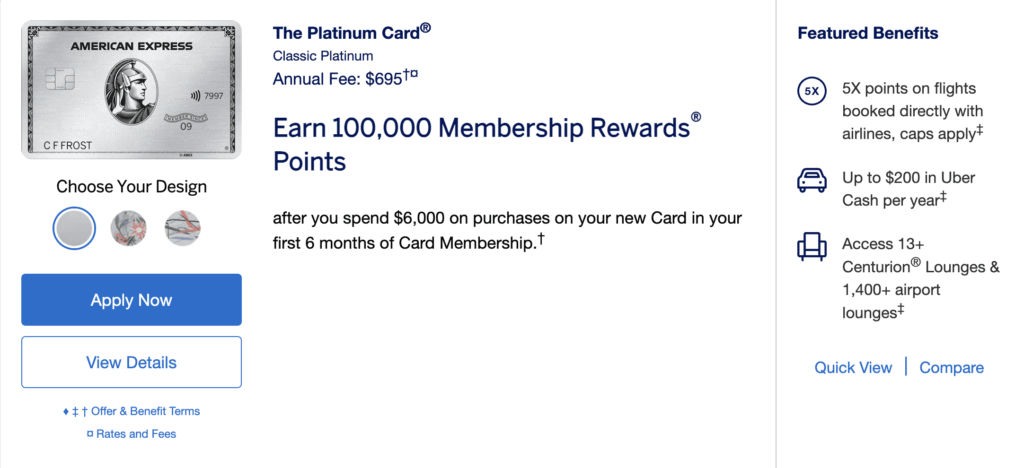

American Express operates as a card network and card issuing bank. You can go to the Amex website and get a card directly from the network.

Visa and Mastercard rely on third-party banks to issue their credit cards. So you’ll see additional branding on those cards to represent the issuing bank.

As a result, Amex has more control since they use a closed-loop network. They don’t rely on the backing of larger banks to issue credit and process transactions.

So the interchange fees imposed by American Express at the card network level are typically higher than other networks.

American Express also offers different processing structures for merchants. There are two different categories:

- Amex OptBlue — Amex OptBlue initially launched back in 2014. OptBlue allows merchants to accept credit cards through third-party credit card processors. This allows for simpler reconciliation and the ability to process all credit cards through a single provider.

- Amex Direct — Merchants that process more than $1 million per year in American Express transactions are mandated to go through Amex Direct. In this scenario, the merchant must have a direct merchant agreement with American Express to accept these cards. This requires a separate merchant account.

Believe it or not, merchants on Amex Direct merchant accounts typically pay more per transaction than the businesses on OptBlue.

You can see all of the Amex Interchange Rates and Processing Fees here, along with more information about how these rates are determined and the latest Amex updates.

Audit Your Monthly Statements

Take the time to sit down and review your monthly statements. Look at how much you’re being charged for American Express transactions, and compare those fees to your transactions from other cards.

Depending on your processing structure, you might find these rates to be the same. If all of your transactions are priced equally, then that’s a red flag—and it’s an indicator that you’re overpaying for credit card processing.

The best way to save money on credit card processing and lower your Amex merchant fees is through an interchange plus agreement.

This means that you pay the interchange fee imposed at the network level (by Amex and other card brands), plus a markup fee imposed by the processor.

Here are some resources to help you with the auditing process:

- Complete Guide to Interchange Fees and Rates

- Average Credit Card Processing Fees

- How to Lower Credit Card Processing Fees

Make Sure Your Equipment is Set Up Properly

Outdated hardware and software could lead to higher merchant fees.

You might be paying EMV fallback fees or PCI non-compliance fees.

Ensuring that your POS systems and credit card terminals are updated to support dip and tap transactions is usually an easy fix. You should also make sure your staff is trained properly and that customers are instructed to use the most secure transaction method—rather than relying on swipes or manually keyed transactions.

Negotiate With Your Credit Card Processor

Most merchants don’t realize that they’re processing rates are negotiable. Sometimes picking up the phone and negotiating is all it takes to lower your rates.

To be clear, interchange fees and assessments imposed by Amex at the card network level are non-negotiable.

But all of the processor markup fees and extra fees are totally up in the air. Your processor does not want to lose your business, so it’s better for them if they lower your rates instead of sending you elsewhere.

You do not need to change processors to save money on merchant fees.

Take a look at your contract to see how much time is left on the agreement. The less time remaining, the more leverage you have in your negotiations.

Continue to Monitor Your Statements

After you’ve negotiated with your processor and lowered your rates, you still need to monitor your statements to see if they’ve actually lowered your merchant fees.

Credit card processors are known for shady practices and not being transparent. So you really need to look closely at your statements.

They might say they’ve lowered your rates. But then all of a sudden, you start to see other random fees appearing on your account—like terminal fees, incidental fees, gateway fees, PCI compliance fees, regulatory fees, and other nonsense.

If you notice chargebacks from American Express on your monthly statements, refer to our guide on Amex chargeback reason codes to better understand where they’re coming from and how you can prevent them.

Consult With an Expert

Auditing credit card statements and monitoring your transactions each month can be challenging for many business owners. Even if you can find the time to do this on your own, these statements can feel like you’re reading a foreign language.

But auditing statements is something that our team does every day here at Merchant Cost Consulting.

Not only will we review your statements for free, but we’ll also negotiate your rates directly with your processor.

We know exactly what to look for and how to handle these negotiations. Our team is trained to spot bogus fees on your statements as well, and get them removed for good.

We’ll continue to monitor your statements in the future—ensuring that your processor isn’t trying to pull a fast one on you.

Final Thoughts

American Express cards are typically the most expensive transactions for merchants. But you don’t have to take these fees at face value.

There are lots of different ways that you can lower your Amex merchant fees and processing rates. Just use this guide as a blueprint to get started.

If you need some help, our team here at MCC will give you a free audit and analysis to see how much money you can save on credit card processing. Reach out today, and we’ll get back to you ASAP!