Merchants and consumers alike should both be aware of the credit card surcharge laws in Minnesota.

For businesses, this information will help you stay compliant and avoid any potential fines, fees, or legal penalties. And as a consumer, keeping yourself informed on the surcharge laws in your state can prevent you from getting ripped off by companies in violation of the law.

Here are the quick facts you need to know about surcharging credit card transactions in Minnesota:

- As of January 1, 2025, Minnesota merchants must include mandatory surcharge fees in the advertised price.

- Credit card surcharging is legal if the fee can be reasonably avoided by the consumer (like paying cash).

- Minnesota state law allows credit card surcharges up to 5% of the purchase price (but Federal law caps this at 4%).

- Non-compliance with Minnesota’s updated Deceptive Trade Practices Act is subject to fines of $25,000 per violation.

- Credit card surcharges in Minnesota are subject to sales tax and use tax.

There’s a lot to unpack here, so we’ll dive deeper into the specifics of these surcharge laws below.

Disclaimer: This information is for reference only, and it does not constitute legal advice. Consult with an attorney with any legal-specific questions.

Is Surcharging Legal in Minnesota?

Yes, it’s currently legal for merchants to surcharge transactions in Minnesota, as long as the surcharge fee is included in the advertised price.

This is part of Minnesota’s Deceptive Trade Practices Act, which modified Minnesota Statute 325D.44, which went into effect on January 1, 2025.

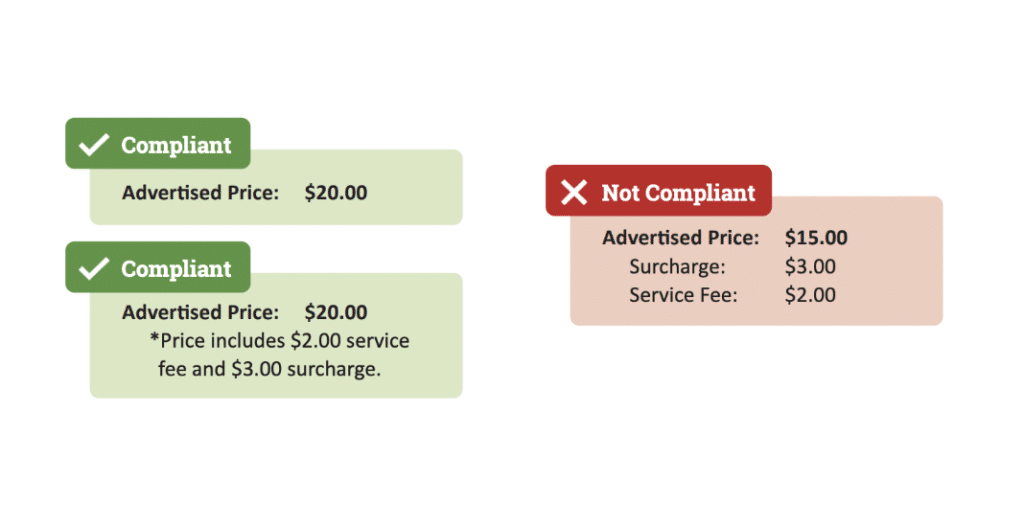

Here’s an example taken directly from a resourced provided by the Minnesota Attorney General Office showing what’s compliant and what’s non-compliant based on this new law:

Does This Apply to Credit Card Transactions?

Minnesota’s new Deceptive Trade Practices laws defines mandatory fees as fees that are not reasonably avoidable by the customer. So credit card surcharging is still legal and doesn’t necessarily have to be listed in the advertised price—as long as the consumer can reasonably avoid the fee (by paying cash, for example).

For example, if you’re running a cashless business and only accept credit or debit cards, then no, you can’t surcharge credit card transactions because this fee is not reasonably avoidable.

The same idea applies to online transactions or sales made over the phone. In these scenarios, it’s not reasonable for customers to pay with cash, so surcharge fees cannot be applied separately (unless they’re included in the advertised price).

Credit card surcharging laws are governed by Minnesota Statute 325G.051, which says credit card surcharges legal if:

- The customer chooses to pay via credit card instead of cash, check, or debit card.

- The merchant posts a sign on the premises notifying customers of the surcharge fee.

- The merchant verbally notifies the customer of the surcharge at the time of the transaction.

- The surcharge does not exceed 5% of the purchase price.

There are two really interesting points to Minnesota’s surcharge laws that I want to highlight—as they’re notably different from the surcharge laws in other states.

First, merchants must orally notify the customer of the surcharge for each transaction. This is really important for any business that’s currently surcharging credit card transactions in Minnesota or plans to do so. Failure to notify your customers verbally (in addition to the posted sign) can result in a $500 penalty per violation.

Second, Minnesota allows credit card surcharges up to 5% of the purchase. But with that said, any credit card surcharge over 4% is in violation of federal law, which supersedes state laws. So in effect, merchants in Minnesota can only add a 4% surcharge on credit card purchases to truly remain within the confines of the law—otherwise you’ll be subject to legal penalties at the federal level.

How Minnesota’s New Surcharge Law Changed What Was Previously Allowed

Minnesota now considers it a “deceptive trade practice” if a merchant “advertises, displays, or offers a price for goods or services that does not include all mandatory fees and surcharges.”

To comply with the new law, Minnesota businesses must include any and all surcharges in the advertised and listed price of an item—not as a separate fee.

Simply disclosing the fee to customers with a posted sign and with a verbal notice (which was previously allowed), is no longer sufficient under the new rules.

This comes from a new bill, HF 3438, which was signed by Governor Tim Waltz. The law itself mostly pertains to consumer protections, deceptive trade practices, and failing to disclose mandatory fees.

Surcharges Fees Cannot Be Added to Store-Branded Credit Cards in Minnesota

It’s also worth noting that Minnesota prohibits credit card surcharges if the card is issued and established by the business.

For example, if you have a Macy’s credit card, a Macy’s store in Minnesota can’t legally charge you a surcharge fee if you’re using that store-branded card to pay for something.

Surcharging vs. Cash Discounts in Minnesota

Minnesota Statute 325G.051 also clarifies the differences between surcharging and cash discounts in the eyes of the state.

For the purposes of this law, the term “surcharge” only refers to fees imposed by a seller in which the price of goods or services increases because the consumer uses a credit card to pay.

It does not govern discounts offered by sellers to buyers who pay by cash, check, debit, or similar means.

Is it Legal to Surcharge Debit Cards in Minnesota?

No.

Debit card surcharging is prohibited in all 50 states, including Minnesota.

How Are Credit Card Surcharge Fees Taxed in Minnesota?

Surcharge fees are taxable in Minnesota. This is governed by state Statute 297A.62 for when sales tax is imposed in the state.

The law has been challenged by merchants in the past, although the appeals have been unsuccessful.

Most notably was in the case of Kurt W. Martin v Commissioner of Revenue, Docket No. 9499-S. In April 2022, Minnesota Tax Court upheld a ruling that credit card surcharges are subject to both sales tax and use tax.

In this particular case, the taxpayer operated a vacation rental business in which they added a 4% surcharge to cover credit card processing fees. This was done legally based on Minnesota’s surcharge laws. However, the business was trying to claim that the 4% surcharge should be exempt from taxes.

Simply put—if you’re surcharging credit card transactions in Minnesota, you need to include those fees in your gross receipts for tax purposes.

Final Thoughts

Surcharging is a hot topic in all 50 states. In recent years, we’ve seen a significant increase in businesses adding surcharge fees to credit card transactions—particularly in the restaurant, food, and beverage space.

While most states allow credit card surcharges, Minnesota is one of the latest states to change the way surcharges can be applied after previously allowing it. This new law went into effect just five months after California’s new surcharge ban gets implemented, and I’m anticipating other states to follow suit.

Fortunately for merchatns, there are other ways you can reduce your credit card processing fees.

Most businesses don’t realize that credit card processing rates are negotiable. That’s right—you can negotiate directly with your existing processor for a rate reduction without having to switch providers or change any of your operations.

In addition to a rate reduction, you should also be monitoring your statements for bogus fees, extra charges, and padded assessments. Eliminating these hidden fees alone could save you thousands each month, which helps offset the inability to surcharge credit card transactions.

If you need help auditing your statements, our team is here for you. Just reach out for a free analysis to find out how much you can save. We’ll even handle the negotiations with your processor so you can focus on running your business.