All debit card transactions are not created equally, and some debit transactions are more expensive than others.

The way you process debit card sales will has a direct impact on your overall transaction fees. In fact, the same debit card used by the same customer, for the same exact amount, can incur completely different fees depending on the debit card routing method that’s used.

Most businesses don’t understand this, which results in the more expensive method being used. That’s why we created this guide.

So how can you lower your debit card transaction fees? The first thing you need to do is learn the difference between PIN and signature debit. We’ll break both of these down, and more, in greater detail below.

Signature Debit Explained

As the name implies, a signature debit transaction requires the cardholder to sign a receipt (or electronic equivalent) as a verification method. This is commonly referred to as “running the card as credit” (even though it’s still technically a debit transaction).

By processing a debit transaction using this method, the sale will get routed through the card network’s interchange (Visa, Mastercard, etc.), as opposed to a PIN debit network.

In short, the transaction is basically going through the same path that a credit card would take, and the fees will be based on whatever network is branded on that card. As a merchant, you’ll pay the interchange rate determined by the card network for that type of debit transaction.

Signature Debit Fees

You can find specific debit interchange rates on each of the following guides:

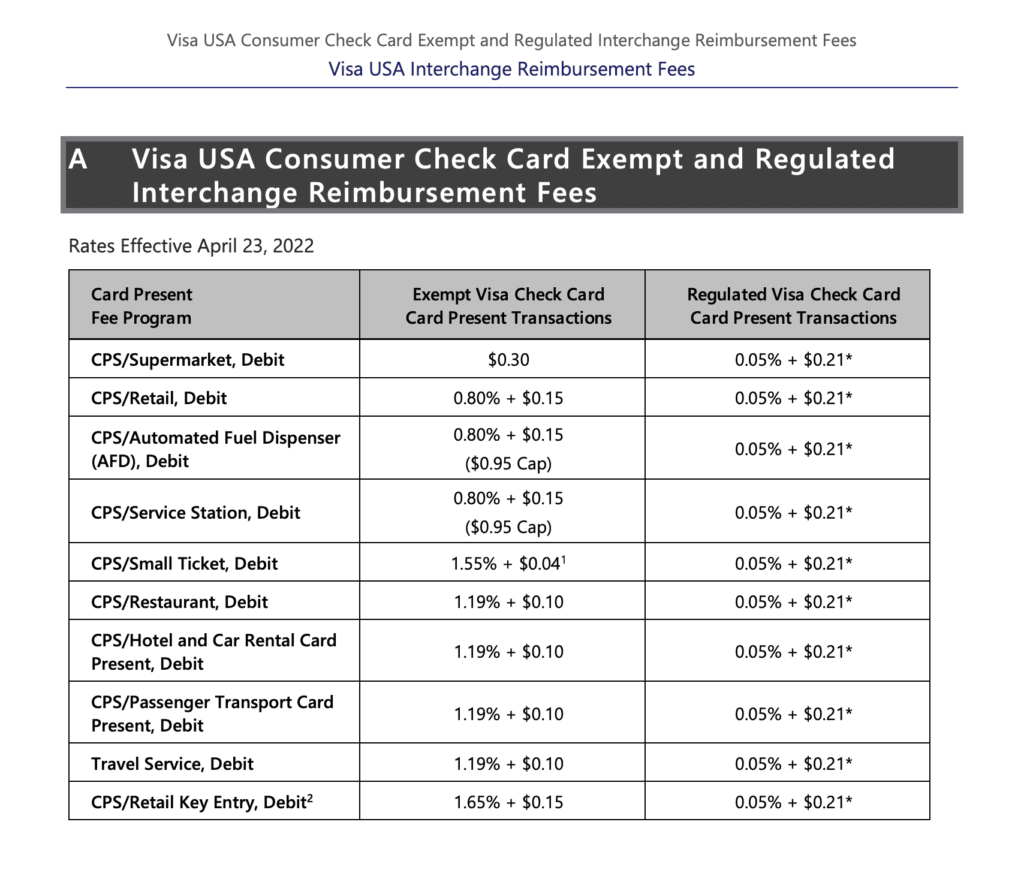

Here’s an example of some debit charges from Visa:

Signature debit transactions are also known as “offline debit transactions” since the sale gets processed off of the debit network.

PIN Debit Explained

With a PIN debit transaction, cardholders must enter their PINs (personal identification number) to verify the purchase. This is the way debit cards were intended to be used (although it’s not a requirement).

PIN debit transactions are not routed through the same networks as credit cards or signature debit transactions. So the interchange rates imposed by the network branded on the card becomes irrelevant.

Instead, the transaction goes through a PIN network, used by your credit card processor.

PIN Debit Interchange Rates

As previously mentioned, pin debit networks aren’t the same as signature transactions. So like many other aspects of the credit card processing industry, pin debit networks incur different fees.

You don’t have control over which debit networks will process the purchase. That’s why the transaction fee will often vary between PIN debit networks. You likely won’t see a flat transaction fee for each transaction, unless it’s imposed by the credit card processors.

PIN vs. Signature Debit: Which is Cheaper?

Now for the burning question—is it cheaper to process debit transactions as signature or PIN?

Unfortunately, there’s not a black and white answer to this question. It ultimately depends on the cost of the transaction. Here’s the general rule of thumb:

Signature debits are cheaper for merchants with lower average ticket transactions. PIN debit transactions are cheaper for merchants with higher average tickets.

Again, this is more of a generalization as opposed to a hard-and-fast rule. But allow me to take a moment to explain the reasoning behind this.

The cost of the transaction ultimately comes down to the fee structure between PIN and signature debits. Signature debits typically have higher percentage fees per transaction and lower fixed costs per transaction. PIN debit network fees usually have lower percentage costs and higher fixed fees per transaction.

You’ll also need to consider the processor’s markup as you’re comparing the two. With a signature debit transaction, your processor will likely apply both percentage-based and per-transaction markups on top of the interchange.

PIN Debit Transactions vs. Signature Debit Card Transactions: Examples Compared

Let’s use an example to fully understand the difference between PIN debit and signature debit.

According to the fee schedule displayed earlier in this guide, Visa charges 0.80% + $0.15 per transaction for an unregulated CPS/Retail purchase or 0.05% + $0.21 for a sale in the same category. So you’ll pay that cost, plus the processor’s markup, if the transaction gets run as a signature debit.

Now, let’s say the transaction was to be processed through the PIN network. The percentage might be a bit higher (say 0.90%), but the processor markup will just be a fixed number for each transaction.

For this reason, businesses with higher transaction amounts would rather have the lowest possible percentage being charged (PIN). But businesses with smaller average tickets (say less than $10) would end up paying more if they route those transactions through the PIN network.

How to Lower Debit Card Processing Fees

So what can you do to keep your debit transaction fees low?

Ultimately, you should pick one method and just go with it, and the method you select should based on your average ticket value. Trying to train your staff to go back and forth between the two will be confusing.

But the best way to lower your debit card processing fees is by slashing your processor markups. Most businesses don’t realize that your processing fees are negotiable—this holds true for debit transactions as well.

Contact our team here at Merchant Cost Consulting. We can negotiate with your processor and help lower your debit and credit card processing fees.

Debit Card Interchange Fees – Rate Increases and Updates

As of July 1, 2023 the amendment to Electronic Fund Transfer Act (EFTA) goes into effect for interchange fees on debit card transactions. The ruling by the Board of Governors and Federal government clarifies the requirement for every debit card transaction, including online (card-not-present transactions), to have a minimum of two unaffiliated networks to process the transaction.

Effective April 2023, Interlink is assessing a $0.10 fee on chip-enabled debit cards that were processed as magnetic stripe transactions at chip-enabled terminals.

Also effective April 2023, STAR is charging $0.01 per transaction whenever a detokenization service is performed.

You can find our complete list of interchange rates here.

FAQ: PIN Debit vs. Signature Debit

Beyond everything covered above, I just want to quickly answer some of the most common questions that I’m asked about processing debit cards.

Do Debit Transactions Go Through Credit Card Networks?

Signature debit cards are routed through the same networks as credit cards, and they’ll be assessed interchange fees imposed by the brand on the card.

What’s the Difference Between a Debit Transaction and Credit Transactions?

Debit transactions are typically cheaper than credit transactions. Even if the transaction gets routed through the same network, card brands impose cheaper interchange rates on debit transactions because they can collect the money faster and they’re not as risky.

It’s also worth noting that merchants cannot require minimum purchase amounts on debit cards, and they cannot surcharge debit transactions. But depending on the card network and state, businesses can legally impose credit card minimums and credit card surcharging.

Refer to our complete guide on debit vs. credit transactions for more information.

Final Thoughts on Interchange Fees and Debit Network Fees

PIN or Signature? Signature or PIN? What’s the best? What’s the cheapest?

There’s no right or wrong answer here. But hopefully after reading this guide, you have a better understanding of the two options.

For some of you, PIN debits will be more cost-effective. The rest of you might be better off running signature debits. But it ultimately has to do with the amount of the sale, the card network, your processor’s markup, and the PIN network.

Some of these factors are out of your control, but you can always try to lower those processor’s fees. We’re here to help you out when you’re ready to do that.