Credit and debit transactions commonly result in different fees for merchants. Debit card interchange rates are usually lower, since they’re less risky for processors. The government also has tighter regulations on how much certain banks can charge for debit transactions.

Debit and credit transactions are processed through different networks. The path a card transaction takes can impact merchant fees as well.

For merchants, the differences between debit vs. credit transactions aren’t always clear. We created this guide to clear up any confusion, so you’ll have a firm understanding of how credit card transactions and debit card transactions differ from each other.

How Credit Card Transactions Work

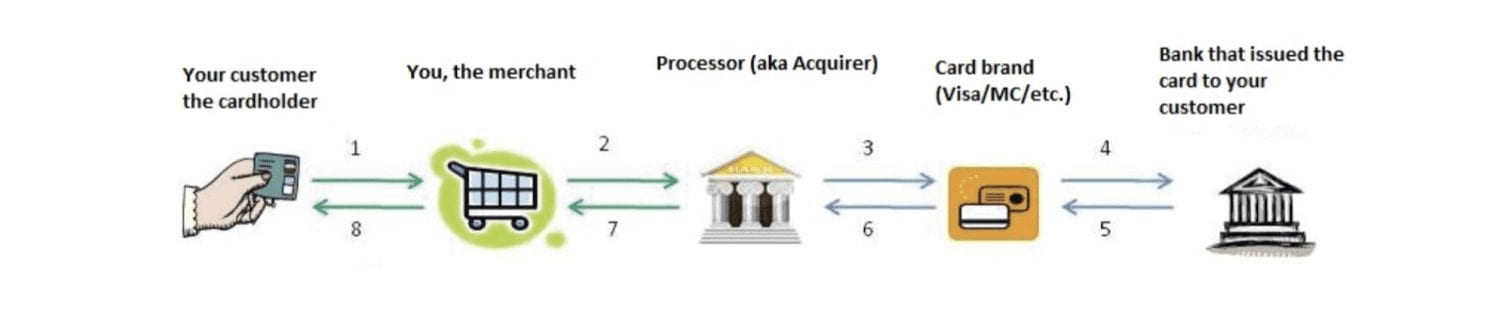

A credit card can best be described as a revolving line of credit between a consumer and the issuing bank. Each time a customer uses their credit card, the money goes through the following path:

- The merchant’s software sends the information to the processor.

- The processor connects with the card company to validate the transaction.

- The card brand validates the transaction and verifies available funds with the issuing bank.

- If the funds are available, they are placed on hold so the money can be sent back to the merchant.

- The issuing bank’s response passes back to the credit card company.

- The credit card company either approves or denies the transaction.

- The processor displays the approval or denial back to the merchant on the processing software.

- If approved, funds remain on hold until the transactions are settled, and the processor finalizes the sale so the merchant can get paid.

With the exception of the settlement, all of this happens in a matter of seconds. Here’s a visual representation to show you how credit cards work:

A credit transaction has more risk for the banks since the cardholder could default on the loan.

How Debit Card Transactions Work

With a debit card, the customer has pre-authorized their bank to take money from a particular checking account associated with the card.

In this case, the issuing bank can authorize the payment without waiting for additional validation. The money is instantly withdrawn from the customer’s bank account.

But behind the scenes are there are two different ways that a debit card can be processed:

- Debit/Online/PIN debit method

- Credit/Offline/Signature debit method

If a customer chooses the “debit” method, the transaction is processed through a separate computer network. Merchant’s get charged a debit-specific rate for these transactions. But if the customer chooses the “credit” option, the purchase goes through the credit processing network.

The most significant difference here is the fee charged to the merchant for the transaction.

Debit Transaction Options: Credit Path vs. True Debit Charge

A credit path debit charge transaction goes through the processing system the same way as a standard credit card (the steps we covered earlier). The transaction still goes through the credit card processing network whether it’s a credit or debit card. The only difference is that it gets flagged as a debit card.

The issuing bank puts a hold on the funds until they are eventually released through the acquirer to pay the merchant.

Merchants get paid in the same way and time frame as a traditional debit charge. For the customer, the money is placed on hold in their account. So technically, the money is still in there as opposed to being withdrawn right away.

For a true debit card transaction, the processing goes through a completely different communications network. It’s the same path used for wire transfers, ATMs, electronic bill payments, and direct deposits.

In this case, the hold on the customer’s account transfers much quicker. Sometimes this can be processed in a matter of hours, and almost always by the end of that business day.

Since the money gets transferred so fast, true debit charges usually require a PIN as an added layer of security. The PIN proves that the cardholder authorized the translation.

The merchant is charged differently depending on the path of the debit transaction, which we’ll get to in greater detail shortly.

Related Article – Pin Based Debit Card Routing

Differences Between Credit and Debit Transactions

There are three main differences between credit card and debit card transactions; cost, disputes, and minimums/surcharges.

Credit Card vs. Debit Card Merchant Fees

Do debit cards charge merchant fees? Yes. Merchants always get charged per transaction, whether a debit or credit card is used.

The amount of the charge depends on whether the card was processed through a credit card network or debit card network. Cards processed through a credit card network (even if it’s a debit card) are charged the standard credit card transaction fee. Depending on the processor, debit transactions are subject to a debit card rate.

The federal government set a standard rate for US banks with more than $10 billion in assets. This rate is 0.05% + $0.21 per transaction for debit cards.

Processing companies can add on to this rate. So just check your processing agreement to see the exact amount. You can also refer to our complete guide on debit card processing fees for additional rates, examples, and fees.

As you probably know, the cost of a credit card transaction can vary based on the card that was used.

Both debit and credit fees can be negotiated with your payment processor. So it’s worth consulting with an expert to handle those negotiations on your behalf.

Cardholder Disputes

Credit and debit cards are covered under different consumer protection laws when it comes to disputes. Credit card companies also have their own rules and regulations to protect cardholders as well.

A dispute will appear on a merchant’s statement as a chargeback, whether it was a debit or credit transaction. We have a more detailed guide on chargebacks, which you can read here.

But in short, consumers have a longer time frame to dispute a credit card charge.

In some cases, the customer can dispute a credit charge up to 120 days after the transaction. Consumers usually assume full responsibility of a debit charge (even if it’s unauthorized) if it’s not disputed within 60 days of receiving a statement.

Minimums and Surcharges

Merchants are allowed to require a minimum charge amount for credit transactions and credit path debit transactions. Furthermore, the merchant can add a surcharge fee (if permitted by state law) to the total, in an attempt to recover processing fees.

Most credit card companies discourage merchants from surcharging, so you should always reference your cardmember agreement before implementing something like this.

On the other hand, debit cards are regulated by a different set of laws.

- Merchants cannot require minimum amounts for debit card transactions.

- Merchants cannot add a surcharge to customers using debit cards.

Basically, you are stuck paying the debit transaction fee as a merchant, regardless of the transaction amount. That’s why it’s so important to negotiate these rates.

Accounts

This isn’t extremely relevant for merchants, but there’s a difference in the way each particular account is set up for consumers, depending on whether or not they’re using a debit or credit card.

Debit card users typically don’t need to provide any credit history to open a bank account. They can only spend money up to the amount of cash in the bank tied to that particular account. They’re not borrowing money from anyone. As soon as a transaction occurs, a credit entry and debit entry is applied to the account. In addition to paying for goods and services with a debit card, these cards can also be used to withdraw cash from ATMs

Credit card usage is directly tied to a consumer’s credit history. A consumer using a credit card for larger purchases doesn’t even need to pay the account balance in full. They just need to make minimum payments each month, and they’ll pay interest on the outstanding amount.

This is technically considered a liability account (as opposed to an asset account or cash account). Payment processors can still issue payments to merchants, even if the customer hasn’t actually paid their bill to the issuing bank.

Final Thoughts on Credit vs. Debit Transactions

Is there a difference between credit and debit card transactions?

Absolutely. Not only does the choice of the card have an impact on the consumer, but there is also a difference for the merchant.

It’s cheaper to accept debit card payments, and there are significant differences between how credit cards and debit cards are processed behind the scenes. Realistically, you don’t really need to trouble yourself with all of that.

At the end of the day, the price you’re paying to process these transactions will have the biggest impact on your business. Here at Merchant Cost Consulting, we negotiate your processing rates to save you money. Contact us today for a free consultation.