EVO Payments provides merchant acquiring and payment processing services in over 50+ markets and 150+ currencies across the globe. They process over $100+ billion for 550,000+ businesses each year.

Originally founded in 1989, EVO Payments was acquired by Global Payments Integrated in March 2023 for $4 billion.

Read on for our insider take on EVO Payments—including an exclusive breakdown of its fees that aren’t publicly disclosed.

MCC Quick Take on EVO Payments

In the past year, EVO Payments increased its rates twice within an eight-month period. This is definitely not something that we like to see, and it’s occurring more often than other processors on the market.

I’m expecting to see at least more rate increase from EVO Payments this year. Here’s why.

Both of the last two rate hikes (June 2023 and January 2024) came after EVO was acquired by Global Payments. In Q4 2023 and Q1 2024 earnings calls, Global Payments has made it clear that they’re planning to set prices for the value they’re providing. As Global continues to integrate EVO Payments technology products, they’ll want to see a faster return on their multi-billion dollar investment.

I honestly hope I’m wrong, as it’s rare to see three consecutive rate increases within an 18-month stretch from a processor the size of EVO Payments. But all signs point to higher prices in the near future.

EVO Payments Pros

- Negotiable rates (with the right approach)

- Interchange plus pricing is available

- Wide range of payment acceptance solutions

EVO Payments Cons

- Frequent rate increases

- Extra fees added to statements

- Tiered pricing structure makes it difficult to get qualified rate

- $495 account closure fee

- Reserve funds required for account termination

- Dated surcharging program

EVO Payments Pricing Breakdown and Fees to Look Out for

EVO Payments typically uses ISOs to pass its fees and services to merchants. This is one of the many reasons why EVO doesn’t publicly disclose its rates online—as the rates can vary depending on who is providing the processing services to your business.

One ISO might offer a flat-rate structure while going directly to an EVO sales rep might get you an interchange-plus agreement.

EVO Payments also offers tiered or bundle pricing, which isn’t ideal for most merchants. In this scenario, each transaction falls into one of three buckets—qualified, mid-qualified, and non-qualified (with qualified rates being the cheapest).

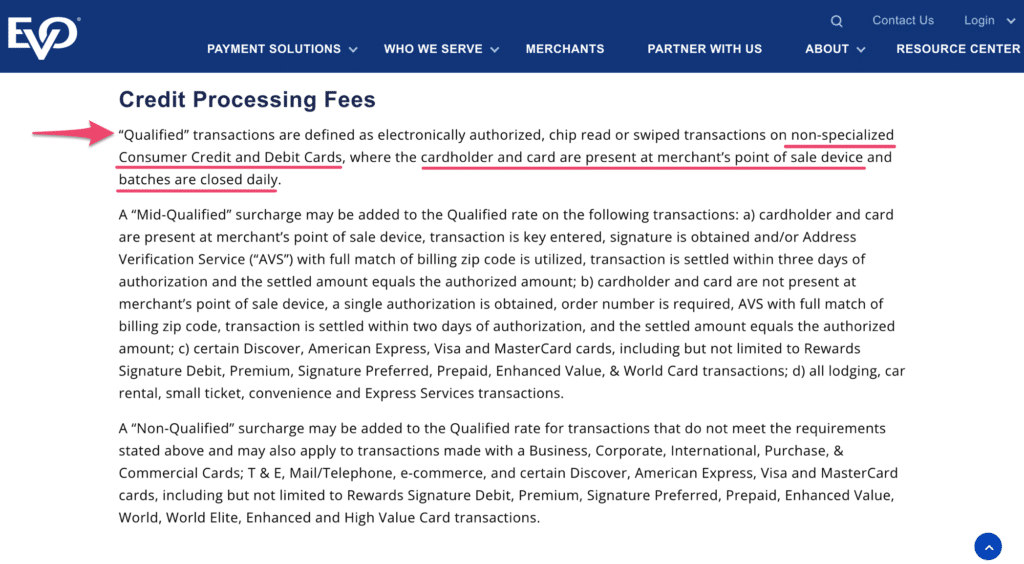

But there’s a major problem with this structure. If you look closely at EVO’s disclosure page, you’ll quickly see that very few transactions actually qualify for the lowest possible “qualified” rates:

If the transaction isn’t processed in person, then it’s not eligible for the qualified rate. Furthermore, most credit cards won’t fall into the “non-specialized” category that EVO uses at the qualified tier. So if your customers are using any type of rewards card or a credit card with perks, it’s unlikely that those transactions will get the qualified rate.

A closer look at this disclosure statement from EVO shows that most transactions will fall into the mid-qualified or non-qualified buckets, which both translate to higher rates.

Fees to Watch Out For: You Can Reduce or Remove These From Your Statement

We have several different clients that use EVO for payment processing. In our experience there are four common fees we see when we’re auditing monthly statements that can either be lowered or removed.

Check your statements for the following charges:

- Monthly Discount Fee — Try to get rid of this

- Ecommerce Fee — Try to get rid of this

- AOB Assessment Fee — Get this lowered to the interchange rate

- AOB Card Not Present — Get this lowered to the interchange rate

With the right negotiation tactics, those first two fees can be eliminated from your statements altogether (and potentially reimbursed).

Both of the “AOB” charges refer to Amex OptBlue. EVO shouldn’t be charging you extra if you’re in the Amex OptBlue program, and you should only have to pay the interchange rates imposed by Amex, plus EVO’s markup—but not an extra fee on top of it.

Other EVO Payments Fees For Credit Card Processing

Here’s a quick explanation of some of the other miscellaneous fees you might find on your EVO Payments statements:

- Cross Border Transaction Assessment — Charged if the card issuer’s country code is different from the merchant’s country code.

- International Acquirer and Service Fees — These are for international transactions, and the exact charge varies by the card network (Examples: Discover International Service Fee, International Processing Fee for Currency Conversion, Mastercard Cross Border and Acquirer Program Support Fee, etc.).

- Transaction Integrity Fee — For Visa signature debit, prepaid, and credit card transitions that fail to meet the minimum CPS requirements.

- Zero Floor Limit Fee — All settled transactions that fail to correspond with a valid authorization issued within the last 30 days.

- Zero Dollar Verification Fee — Assessed if a merchant requests address verification without authorization.

- CVC2 Fee — Charged whenever the three-digit CVC2 code on the back of the card is included with the authorization request to verify the cardholder’s information.

- Payment Card Access Fee — Assessed by Visa, Mastercard, and Discover, for use and access of their systems.

- Digital Enablement Fee — Charged on total CNP sales volume on signature debit cards, consumer credit cards, and commercial credit cards.

Since most of these fees are assessed at the card network level, they can’t be negotiated or removed from your statements.

Latest EVO Payments Rate Increases and Credit Card Processing Updates

Effective April 2025, EVO Payments is passing through new and updated rates from the card networks—including discount rates, assessments, authorization fees, and per-item charges).

EVO Payments increased its discount rates by 1% for all Visa, Mastercard, Amex, and Discover transactions on January 1, 2024.

Prior to that, EVO increased discount rates by 0.50% on all transactions in June 2023, along with the following changes that same month:

- $0.10 increase to authorization fee

- $0.05 increase to excessive authorization attempts (Mastercard only)

- 0.02% increase to Visa estimated and incremental authorizations

We have a full summary of EVO’s rate changes over time that you can view here.

Be Careful With EVO Payments Surcharge Program

Like many credit card processors, EVO Payments offers surcharging solutions for merchants who wish to pass credit card processing fees to their customers.

But businesses need to be very careful when setting up these programs because processors aren’t on the hook if you’re non-compliant. This is 100% on your shoulders.

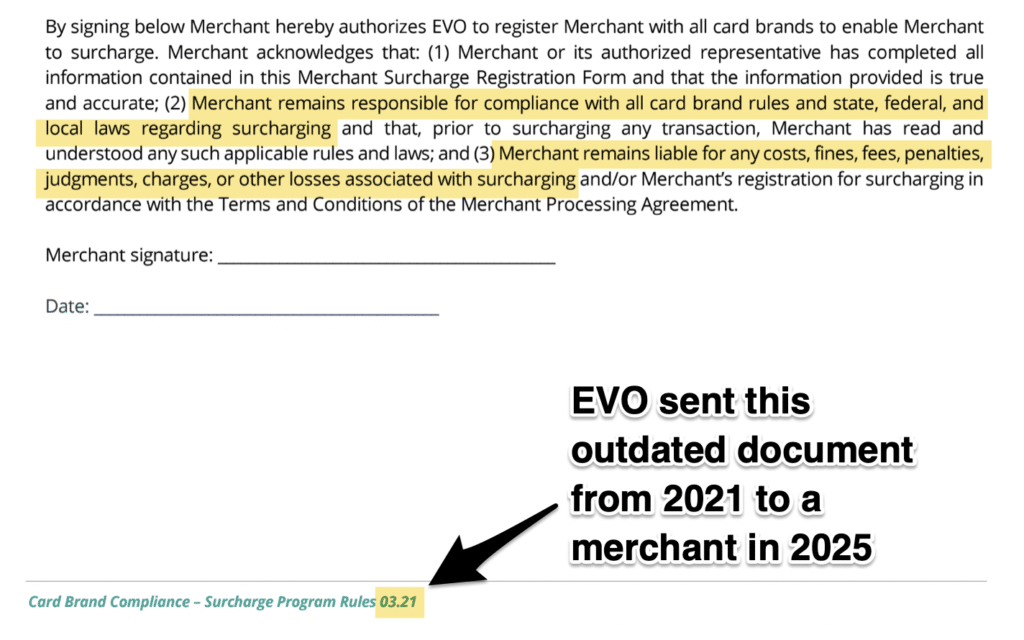

In March 2025, EVO Payments sent its surcharge program registration and resources forms to one of our clients—with information that hasn’t been updated since March 2021.

Surcharge laws vary by state, and we’ve seen a ton of changes at state-specific levels over the past four years. The fact that EVO Payments isn’t taking the time to update these resources with the latest information is a bit concerning.

Any merchant who receives this form could assume that their payment processor wouldn’t send them information that could lead to legal penalties and hefty fines associated with non-compliance. But that’s exactly would could happen if you’re not careful and don’t do your own due diligence.

EVO essentially absolves themself of any wrongdoing here by saying it’s the merchant’s responsibility to stay compliant with state, federal, and card brand rules:

While this is always the case with surcharging programs—meaning responsibility and liability falls on the merchant—I’d at least expect the processor to keep their resources up to date with the latest information.

This is a big red flag.

Should You Switch to EVO Payments?

We don’t recommend switching to EVO Payments, especially if you’re a smaller merchant.

EVO increases its fees far too frequently for our liking. And while interchange-plus pricing is available, many ISOs offer EVO’s services at a flat rate to increase their own profit margins. Even if you go directly to an EVO sales rep, they may try to convince you to sign a tiered contract (dangling an attractive “qualified” rate in front of your eyes).

But as previously discussed, it’s unlikely that most of your transactions will actually be charged at the qualified rate. So you’ll end up paying more than you anticipated.

Rather than switching to EVO Payments, you’ll have better luck negotiating your rates with your existing processor.

Should You Cancel Your EVO Payments Contract?

EVO Payments charges a $495 account closure fee for early termination. They’ll also keep a portion of your funds held in a reserve account for 270 days following the cancellation.

While this definitely isn’t the worst early termination clause we’ve ever seen, it’s definitely not ideal. The $495 fee is minimal, but having your funds on hold for 9 months is brutal.

EVO Payments currently has four different Merchant Processing Agreements that they use, which you can access here. There are slight variations to each one, which can be tricky to understand. So if you have any questions about the agreement you’ve signed, our team here at MCC can review that contract on your behalf to ensure you understand any potential penalties before canceling.

But with that in mind, we don’t recommend terminating your merchant agreement with EVO Payments.

Here’s the thing. While EVO Payments definitely isn’t our favorite processor in the market, it’s typically better to deal with the devil you know compared to the devil you don’t.

EVO doesn’t want to lose your business. So you have more leverage with them compared to a new processor.

If you’re currently on a flat-rate or bundled structure with EVO, switching to an interchange-plus pricing plan is the first step to lowering your rates. If you’re already on an interchange-plus plan, then you can negotiate EVO’s markups to get an even better deal.

We have an in-depth guide that explains how to lower your processing fees that you can reference for your negotiations. Otherwise, you can just let our experts at MCC handle this on your behalf. We’ll deal directly with EVO to lower your rates so you don’t have to switch.

How We Reviewed EVO Payments

We’re in a really unique position in the payments space. As a merchant consultant, we have access to thousands of monthly statements from different businesses—including statements from EVO Payments.

This means we can compare EVO’s rates, fees, and billing practices against other providers to see if their pricing is fair or too high.

Furthermore, we can identify billing inconsistencies between multiple merchants using EVO Payments. If one merchant is being charged a particular fee but another company isn’t, then there’s a good chance that fee can be removed or negotiated.

We also have years of experience negotiating directly with EVO Payments (and Global Payments, EVO’s parent company) on behalf of our clients.

Not many people have access to this type of information, which is what makes our reviews so unique.

Unlike other EVO Payments reviews, we’re not just compiling Trustpilot comments and Better Business Bureau complaints. It’s easy enough for you to do that on your own. Instead, we’re giving you insider information that you won’t find anywhere else.

Final Thoughts on EVO Payments

EVO Payments is a legit processor and payments technology provider. But they increase their rates much more frequently than other processors—and many of these increases are substantial (the most recent was a full 1% rate hike).

Their merchant agreement isn’t the worst or strictest we’ve ever seen. However, you’ll still have to pay a cancellation fee and keep your funds in a reserve account for roughly nine months following your account termination.

I think that EVO will continue to raise its rates in the short term, and we might even see another one by the end of the year.

If you’re considering EVO Payments as your processor and merchant services provider, don’t jump into a new agreement just yet. Try negotiating with your existing processor first.

Contact our team for a free audit to find out how much you can save. We can compare your current statements to help estimate potential cost savings against what you would be paying to use EVO.