Before diving into Level 2 and 3 pricing, if you are not familiar with the credit card processing standard fees we highly suggest reading our credit card processing guide to familiarize yourself with this difficult industry first. That being said, if you already have a good understanding of the basics of credit card processing this blog is designed to help ensure all your transactions are receiving the lowest cost possible.

Overview

Visa/MasterCard set the underlying interchange rates for all credit card transactions. These rates vary widely based on numerous factors. These factors include type of card, MCC Code, size of sale, time difference between authorization/capture and more. In particular, certain MCC codes can impact the underlying interchange rates if your business is listed as a B2B merchant.

Below we have outlined the pricing eligible if you are a business taking B2B and B2G cards. If you are wondering if your business is eligible prior to reading this blog, simply scroll to the bottom and we have outlined the ineligible Merchants.

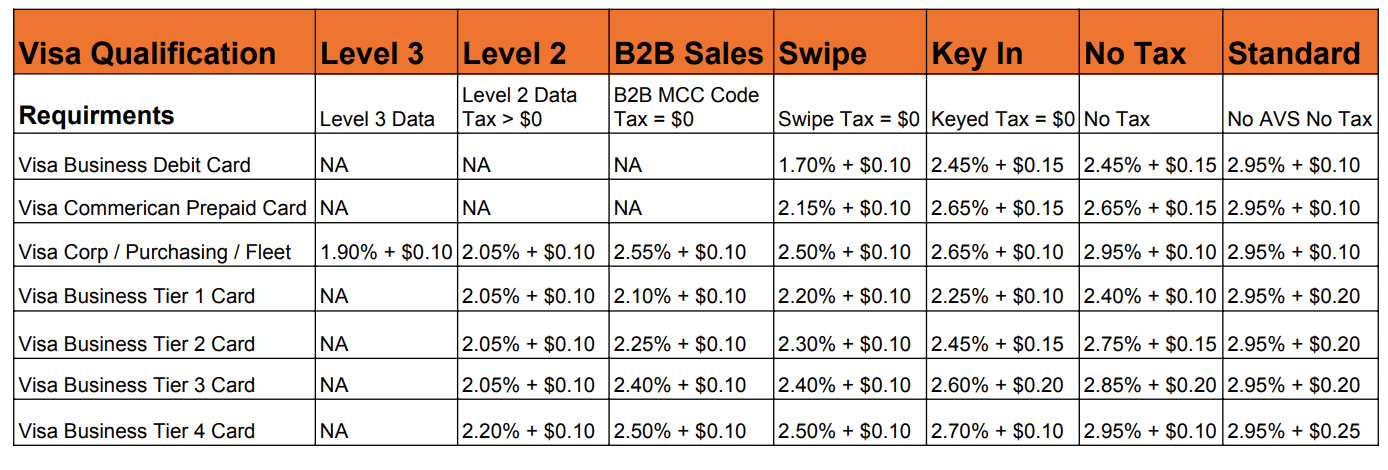

What Business-Card rates can I expect with Visa?

Well, this is very complicated and has to do with numerous factors. To make things simple we have created a graph below showcasing each levels of different rates of B2B and B2G cards. As you will see, it is very important to always submit AVS Information and a PO Number. If you can include a tax value above $0 you will be able to qualify for Level 2 and 3 rates which are even lower than B2B rates. See the chart below to fully understand the difference.

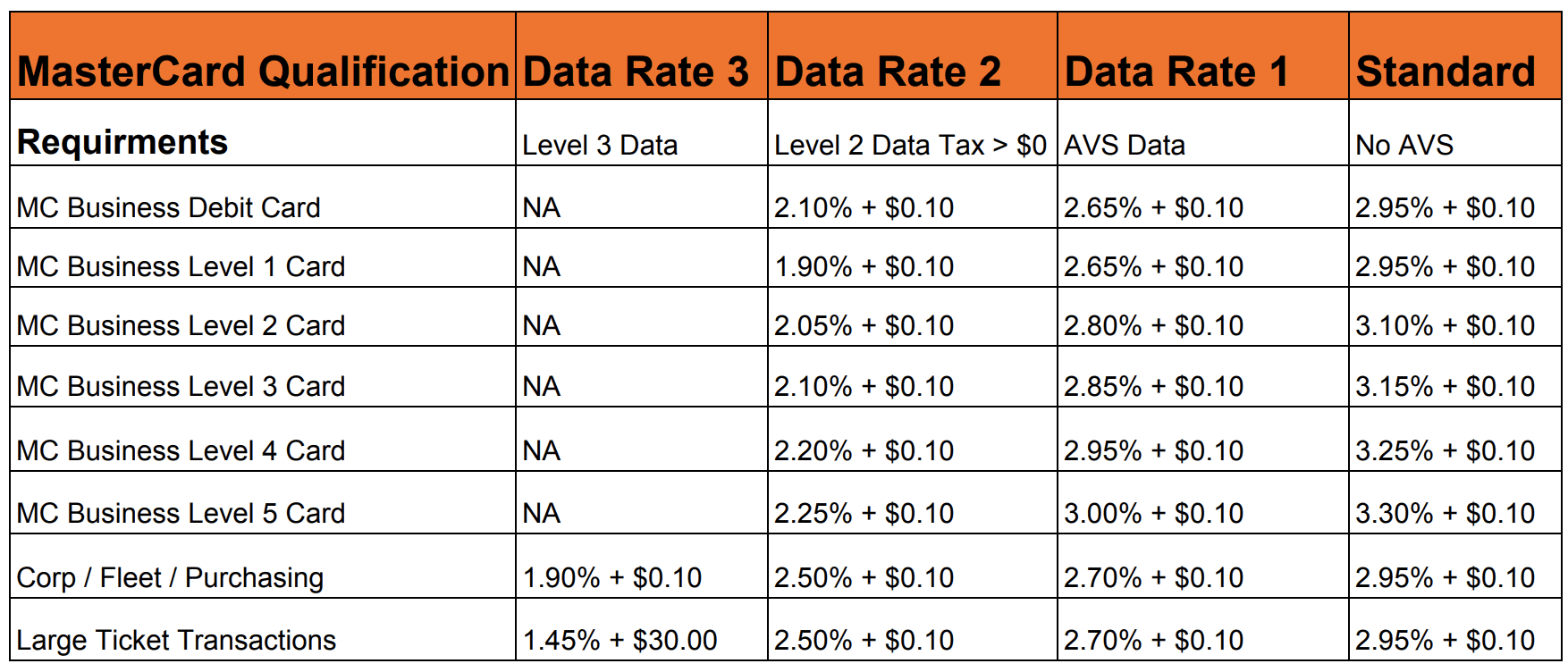

What Business-card rates can I expect with MasterCard?

MasterCard does not distinguish B2B merchants like Visa does. A business either gets Level 3 rates by submitting all Level 3 info, Level 2 rates if you submit a tax amount greater than $0 and a PO Number, or you get Data Rate 1 if you only submit AVS. As you can see, submitting a MasterCard sale without AVS will result in the Standard Rate section. In some cases this can result in more than a full 1.00% on the sale. Refer to the chart below to fully understand the difference in rates.

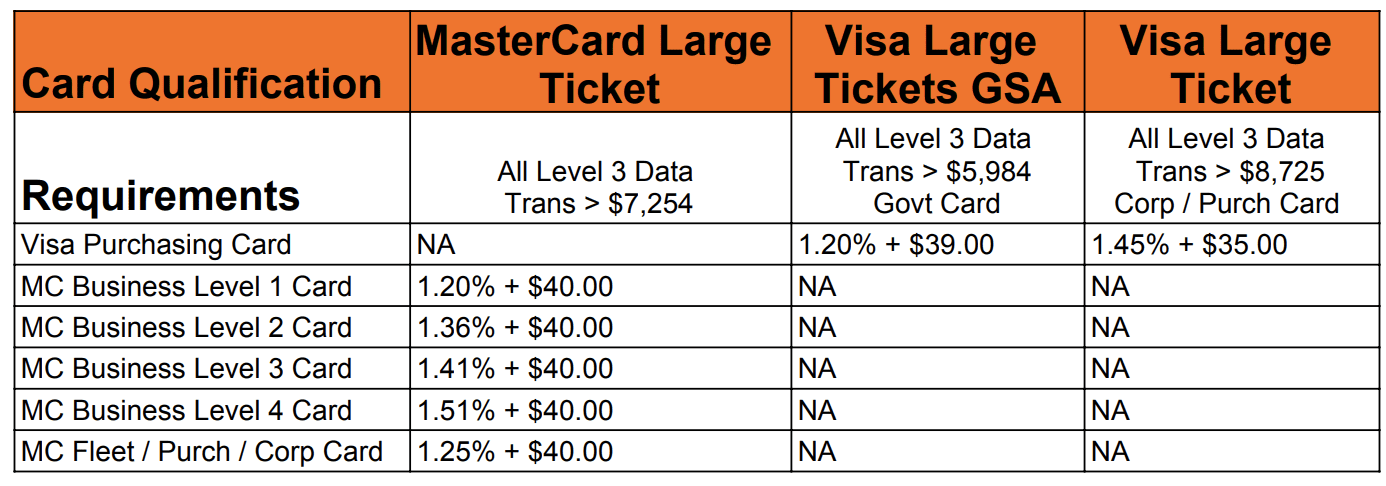

Large-Ticket Reductions

As mentioned above, interchange rates have a lot of different factors. And yes, sometimes the amount of the transaction can effect this. See below for how your large sales may be eligible for additional discounts.

Who is eligible for these reductions?

Other than Travel/Entertainment merchants listed below, almost all merchants are eligible for the above rate reductions. Of corse, your business has to be seeing these B2B and B2G kinds of cards to qualify for lower rates.

List of ineligible merchants

- Restaurants/Fast-Food

- Airlines/Cruise Lines

- Direct Marketing

- Passenger Transport

- Hotels/Lodging

- Car Rentals

We get it, this stuff can be a bit confusing. The credit card processing world can be difficult to understand. Not only that, throw in potential L2 and L3 interchange optimization and it can make your head start to spin. That is where Merchant Cost Consulting comes in. We bring transparency and simplicity to the credit card processing industry by helping our clients ensure wholesale pricing along with interchange optimization. We work with you every step of the way to ensure you are priced appropriately with your current vendor. From there, we have an auditing system to police each transaction to ensure you are receiving the correct interchange costs based of various factors including interchange optimization.

0 Comments