North American Bancard is one of the largest non-bank merchant acquirers in the world. With over 30+ years of experience under their belt, this processor currently handles more than $100+ billion transactions for 100,000+ businesses every year.

They provide a wide range of payment solutions for businesses of all sizes, including services for online processing, in-person payments, and hybrid processing.

Whether you’re thinking about using these payment processing solutions or you’re a current North American Bancard customer, this review will cover everything you need to know—including insider information that you won’t find anywhere else on the web.

Our Insider Take on North American Bancard

North American Bancard is a true merchant acquirer. Similar to Fiserv, they rely on third-party ISO agents to resell processing services on their behalf.

They actually have one of the better entry-level offerings for 1099 agents who are just getting started. So we tend to see lots of reps using North when starting their own unregistered ISO business.

For merchants, any time you’re going through a third-party ISO, your rates are always going to be slightly inflated because there’s an extra layer that needs to take a cut. And while North American Bancard’s pricing isn’t typically egregious, we tend to find savings opportunities on every statement we audit for our clients.

Pros

- Interchange-plus pricing is available.

- They are open to negotiations and will lower your rates if pressed.

- They operate as a full-service merchant acquiring bank.

Cons

- Complex reporting on statements makes it difficult to understand your pricing.

- Many sales reps are still offering tiered pricing contracts to merchants.

- They don’t have tons of software integration capabilities.

Recently, “American Bancard” was dropped from the company’s name as they rebranded as just “North.” But we’re still seeing North American Bancard on statements from our clients as recently as last month.

So for now, it appears as though the payment processing division is still using the old name. But it’s worth noting this as you’ll likely see both names used when researching this processor elsewhere on the web.

While I wouldn’t go as far as to call them a legacy processor, North American Bancard’s technology isn’t the latest and greatest in the industry.

I think the rebrand might be their first step towards trying to do a bit more and potentially improve technology. So maybe we’ll see them offer more integrated payments capabilities in the future.

This would help them keep up with some of their top competitors, like Global Payments and Worldpay.

North American Bancard Pricing and Credit Card Processing Rates (With Examples)

North American Bancard’s fees are not publicly published online, and rates vary (sometimes drastically) from merchant to merchant. Your exact costs will primarily depend on factors like the ISO who set up your account, your processing volume, and your contract structure.

We tend to see lots of ISOs offering tiered pricing plans to merchants. These may seem appealing because the qualified rate is low, but you rarely (if ever) actually get that rate applied to your transactions.

Even if you’re on an interchange-plus pricing structure (which is what we recommend), lots of merchants struggle to identify the exact markup being paid to North American Bancard because the reporting is very complicated.

To determine North American Bancard’s discount rate (the processor’s markup) on your statement, you need to do some math.

Let’s look at an example so you can see what I mean.

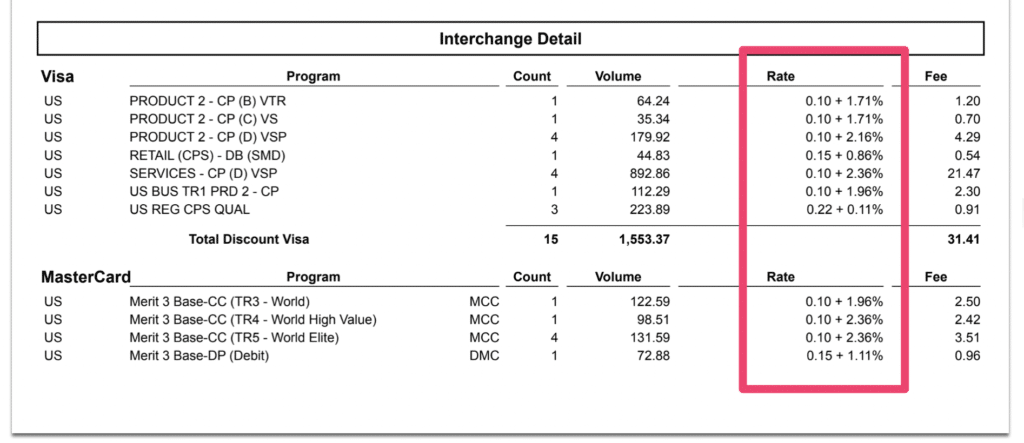

This is a typical statement from North American Bancard. When you get to the Interchange Detail portion, the Rate column is the total cost you’re paying for the transaction—which includes the interchange rate imposed by the card network plus the discount rate paid to North American Bancard.

Most processors show the discount rate on statements so it’s obvious what you’re paying.

But with North American Bancard, you actually have to locate the true interchange rate and then subtract that from the rate on your statement.

For example, if we look at the Mastercard section, we can see the first line item is for a Merit 3 Base World credit card. Now you have to look up Mastercard’s interchange rates on your own to figure out that these transactions are charged 1.90% + $0.10 per transaction.

North American Bancard charged this particular merchant 1.96% + $0.10, and with some quick math, we can determine that the discount rate is 0.06% or 6 basis points—which is a good deal.

That same discount rate of 6 basis points is applied to the next two line items as well. MC Merit 3 Base World High Value and World Elite are both charged 2.30% + $0.10 at the interchange level, and North American Bancard charged 2.36% + $0.10.

Now let’s spot-check a Visa charge to see if the same rate is being applied.

If we look at the top line item under Visa, we see it’s categorized as a Product 2 Traditional Rewards transaction, which Visa charges 1.65% + $0.10 at the interchange level.

Since North American Bancard is charging 1.71% + $0.10, it checks out that the 6 bp markup is being consistently applied. But it’s still a pain to have to do this manually on every line item to truly figure out what you’re being charged.

Additional Resources: How to Read Your Merchant Processing Statement (With Examples)

Other North American Bancard Fees to Look Out For

Aside from the processor markup, North American Bancard does charge some other miscellaneous fees. Some common examples that we find on our client’s statements include:

- Annual Regulatory Fee — $169 per year

- PCI Compliance Fee — $145 per year + $15-$27 per month

- PCI Non Compliance Fee — $145 per year + $65-$75 per month

- Monthly Minimum Processing Fee — $30 per month

- Processor Authorization Fee — $0.03 per authorization request

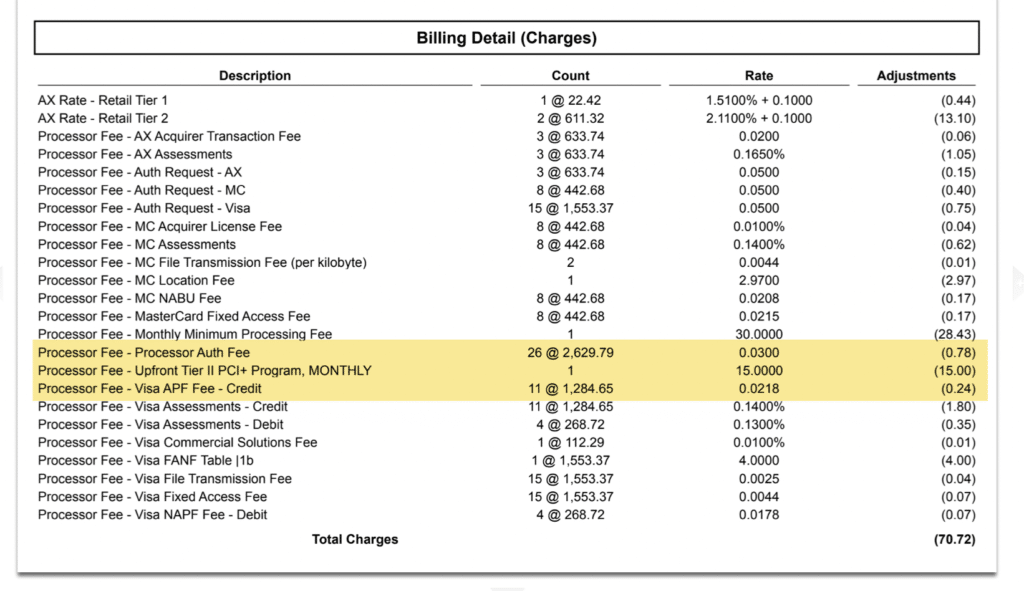

Here’s an example of a North American Bancard statement that shows a range of different assessment fees from the card networks and processor fees mixed in.

I’ve highlighted the processor fees so they’re easy to see. But if you’re just glancing through this and you’re not sure what you’re looking at, it’s fairly easy to either miss these or mistake them as a mandatory assessment from the card networks.

Latest North American Bancard Rate Increases, Updates, and Noteworthy News

We typically see rate increases from North American Bancard at least once or twice per year. Here’s a quick summary of the most recent ones:

- December 2024 — Automatically upgraded merchants to PCI Plus service

- November 2024 — Increased daily discount rates by 0.25%

- October 2024 — Increased monthly discount rates by 0.25%

- October 2024 — Increases discount rates by 0.025% to 0.15%

It’s also worth noting that for tax year 2024, North American Bancard will no longer be shown on 1099-K forms. Instead, this will be replaced with EPX Acquisition Company (EPX) as the filer.

Also, the rebrand from North American Bancard to North took place in August of 2024. But as previously stated, we’re still seeing the full North American Bancard name and logo on merchant statements.

You can view a complete history of these pricing changes and other updates here.

Should You Switch to North American Bancard?

I wouldn’t switch to North American Bancard.

You should always try negotiating a better deal directly with your existing processor before you consider switching. This is often the best way to save money on credit card processing.

And while North American Bancard is solid, they aren’t amazing. You can get a pretty decent rate if you know how to negotiate a good contract. But their technology is a step behind some of the other providers on the market offering more robust software integrations.

So if you just need a basic solution, it’s fine. But for more complex setups, you’ll likely have better luck elsewhere.

Our Final Thoughts on North American Bancard

North American Bancard is a good processor.

As a true merchant acquirer, you can have access to good rates. However, your ISO using North American Bancard on the backend might be marking you up higher so they can earn more commissions—and that’s definitely the case if they’re putting you on any sort of tiered or qualified rate plan.

I’d prefer to see a bit more transparency on North American Bancard’s statements. The fact that you have to manually calculate your discount rates by viewing third-party sources is a pain and definitely not the industry standard we’re used to seeing.

With that said, you can still get a good deal. The example we looked at earlier where the merchant was only paying 6 basis points is solid, and may be worth a few headaches to get a low rate.

For deeper insights into your current deal, either directly with North American Bancard or another processor, let our team here at MCC audit your statements. We’ll help you identify any cost-saving opportunities without having to switch providers.