The Complete Guide to Interchange Fees and Rates (2024)

If your business accepts credit cards, then I’m sure you’ve heard of interchange fees. You’ve probably even seen these fees listed on your credit card processing bill.

Surprisingly, most business owners don’t really understand interchange rates and how they work, which is why we created this guide.

Interchange can be a complicated subject. So for the purpose of this resource, I’ll give you a simple explanation.

What Are Interchange Fees?

Each time your business accepts a credit card, you pay a fee to your credit card processor. The processing fee is broken down into three parts:

- Interchange

- Assessments

- Markup

The interchange gets paid to the bank that issues the card to the customer. Interchange rates are non-negotiable.

Interchange fees are the costs associated with an interchange category. Each category has specific requirements. When a transaction meets certain standards, it’s charged the interchange fee for that category.

The exact rate for interchange fees vary. They can be less than 1% or up to nearly 3%.

Some credit card companies publish the interchange fee tables. These tables include dozens of different interchange rate categories. Here’s an excerpt from Visa’s interchange table.

Again, this just a small section from one small section on a 26-page document filled with different rates.

As you can see from the table, Visa has credit performance thresholds for retail merchants and supermarkets. These are the criteria for retail threshold:

- Threshold I — $105.5 million transaction minimum, $7.3 billion volume minimum

- Threshold II — $68.2 million transaction minimum, $3.9 billion volume minimum

- Threshold III — $15.2 million transaction minimum, $885 million volume minimum

Here are the tiers for supermarkets:

- Tier 0 — $370 million transaction minimum, $19.6 billion volume minimum

- Tier I — $132.5 million transaction minimum, $10.65 billion volume minimum

- Tier II — $72.5 million transaction minimum, $4.2 billion volume minimum

- Tier III — $16.5 million transaction minimum, $950 million volume minimum

Using this table, a Supermarket Credit Tier 0 transaction would pay a 1.15% + $0.05 interchange fee for a Visa traditional rewards card. However, a Retail Performance Threshold III business would pay 1.51% to accept the exact same card.

This is just one example. Believe it or not, it’s actually very straightforward. There are other factors used to determine interchange fees. This is known as interchange qualification, which we’ll get to in greater detail shortly.

Who Pays Interchange Fees?

Merchants pay interchange fees. However, it’s done indirectly.

You pay your credit card processor a fee to accept credit cards. These are some examples of different credit card processing pricing structures:

- Tiered or Bundled Pricing

- Flat Rate Pricing

- BackBill or ERR Pricing

- Subscription or Membership Pricing

- Interchange Plus Pricing

All of these pricing models have interchange fees built-in.

Interchange Plus pricing is the best option for merchants because it’s the most transparent. You’ll pay the interchange rate for each transaction, plus the payment processor’s agreed markup.

The markups are generally much higher for other pricing structures.

Technically, the acquiring bank pays the issuing bank for interchange fees. Then the merchant repays the acquiring bank.

Interchange is actually short for “interchange reimbursement fees.” But in the payment processing industry, “reimbursement” is usually cut out to shorten the term.

How Interchange Fees Work

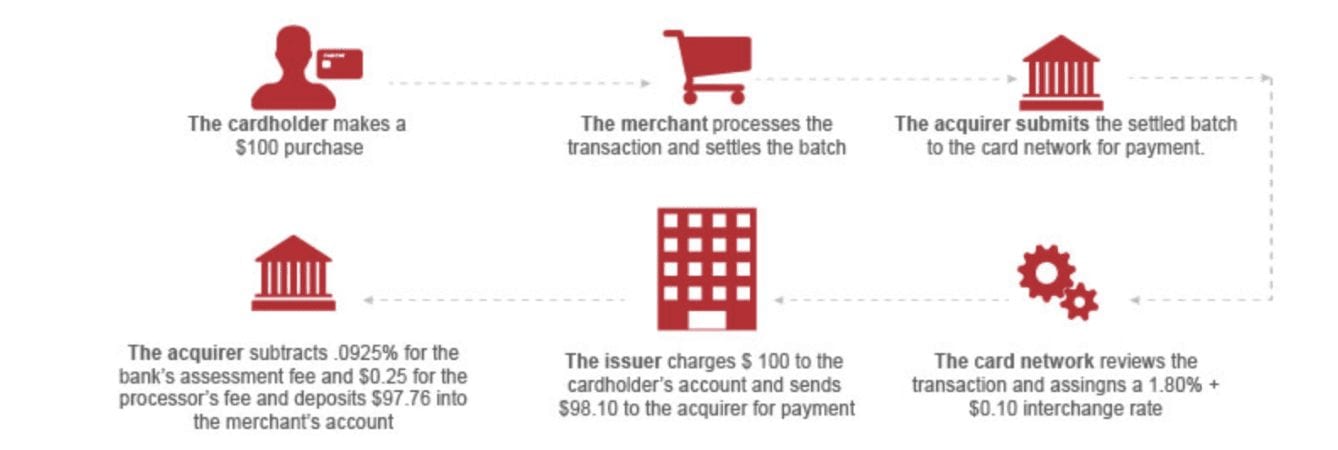

Each time you accept a credit card, the funds don’t come directly from the customer’s account. At least not right away.

The processor (acquiring bank) deposits the funds into your account, usually within 48 hours.

Then the cardholder’s bank (issuing bank) takes the money from the customer’s account. The issuing bank deducts the interchange fees and sends the rest to the acquiring bank.

Here’s a visual example of how this works.

However, the transfer of funds between the issuing bank and the acquiring bank is not the same as the initial transaction. Your processor hasn’t made any money yet, and technically, they’ve lost money so far.

So they charge merchants the difference between the transaction and the amount deposited (bringing them back to even) plus a markup fee (payment processor’s profit).

In short, the acquiring bank pays the issuing bank. Then they collect the fees, plus profits, from the merchant. At the end of the day, the merchant receives the gross amount of the sale, minus the interchange fee, assessments, and markup.

Determining Interchange Qualification

Interchange qualification is determined by a wide range of factors. Some of these are in your control; others are not.

- Processing Method — Card present vs. card-not-present. Swipe, dip, tap, or keyed.

- Transaction Data — Information provided with each transaction.

- Merchant Category Code — Based on the type of business you have.

- Card Brand — Visa, Mastercard, American Express, Discover.

- Card Type — Credit vs. Debit, Rewards credit card vs. non-rewards, etc.

- Cardholder — Cards issued to businesses, corporations, or municipal agencies have different interchange categories than traditional consumer credit cards.

Earlier, we looked at an example that showed a few different qualification terms with Visa’s interchange table (card brand, card type, CPS threshold). But those rates would be impacted even further depending on the payment processing method.

How Are Interchange Fees Calculated?

As mentioned above, these transaction fees are determined by several different variables. To simplify things for merchants, a credit card company computes the fee by imposing a flat rate plus a percentage of the sale for each transaction.

This holds true for credit card transactions and debit card transactions alike. With that said, the credit card fees are usually higher than the fees imposed on debit cards. So you can always expect credit transactions to cost you more money.

As part of the Durbin Amendment, there’s an interchange fee regulation for every debit card transaction. Debit transactions are limited to a maximum of 21 to 24 cents, depending on the size of the customer’s bank.

Before this amendment, swipe fees on a debit card were nearly double this amount.

How to Reduce Interchange Fees

As I said before, interchange rates are non-negotiable.

However, there are certain ways that you can adjust how you take credit cards and settle transactions to qualify for a lower interchange category. This is known as interchange optimization, which will ultimately lead to a lower interchange fee per transaction.

Additionally, you can reduce the other rates and fees charged by your processor. Sometimes this is more transparent than others.

Interchange “padding” is when a processor adds to the cost of an interchange fee without telling the merchant. Then they list those rates on the bill simply as “interchange fees.” This practice makes merchants assume the rate is non-negotiable.

To catch a padded interchange, you’d need to look them up individually, which isn’t reasonable for most merchants. We’ve already seen how long and complex those charts can be.

You should consult with a professional advisor to assess how you’re being charged for interchange fees.

Latest Interchange Fees, Rate Increases, and Updates From Credit Card Networks and Processors

All major credit card networks update their interchange fees on a regular basis. It’s also extremely common for credit card processors to increase rates and change their fees. Here at Merchant Cost Consulting, we keep a close eye on these changes to keep our clients and readers informed.

Check out our guides below to see the latest updates.

Credit Card Network Interchange Fees and Updates

- Visa Interchange Rates

- Mastercard Interchange Rates

- Discover Interchange Rates

- American Express Interchange Rates

Credit Card Processor Interchange Rates and Updates

- Shift4 Payments

- Heartland (Global Payments)

- TSYS (Global Payments)

- Global Payments Integrated (Formerly OpenEdge)

- Paya

- Worldpay from FIS

- Chase Paymentech (Chase Payment Brand/Chase Payment Solutions)

- Rectangle Health

- Fiserv (formerly First Data)

- Elavon Payment Processing

- Clearent

- PayPal and Venmo

- PNC Bank Merchant Services

- Square

- Toast

- Fullsteam Payments

- North American Bancard

- Vanco Payments

- Bank of America Merchant Services

- EVO Payments

- CardConnect

- PatientNow

- Bluefin

- Lightspeed POS

- Wells Fargo Merchant Services

Final Thoughts

Every merchant has to pay interchange fees. It’s just part of accepting credit cards.

So many factors determine how much you’re being charged for each transaction. From card brands to card types and merchant category codes, interchange fees vary.

While interchange rates are non-negotiable, you can still save money on credit card processing. Adjusting your pricing structure and making sure that your interchange fees aren’t being “padded” are two logical places to start.

Contact us here at Merchant Cost Consulting, and we can negotiate these terms on your behalf. Find out how much money you can save with a free audit and analysis.

What is the difference in Interchange costs for caterers vs supermarket? My processor has me with a supermarket sic number whereas I am a carryout only restaurant and caterer?

Hi Steve thanks for reaching out. Based on SIC codes, merchants can qualify for better interchange pass thru rates than other businesses. Supermarkets have the lowest IC costs out there at the retail level so its OK that you are categorized differently, although its worth changing to be accurate and up to date with your processor.

There are other SIC codes that qualify for better IC rates, but your type of business unfortunately is not one of them.