Visa Surcharging Rules

Businesses accepting Visa cards pay a fee for each transaction. To offset those costs, some merchants impose a surcharge—which passes the processing fees to the customer.

Sounds simple, right? Not so fast.

Visa has its own surcharging rules. So before you start surcharging credit card transactions, you need to make sure you’re doing so in a way that’s legal and compliant.

Quick Summary of Visa Surcharge Rules

- Surcharges cannot exceed the merchant’s cost of acceptance.

- Surcharges cannot exceed 3% (even if the cost of acceptance is higher).

- Surcharges cannot be imposed on debit cards or prepaid Visa cards.

- Merchants must follow all federal and state-specific surcharge laws.

- Merchants must provide 30 days’ notice to their acquirer prior to surcharging.

- Surcharge disclosure statements must be posted at the entry and point of sale

- Surcharges must be itemized as a separate line item on the customer’s receipt.

Read on for a more in-depth explanation of these rules.

Visa Does Not Allow Businesses to Impose Surcharges That Exceed the Merchant’s Cost of Acceptance

Visa doesn’t allow merchants to profit on surcharging fees. Any surcharge that’s added to Visa transactions cannot exceed the merchant’s cost of payment acceptance.

Simply put, if it costs your business 2% to process a Visa transaction, you can’t add a 3% surcharge.

To calculate your cost of acceptance, you need to factor in the interchange rate imposed at the card network level, assessment fees imposed by Visa, and your processor markups.

The Maximum Allowable Visa Surcharge is 3%

Surcharges on Visa transactions cannot exceed 3%. This holds true even if the merchant’s cost to process the transaction is higher than 3%.

This Visa surcharge rule is one that can often confuse merchants, as it somewhat contradicts the first rule.

Let’s say it costs you 3.5% to process Visa credit cards. You’re still not allowed to impose a surcharge higher than 3%. So while you can get your customer to pay for most of the fees, you’re still on the hook for that remaining 0.5%.

Visa Only Allows Credit Card Surcharging (Debit Card Surcharging is Prohibited)

Merchants can only surcharge Visa credit card transactions.

Businesses are strictly prohibited from surcharging any Visa-branded debit cards (or any debit card, for that matter). Surcharging prepaid cards is also in violation of Visa’s surcharging policies.

This includes debit card transactions that are “run on credit” and routed through the same network as your credit card transactions. It’s super important to make sure your POS system is set up to remove any surcharge fees when customers pay with a debit card.

Surcharges Must Be in Accordance With All State and Federal Regulations

State and federal laws override Visa’s surcharging rules.

Failure to abide by these regulations can land your business in significantly more trouble. Instead of just being found non-compliant and subject to fines by Visa, you can land yourself in legal trouble for breaking the law.

We have a complete guide that breaks down the surcharging laws in all 50 states. You can use this as a quick reference to see the credit card surcharge laws in your particular state. But it’s always in your best interest to consult with an attorney to verify the accuracy of these regulations, as states are constantly passing new laws.

For example, the maximum allowable surcharge in Colorado is 2%. In Illinois, the maximum allowable surcharge is 1% or the cost of processing (whichever is less). So even though Visa allows surcharging up to 3%, merchants in those states must follow the local regulations.

Some states—like Connecticut, Maine, and Massachusetts—ban surcharging outright.

At the federal level, credit card surcharging is allowed up to 4%. But again, Visa only allows a 3% maximum surcharge. So a business that imposed a 4% surcharge wouldn’t necessarily be breaking the law, but they’d be in violation of Visa’s surcharging rules and subject to any applicable penalties as set forth by the card network.

Visa, the federal government, and all 50 states do agree on one thing—debit card surcharging is never allowed.

Merchants Must Notify Their Acquirer 30 Days PRIOR to Surcharging

Any business that wants to surcharge Visa transactions must provide advanced notice to their acquiring bank at least 30 days before implementing the new policy.

Even if you live in a state that allows surcharging and you can’t just start adding this fee to transactions tomorrow.

According to Visa’s rules, you must give 30 days’ notice to your acquirer before your surcharging policy goes into effect.

Visa Requires Proper Signage and Disclosures For All Surcharging Policies

Visa does not allow you to surprise customers with surcharge fees. Merchants must properly disclose the surcharge fee in three places:

- At the entry of the business

- At the point of sale

- Itemized separately on the receipt

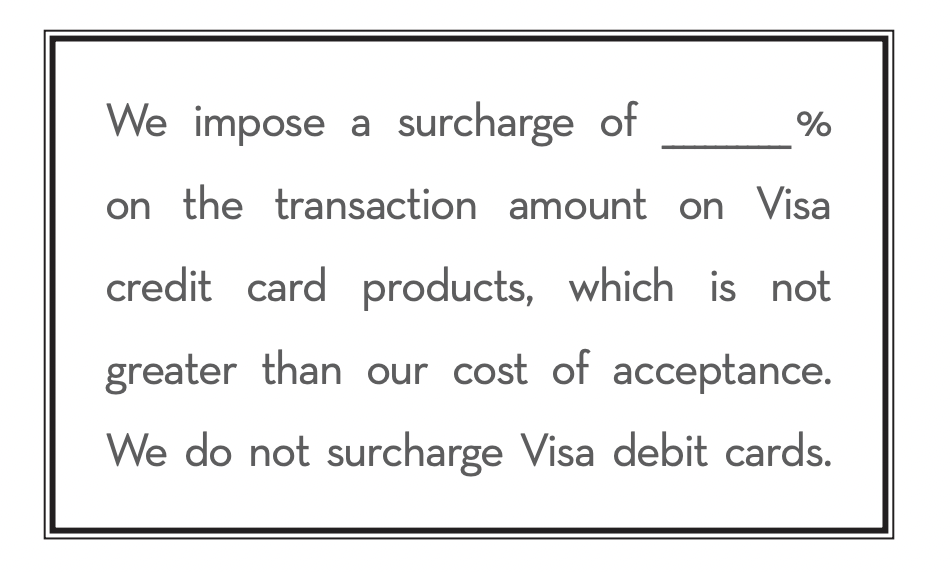

Here’s an example of a POS disclosure statement that’s compliant with Visa’s surcharging rules:

If you’re surcharging other cards (like Mastercard, Discover, or Amex), Visa does say it’s ok to include those additional card brands on the same signage.

Just be aware that some states have additional stipulations on what your disclosure signs must say and where they need to be displayed.

Merchant FAQs For Visa Surcharging: Your Top Questions Answered

Visa’s surcharging rules are pretty straightforward. But you may still have some questions about how to follow them. Here are some of the most common questions we hear related to Visa’s surcharge rules:

How Do I Make Sure Only Credit Cards are Surcharged and Not Debit Cards?

You need to work these logistics with your merchant services provider. In many cases, it’s a matter of the customer or employee selecting “debit” as the payment method on the POS system or card reader.

But this can be tricky when POS systems automatically add a blanket surcharge to all transactions, and then the customer just swipes, dips, or taps the card reader without making a selection or having any verbal communication with the employee.

Who Enforces Visa Surcharge Rules?

To be clear, you’re not “breaking the law” by violating Visa’s surcharge policies (unless you’re actually breaking federal or state-specific surcharging laws).

Enforcement is left up to Visa.

In January 2024, Visa announced that they are beginning to crack down on merchants in violation of these rules and increasing efforts to enforce their policies.

What Are The Penalties For Violating Visa Surcharge Rules?

Merchants in violation of Visa’s surcharging rules can be hit with fines of $50,000 to $1 million. Your ability to accept Visa cards could also be revoked.

Can I Choose Which Types of Visa Credit Cards to Surcharge?

You can choose what card brands to surcharge (Example: Visa vs. Amex) OR what product-level cards to surcharge (Example: Visa Traditional Rewards vs. Visa Signature), BUT NOT BOTH.

You can decide to surcharge Visa transactions but not impose a surcharge fee on Mastercard transactions. That’s totally fine and allowed by Visa’s surcharging policy.

But if you do this, you cannot pick and choose what types of Visa cards to accept.

On the flip side, you could choose to only apply a surcharge to specific types of Visa cards. But then you can’t surcharge anything else—including non-Visa-branded cards.

Can Businesses Worldwide Surcharge Visa Cards?

Visa’s surcharging rules only apply to the United States and certain US territories.

Surcharging Visa cards outside of the US is prohibited (with some limited exceptions)

Can I Require a Minimum Purchase Amount on Visa Cards?

Yes, it’s legal for businesses to require a minimum purchase amount on Visa cards—up to $10 maximum. You cannot require a minimum purchase amount on debit card transactions.

Final Thoughts: Keeping Up With Visa’s Surcharge Rules

It’s possible to pass processing fees to customers in the form of a surcharge. But to do so, you must follow all of Visa’s surcharging policies and all surcharging laws at the state and federal levels.

This can sometimes be tricky, as the card network rules sometimes conflict with what’s legal in certain states or what the federal government deems legal. In some instances, the federal government has overturned state laws regarding surcharges. But even with the overturns, what’s legal may still violate Visa’s policies.

Whether you’re imposing a surcharge or cash discount in an effort to offset Visa fees, you need to stay up to date and informed on Visa’s rules and state-specific policies.

Changes are made on a regular basis. In fact, Visa’s surcharging rules today are different than they were just last year (the maximum allowable Visa surcharge dropped from 4% to 3% on April 15, 2023). So you could go from compliant to non-compliant overnight if you’re not careful.

Sign up for our monthly newsletter to stay informed. We do our best to keep track of all major changes, fee increases, and other news in the payment processing world—including any changes to surcharge rules. We’ll deliver these updates straight to your inbox.

0 Comments