Credit Card Processing Fees: Transactional, Recurring, and One-Off

Credit card processing fees can be complicated. For those of you who have been accepting card payments for a while, you’ve probably noticed that your monthly bill fluctuates substantially.

These varying costs can make it difficult to predict what you owe each month. A surprisingly high bill from your processor could put your business in a financial predicament. It’s much easier to pay the bills when you know much they’re going to cost you ahead of time.

Unfortunately, some merchant service providers over-charge business owners—there’s no way around that statement.

Some processors charge high fees for things that don’t cost them anything. They are hoping that business owners and CFOs don’t question these charges mixed in with other line items on the statements.

I created this guide to give you a better understanding of your processing fees. Generally speaking, these charges can be broken down into three categories—-transactional, recurring, and one-off. I’ll explain each one in greater detail below.

Transactional Credit Card Processing Fees

Transactional credit card fees are required. As the name suggests, these are the costs associated with each card transaction processed by your business.

Whether the card was swiped, dripped, tapped, manually entered, processed online, or through a virtual terminal, there’s a fee that you’ll have to pay to accept that payment.

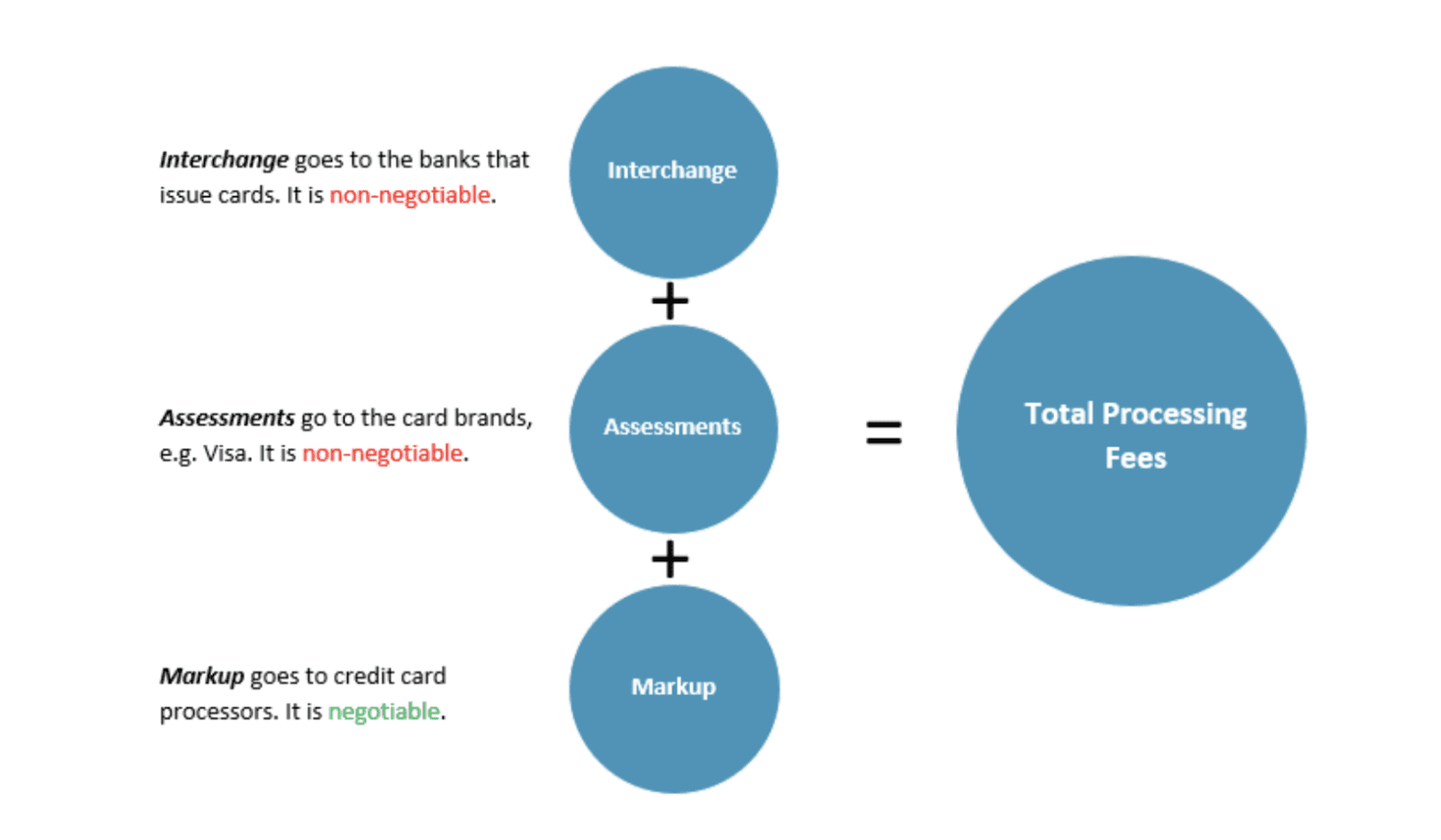

All of your transactional fees are based on three main components—interchange, assessments, processor markup.

The interchange fees and rates are imposed by the card networks. Each card network has a unique method to categorize transactions. Factors like card type, pay method, transaction amount, and merchant category code (MCC) all impact the interchange category and corresponding rate.

Interchange and assessment fees are non-negotiable. But the total transactional fee that you pay depends on the contract structure with your processor.

Your processor needs to receive compensation for their role in the transaction. But certain contract structures give your merchant services provider more money then they’re entitled to.

Here’s a quick overview of the different contract types:

- Tiered or bundle pricing

- Flat rate pricing

- ERR Pricing

- Subscription or membership pricing

- Interchange plus pricing

Tiered or bundle pricing is the worst type of billing structure you can have. It gives processors more control to manipulate how much you’re being charged per transaction. Flat rate pricing isn’t great either. While the flat-rate structure makes it easier to understand what you’re being charged, you’ll often overpay for transactions that would be significantly less than your flat cost.

Interchange plus is the best for merchants. With this structure, you’re paying the interchange imposed by the card networks plus a predefined markup rate to the processor.

For more information about transactional fees and contract types, check out our complete guide to credit card processing fees.

Recurring Credit Card Processing Fees

In addition to the fees associated with each transaction, most processors make the bulk of their profits by adding recurring fees to your monthly statement. For the most part, these extra fees are pure profit for the processor. Lots of these fees don’t actually cost the provider any money to offer services to the merchant.

Think of it like buying a car. Before you sign on the dotted line, the salesman hits you with fees for rustproofing, dealer fees, advertising fees, VIN etching, dealer preparation fees, and more.

Now imagine if that car dealership charged you for these silly fees on a recurring basis every month—that’s what some credit card processors are doing.

Examples of recurring processing fees include:

- Annual fees

- Statement fees

- Batch fees

- IRS reporting fees

- Funding fees

The list goes on and on. It’s worth noting that some of these charges are justified. If you’re on a subscription pricing structure, you’ll be paying a fixed monthly or annual fee to access lower transactional fees.

For example, check out this pricing table from Payment Depot.

As you can see, the more money you pay per month, the lower your transactional fees will be. At $49 per month, you’re paying $0.15 per transaction on top of the interchange. That drops to $0.05 + interchange at $199 per month.

To be clear, I’m not recommending this by any means. Membership pricing makes sense for some merchants based on their volume, but this is just an example of a recurring cost.

One-Off Credit Card Processing Fees

Processors will also charge you for certain actions that trigger a one-time fee.

It’s common for these to appear on your statement when you’re starting or ending a contract. But some of these one-off charges can show up seemingly randomly based on actions you make without even knowing it.

Here are some examples:

- PCI compliance fees

- Terminal fees

- Address verification fees

- Gateway fees

- Setup fees

- Reprogramming fees

- Chargeback fees

Similar to the recurring fees, lots of these one-off fees are pure profit for the processor. But that’s not the case for all of them.

For example, if a customer files a chargeback on a transaction, that’s going to cost you—and there’s really no way around it. Even if you win the dispute and the chargeback ruling ends in your favor, the initial chargeback fee on your statement will likely remain.

Final Thoughts — Save Money on Credit Card Processing

Your credit card processing statement could have dozens of different fees on it. Trying to decipher what all of it means can be confusing.

But here’s what you need to understand. The vast majority of your credit card processing fees are negotiable.

With the exception of interchange and assessment, the remaining fees in all three categories described above can all be adjusted. Here at Merchant Cost Consulting, we specialize in negotiations with processing rates.

We’ll contact your merchant services provider on your behalf and help you get rid of the unnecessary fees that you’re being charged for.

As I said before, most processors bank on the fact that business owners don’t understand the charges on their statements—so nothing is questioned. Our team of experts can spot those extra charges and lower your processing fees. Contact us today for a free audit and analysis.

0 Comments