Interchange fees and assessments are two foundational elements in the world of payment processing. Every business that accepts credit and debit cards pays these fees—and both are crucial components to a merchant’s overall cost of accepting credit card payments.

While interchange fees and assessments share some similarities, they are not the same thing. Not only does each serve a different purpose but they’re also billed differently and have contrasting fee structures.

This guide breaks down the differences between interchange fees and assessments so you have a clear understanding of each.

What Are Interchange Fees?

Interchange fees are the transactional costs associated with card-based transactions, paid directly to the issuing bank (the bank that issued the customer’s credit or debit card).

Interchange rates are most commonly charged as a percentage of the transaction plus a fixed fee (such as 1.80% + $0.05 per transaction). But the exact rate varies based on card type, industry, and transaction environment.

The purpose of an interchange fee is to compensate the issuing bank for its role in the payments ecosystem and for taking on the risk of issuing credit to consumers.

What Are Assessment Fees?

Assessment fees are paid directly to the card networks—Visa, Mastercard, American Express, and Discover. Unlike interchange fees, which are charged and billed per transaction, the bulk cost of assessments is aggregated and based on monthly processing volume.

Network assessment fees are billed at a much lower rate than interchange fees. Most assessments range from 0.12% to 0.15% of total monthly sales.

Card networks use these fees to help cover their operating costs and infrastructure requirements for payment processing.

Examples of Interchange Fees

There are hundreds of different interchange rates. The exact rate charged for a particular transaction is determined based on several factors, including:

- Card brand (Visa, Mastercard, Amex, etc.)

- Card type (Credit, debit, commercial, rewards, etc.)

- Transaction environment (in-person, online, phone, manually keyed, etc.)

- Merchant category (retail, supermarket, restaurant, travel, etc.)

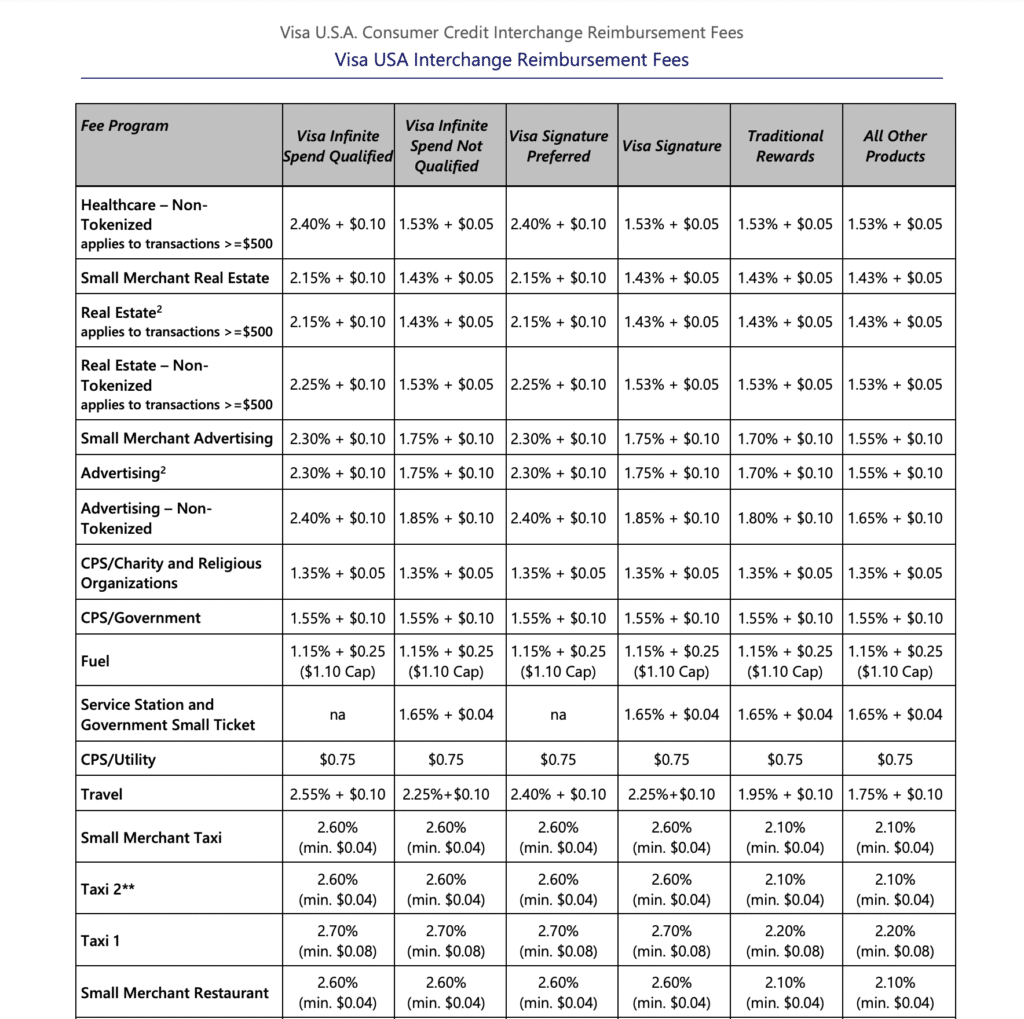

Here are some examples of interchange rates set by Visa:

This is just one chart of a 26-page document. But it shows how widely different interchange fees can vary based on the merchant’s industry and what type of card is used.

For more specific examples and exact rates, we have separate resources covering the interchange fees for all four major card brands in the US.

- Visa Interchange Fees

- Mastercard Interchange Fees

- Discover Interchange Fees

- American Express Interchange Fees

Examples of Assessment Fees

Assessment fees are shown as separate line items on a merchant’s monthly payment processing statement. But the reporting all depends on what processor you’re using.

Let’s look at some real examples of assessments so you can see what I mean.

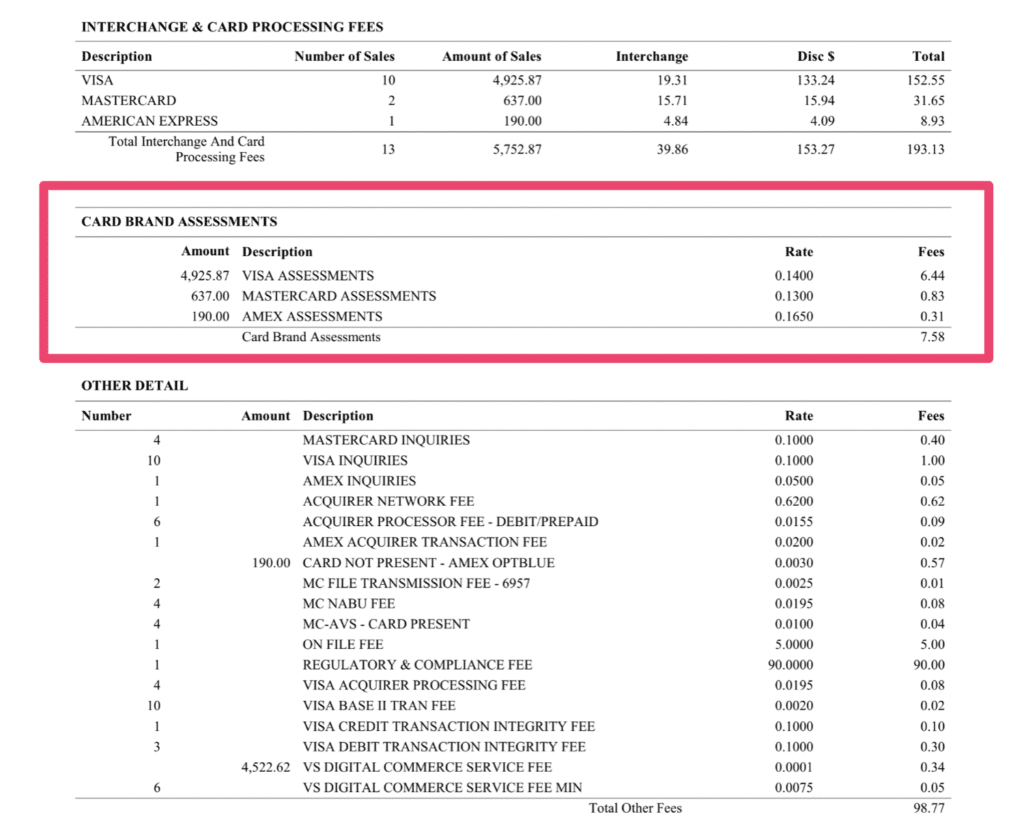

This is a really straightforward example of assessment fees shown on a Rectangle Health statement.

They have a separate “Card Brand Assessments” section, which is strictly based on monthly processing volume for each network.

But if you look at the “Other Detail” section at the bottom of this page, you’ll also see a list of miscellaneous fees that also include additional assessments, including:

- MC NABU Fee

- MC AVS Card Present

- Visa Acquirer Processing Fee

- Visa Base II Tran Fee

- Visa Credit Transaction Integrity Fee

- Visa Digital Commerce Service Fee

These are all examples of other assessment fees—but they don’t necessarily apply to every transaction, which is why they’re listed separately.

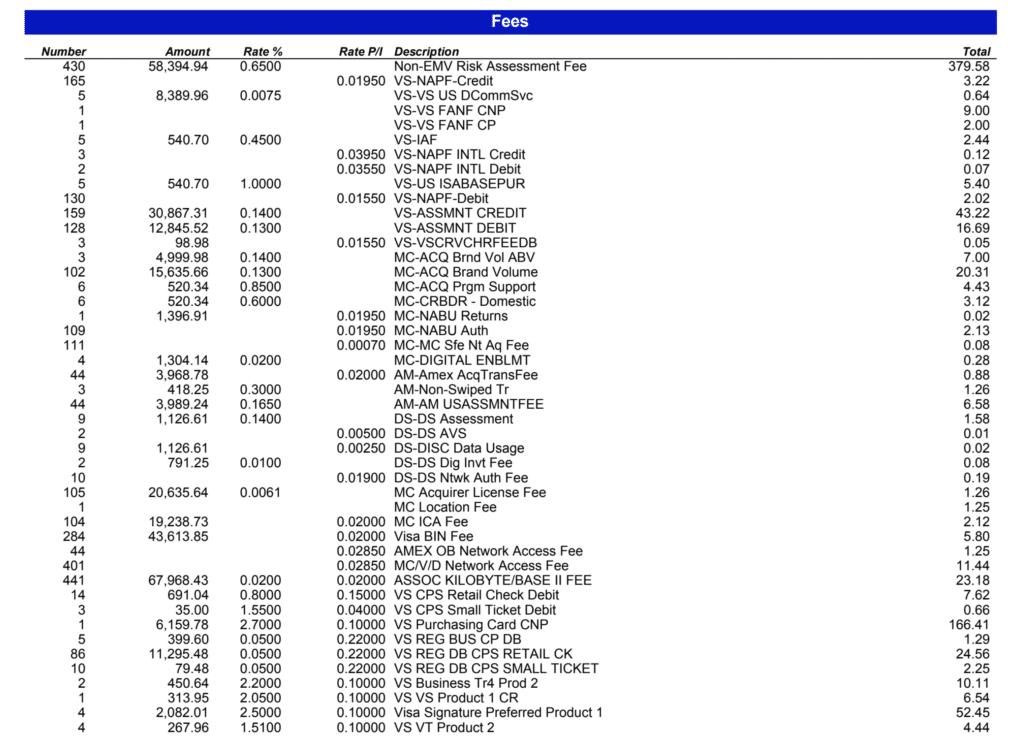

Here’s another statement—this time it’s from Cayan (owned by TSYS).

As you can see, Cayan lists all assessments together—without separating the charges based on monthly processing volume as its own section.

For example, if we look at the line item for MC-ACQ Brand Volume, we see 102 transactions billed at a 0.13% rate. But just a few lines below, we see an MC-Digital Enablement Fee that’s only applied to 4 transactions and billed at a 0.02% rate.

So only 4 of 102 Mastercard transactions in this cycle were assessed with Mastercard’s Digital Enablement Fee.

Who Sets Interchange Rates?

Interchange rates are set by the card networks—Visa, Mastercard, American Express, and Discover. These rates get updated periodically, often in April and October of each year.

Who Sets Assessment Fees?

Assessment fees are also set by the credit card networks. But unlike the interchange fees that are paid to the issuing banks, assessment fees go straight to the card networks. Assessment fees aren’t adjusted as frequently as interchange fees, and there are much fewer assessment categories compared to interchange categories.

Who Pays Interchange Fees?

Interchange fees are by acquiring banks (the merchant’s bank) or payment processors. However, these fees are typically passed through to merchants as part of their overall cost of accepting payments.

So the merchant ultimately inherits and bears responsibility for all interchange fees. But the way they pay interchange fees varies based on the arrangement they have with their credit card processor.

For example, if you’re on an interchange plus pricing plan, you’ll pay the exact rate set by the card networks plus a small markup that’s paid to the processor. But if you’re on a fixed rate plan, you likely won’t see a breakdown of the interchange fees on your statements. Markups and profit margins are much higher for processors with this structure, which is why we always recommend getting an interchange-plus contract for the lowest possible rates.

Who Pays Assessment Fees?

Similar to interchange fees, assessment fees are initially paid by the acquiring bank or payment processor—directly to the card networks. But processors recoup those charges by passing them along to the merchant.

While much smaller than interchange fees, assessment fees still contribute to a company’s total processing costs.

Are Interchange Fees and Assessment Fees Negotiable?

Unlike other costs associated with payment processing, interchange fees and assessments are not negotiable.

That said, there are certain ways you can avoid paying interchange rates and assessments. For example, certain interchange categories are downgraded if they fail to meet a particular criteria. So if you manually enter card details as opposed to dipping or tapping the card in person, the manually keyed interchange rate will always be higher.

And while you can’t negotiate interchange rates and assessments, you can negotiate your processor’s markup and other miscellaneous fees charged by your merchant services provider.

It’s also worth noting that some processors unethically “pad” or “inflate” assessment fees. Rather than charging you 0.14% on total volume, they might double it and charge you 0.28% while pocketing the difference.

What makes this so unethical is that assessment padding is often listed on statements as if the fee is coming directly from the card networks. This makes it incredibly difficult to catch if you don’t know what to look for.

We have an in-depth guide on how to spot padded assessments that you can use as a reference. But if you suspect that your processor is overcharging you, our team here at MCC can audit your statements and negotiate those fees on your behalf.

Final Thoughts

Let’s quickly recap what we’ve learned about the differences between interchange and assessment fees.

- Interchange fees and assessments are both set by the card networks.

- But interchange fees go to the cardholder’s issuing bank, while assessments are kept by the card networks themselves.

- Technically, the acquiring banks and payment processors are responsible for paying interchange fees and assessments—but they’re always passed through to merchants.

- Interchange fees are charged per transaction, while assessment fees are based on monthly volume.

- Neither of these fees is negotiable.

At Merchant Cost Consulting, we specialize in helping businesses navigate the complex world of payment processing. Our experts can analyze your current fee structure and identify opportunities to reduce your overall processing costs—without switching processors.

Contact us today to learn how we can help your business save money on credit card processing.