Network tokens and tokenization are crucial for modern payment processing.

With credit card fraud losses expected to reach $12.5 billion this year in the US, this added security helps businesses and consumers alike. In fact, network tokens help reduce fraud by up to 28% on average.

However, I’ve found that many businesses still aren’t exactly sure what network tokens are and how they work. This can be particularly confusing when merchants see network and token fees on their statements or in marketing materials from their processors.

So I created this guide to help merchants fully understand everything they need to know about network tokens and the role tokenization plays in secure payment processing.

What Are Network Tokens?

Network tokens are secure, unique identifiers that replace the traditional Primary Account Number (PAN) at the point of sale.

When a customer purchases something either in-person or online, the token acts as a proxy across the entire payment ecosystem. This allows the business to accept the payments while protecting cardholder data as information moves from the processor through the issuing bank to authorize the transaction—all without exposing the customer’s card number.

Network tokens are issued directly from the card networks, like Visa, Mastercard, American Express, and Discover. Unlike other types of payment security measures, these tokens maintain all of the original functionality of the card while significantly reducing fraud risks and simultaneously optimizing your processing rates.

How Network Tokens Work — A Simple Breakdown

Network tokens work by using the process of tokenization.

Tokenization, in any context, simply replaces sensitive data (like a credit card number), with a placeholder known as a “token.” The token is random and has no relationship with the data that it’s replacing.

There aren’t any keys or algorithms that can be used to unscramble or decode the token to find the real data. Instead, the sensitive data (PAN numbers) are stored in a vault and encrypted.

So if a hacker or malicious user attempts to steal the token, the string of characters is useless because tokens alone can’t be turned back into an account number or reveal sensitive cardholder information.

Since the tokens are issued directly from the card networks as opposed to a gateway or third-party provider, they’re protected by best-in-class payment security.

It’s also worth noting that card network tokens are processor agnostic—meaning merchants can use them regardless of which payment processor handles their transactions.

Example of Network Tokens Being Used in Payment Processing

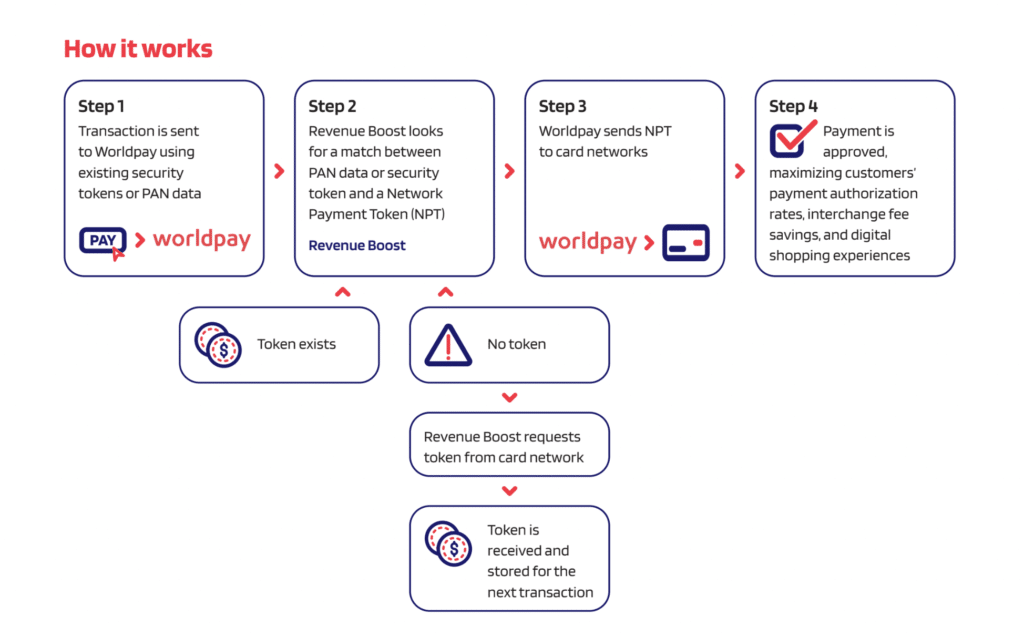

To illustrate how this whole thing works, here’s an example of how Worldpay implements network tokenization through its Revenue Boost service:

As you can see, the process follows a few simple (yet crucial) steps:

- First, a transaction is sent to Worldpay using an existing token or PAN data.

- From there, the Revenue Boost service checks to see if a payment token already exists for the payment method being used.

- If a token exists, it continues being routed through the transaction process to complete the payment.

- If no token exists, one is requested from the appropriate card network and then stored for future transactions.

This tokenization process also enables automatic updates whenever a customer’s card information changes. Since the token maintains its connection to the cardholder’s account at the card network level, merchants don’t need to collect new information once cards expire or get replaced. The token is still valid and can seamlessly be used for future payments.

Key Benefits of Network Tokens For Merchants

Despite the perceived complexity and technology used to handle tokenization, there are actually lots of advantages for merchants using network tokens to process payments for their customers.

I’ve identified the top benefits of them below:

Improved Security

As we’ve already discussed, network tokens can significantly boost your payment security systems because cardholder PAN numbers are replaced with unrelated strings of random characters.

These tokens are typically merchant-specific—meaning they only work with your business and can’t be used elsewhere (even if they’re intercepted). So even in the unlikely event of a data breach, the exposed tokens are useless to criminals attempting to use them at other merchants, creating multiple layers of protection for both you and your customers.

Optimized Interchange Rates

Using network tokens helps your business qualify for lower interchange rates automatically.

According to Fiserv, Visa’s network token can lower your interchange rates by up to 10 basis points compared to non-tokenized rates.

Automatic Card-On-File Updates

For card-on-file payments, network token services eliminate the need for businesses to constantly collect updated card information from their customers whenever a card gets lost, stolen, or expires.

Tokens are updated in real time to ensure they reflect any changes to the account. So you won’t have to call, email, or text your customers to get updated payment credentials.

Fewer Declines

Piggybacking off of the last point, the automatic updates ensure that card-on-file transactions aren’t declined due to outdated card information. The token is still attached to the account.

It also helps reduce false declines on CNP transactions in instances where legitimate transactions are incorrectly rejected for suspicious activity.

According to Mastercard, network tokens increase CNP authorization rates by 2.1% on average.

Better Customer Experience

In addition to providing more robust security for your business, network tokens can also help improve customer checkouts—especially for online transactions.

Research shows that about 35% of people abandon their cards after their cards haven’t been declined just one time. By resolving issues with false declines and automatically updating credentials on file, network tokens ultimately reduce friction for your customers.

Streamlined PCI Compliance

While using network tokens alone won’t make you PCI compliant, it can help you adhere to standards for how you’re handling sensitive cardholder data.

This applies to more than one of the 12 requirements of PCI DSS compliance as it relates to storing and transmitting sensitive card information.

Read More: PAN Masking For PCI Compliance

Network Token Fees

Merchants using network tokens to facilitate payments will likely incur some additional fees. Some of these are passed through from the card networks as an assessment fee while others come directly from the processor.

For example, Visa charges a $0.12 fee whenever network tokens are used for authorization requests after a credentialing update. This charge would apply to instances where a card on file was updated because it was lost, stolen, or expired.

STAR (a debit network owned and operated by Fiserv) charges a $0.01 fee on debit transactions to support its tokenization service.

Most processors don’t necessarily have a direct line item or specific cost used for network tokens, but these costs are definitely baked into the overall fees that you’re paying them.

Some processors have separate services that they may or may not try to charge extra for—like Fiserv’s Network Token Service or Worldpay’s Revenue Boost solution. But we’ve also seen processors throw these types of services in for “free” on accounts as more of a marketing ploy and an attempt to enhance their perceived value.

The Future of Network Tokenization

Tokenization technology has been around for a while, but its recent traction and prevalent use in the payment processing space has changed the trajectory for how people will pay and how businesses will accept payments moving forward.

Mastercard has already announced that it’s planning to phase out 16-digit credit card numbers by 2030.

Prior to that happening, we’re expected to see a sharp rise in how many transactions are processed using network tokens worldwide.

$283 billion is expected to be processed in 2025 via network tokens. Projections show that this figure is expected to in less than four years—eclipsing $574 billion in 2029.

The fact that advancements in this technology is coming straight from the card networks shows that network tokens will be here for the foreseeable future, and I think we’ve only reached the tip of the iceberg right now.

Final Thoughts

For merchants, network tokens are a good thing. They add an additional layer of security to your payment acceptance process, protecting both you and your customers.

While they may carry a few extra costs, they can actually lower your interchange rates and help you process transactions that may have otherwise been declined—so overall, it’s a net positive.

That said, if your credit card processing statement has lots of token-related charges or network fees that you just don’t quite understand, it could be cause for scrutiny. Let our team here at MCC audit your statements to ensure the fees are legit and that your processor isn’t trying to take advantage of you.