Credit card processing statements are tough to understand, especially to the untrained eye. But if you noticed a Visa FANF fee on your monthly statement and you don’t know what it is, you’ve come to the right place.

This guide explains everything you need to know about Visa’s fixed acquirer network fee (FANF) and what it means for your business.

What is Visa FANF Fee?

FANF (fixed acquirer network fee) is a monthly charge that was first introduced by Visa in April 2012. This fee is charged by Visa to cover the overhead costs associated with processing cards through its network.

It applies to all merchants that accept Visa cards, but the rate itself varies based on factors like business type, sales volume, transaction environment, MCC code, and more.

Processors calculate Visa FANF fees monthly but charge merchants quarterly for the previous period.

That’s why you may not always see the Visa FANF fee on your statement, and some merchants are surprised or perplexed when comparing two or three statements side-by-side.

How Are Visa FANF Fees Calculated?

Despite having the word “fixed” in its name, Visa FANF fees are actually a variable cost—which makes them different from other credit card assessments and processing fees.

This is just one of the many reasons why merchants are confused when they see Visa FANF on processing statements. Unless you know the formula, it’s not always clear how these rates are calculated.

These are the factors that Visa uses to determine FANF fees:

- Number of card-present locations a merchant has

- Monthly gross sales for all Visa card-not-present transactions

- Special cases for high-volume MCC codes, fast food, and unattended terminals

All Visa FANF fees are calculated per merchant taxpayer ID, which includes all merchant accounts using that TIN. This means that multiple steps may be used to calculate the Visa FANF fee for merchants with multiple locations and various transaction environments. We’ll go through some specific examples of this later on so you can see what I mean.

But first, let’s take a look at the Visa FANF fee rate tables.

Visa FANF Fees For Card-Present Businesses and High Volume MCC Codes

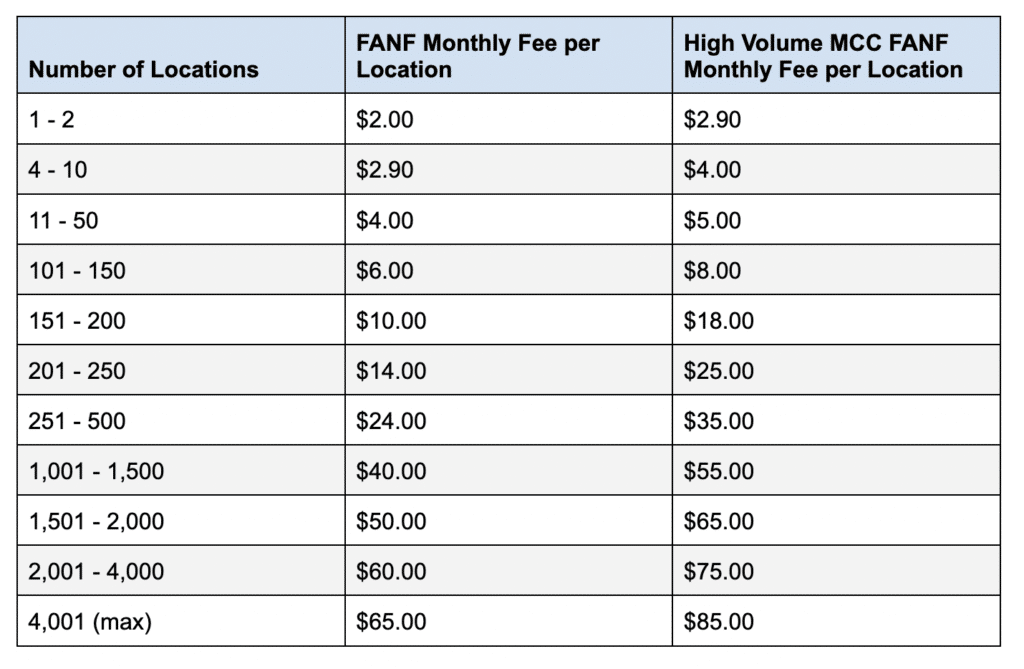

Merchants accepting Visa cards in person are charged FANF fees based on the number of locations they have. Depending on the MCC code, some merchants fall into a “high volume” category and are charged slightly more per location when assessed the FANF fee.

This table explains how Visa charges FANF fees for card-present merchants:

For the purposes of FANF assessments, here are some merchant category codes (MCC) that Visa uses to qualify high-volume merchants:

- Airlines — MCC Codes 3000 – 3299 and 4311

- Auto Rental — MCC Codes 3300 – 3499 and 7512

- Auto Dealers — MCC Codes 5511 and 4411

- Discount and Department Stores — MCC Codes 5310 and 5311

- Drugstores — MCC Code 5912

- Electronic Stores — MCC Code 5732

- Family Clothing Stores — MCC Code 5651

- Furniture Stores — MCC Code 5712

- Grocery and Supermarket — MCC Code 5411

- Lodging — MCC Codes 3500-3999 and 7011

- Movie Theaters — MCC Code 7832

- Service Stations — MCC Codes 5541 and 5542

- Tire Stores — MCC Code 5532

- Warehouses — MCC Codes 5200 and 5300

- Wire Transfers — MCC Code 4829

All of these are high-volume MCC code examples that would be charged the Visa FANF fees listed in the third column from the table above.

Merchants who process less than $200 in Visa transactions per month are exempt from FANF fees.

Visa also waives FANF fees for charitable organizations registered in the United States under MCC Code 8398. This is handled as a rebate after the fees have been assessed.

Visa FANF Fees For Card-Not-Present Businesses

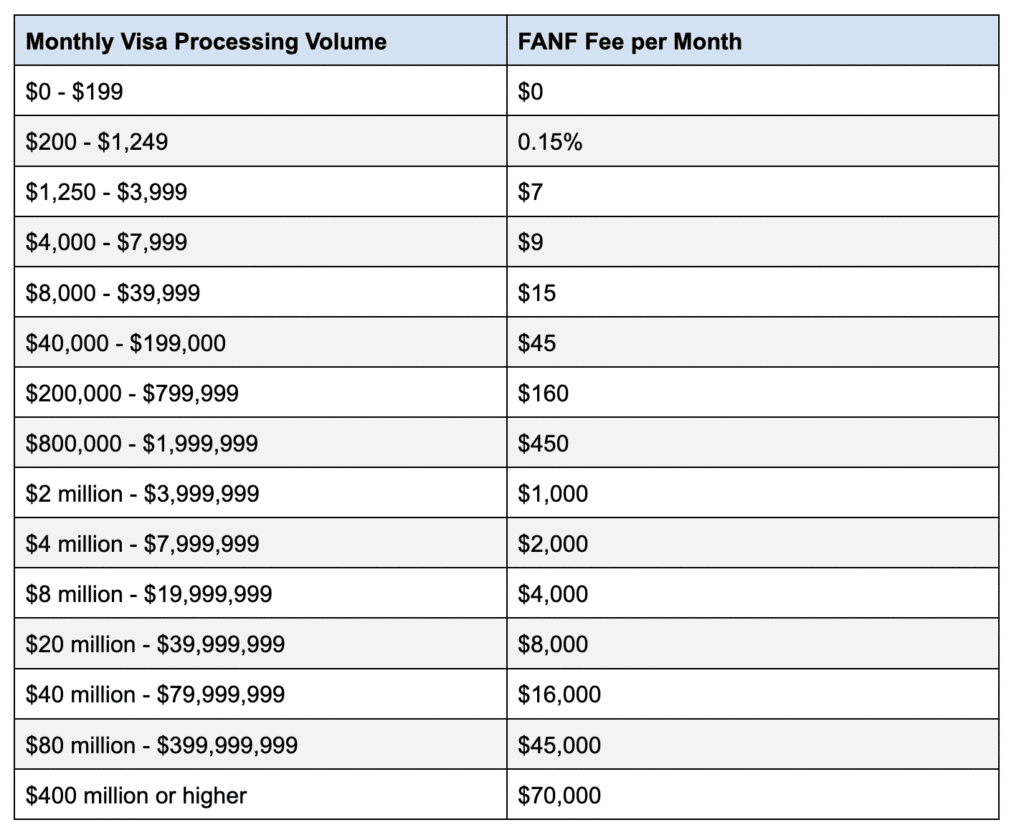

Merchants selling online or processing Visa transactions via manual card entry (phone, email, etc.) fall into the card-not-present bucket. For the purposes of FANF assessments, fast food restaurants and unattended terminal transactions also fall into this category (even though they traditionally would not be considered a CNP transaction).

In these scenarios, Visa FANF fees are assessed based on monthly gross processing volume for Visa transactions. So if your volume varies from month to month, you’ll notice a difference in the FANF fees that appear on your statements.

Use the table below to estimate how much you’ll pay:

As you can see, merchants processing card-not-present transactions pay higher FANF fees.

Examples of Visa FANF Fees

Let’s go through a couple of scenarios to further explain how Visa FANF fees are calculated for different business types.

Example #1 — Business with 1 location that only processes card-present transactions

We’d use the first table to find this rate, which says that the merchant pays $2 per month.

Example #2 — High-volume MCC code with 5 locations that only processes card-present transactions

Again, we’d look at the first table to see that the high-volume MCC rate is $4 per month per location—which translates to $20 per month for 5 locations.

Example #3 — Business with 2 locations and a mix of card-present and online transactions

Let’s say a restaurant has two locations. 85% Visa transactions occur in-person, but an additional 15% of Visa transactions are processed over the phone or through an online ordering portal. In this scenario, we’d use two steps to calculate the FANF fee.

First, we’d use the top table to determine that two locations are charged $2 per month each (for a total of $4). Then we’d use the second table based on the monthly volume for CNP sales. We’ll say the restaurant processed $20,000 in Visa CNP transactions, which translates to $15 per month.

So the total Visa FANF fee that this merchant pays would be $19 ($4 + $15).

Can You Negotiate Visa FANF Fees?

Visa FANF fees are non-negotiable. All Visa interchange rates and assessments imposed at the card network level must be paid, and there’s no way around it.

However, some credit card processors “pad” assessment fees—which means they inflate the charges set by Visa to earn extra profits from your business.

That’s why it’s so important to understand how Visa FANF fees work and how they’re calculated. Otherwise, you could be paying more than you need to if your processor decides to take advantage of your lack of knowledge.

Since these fees only appear on statements every quarter (and they can vary significantly), it’s easy for padded assessments to go overlooked.

Working with a merchant consultant can help you identify hidden fees on your statements. So while you can’t negotiate Visa FANF fees directly, there are other ways that you can lower your credit card processing rates.

Final Thoughts on Visa Fixed Acquirer Network Fees

Visa FANF is just one of the hundreds of different fees that you may find on your statements.

This can be overwhelming for most businesses to comprehend. So it’s definitely in your best interest to let trained professionals review those statements on your behalf.

Our team here at Merchant Cost Consulting can provide a free audit and assessment of your processing rates. We’ll help you determine how much money you can save—without having to switch processors, get new equipment, or change anything that you’re already doing.