Why Amex Isn’t Universally Accepted

As an American Express cardholder, it can be frustrating when you go to pay for something only to hear the words, “we don’t accept American Express here.” This is something that happens to me all of the time.

Amex is known for providing exceptional customer service and a wide range of benefits to members. So why doesn’t every business take this payment method?

Merchants don’t necessarily have the same positive feeling about Amex as cardholders do. In fact, even businesses that accept Amex aren’t always thrilled when a customer pays with an American Express card.

So why aren’t retailers, small businesses, and organizations across a wide range of industries accepting American Express? Find out why below.

Why Doesn’t Every Business Accept American Express?

It’s safe to say you can pay with a Visa or Mastercard at any business that accepts credit cards. But that isn’t always the case for Amex.

Why? The reason is simple—it’s more expensive for merchants to process Amex transactions.

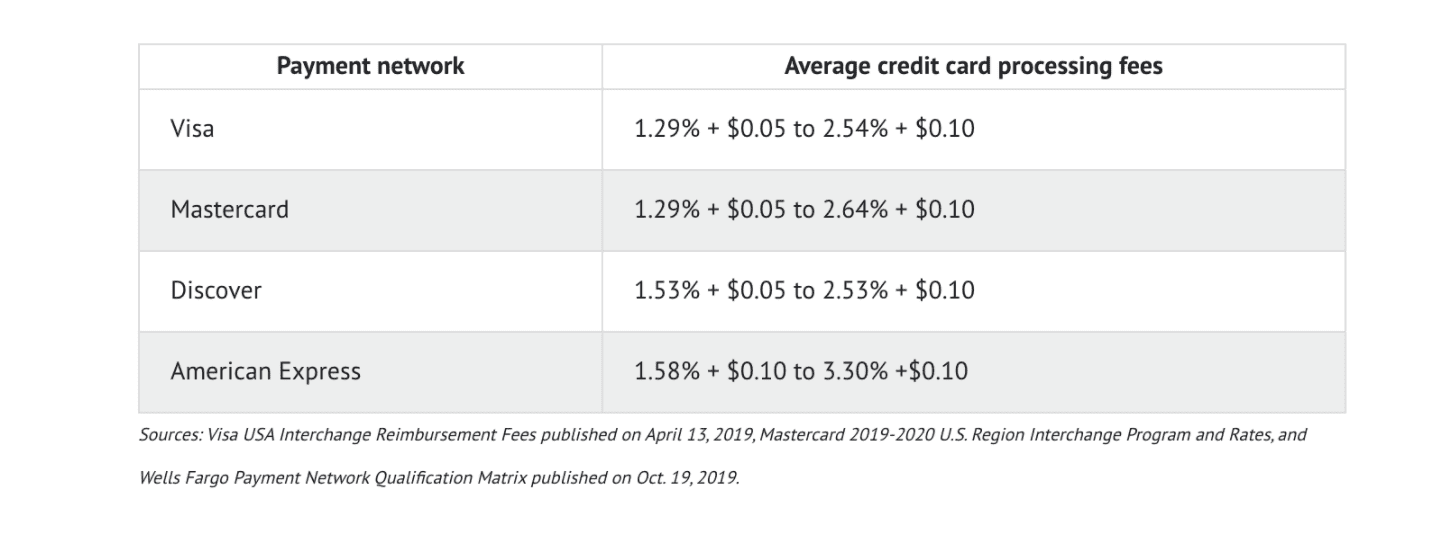

When comparing the four major credit card networks (Visa, Mastercard, Discover, and American Express), Amex has the highest average processing fees.

Obviously, the exact rates paid by the merchants will depend on a wide range of factors. You can check out our complete guide to interchange fees and rates for more information on this subject.

Obviously, the exact rates paid by the merchants will depend on a wide range of factors. You can check out our complete guide to interchange fees and rates for more information on this subject.

But let’s just make a quick comparison here based on these rates. Here’s an extreme example, using Visa’s lowest average range and Amex’s highest average range, we’ll say a business processes $50,000 in credit card transactions for each card type per month.

Before the $0.05 per transaction fee, processor fees, and other charges, merchants would pay as little as $645 in interchange fees with Visa at a 1.29% rate. But they could pay as much as $1,650 in Amex interchange fees on the same amount. Not to mention the additional Amex per-transaction fee is double that of Visa ($0.10 vs. $0.05).

I understand this example is a bit extreme, but you can clearly see the point. The Amex interchange fees can be more than 2.5x higher than Visa.

At scale, this can cost merchants tens of thousands or even hundreds of thousands more in processing fees every year.

How is American Express Different From Other Credit Card Networks?

To further understand why Amex isn’t universally accepted, it’s important to recognize the differences between Amex and other credit cards. Compared side by side with Visa and Mastercard, the most significant difference is that Amex issues their own credit cards.

American Express is a card network and an issuing bank.

As the name implies, the issuing bank issues cards to cardholders. They work directly for the cardholder. Before a credit card network can approve or deny a sale, the issuing bank has to verify the transaction.

Issuing banks are also responsible for things like setting cardholder interest rates, handling cardholder communication, coming up with cardholder rewards programs, setting foreign transaction fees, etc.

Let’s say a Visa cardholder has a question about their benefits or wants to dispute a charge. They don’t call Visa directly; they call their issuing bank.

If you look at a Visa or Mastercard, you’ll typically see the issuing bank printed directly on the card.

As you can see from the example above, Bank of America is the issuing bank for this Visa Signature Rewards credit card.

As you can see from the example above, Bank of America is the issuing bank for this Visa Signature Rewards credit card.

American Express cards are only issued directly from Amex. You can’t get them from a third-party bank. All of the issuing bank responsibilities are handled under the same roof as the card network. Discover is also a card network and issuing bank.

Why is American Express So Expensive For Merchants?

Based on what we just learned about the role American Express plays in the transaction process, you can see that the company has more responsibilities to handle than Visa and Mastercard.

As a result, they charge higher fees to merchants.

This next part is a bit speculative and open to debate. But generally speaking, American Express is also known for providing the best rewards and customer service to its cardholders.

They have an excellent reputation for fast communication, great benefits, and siding with the cardholder during disputes.

Another reason why some businesses don’t accept American Express is because they feel like they’ve been wronged by the card network in the past during a chargeback or dispute. Again, this is great news for cardholders, not always such great news for merchants.

Should Your Business Accept American Express

In short, yes.

Even with the high fees and their reputation for siding with cardholders as opposed to merchants, every business should be accepting all major credit card networks in today’s day and age. Plus, the notion that Amex isn’t universally accepted is starting to lose its weight. According to a 2020 Nilson Report, Amex is accepted at 99% of places in the US that accept credit cards. American Express has proudly displayed this information on its website.

That’s because American Express has put initiatives in place to make card acceptance easier for all types of organizations, including small businesses.

For example, the Amex Shop Small Initiative has been encouraging cardholders to spend money at small businesses. In 2020, Amex rewarded cardholders with $5 cash back up to 10x on purchases of $10+ at small businesses during specific dates.

It’s estimated that the small business spending initiatives generated $19.6 billion in sales for local businesses in the US last year in 2019.

Final Thoughts

It’s no secret that American Express is expensive for merchants to process. While there isn’t anything you can do about the interchange fees imposed by the card network itself, there are other ways you can save money on credit card processing.

Contact our team here at Merchant Cost Consulting. We’ll give you a free analysis to find out how much money you can save on processing costs, without switching processors.

These savings can help offset the costs associated with accepting Amex cards.

0 Comments